25 Percent Tariffs Against Mexico and Canada Begin Tuesday

March 4, 2025 | Sundance

For many of us who walk the deep weeds of honest economic analysis, this is the moment we have been waiting for.

Second only to the elimination of the U.S-Marshal Plan, which is scheduled to end April 2, 2025, the structural implementation of North American tariffs against Mexico and Canada provides the most significant opportunity for GDP expansion, jobs, wage increases and massive economic gains in the United States.

Simultaneous to the tariffs scheduled to go into effect tomorrow, President Trump notes U.S. food prices are positioned for major supply-demand changes that will benefit all American consumers. What President Trump notes in the Truth Social message below, is a reality we experienced in 2018/2019 as the result of national agriculture supply.

[Source]

White House trade adviser Peter Navarro told CNBC on Monday that the inflationary impact from any tariffs would be “second-order small, so I don’t see the president wavering on any of this, because he knows in order to get to a world in which America is strong and prosperous, with real wages going up and (more) factory jobs. This is the path that he’s chosen.” (more)

CTH outlined the prediction for ’18/’19 back in 2016 when we discussed what happens when the American food supply equation is modified to focus on domestic production to the benefit of domestic consumers. The food supply chain will shift, slowly at first and then ultimately by around Thanksgiving of this year (fall harvest) we will see major price drops in the American food basket.

There are going to be major opposition forces, notably related to decades of Big Ag exfiltration, screaming that U.S. consumers will see higher prices. However, as previously experienced/outlined these claims are entirely false. We will see major drops in food prices as a result of a more balanced U.S production-import/export dynamic.

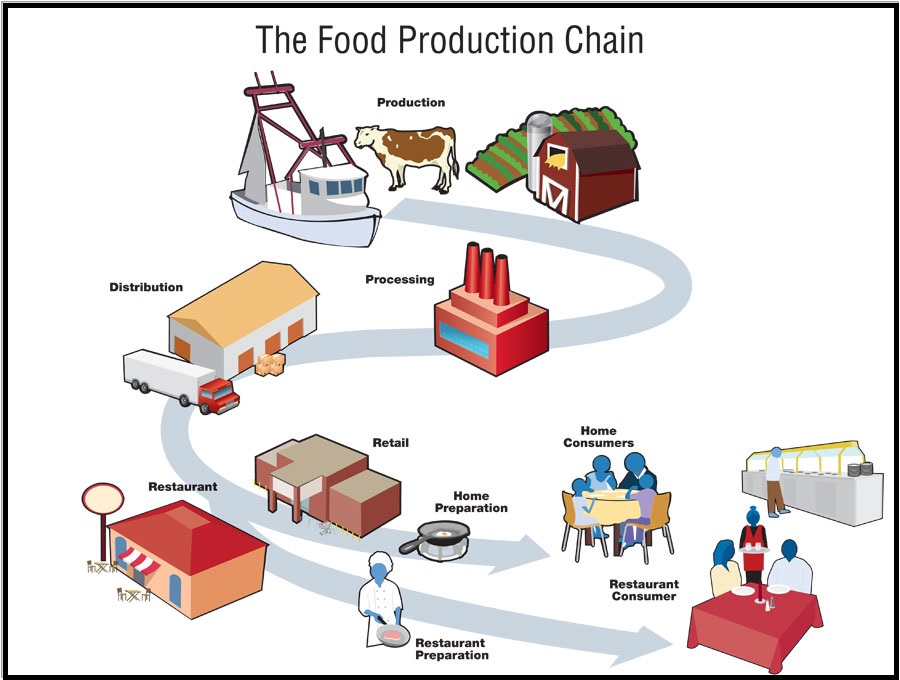

Think in terms of the COVID-19 disruption we experienced in the food supply chain. Major shortfalls in consumer products were noted because the supply chain for agriculture could not respond quickly enough to the shutting down of 50% of the food/caloric delivery system (food away from home).

In the food production system we are about to experience, a reversal of product availability is to be anticipated; there will be abundance.

In the short term, there will be some supply chain disruption as the import equation (total cost of goods) changes to reflect the tariff impact. However, long term, we will see (example citrus) farm products returning to FL/CA farm production from Mexico.

Generally speaking about 50% of the USA bulk food system is ‘one full harvest’ ahead of demand. Grain silos, frozen product and processed food stuffs are generally a full harvest ahead. Ex. the Frozen turkey you purchase in November is a product outcome of a production process that takes place all year. Canned foods, dried foods, spices and other derivatives follow the same supply chain background. The length of this process is approximately 6 months.

On the fresh food side (think in terms of the perimeter of the grocery store), the supply chain is thin and holds less inventory in the supply system; the flow from field to fork is much faster. Fresh seasonal foods come/go as this supply chain reflects the seasonal harvests – with a portion of those fresh products also entering the processed space as ingredients.

The USA exports a massive amount of food. Our farmers are some of the most productive farmers in the world, not only feeding Americans but also exporting food and ingredients globally. Corn, soybeans, wheat, hay, potatoes and derivatives are major exports. Also, as an example, every McDonald’s french frie in the world comes from U.S.A potatoes.

Our row crops are top quality products recognized throughout the world for the consistency that comes from a loving God who has blessed the United States with some of the most fertile soil on the planet. Americans are blessed.

The issues we have faced in the past several decades comes from Big Ag and Big Rx manipulating our domestic production (genetically modified outputs) in order to maximize the corporate profit agenda. Big Ag and Big Rx will fight against tariffs with extreme ferocity because the dynamic of economic nationalism, supply-demand production and lower prices therein are against the multinational interests.

Our sunbelt farmers can produce everything that is imported from Mexico and central America, an import tariff resets the price structure permitting them to enter the production system with organic profits. It may take a little time for the reset of pricing to travel to new fields and then ultimately to our forks, but it will happen if the USA holds strong in support of the rebalancing.

Influential people, politicians (rules) and corporate leaders (profits), both with vested financial interests in the process, have sold a narrative that global manufacturing, global sourcing, and global production is the inherent way of the future. The same voices claimed the American economy was/is consigned to become a “service-driven economy.”

What was always missed in these discussions is that advocates selling this global-economy message have a vested financial and ideological interest in convincing the information consumer it is all just a natural outcome of economic progress.

It’s not.

It’s not natural at all. It is a process that is entirely controlled, promoted and utilized by large conglomerates, lobbyists, purchased politicians and massive multinational corporations.

To understand who opposes President Trump, Jair Bolsonaro, or any economic nationalist, specifically because of the economic leverage against multinational corporations their policy creates, it becomes important to understand the objectives of the global and financial elite who run and operate the institutions.

The Big Club.

Understanding how trillions of trade dollars influence geopolitical policy we begin to understand the three-decade global financial construct they seek to protect.

That is, global financial exploitation of national markets.

FOUR BASIC ELEMENTS:

♦Multinational corporations purchase controlling interests in various national outputs (harvests and raw materials), and ancillary industries, of developed industrial western nations. {example}

♦The Multinational Corporations making the purchases are underwritten by massive global financial institutions, multinational banks. (*note* in China it is the communist government underwriting the purchase)

♦The Multinational Banks and the Multinational Corporations then utilize lobbying interests to manipulate the internal political policy of the targeted nation state(s).

♦With control over the targeted national industry or interest, the multinationals then leverage export of the national asset (exfiltration) through trade agreements structured to the benefit of lesser developed nation states – where they have previously established a proactive financial footprint.

For three decades economic “globalism” has advanced, quickly. Everyone accepts this statement, yet few actually stop to ask who and what are behind this – and why?

Every element of global economic trade is controlled and exploited by massive institutions, multinational banks and multinational corporations.

Institutions like the World Trade Organization (WTO), World Bank and International Monetary Fund (IMF), control trillions of dollars in economic activity. Underneath that economic activity there are people who hold the reins of power over the outcomes. These individuals and groups are the stakeholders in direct opposition to principles of America-First national economics.

The modern financial constructs of these entities have been established over the course of the past three decades. When you understand how they manipulate the economic system of individual nations you begin to understand why they are so fundamentally opposed to President Trump.

In the Western World, separate from communist control perspectives (ie. China), “Global markets” are a modern myth; nothing more than a talking point meant to keep people satiated with sound bites they might find familiar; but the truth is ‘global markets’ have been destroyed over the past three decades by multinational corporations who control the products formerly contained within global markets. This is the function of the World Economic Forum.

The same is true for “Commodities Markets.” The multinational trade and economic system, run by corporations and multinational banks, now controls the product outputs of independent nations. The free market economic system has been usurped by entities who create what is best described as ‘controlled markets’. {GO DEEP}

Commerce Secretary Howard Lutnick gets it. The essential core of MAGAnomics. Drive down the cost of goods through expanded energy development, then leverage reciprocity in tariffs to end the exfiltration of wealth. Then cut out regulation and unleash American enterprise. This is the way to reverse this insufferable economic trajectory that creates a “service driven economy.”

President Trump wants to Make the American Farmer Great Again!