Posted on 10/24/2024 10:10:47 AM PDT by E. Pluribus Unum

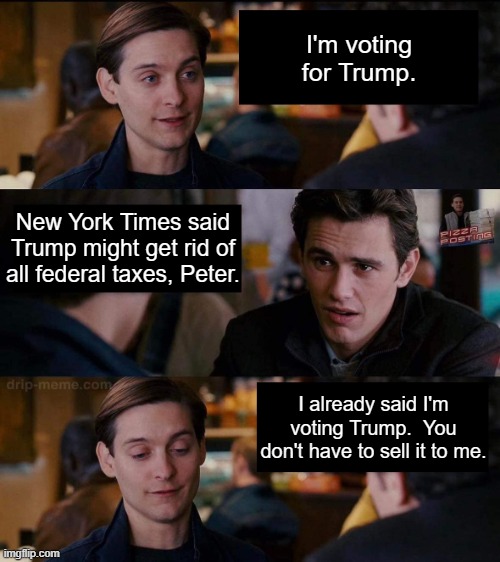

Former President Donald J. Trump has spent much of the presidential campaign brainstorming new, and sometimes untested, ways to cut taxes. In the election’s final stretch, he raised the possibility of going even further: eliminating income taxes entirely.

During a Fox News segment on Monday, Mr. Trump took questions at a barbershop in the Bronx. When asked if the United States could potentially end all federal taxation, Mr. Trump said the country could return to the economic policies in the late 19th century, when there was no federal income tax.

“It had all tariffs — it didn’t have an income tax,” Mr. Trump said. “Now we have income taxes, and we have people that are dying. They’re paying tax, and they don’t have the money to pay the tax.”

In June, Mr. Trump floated the idea of replacing federal revenue from income taxes with money received from tariffs. Mr. Trump has not provided specific details of how that would work, and it is unclear if he wants to eliminate all federal taxes, including corporate income taxes and payroll taxes, or only end the individual income tax.

Either way, both liberal and conservative experts have dismissed his idea as mathematically impossible and economically destructive. Even if Republicans control Congress, lawmakers are unlikely to dismantle the income tax system. Yet Mr. Trump’s combination of tax cuts and tariff increases has been central to his political pitch.

“There is a way, if what I’m planning comes out,” Mr. Trump said of ending income taxes.

Replacing income taxes with tariffs would reverse the progressivity of the tax system in the United States. In general, income taxes are progressive, meaning that Americans with more income pay a higher tax rate. Tariffs, which impose a tax on products imported into the United States, are regressive. They...

(Excerpt) Read more at nytimes.com ...

And it would be so sweet to see the IRS dissolved and all those IRS agents looking for real jobs.

Good stuff... So the world have finally paid for Word War 1... The reason why personal income taxes were introduced... Before that, there were no personal income taxes.

it’s extortion...

USA did just fine for over 100 years until 1916 under our original Constitution prohibiting the federal government from levying an individual income tax

....

Hopefully this will motivate democrats to take the gas pipe.

I’m also in favor of eliminating property taxes, true property ownership.

I said a couple of years ago he would kill the income tax.

Yep, eliminate property taxes and any transfer taxes as well as inheritance taxes. If you own your own property then the government shouldn't have anything to do with it.

An immediate economic boon leading to an era of prosperity to the American People never seen before.

Hopefully it would also lead to the abolishing of much of the illegal and unconstitutional federal bureaucracies and agencies. That would lead to the recovery of America’s Free Constitutional Republic.

Im all for abolishing the IRS and getting rid of taxes altogether..lets start with property taxes..my Mom alone here in Commiefornia has to pay 18 grand in property taxes every year

Plank #1 of the Communist Manifesto: Abolition of private property in land and application of all rents of land to public purpose.

central_va wrote: “Eliminating the individual income tax with tariffs is possible but ending payroll taxes is a bridge too far.”

Why a bridge too far? Why not a consumption tax model, ala the FairTax plan?

Do it..

Tarriffs and. if necessary a national vat.

Thanks, Tell It Right!

Once the proles understood that the Federal Reserve could simply print money out of thin air and in effect deflate and tax everyone, the proles also understood that the Income Tax is about control, not revenue.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.