Skip to comments.

Meet the Gen Zers maxing out their retirement savings: ‘It’s no longer chasing money; it’s chasing time’

Cnbc ^

| 29th may 2024

| Jennifer lu

Posted on 05/29/2024 11:03:26 PM PDT by Cronos

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-53 next last

To: Sir_Humphrey

I have to agree. What else can we expect them to do? My own 36 yo very wise daughter I know probably has six figures stashed already, college accounts started for her kids. They live in a HOVEL and she works part time so she can be home with her kids part time. They shop thrift stores, drive a simple car, and hardly EVER take vacations or go out.

I feel for them. Life will be harder for them. We plan to leave them a good stash as well, and they are going to need it.

To: Antoninus

I agree with this. In mid-life, I suddenly realized that I had a lot of money socked away in a 401K which I would have trouble getting at if it was ever needed. I had comparatively little in liquid cash. So I decided to scale-back the 401k additions the amount needed to maximize the company match—and put the rest into a brokerage account. Now, that money is available for investment, home improvement, new vehicles when needed, etc. and is collecting about 5% in interest.

***

Smart. Please, can you convince my bone headed husband to do this!!

To: Cronos

Compound Interest is the Eighth Wonder Of The World.

23

posted on

05/30/2024 6:19:32 AM PDT

by

dfwgator

(Endut! Hoch Hech!)

To: EQAndyBuzz

““A lot of people think saving toward retirement means you don’t get to enjoy life right now,” she says.”

Not true. There are many ways to enjoy life on the cheap.

*I bagged lunch most of the time eating out and I did not always go on vacations and we were careful with our budget*

These are the minority population-proof? Just look at all the tattoos being worn or the newer Ford 150’s on the road driven by young people making payments.

An Asian woman saving is nothing new. The rest is fake news.

To: dfwgator

Compound Interest is the Eighth Wonder Of The World.Most especially over periods of time, starting young produces amazing results.

25

posted on

05/30/2024 6:22:05 AM PDT

by

1Old Pro

To: LibsRJerks

Life will be harder for them. Harder if the demoncraps win. Your daughter's family will incur a "wealth" tax on whatever they've saved up if pedojoe is installed again. Gen Z better turn out in droves for Trump.

26

posted on

05/30/2024 6:23:46 AM PDT

by

Sirius Lee

(They intend to kill us. Plan to avoid this.)

To: Sir_Humphrey

It’s like when I hear some story about some professional athlete who made millions over their career going broke.

If they’d only took their first year’s salary and socked it away, and then spent everything else, then live off of the interest of that account, without touching the principal, they’d be fine.

27

posted on

05/30/2024 6:24:20 AM PDT

by

dfwgator

(Endut! Hoch Hech!)

To: 1Old Pro

The difference between starting at 22 and starting at 27, is huge.

28

posted on

05/30/2024 6:25:01 AM PDT

by

dfwgator

(Endut! Hoch Hech!)

To: Sir_Humphrey

Agree, this is a tough crowd for sure!

29

posted on

05/30/2024 6:26:04 AM PDT

by

Unassuaged

(I have shocking data relevant to the conversation!)

To: EQAndyBuzz

Wow what an great story. Some of these younger people have this dream of blitzing saving early on and then retiring at a relatively young age. It was a struggle for me to retire at 62 but I wish them well.

To: EQAndyBuzz

That’s the other point of saving early.

Don’t expect to be able to work for somebody else by the time you’re 40. By then, they look for any excuse to get rid of you.

Have a plan to be able to generate income on your own by then. Either by starting up your own company, or investing.

31

posted on

05/30/2024 6:30:54 AM PDT

by

dfwgator

(Endut! Hoch Hech!)

To: Jonty30

Or, that 200k doesn’t really get you much.. especially 40-50 years from now..when Hunter Biden Jr. Is selected for he/she’s insecond term as President.

32

posted on

05/30/2024 6:32:02 AM PDT

by

Leep

(Leftardism strikes 1 in 5.)

To: EQAndyBuzz

As you can see from the thread, most FREEPERS don’t think it’s worthwhile saving for retirement. I wonder if they thought this in their twenties as well. I am surprised the negativity at these young people being smart with their money including your son.

33

posted on

05/30/2024 6:48:08 AM PDT

by

napscoordinator

(DeSantis is a beast! Florida is the freest state in the country! )

To: EQAndyBuzz

As you can see from the thread, most FREEPERS don’t think it’s worthwhile saving for retirement. I wonder if they thought this in their twenties as well. I am surprised the negativity at these young people being smart with their money including your son.

34

posted on

05/30/2024 6:48:48 AM PDT

by

napscoordinator

(DeSantis is a beast! Florida is the freest state in the country! )

To: napscoordinator

Of course if the government just winds up taking the money from savers and giving it to the people who didn’t save, then maybe the savers really are the “suckers”.

35

posted on

05/30/2024 6:49:21 AM PDT

by

dfwgator

(Endut! Hoch Hech!)

To: Tell It Right

With 40 mutual funds, don’t you run the risk of overlapping assets in them? I mean — does it make sense to own 40 different mutual funds if 20 of them all own the same core underlying assets (ExxonMobil, Walmart, Amazon, etc.)?

36

posted on

05/30/2024 6:58:57 AM PDT

by

Alberta's Child

(“Ain't it funny how the night moves … when you just don't seem to have as much to lose.”)

To: Cronos

Just how much are these kids being paid to be able to save so much so quickly? I saved more than 25% of my gross of what I thought was a well paying profession and accumulated just over a million in the first 20 years.

I may also have been one of the few 22 year-olds who asked HR for a copy of the pension fund trustee's report when I went to work.

Weighing in on a few subjects:

1. Knowing what I know now, I would have put just about everything in S&P ETF, they didn't exist when I started saving. You don't get much more diverse and low cost than that. It will go up and down but it reverts to a mean. Untouched, it will be fine until you need it. I have not seen a single money manager who beats the markets that is not a hedge fund.

2. Accumulating assets that pay dividends become mail box money generators. Companies will borrow to bridge troubled times to keep paying dividends.

3. There is no fail safe fool proof investment. Reward follows risk obviously. Fortunes have been made in real estate but it is not one for me.

4. Mix savings between AFIT and BFIT, the BFIT money hides and earns without taxation though but so do unsold stocks except for the dividends. The rub comes when you harvest BFIT savings. TANSTAAFL. Max out the match but probably no more than that. For high income self-employed people the SEIP is a good value for high marginal tax avoidance and investing more early time dollars.

5. After having had one for quite some time I think the balanced portfolio is a bunch of bull. It is an overly complicated less than mediocre performer that is a safe place for advisors to send you and they are very hard to unwind without getting beat up for taxes. Nobody who sends you this direction will ever be accused of malfeasance or even getting close to matching the markets most of the time.

6. I don't think anyone has a clear enough crystal ball to avoid pitfalls or to beat the mean very much if at all. Shoot for 3.5 yards per carry. It may not be glamorous but it will avoid drama and it will get you to the goal post eventually. There may be times when you need to kick though.

7. Everybody has an opinion in this subject and all of them will be wrong at least part of the time but most of us have to take one or two of them to get our bearings. Problem is, if you take the wrong road time is not on your side to recover. Lots of things are like that.

Just my thoughts for today. I'm very happy to see these young people investing. Everyone needs to understand the difference between investing and saving.

37

posted on

05/30/2024 7:36:08 AM PDT

by

Sequoyah101

(The Government that got us in this mess is not the Government that can get us out of it.)

To: Alberta's Child

With 40 mutual funds, don’t you run the risk of overlapping assets in them? You are correct, there is some overlap. For example, I'm well aware that my S&P 500 index fund owns some shares of companies that are also in my energy fund, and some shares of companies that are also in my tech fund, and some shares of companies that are also in my real estate fund (which includes banks).

However, that doesn't change the fact that they don't all track in the same ups and downs.

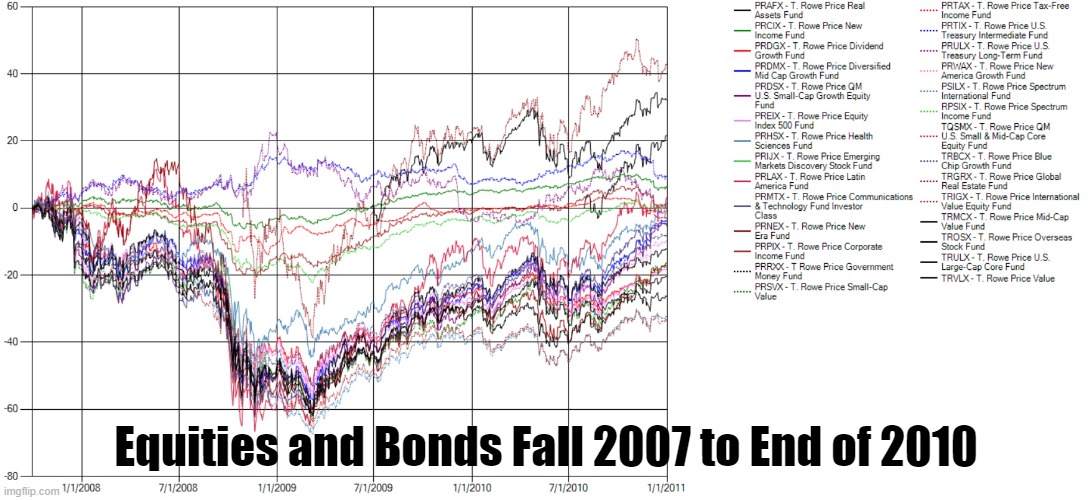

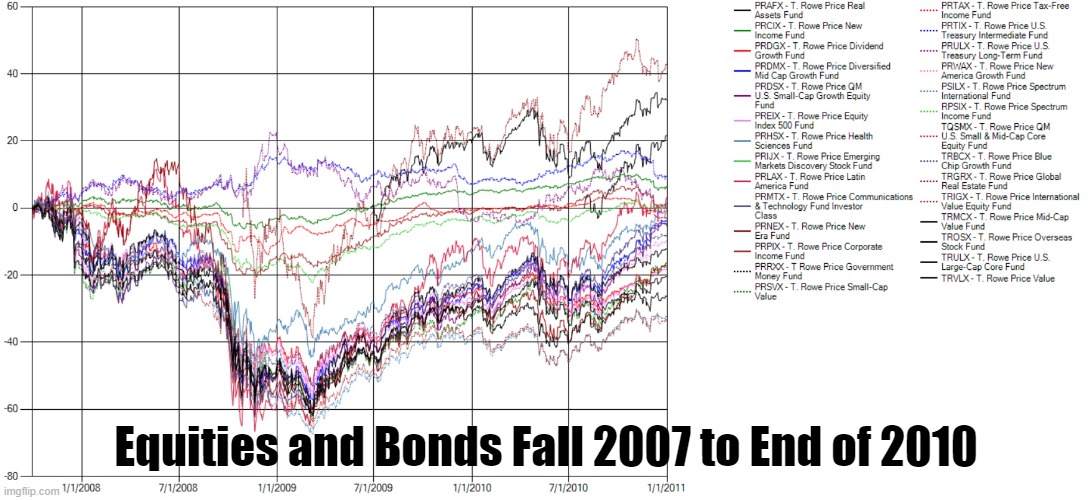

Below is an all equities portfolio during the 2000 to fall 2002 market down turn (dot com bubble burst). Note that a handful of them were positive most of the time, with a couple of them positive the entire time. Thus, if you were retired then and doing your annual 4% withdrawal, you wouldn't even need the bond funds. Even during that downturn, some of the equities mutual funds were up.

Below is the market downturn from Oct 2007 to March 2009 (mortgage meltdown). With that one, you could withdraw from your energy fund and Latin American fund during 2008. But in 2009 you'd depend on the 25% bond portion of the portfolio (until stocks came back up).

This is where the 25% in bonds comes through. I altered the graph above to make the graph below to include bonds and treasuries. I also expanded to more years later to include the stock upswing as a lesson to not panic, keep your money in your stock funds. Do your annual withdrawal only from whatever mutual funds have the highest balances.

So in January 2008 when you do your annual refunds, withdraw from the treasury funds (purple and blue lines that are up 1/1/2008 more than the energy and Latin America funds). Same for January 2009. In January 2010 you'd withdraw your 4% from the global real estate fund (brown line) and large-cap core fund (black line). In January 2011 you had 3 funds that were up (the 2nd black line is domestic real estate fund, even though real estate took a beating during the mortgage meltdown).

Basically, you wouldn't be "timing the market". When you do your annual or quarterly withdrawals (or monthly withdrawals), you'd be withdrawing from whatever mutual funds have the highest balances at that time (sell high).

38

posted on

05/30/2024 7:47:33 AM PDT

by

Tell It Right

(A1st Thessalonians 5:21 -- Put everything to the test, hold fast to that which is true.)

To: DeplorablePaul

“A house is a very good way to accumulate wealth.”

************

Not really. When you allow for all of the carrying costs of home ownership that occur over the years you’ll find that the annualized rate of return isn’t all that great.

I’m not arguing against home ownership mind you, just saying that as an investment, they don’t generate the same kinds of returns that some other investment do.

In short, other investments don’t require a constant outflow of money over many years like homes do. Every home I’ve ever owned (including vacation homes) increased in value but I acquired them as residences of convenience, not as investments. With homes you won’t lose money, but you make a lot either when you look at annualized returns that factor the outflows into the discounted cash flow calculations.

To: Cronos

There is a phenomenon called ‘IT millionaires” which are people that worked in IT all their career and have a $1M in assets when they retire. Some call them “Unexpected Millionaires” because they didn’t set out to be one and they worked a “staff” job all their life. Many of them leveraged their money by moving to Low COL places like Appalachia which is how I met them. Poorer communities love them because they have money but don’t use services like schools.

40

posted on

05/30/2024 8:16:40 AM PDT

by

AppyPappy

(Biden told Al Roker "America is back". Unfortunately, he meant back to the 1970's)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-53 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson