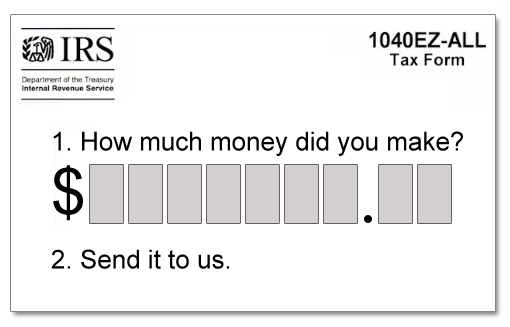

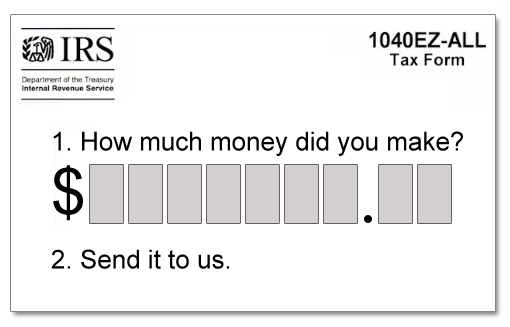

Biden's proposed new tax form:

I'd love if someone could put together a PHP or Python script that I could host on my website that would let people input their own numbers, and compare to what they actually pay today. I know that I would MUCH prefer being able to pay the rates specified in this form, even with the inflation that has masively eroded the value of the dollar.

“Well, that sounds like a lot of money until you consider that what that really means is that in today’s dollars, someone would have to make $754,518.18 per year to pay that $2,515.06 in income tax.”

I don’t understand that statement; doesn’t sound right.

A person I know pays a lot more than $2,515.06 in income taxes on a lot less income than $754,000.

Excellent post. FReepers here take note— 1913 is also the year that the Federal Reserve Bank (a Private Bank then and now, for bankers to bank with each other and “guide” the economy. Something they know very little about and have dutifully screwed up many time. Jekyll Island 1913 Senator Aldrich (Rockefeller’s man),, and they got this “chartered” to them by Congress (giving up Congress’s Constitutional responsibility to manage US Currency!).

Income Tax, and Federal Reserve Bank- the same year and then hand in hand ever since bringing our American Republic down every single time through 2 World Wars and the Cold War and several “recessions” following the Great Depression which they caused right after forming JP Morgan’s club. This is the reality. And don’t forget Bretton Woods, after WWII. The very last people one would ask for business solutions to maintain the great wealth of the USA, created by our Citizens.

The whole thing has gotten crazy.

Last year (before I retired), my personal and business tax forms totaled almost 120 pages!

This year (after retirement), I’m down to slightly over 50 pages. Zero income tax this year, only a little self-employment tax (SS and MCare).

yeah. i’d say they’ve been stealing us blind for more than a century: in both our time and money.

that thing turned the gov’t into the mob, and us into slaves. the worse thing is that thing has no limits whatsoever. the Founder’s would have puked on hearing that language.

It was always a fact, given the nature of the Progressives who pushed for the national income tax, that higher rates and more complex rules, along with more deductions, exclusions, exemptions and credits would come along in time. The original was just an introduction intended to get folks used to and accepting of the income tax. Everything the Progressive do is always stealth, intended to broaden and deepen over time.

Friedman had the right idea: Go to a proportional tax. Everyone pays 17% (Friedman’s number) of gross income. No deductions. The complete tax form could be on a post card. Indeed, for domestic income, you wouldn’t even have to file a return as you could have anyone paying someone an income pay the tax directly to the IRS. Removing all deductions means the reallocation impact of income taxes would be removed.

The current tax code is so complex, even the IRS doesn’t give the same answers to the tax owed for certain types of income. I called the IRS helpline twice for an answer to a question and got two different answers. As a result, I always ask for the person’s name if asking a question.

Our government is awash in tax dollars. They can spend a trillion for covid handouts in a blink of an eye and not think anything of it. We can send Ukraine 80 billon and it's not even worth accounting for how it's spent. We should go to a 10% flat tax.

Biden's proposed new tax form:

BOHICA b——es!

INCREDIBLE - and they didn’t even require a Social Security Number! I guess people were more honest back then.