Posted on 08/18/2023 8:48:19 AM PDT by thegagline

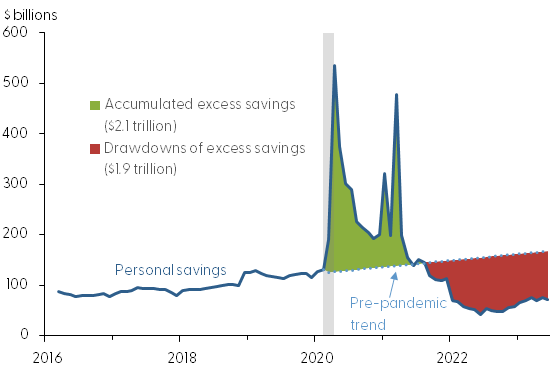

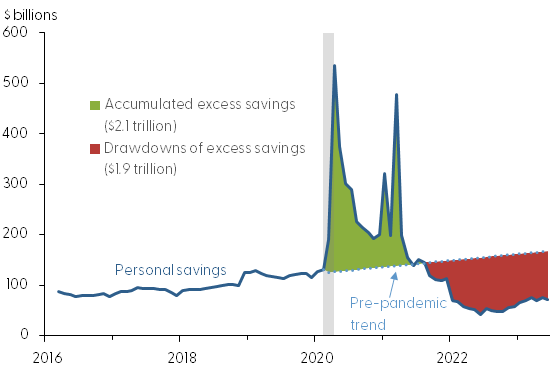

In a study earlier this year (Abdelrahman and Oliveira 2023), we examined household saving patterns since the onset of the pandemic recession. Our study showed that households rapidly accumulated unprecedented levels of excess savings—defined as the difference between actual savings and the pre-recession trend—relative to previous recessions. Our analysis suggested that some $500 billion of the $2.1 trillion in total accumulated excess savings remained in the aggregate economy by March 2023.

Since then, data revisions show noticeable changes in household disposable income and consumption, while new data releases indicate that consumer spending picked up in the second quarter. Our updated estimates suggest that households held less than $190 billion of aggregate excess savings by June. There is considerable uncertainty in the outlook, but we estimate that these excess savings are likely to be depleted during the third quarter of 2023

Households spent more and saved less

The Bureau of Economic Analysis recently revised its previous estimates to show household disposable income was lower and personal consumption was higher than previously reported for the fourth quarter of 2022 and first quarter of 2023. The combined revisions brought down the Bureau’s measure of aggregate personal savings by more than $50 billion. In addition, second-quarter data indicate that household spending continued to grow at a solid pace.

Figure 1 shows that estimates of accumulated excess savings, in nominal terms, totaled around $2.1 trillion by August 2021 when it peaked (green area). Since then, aggregate personal savings have dipped below the pre-pandemic trend, signaling an overall drawdown of pandemic-related excess savings. The drawdown on household savings was initially slow but started to accelerate in 2022 and has remained around $100 billion per month on average.

The red area in Figure 1 shows our updated estimate for cumulative drawdowns, which reached more than $1.9 trillion as of June 2023. This implies that there is less than $190 billion of excess savings remaining in the aggregate economy. Should the recent pace of drawdowns persist—for example, at average rates from the past 3, 6, or 12 months—aggregate excess savings would likely be depleted in the third quarter of 2023.

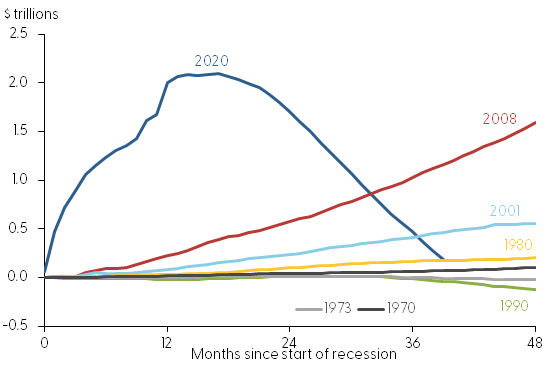

In Figure 2, we update our Economic Letter’s depiction of the monthly progression of excess savings following post-1970 recessions. The rapid accumulation and subsequent drawdown of excess savings following the onset of the pandemic recession contrasts starkly with prior recessions. This contrast holds true when the data are adjusted for inflation, as well as when we define excess savings as a share of trend savings or as a percent change from pre-recession periods.

*** [T]he existing body of work on household savings following the pandemic recession firmly points to the rapid accumulation and drawdown of excess savings in the United States. Our estimates suggest that a relatively small amount—around $190 billion—remains in the overall economy, and we expect the aggregate stock of excess savings will likely be depleted during the third quarter of 2023—that is, the current quarter—for which initial data will be released later.

People are getting hit hard by inflation. Unsurprisingly with the way we’ve printed money for the last 3 years in particular.

“Pandemic Savings” never should have happened.

People were getting paid by the government to sit at home. That is a double whammy hit to your economic standard of living, because you are inflating your currency and you are producing nothing!

People are like, “I don’t understand why everything got so expensive! derp”

People don’t understand that currency is just a symbol for how much your standard of living is worth. 2020 was a direct attack on our standard of living. The inflation is just a way to measure that.

Like I told everyone the past couple years, when they were talking about taking a cruise or trading in their car with their windfall “stimulus/covid” checks-— you better invest it wisely, because you’re going to be paying for it -—for a LONG time, there ain’t no such thing as a free lunch.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.