Posted on 07/19/2023 2:31:56 AM PDT by RomanSoldier19

That’s a bogus argument for fascist crony capitalism.

A bank can fail without destroying the currency.

Glass-Steagall and antitrust could and should have kept our banks smaller and thus less individually systematically important.

Heh, true

They can (and will) bail out the banks, but how can they bail out the (Democrat) cities?

NYC commuters were earning about 2 x as much as the average NYC resident. I paid a lot of taxes when I worked there. (I utilized minimal services and I couldn't vote there, as well.)

Access to features of the city like Broadway shows and museums is nice, but it is not worth as much as as the convenience of remote work and personal safety.

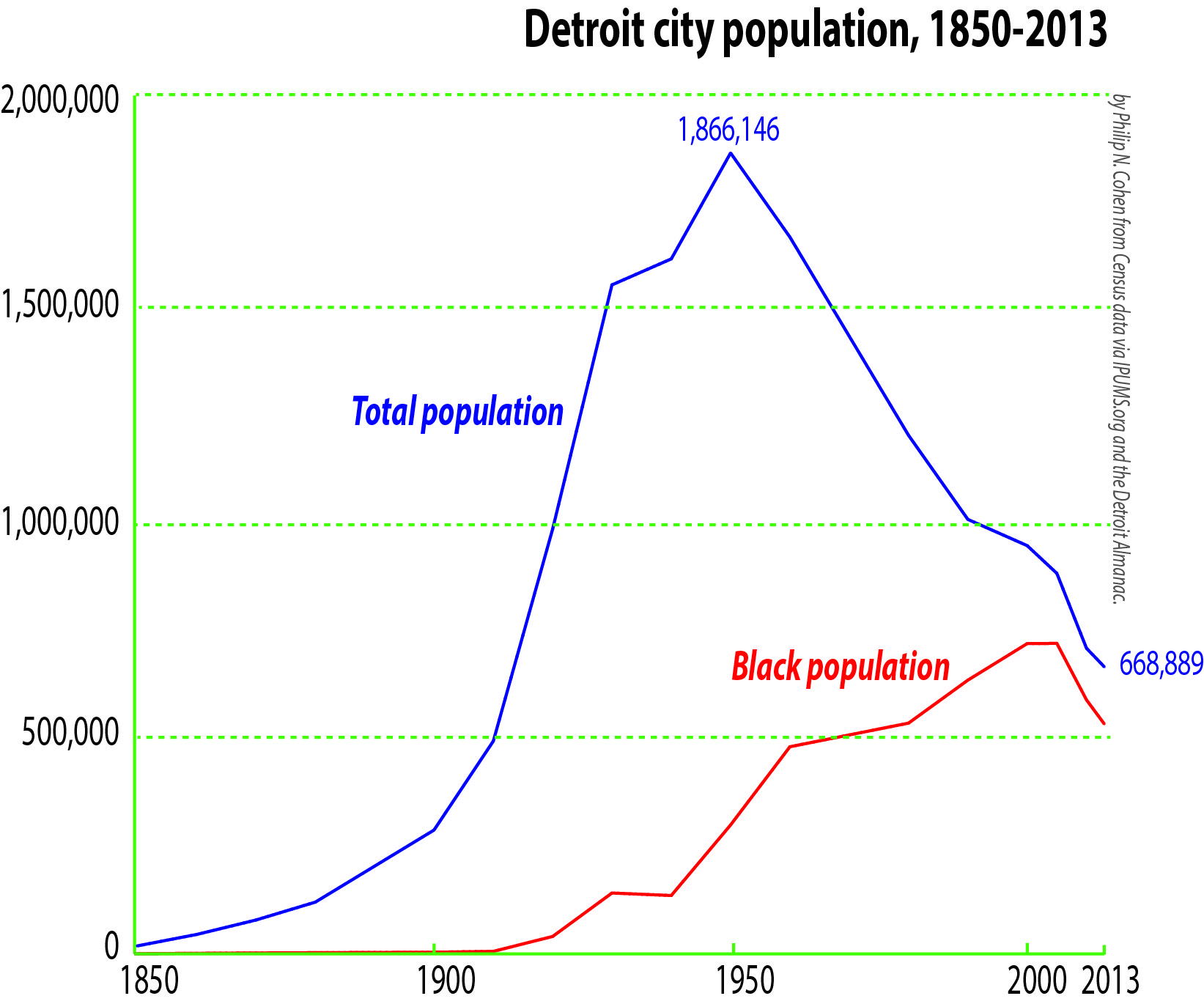

Will most US cities turn into Detroits?

I’m just telling you how it works.

We would have had the same issues — though on a much smaller scale — even if Glass-Steagall was still in force.

The problem is that cities are obsolete.

The real estate is just no longer required

“though on a much smaller scale”

building -> limited partnerships of rich people -> fancy ‘art studios’ for rich people -> condos for themselves

Prime metropolitan real estate commands $300 to $1000 per square foot.

SOHO in NYC was converted from factory space to artist space to prime residential.

What the difference between an ‘art studio’ and an apartment? A fold-out couch.

The solution to this problem is simple. It’s called failure. Life goes on. People and businesses recover, perhaps in another form. You can’t have capitalism without loss. It has never been the case that investing only has winners. It’s great when both sides of a transaction benefit, but without loss there is no lesson for improvement.

What part of ESG, BLM, defund the police, COVID 19 lockdowns did these guys not back to the hilt?

As the Austrian school explains it, successful investment leads to a boom, which leads to overinvestment which leads to emormous wasted allocation of resources that can be recovered except when recycled at a huge loss through liquidation.

(Nor was Detroit.)

You can see how this works even here on Free Republic, of all places. I'm always surprised to see how many people here seem to think they have a God-given right to pay 3% rates on their mortgages and collect 5% interest on their savings -- from the same bank. How long does a bank stay in business under those circumstances?

And yet in many respects our banking system is set up to operate that way. Large, national (and international) banks have been allowed to proliferate because it's one of the only ways to minimize the impact of that underlying flaw in their business models that is forced onto them by law.

What law are you referring to?

What this effectively means is: There's no such thing as a fixed-rate mortgage.

Sure -- you can sign a mortgage for a fixed interest rate over 15 or 30 years, and take the full 15 or 30 years to pay it off. But you always have the right to refinance it with no penalty if interest rates decline. The bank, however, has no corresponding rights to refinance the mortgage if interest rates RISE.

The end result is what we have now, where banks get mortgages off their books as quickly as possible to minimize their exposure to this interest-rate risk. And the only way to do this is to sell them to big financial institutions (or the U.S. government) that bundle the mortgages and sell them to investors as collateralized mortgage obligation (CMO) bonds.

That is correct, though left to their own market pricing could compensate for it.

But not really relevant to the larger smaller-bank argument.

Isn’t part of the system as well, that banks want to get mortgages off the books, so they get money to make more mortgage loans, and other loans?

Nice chart, but would you mind buying me a new monitor so I can see the whole thing?

PS Try adding to your img-src html: “width=”650” << or under 1200 at least to reduce to typical screen

Yes but wasn't most of the cost just covering insured deposits? FSLIC became insolvent the Fed and FDIC had to step in to cover the insured deposits. An entire sector of the banking system went belly up. The savings and loan system was dismantled. The criminals who ran the savings and loans had to find new work.

Oh! I almost forgot. Michael Milkien walked away with over a Billion dollars after going to jail for architecting the destruction of the S&L system with his Junk Bond sales

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.