Columbia University in Manhattan in New York on May 10, 2021. (Samira Bouaou/The Epoch Times)

Posted on 06/16/2023 8:32:47 PM PDT by SeekAndFind

Federal student loan payments have been on pause since March 2020. But that will change soon.

Columbia University in Manhattan in New York on May 10, 2021. (Samira Bouaou/The Epoch Times)

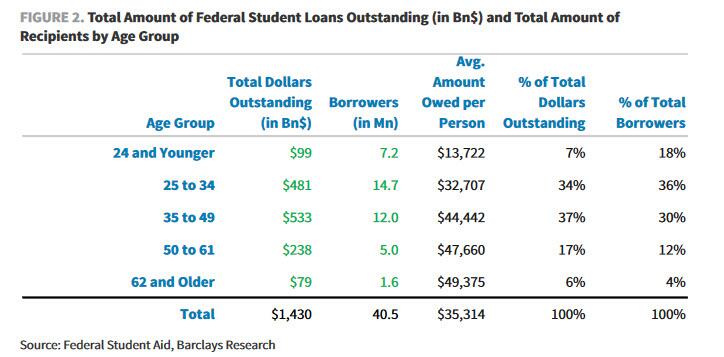

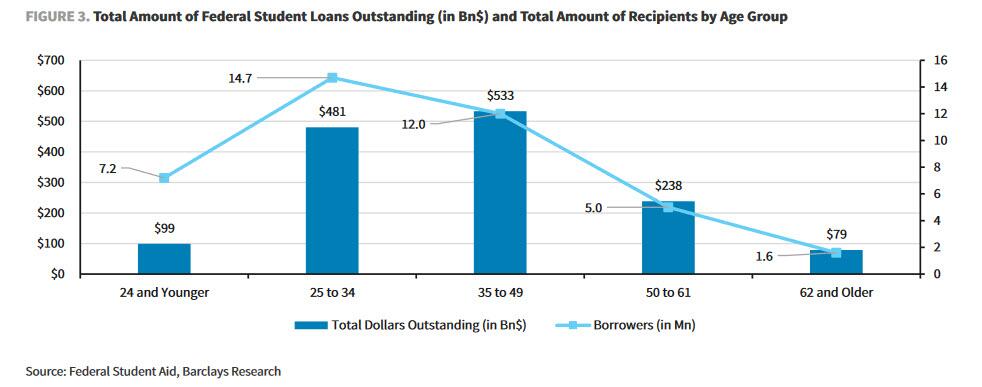

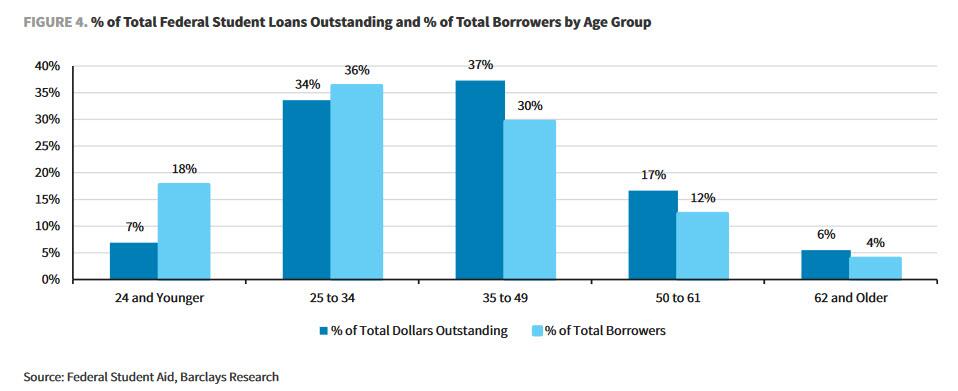

The U.S. Department of Education, which oversees a $1.6 trillion portfolio in federal student loan debt owed by about 43 million Americans, has posted a notice at the top of its student aid website confirming when borrowers should start paying their bills again.

According to the notice, interest will kick in starting Sept. 1, but borrowers won’t need to make payments until October.

“Congress recently passed a law preventing further extensions of the payment pause,” the department stated. “Student loan interest will resume starting on Sept. 1, 2023, and payments will be due starting in October. We will notify borrowers well before payments restart.”

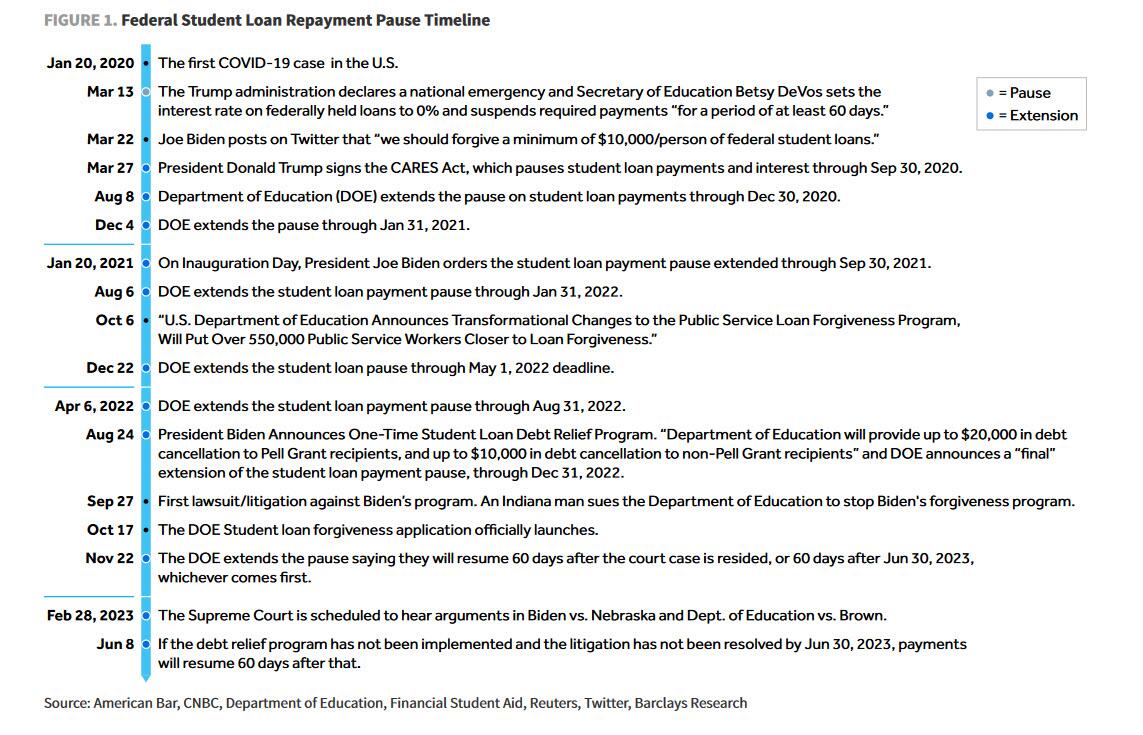

The pause on federal student loan payments and the accumulation of interest was first ordered by then-President Donald Trump at the onset of the COVID-19 pandemic in an effort to ease the financial pressure Americans were facing. It has since been extended many times by both the Trump and Biden administrations.

As part of the recent bipartisan deal that suspended the U.S. government’s borrowing limit, the Biden administration is prohibited from extending the pause again.

There has been some confusion over exactly when student loan payments would resume. The Biden administration previously stated that the payment freeze would end either 60 days after the U.S. Supreme Court issued a decision on the so-called forgiveness plan or 60 days after June 30, whichever came first.

The debt-ceiling deal, which gained final approval from Congress earlier this month, mandates that the student loan payments restart 60 days after June 30, or Aug. 29.

The June 13 clarification also comes as the U.S. Supreme Court considers whether to give its blessing to the Biden administration’s attempt to “forgive” hundreds of billions of dollars of debt.

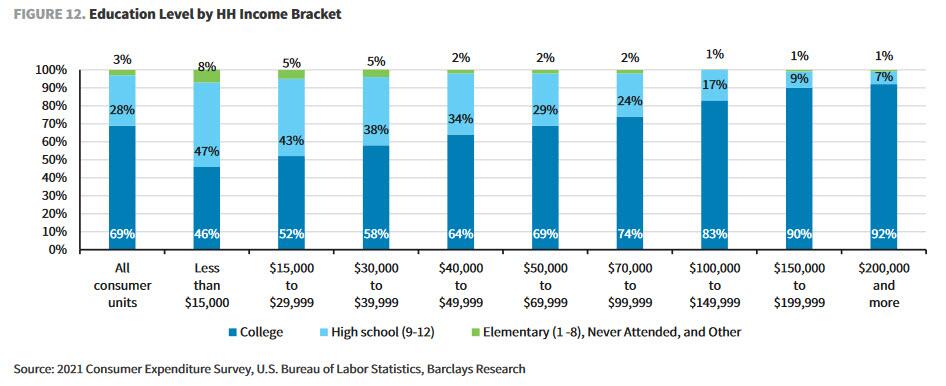

At the core of the legal challenge is the question of whether President Joe Biden has the authority to implement his $400 billion plan, which would erase up to $10,000 in student loan debt for every borrower who earns less than $125,000 per year while canceling up to $20,000 for each Pell Grant recipient who meets that income standard.

It’s unclear when the Supreme Court will rule on the case. Supreme Court justices typically go into recess as soon as they issue their last decision of the current term in late June or early July, and they won’t be back to work until Oct. 2, the official start of the new term.

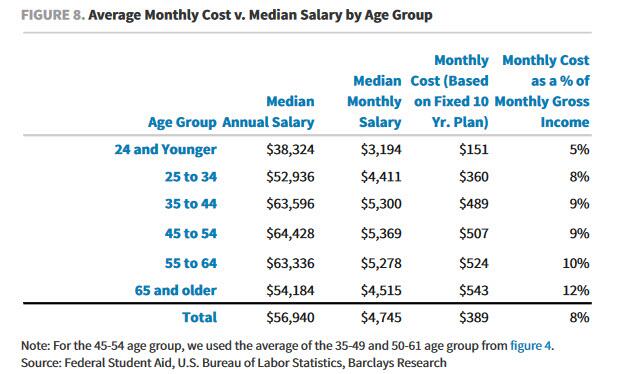

A scenario in which the high court’s conservative majority strikes down Biden’s plan could mean financial hardship for millions of people, according to an analysis by the Consumer Financial Protection Bureau (CFPB), an agency within the Federal Reserve.

Read more here...

The smart ones saved their money, so they can make a large payment when the payments restart.

Biden ended the national emergency on April 11, 2023. You could argue that the payments should have restarted 30 days after that date.

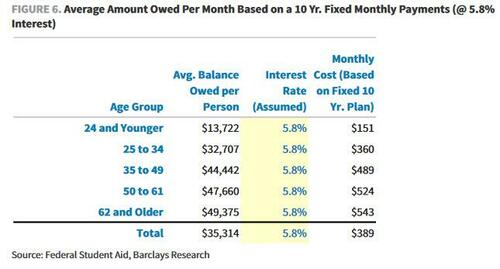

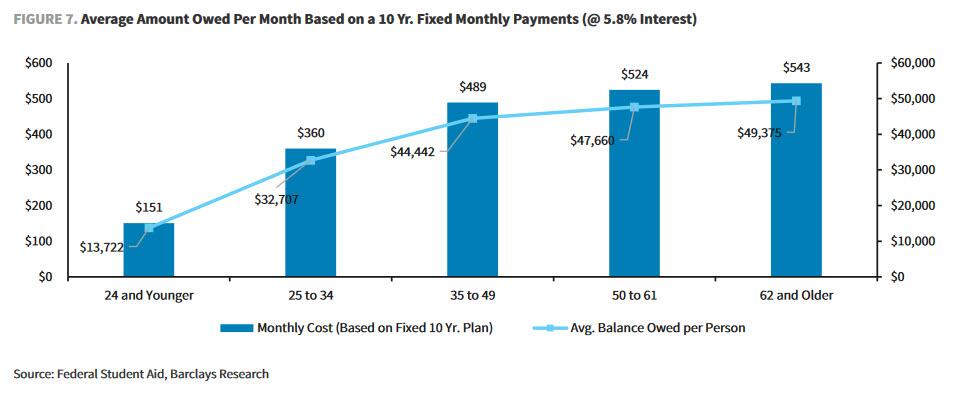

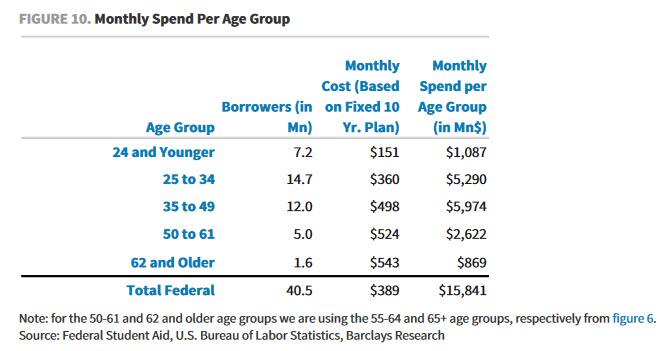

How could there be 1.6 million people aged 62 and older who still haven’t paid off their student loans?

RE: How could there be 1.6 million people aged 62 and older who still haven’t paid off their student loans?

Apparentlywe have many Baby Boomers who took on loans to go to expensive colleges and majored in useless courses, finding themselves in dead end jobs that don’t pay much.

And not striking down the plan will cause financial hardship for every American taxpayer who will be forced to pay off the loans for these deadbeats.

I had a little discussion on Yahoo News with a woman who took exception to me calling them deadbeats, moochers, and oathbreakers. She said her loan was predatory. When I said she was screwing innocent taxpayers, she said she was a taxpayer and had been paying her loan since 1984. I told her I wouldn’t call a lender who gave you 40 years to pay a loan predatory.

The horror, the horror.

We both know they spent it on vacations and other lifestyle choices.

The kids are not going to be happy.

Hubby went back to get his MBA at age 47. I went to a community college after I was laid off and my job was offshored in 2011. I was in a 2 yr billing and coding program, but I quit 3/4 of the way through because I got a full time job. I still owe the money though, even though I never got a job as a biller/coder. 😖

The smart ones continued paying when the interest was zero.

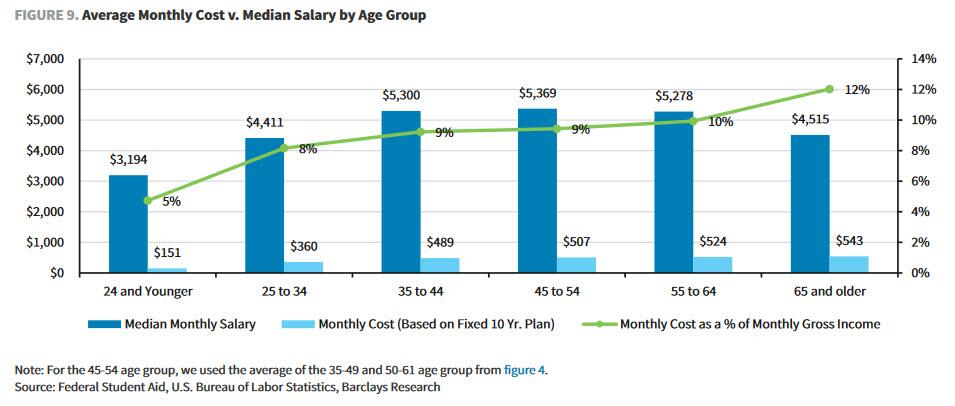

Going back to making payments will suck $8 billion a month out of the economy.

I can hear the screams already.

And who are these 62 year olds still paying college debt?

Every penny of every PPP loan should be repaid as well. Hearing rethuglicans complain about student loans but not about PPP loans is disgusting.

Yup. No more discretionary spending from that group. Economy is going to fall off a cliff. Oh well.

Isn’t SCOTUS considering a student loan case right now?

In many cases, schools don’t sell education, they sell dreams. I wish I had a dollar for every mom I knew that went back to school($$$) to become a nurse and quit nursing after a few years but are still paying back the loans.

THEIR FINANCIAL HARDSHIP——

REALLY????

THEY TOOK OUT THE LOANS

THEY GOT THE EDUCATION

THEY AGREED TO PAYING THE $$$$ BACK

MILLIONS OF USA CITIZENS worked 2 jobs-—did night school ( I did) or did what they needed to do & PAID THEIR OWN WAY AR EACH SEMESTER.

WHY SHOULD ANY OF THESE SNOWFLAKES GET THEIR LOANS FOR FREE???

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.