Posted on 03/19/2023 6:22:24 AM PDT by Oldeconomybuyer

A coalition of midsize U.S. banks, Mid-Size Bank Coalition of America (MBCA), has asked regulators to extend FDIC insurance to all deposits for the next two years, Bloomberg News reported on Saturday citing an MBCA letter to regulators.

The letter argued that extending insurance will immediately stop the exodus of deposits from smaller banks, which in turn will stabilize the banking sector and restore confidence in banking system, the report said.

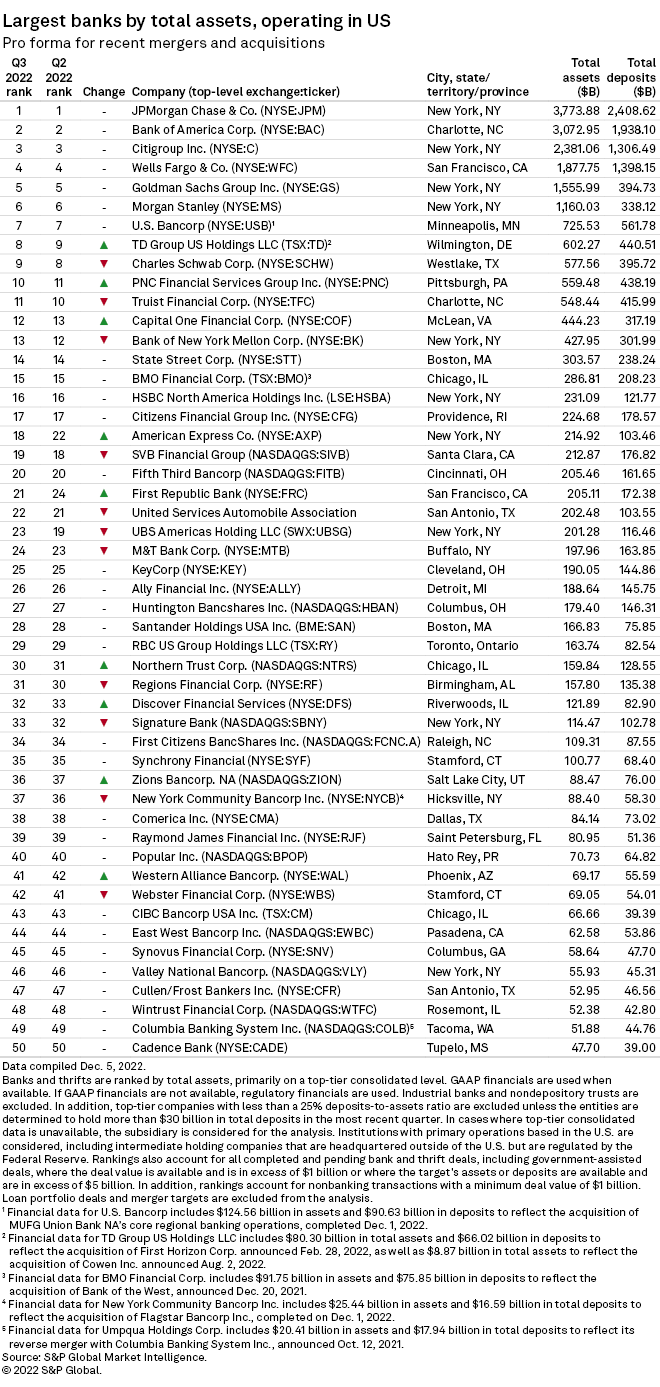

The collapse of Silicon Valley Bank, which held a high number of uninsured deposits beyond the FDIC guaranteed limit, prompted customers to move their money to bigger banks and triggered sharp selloff in banking stocks.

(Excerpt) Read more at cnbc.com ...

Big government likes big business, easier to control.....

Hopefully Americans are learning what moral hazard is and why this idea is not a good one.

Good News, Bad News. Your money is protected but only worth enough to buy a cup of coffee.

Yellen set a bad precedent.

Honestly I don’t know if there was a good aolution other than another bank immediately buying Silicon Valley Bank.

What they’re actually asking is for all of us taxpayers to bail them out.

Not to throw gas on this....but if you went and saved ALL of them, what happens then?

Bad bank ‘gaming’ over next five to ten years...arriving at disaster again in 2030, and cranking out saving people a second time with fresh new cash?

People ought to pull some books over 1929 and start reviewing bank failure, and why the Fed didn’t do much.

Yellen told the truth! Democrats will be made whole and screw the Republicans!

No need to steal money when the govt will refund money you “lost”.

Will the govt refund all money I lost at the First National Bank of Slot Machines. Or the State Bank of Horse Track.

These banks should have to pay a premium for the two years of extra protection, and the banks should be required to raise the interest rate they’re paying on ordinary deposits to 3% and have that rate rise with inflation.

Credit unions already pay their depositors a better rate of interest, and there hasn’t been any CU runs or failures.

Fire all the “risk managers”. They’re all idiots anyway. Banks should just change their names to government money holes.

Yellen has made it clear—some animals are more equal than others.

Orwell nailed it.

However, it is Ayn Rand gave the best explanation of the world we live in today:

“When you see that in order to produce, you need to obtain permission from men who produce nothing –

When you see that money is flowing to those who deal, not in goods, but in favors –

When you see that men get richer by graft and by pull than by work, and your laws don’t protect you against them, but protect them against you –

When you see corruption being rewarded and honesty becoming a self-sacrifice –

You may know that your society is doomed.”

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.