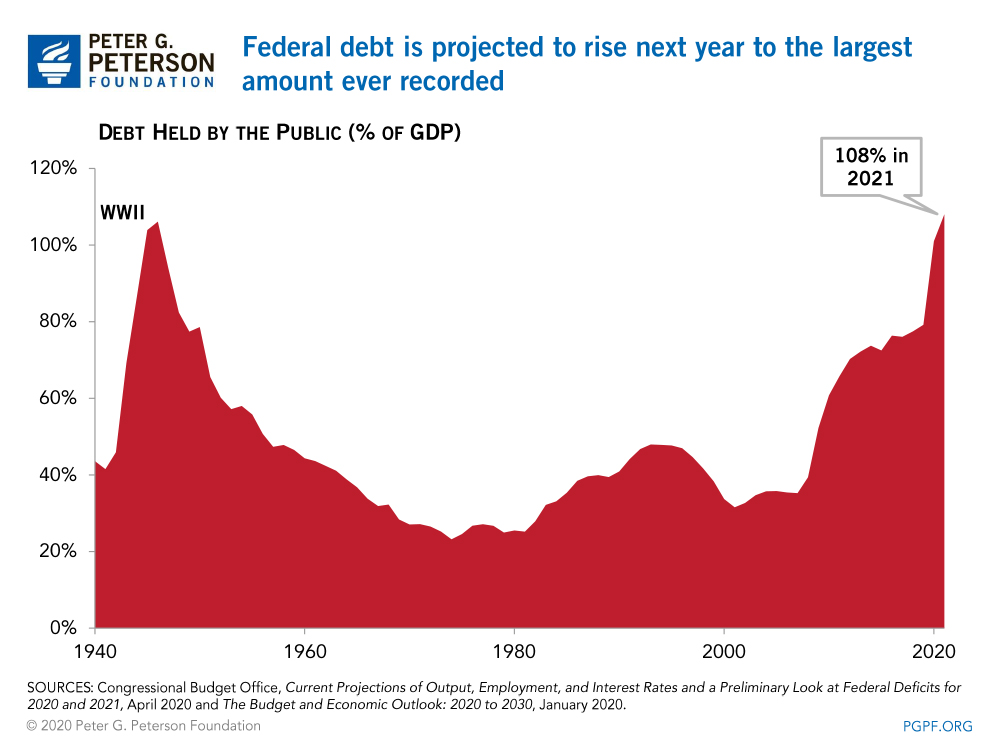

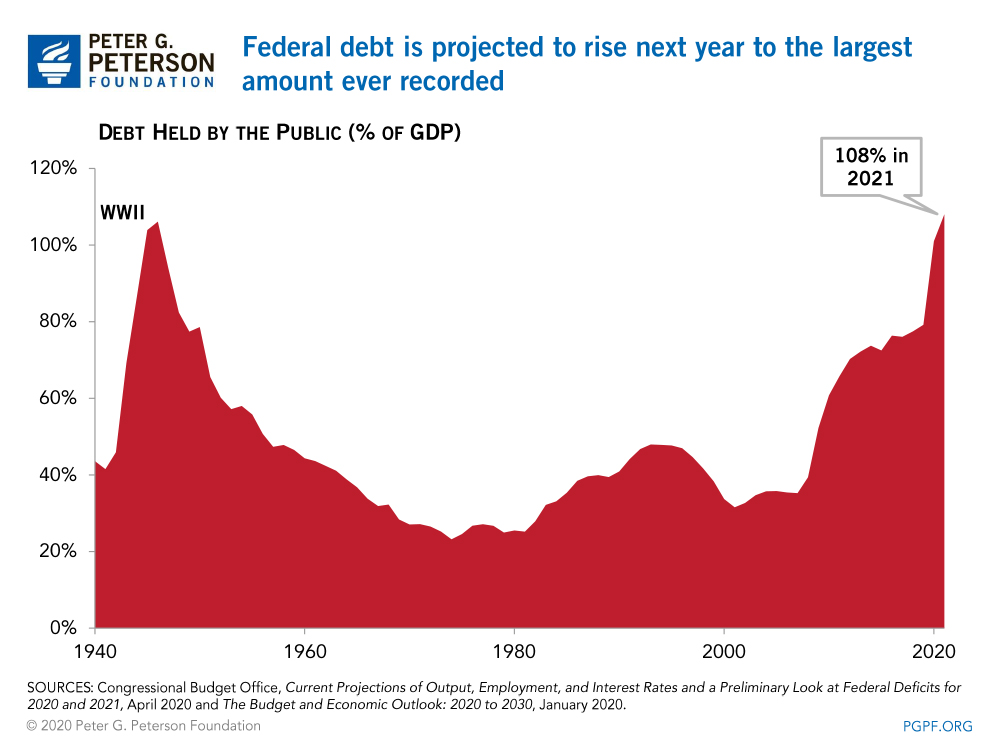

Today's debt is $31 trillion while GDP is circa $23 trillion.

That ratio is 135%, the highest in history.

In late May, the Congressional Budget Office (CBO) projected that annual net interest costs would total $399 billion in 2022 and nearly triple over the upcoming decade, soaring from $442 billion to $1.2 trillion and summing to $8.1 trillion over that period. However, if inflation is higher than CBO’s projections and if the Fed raises interest rates by larger amounts than the agency projected, such costs may rise even faster than anticipated.

The growth in interest costs presents a significant challenge in the long-term as well. According to CBO’s projections, interest payments would total around $66 trillion over the next 30 years and would take up nearly 40 percent of all federal revenues by 2052. Interest costs would also become the largest “program” over the next few decades — surpassing defense spending in 2029, Medicare in 2046, and Social Security in 2049.

Ballooning interest costs threaten to crowd out important public investments that can fuel economic growth in the future. CBO estimates that by 2052, interest costs are projected to be nearly three times what the federal government has historically spent on R&D, nondefense infrastructure, and education, combined.