Posted on 09/28/2022 5:50:06 AM PDT by dennisw

Acostly troop mobilization, plunging energy prices and a new round of Western sanctions threaten to bear down on Russia’s already embattled economy and undermine the financial underpinnings of President Vladimir Putin’s war in Ukraine.

Russia's Mobilization and Plunging Oil Prices Weaken Putin's Economic Hand Russia's Mobilization and Plunging Oil Prices Weaken Putin's Economic Hand © ALEXEY MALGAVKO/REUTERS The economic storm clouds come as Mr. Putin orders more financial resources directed at the war in Ukraine. The Kremlin’s decision to call up more than 300,000 soldiers will require new funds to equip, train and pay the new reinforcements, analysts said. It has also spread disruption among Russia’s private businesses, which face a fresh challenge as workers report for duty or flee the country.

And it is happening as the windfall from soaring energy prices—Russia’s main economic strength—appears to have peaked. Russia’s federal government budget was in deficit last month because of diminished energy revenue. That was before the latest leg down in prices for oil and before Moscow shut down most of its remaining natural-gas flows to Europe.

“Mobilization is another serious hit on the Russian economy, especially because of the increased uncertainty,” said Maxim Mironov, professor of finance at Madrid’s IE Business School. “And it happens when oil and gas revenues are beginning to dry up.”

Wars are often won by the side that has the economic wherewithal to support fighting over the long haul. Ukraine’s economy has been battered, but receives a gusher of aid from the West to stay afloat.

(Excerpt) Read more at msn.com ...

MORE>>>>>

Western sanctions staggered Russian commerce, but Moscow succeeded in stabilizing the economy thanks to a jump in energy prices. The ruble, which plunged at the start of the war, rose sharply against the dollar and inflation moderated. The Russian government and independent economists now predict a shallower recession this year than previously assumed.

While there is no evidence of an imminent economic collapse, business owners and investors inside the country reacted with dread to the news of the mobilization. Activists and analysts said Mr. Putin’s order opens the door to a much larger draft. Russia’s stock market, limited mostly to domestic investors, tumbled after the draft announcement.

“It’s really impossible to count,” said Mihail Markin, head of the business development department at Moscow-based logistics company Major Cargo Service. “If it’s five people in a 1,000 person company that’s one thing, but what if it’s half?”

“And then who knows how businesses will act without the people who are drafted,” he said.

Before the draft, official data showed the government veered into a big budget deficit in August. It reported the budget surplus for the year narrowed to 137 billion rubles, or $2.3 billion, for the first eight months of the year, from about 481 billion rubles in July.

The government has come up with several measures to plug the gap, including raising taxes on the energy industry. It issued government bonds this month for the first time since February and promised to run a deficit next year. The bonds will have to be financed by local savers. Foreign investors, who owned 20% of government bonds before the war, are barred from the market. Moscow is shut out of foreign debt markets.

Russia’s economic problems are partly a boomerang effect of the country’s own policies. High energy prices caused by the war in Ukraine initially created huge revenues for Russia. Around 45% of Russia’s total federal budget revenues came from oil and gas in the first seven months of the year, according to the Institute of International Finance.

But high energy prices have put a brake on global growth and led to a widespread slowdown in demand for oil. Benchmark Brent crude has fallen by almost a third from its June high to trade at less than $85 a barrel.

Factoring in the discount of about $20 for Russian crude, Moscow is already selling its oil below the price needed to balance the budget, estimated at $69 a barrel in 2021 by S&P Global Commodity Insights. The strong ruble complicates matters for the Kremlin by reducing the value of oil exports when the proceeds are converted into Russia’s currency.

Exports of oil have fallen as well as the price in recent weeks, analysts and ship-tracking firms say. The drop has likely been driven by a combination of a slowing world economy and looming European Union sanctions on Russian fuel, which come into effect in December.

Neil Crosby, senior analyst at OilX, said Russian crude exports have fallen to about 4.5 million barrels a day in September, down from over 4.8 million a day in August, because of a drop in flows to Turkey, China and India. Those three countries scooped up much of the Russian crude shunned by the West and its allies in the wake of the invasion.

Capital Economics estimates that Russia’s total oil-and-gas export revenues will halve from around $340 billion this year to $170 billion in 2023, a loss equivalent to more than twice Russia’s defense budget last year.

The West is also preparing to tighten the vise on sanctions, after already hitting Moscow with an unprecedented barrage of measures over the course of the year. A price cap on Russian oil organized by the Group of Seven nations is also in the works.

Just as Russia suffers setbacks on the battlefield, the costs and complications of the draft have rattled confidence.

“Mobilization is the sword of Damocles now hanging over all Russian households,” said Janis Kluge, an expert on Russia at the German Institute for International and Security Affairs. “This will hurt the optimism of the average Russian consumer.”

The anxiety has triggered a run for the Russian borders by thousands of fighting-age men, adding to an already sizable brain drain wave earlier in the year.

“People are escaping where they can,” Mr. Mironov said. “These are mainly highly skilled, educated workers. So this mobilization is going to have a severe economic effect not just for the next year but for decades.”

Russian businesses are trying to figure out which employees are likely to be called up, and how to reduce those numbers.

The chief executive of a food-production facility in central Russia said he received a blank form from the local town administration on Saturday that he was told to fill out with the information about his employees who may be eligible for military service. The form, reviewed by The Wall Street Journal, asks for information including name, address, military rank, reserve status, family status and work role of the employees.

The price of international benchmark Brent crude slipped below $85 a barrel for the first time since January on Monday morning.

Brent futures for November slipped more than 1.5% to around $84.51 during early trading, recovering $85.34 at 9.44 a.m. London time.

West Texas Intermediate (WTI), the U.S. benchmark, dropped as low as $77.22 a barrel early Monday morning—its lowest level since early January—though it recovered and was trading at $78.57 4:52 a.m. Eastern time.

The drop continues weeks of straight declines in oil prices, which caused both benchmarks to fall to their lowest levels since January last Friday.

Widespread fears of a recession and the strong performance of the U.S. dollar have dampened global demand for oil.

https://www.forbes.com/sites/roberthart/2022/09/26/oil-prices-plummet-as-dollar-soars-and-global-recession-fears-grow/?sh=6d62eedee6a3

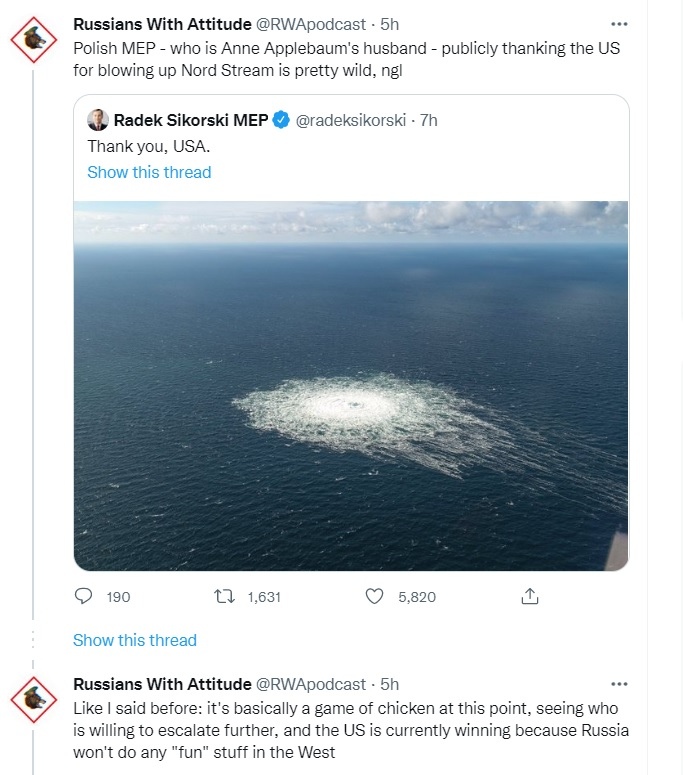

Link takes you to the Seapower article above.

Seapower is the official publication of the U.S. Navy League.

“BALTOPS 22: A Perfect Opportunity for Research and Testing New Technology “

BALTIC SEA — A significant focus of BALTOPS every year is the demonstration of NATO mine hunting capabilities, and this year the U.S. Navy continues to use the exercise as an opportunity to test emerging technology, U.S. Naval Forces Europe-Africa Public Affairs said June 14.

In support of BALTOPS, U.S. Navy 6th Fleet partnered with U.S. Navy research and warfare centers to bring the latest advancements in unmanned underwater vehicle mine hunting technology to the Baltic Sea to demonstrate the vehicle’s effectiveness in operational scenarios.

Experimentation was conducted off the coast of Bornholm, Denmark, with participants from Naval Information Warfare Center Pacific, Naval Undersea Warfare Center Newport, and Mine Warfare Readiness and Effectiveness Measuring all under the direction of U.S. 6th Fleet Task Force 68.

BALTOPS is an ideal location for conducting mine hunting experimentation due to the region’s unique environmental conductions such as low salinity and varying bottom types. It is also critical to evaluate emerging mine hunting UUV technology in the Baltic due to its applicability with allied and partner nations. This year experimentation was focused on UUV navigation, teaming operations, and improvements in acoustic communications all while collecting critical environmental data sets to advance the automatic target recognition algorithms for mine detection.

“In prior BALTOPS we demonstrated advanced capabilities to detect, reacquire and collect images of mine contacts, and transfer those images in near real-time to operators through the use of a specialized Office of Naval Research UUV,” said Anthony Constable, Office of Naval Research science advisor to U.S. 6th Fleet. “This year, through the work of NIWC Pacific and NUWC Newport, we are showing that this capability can be integrated into programs of record by executing complex multi-vehicle UUV missions with modified U.S. Navy fleet assets.”

[more at link]

Poverty induced price declines feels like winning!

Also, the mobilization is a double whammy to the Russian economy because you are taking working age men out of the jobs market and essentially putting them on the government dole (Russian conscripts do get paid after all), increasing government spending. But, also, with all the other economic problems, wages (and prices) are driven up due to all those men pulled out of the job market.

I believe that some people think the price of oil will soon begin to rise. Personally, IDK except to say that the price is always moving and that anyone who tells you where it will be months into the future and beyond is making a guess, educated or otherwise.

The partial mobilization (1-1.1% of Russia’s total reserve pool) will have little effect economically.

On the other hand, had it been a full mobilization, yes.

Exactly...the EU zone is in free fall right now.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.