Posted on 06/05/2022 9:03:49 PM PDT by lasereye

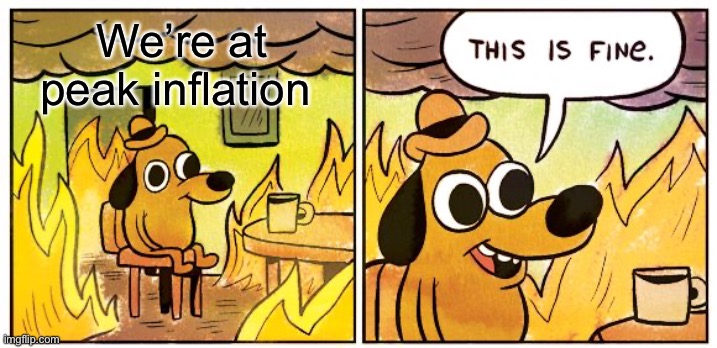

‘Team Transitory’ hasn’t given up hope of winning the great inflation debate.

That was the tag given to everyone -- from Federal Reserve Chair Jerome Powell on down -- who expected pandemic price-spikes to be shortlived. With inflation still breaking records all over the world, they essentially lost that argument.

But there remain plenty of economists who argue that the shock will soon fade, as supply blockages ease and energy costs stabilize. Some warn that central banks are in danger of making a big mistake by raising interest rates too aggressively even as price pressures show signs of peaking.

With inflation now exceeding 8% in the euro area, and expected to stay above that level in the US when May data comes out on Friday, here’s a roundup of some of the main arguments laid out by Team Transitory 2.0.

Central banks argue they can raise interest rates at a pace that allows their economies to achieve what’s known as a soft landing. Skeptics say they’ll tip their economies into recession by tightening too much, with inflation likely to undershoot targets again as a result.

History illustrates the risks: The European Central Bank in 2011 raised borrowing costs only to be forced to reverse them later that same year while the Bank of Japan in 2006 raised rates and had to unwind that move in 2008.

Ongoing supply chain blockages prompted retailers to stock up on the goods they need to ensure they can meet demand. With signs that consumers are growing cautious as interest rates rise, that’s now leaving an overhang of goods that will add downward pressure on prices.

Inventories rose $44.8 billion, or 26%, for businesses on S&P consumer indexes with a market value of at least $1 billion of companies who reported earnings in late May.

(Excerpt) Read more at finance.yahoo.com ...

Phenomenal the way the MSM gives their man in the WH the benefit of every doubt and puts the sweet spin on every problem.

When a Republican is in office, it’s exactly the opposite.

Sounds like they want the Fed to delay the interest rate hikes and QT. BS.

Propagandists have been predicting supply chain clearing for over a year now, and energy prices will keep going up for......who knows how long?

That's what is required for the "great reset".

Effin gaslighting retards.

Every economist says this goes on through 23-24.

There is one lingering problem. Oil prices will remain high until the Ukraine/Russia conflict is resolved.

“Expert textpert, choking smokers, don’t you think the Joker laughs at you?”

They didn't flunk economics - they weren't smart enough to get in the classroom door.

Real Inflation must be at 20 percent.

I call BS. This ain’t over. Not by a long shot.

Pure gaslighting.

The Feds think they are cute not factoring the cost of fuel in the inflation index. Nevertheless fuel shortages, expensive gasoline, diesel and electricity , along with unabated dollar printing are driving inflation. Its only going to get much worse.

I have hopes that things will somewhat stabilize with the election of a Republican Congress. I don’t expect improvement until 2025 at the earliest. At that point, we should have a Republican Congress and president.

The government must pick one, sooner or later:

1) Continued inflation and wage degradation

2) Raised interest rates and Great Depression

3) Rationing of goods thru programmable digital currency

When we lose reserve currency status, they will pick immediately.

This reminds me of the movie Animal House at the end during the parade Kevin Bacon is yelling remain calm all is well

“But there remain plenty of economists who argue that the shock will soon fade .. and energy costs stabilize.”

————

NP Morgan says that we’re going to have an average gas price of $6.50/ gallon by August 1. Inflation is just getting started.

Now we’re really screwed.

The experts think this is coming to an end.

That tells me, it’s just beginning..

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.