Skip to comments.

A Student’s Take on Student Loan Forgiveness

Townhall.com ^

| May 19, 2022

| Mylie Biggs

Posted on 05/19/2022 7:42:30 AM PDT by Kaslin

As a current college student, I can attest that attending college today is expensive and, for many students, impossible without taking out a loan. Borrowing money means taking on the responsibility of repaying it. Multiple student loan forgiveness plans have been proposed by Democrats, including Sen. Elizabeth Warren, Sen. Bernie Sanders, and President Joe Biden, which would allow students to forgo their financial responsibilities.

President Biden plans to forgive at least $10,000 worth of loan debt for every student making less than $125,000 per year after college–more than $1 trillion total. But there are no other details yet. How does the president plan to explain to Americans that they have to start paying for every student’s debt? Beyond that, how can one generation have their loans forgiven while the next doesn’t? Or will all future students have their loans forgiven?

College is a time to learn to take responsibility for your own actions and understand the value of hard work and earning something on your own. For many students, figuring out how to pay for college is the first major financial decision they make in life. Taking out loans and expecting debt to be canceled sets a precedent for relying on others, and creates an unrealistic expectation for future responsibilities.

College is not a right, and whether to attend or not is entirely contingent upon individuals’ merit and choice, along with the corresponding responsibilities.

Many college students today are in favor of loan forgiveness. After all, it sounds great not to have to pay your debts. But this is a selfish view; it is a shortsighted perspective that will eventually backfire on college students and their families. It is easy to look at a current situation and want the quickest and easiest solution without thinking of the repercussions.

Knowing that loans will be forgiven, it’s not far-fetched to assume that more people will choose to attend college. Tuition prices will undoubtedly rise, placing a heavier burden on students who work to pay for college. Those who made the economic decision to skip or delay college and enter the workforce will find themselves paying higher taxes to account for others’ decisions to attend college.

While college can be valuable, more people attending college does not necessarily mean that we will have a stronger or more intelligent society. As Elon Musk said, “I hate when people confuse education with intelligence. You can have a bachelor’s degree and still be an idiot.”

Canceling student loan debt is also a massive giveaway to the wealthy and privileged. Nearly half of all outstanding student loan debt is owed by people with graduate degrees. It’s no secret that people with graduate degrees make more than those without, on average. This means that graduate degree holders are more likely to be in a better position to repay their student loans than those two-thirds of Americans without college degrees who would be left to foot the bill. If Democrats really cared about helping the average American, they would not be pushing to forgive the loans of those who are typically better-off.

The political Left is all about “forgiveness” and “kindness,” but everything they do seems to benefit one group at the expense of another. Student loan forgiveness is no different—a textbook example of robbing Peter to pay Paul. Loan forgiveness seems like a nice idea on the surface but it has an ugly underside filled with negative consequences. It makes me question if these Democrats in power actually want to help Americans.

For all former, current, and future college students, your debt is your own, my debt is my own. Why choose a socialist collective “solution” to a problem that is distinctly individual?

Like putting a bandaid over a crack in a boat, this short-term “solution” will not hold. Biden is hurting many to please a few. Student loan forgiveness will fuel inflation, raise taxes, and redistribute responsibility.

On an individual level, I have always been taught to take responsibility for my own actions. I want to be accountable for my own choices. I want to feel empowered by my hard work. This desire is encapsulated in a quote from psychologist Jordan B. Peterson: “The way that you live properly so that you can withstand the nature of your own being is to pick up a load that’s heavy enough so that if you can carry it you have some self-respect.”

TOPICS: Culture/Society; Editorial

KEYWORDS: bidenadmin; highereducation; loanforgiveness; studentloanforgive; studentloans

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

1

posted on

05/19/2022 7:42:30 AM PDT

by

Kaslin

To: Kaslin

One aspect of student loan forgiveness always puzzles me.

And that is, what about students taking out loans now, to attend college. Is there a presumption that loans given today and in the future will also be forgiven? And if so, does this whole thing morph into a system where nobody ever pays to go to college ever again? But then wouldn’t that translate into college just being an adjunct of K-12 education, in which taxpayers pay for college education directly, even at private universities?

To: Kaslin

President Biden plans to forgive at least $10,000 worth of loan debt for every student making less than $125,000 per year after college–more than $1 trillion total. Only one $Trillion Joe? That will hardly put a dent in the student debt. Not likely to buy you many votes. You should go for $100,000 and 10 $trillion. We can afford it - paper is cheap.

3

posted on

05/19/2022 7:54:14 AM PDT

by

InterceptPoint

(Ted, you finally endorsed.)

To: Kaslin

How ridiculously unfair is it to make low income or middle class pay for the student debt of someone earning over $100,000 per year, two and three times their income? What happened to high earners paying their fair share? /s

4

posted on

05/19/2022 7:55:41 AM PDT

by

newzjunkey

(“We Did It Joe!” -The Taliban / “Thanks Joe!” -Putin)

To: InterceptPoint

10^9 dollars is about 18 cu. yds of gold...

5

posted on

05/19/2022 7:59:04 AM PDT

by

sasquatch

To: Kaslin

I could support $10,000 per person (including parent PLUS loans) forgiveness in exchange for getting the government permanently out of the student loan and guarantee business.

If the colleges feel this is important, they can line up their own group of lenders as Hillsdale College does.

If the states feel it important, then they can set up their own bank as the state of North Dakota does.

There is no need to reinvent the wheel, but there is a need to get Fedzilla out of this business completely and permanently.

6

posted on

05/19/2022 8:01:49 AM PDT

by

Vigilanteman

(The politicized state destroys aspects of civil society, human kindness and private charity.)

To: Kaslin

Government at any level, especially federal, should not be in the student loan business. Government at any level should not be involved in postsecondary education.

To: Kaslin

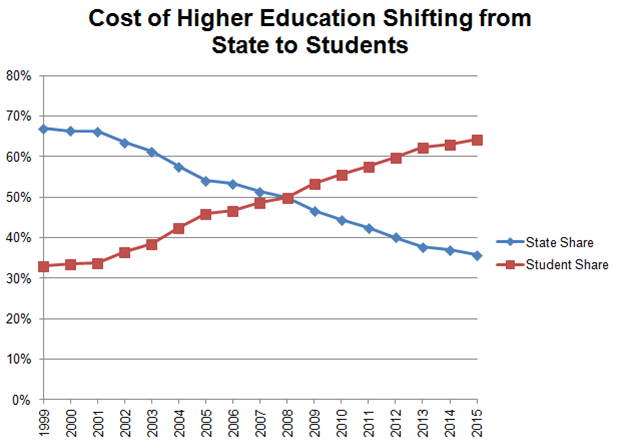

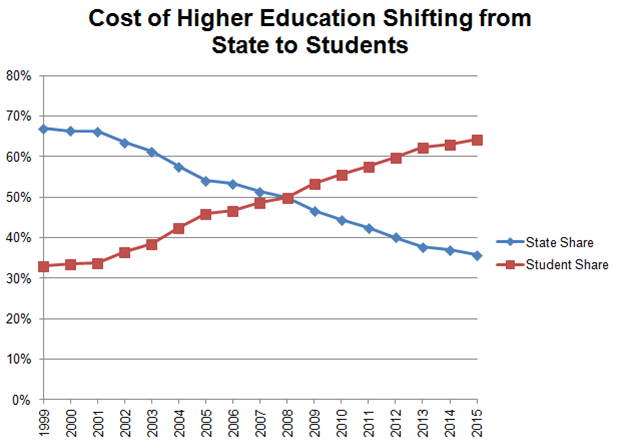

Most of the blame for college tuition cost increases and resulting massive student debt lies with state legislatures.

State legislatures have for decades reduced the amount of subsidies to public universities, forcing universities to raise tuition to fully cover costs.

The total cost of a four-year degree has not gone up any faster than overall inflation for the past 20 years, but the percentage of tuition costs covered by state subsidies has steadily decreased.

When I first went to college in 1981, in-state tuition costs at my public university were around $35/hr, or $1,050 per academic year, and a summer job could easily cover the costs.

Now those tuition costs are over $500/hr, or around $15,000 per academic year.

And this is just tuition. It doesn't address room and board , textbooks, or other fees. When you factor those costs, it's closer to $30,000/academic year. There isn't a summer job around that pays $30,000 in one summer.

8

posted on

05/19/2022 8:14:30 AM PDT

by

Yo-Yo

(Is the /Sarc tag really necessary? Pray for President Biden: Psalm 109:8)

To: Kaslin

Maybe these students should study economics. Biden will print this money and it will push inflation rate to 15%. And corresponding loan interest rates past 10%. This hidden tax will have a huge impact those that don’t have marketable college degrees, minimum wage earners, and fixed income retirees.

To: Yo-Yo

“There isn’t a summer job around that pays $30,000 in one summer.”

There are some, but you might end up attending Graybar U., and maybe not graduating in four years, either.

To: Kaslin

Honestly,

Education expense should be tax deductible. Not forgiven. You should be able to deduct payments up to 25K per year.

That gives an incentive for people to have jobs, make payments, and allows young people to start a family. It’s not loan forgiveness, but it certainly respects that it’s a business expense and using it like depreciating an item.

That’s what I think would be best.

To: Pete Dovgan

I think that’s a good idea.

Also restrict the program to degrees\training which have a higher rate of return in taxes - in short no hobby degrees!

12

posted on

05/19/2022 8:32:15 AM PDT

by

Reily

To: Kaslin

You get a 1099-C in the amount of your forgiveness which must be treated like income on your next Federal Income Tax filing. So, whatever you make that year, add the forgiveness amount and that is your reportable income.

13

posted on

05/19/2022 8:36:00 AM PDT

by

plangent

To: Kaslin

Without fixing the cause, forgiving debt is simply stupid.

But, fixing the “cause” will mean the destruction of a lot of private colleges. It will push the “attending” college back to the “elites”.

The thing is…”free” college is not what these kids want. They want the Hollywood college experience. They don’t really care about filling their brains.

These are no easy solutions to this problem.

To: Yo-Yo

Yes, $30K/year is about right. I have 4 kids and saved up in their 529s from birth. I’ve told them in-state tuition only, 4 years only, no grad school.

In CA that means Cal State or UC at between $7K-$15K tuition and $15K/year room and board etc. Times four years times four kids is a half million dollars. And that’s PUBLIC, in state college costs. . .

No loans for my kids though as their 529s since 1996 when I started them have done well.

To: Kaslin

There is a sort of quid pro quo between Democrats and educational establishment to help each other at the expense of tax payers and parents.

Democrats guarantee ever bigger flow of money to educational institutions and educational institutions in turn do the bidding to implement democrat agenda and ideology.

Inflation in Tuition costs has been astronomical and it has been underwritten by democrats via generous student loan programs that prevent any kind of cost reforms within educational institutions. Democrats are throwing money at them and turning them into their partisan ideological assets. And they make parents and students and now tax payers to foot the bill.

16

posted on

05/19/2022 9:08:50 AM PDT

by

kp2hot

To: Dilbert San Diego

Don't forget to add......and everyone ends up being dependent on the government for life.

17

posted on

05/19/2022 9:12:46 AM PDT

by

JohnMac

To: Yo-Yo

The problem is that government at ANY level is involved in “higher education”. Educating your kid is your responsibility. You do the math and it’s worth it to you then YOU find a way to pay for it.

Laying this off on the state legislature is a cheap cop out.

L

18

posted on

05/19/2022 9:18:52 AM PDT

by

Lurker

(Peaceful coexistence with the Left is not possible. Stop pretending that it is)

To: Lurker

Nope, not a cheap out, just an explanation of why “back in my day I could work two jobs and pay for college” isn’t true anymore.

19

posted on

05/19/2022 9:24:04 AM PDT

by

Yo-Yo

(Is the /Sarc tag really necessary? Pray for President Biden: Psalm 109:8)

To: Kaslin

I’m paying about 14k per year out of pocket for my daughter to go to Northern AZ Uni. Most of that is just dorm/food/and other expenses. She’s smart, so always eligible for the school’s largest scholarship.

Good thing, cause I didn’t save a dime for her schooling. Just couldn’t do it. Now, I’m doing much better. Also, no car payments, and a manageable mortgage helps a lot.

The thought that some loans are going to potentially be forgiven, makes me wonder who though up this BS. It’s so freakin unfair to us, and further to every smart kid that skipped college for fear of going into big debt. To think, now they get to work for the person who borrowed the money and didn’t pay it back. It’s infuriating.

20

posted on

05/19/2022 9:24:48 AM PDT

by

Greenpees

(Coulda Shoulda Woulda)

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson