Posted on 05/03/2022 5:22:56 AM PDT by Kaslin

It might be the biggest giveaway in American history. resident Joe Biden wants to cancel more than $1 trillion of outstanding student loan debt. Biden has already delayed for more than a year student loan repayment, and under his new rules, most delinquent and deadbeat borrowers would NEVER have to repay.

What a deal for the people who never paid a dime back of the tuition money they owe to Uncle Sam.

This plan makes suckers out of the millions who have felt honor-bound to pay off their debts. My wife spent years after graduating from college diligently writing checks to pay off the tens of thousands of dollars of loans. That's the way it works when you borrow money and you've signed a commitment to pay the money back.

Think about what would happen if this loan repayment policy were to be implemented. Who would ever pay off a student loan ever again after this blanket forgiveness program?

Who would benefit? The most recent Federal Reserve Survey of Consumer Finances found that only 22% of families had student loan debt and that "student debt has consistently been disproportionately held by higher-income families." So this is a giveaway to the financially successful students and families paid for by middle-class workers, millions of whom didn't go to elite universities in the first place.

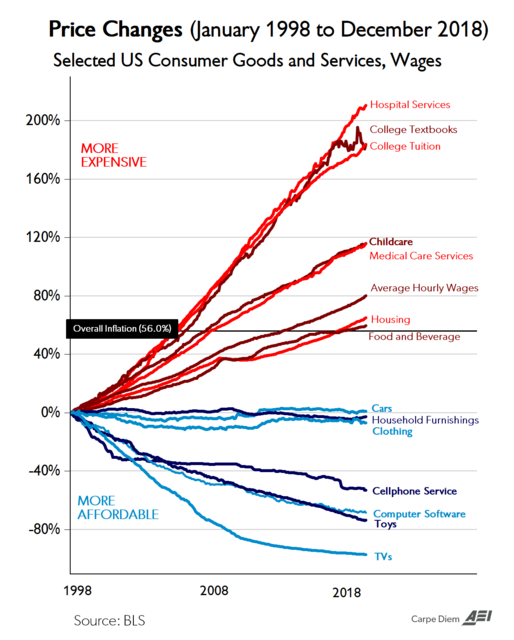

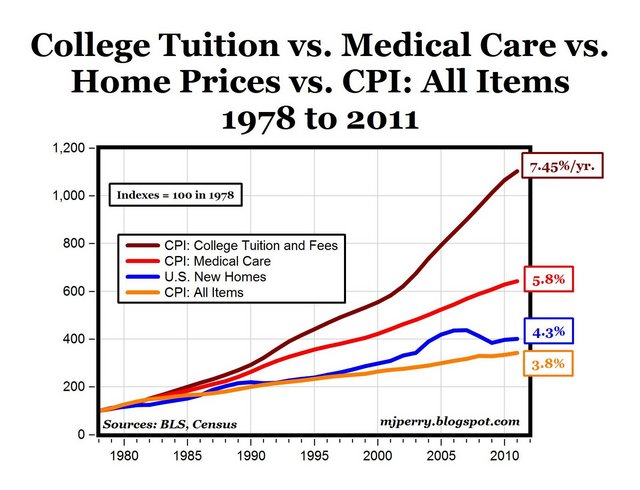

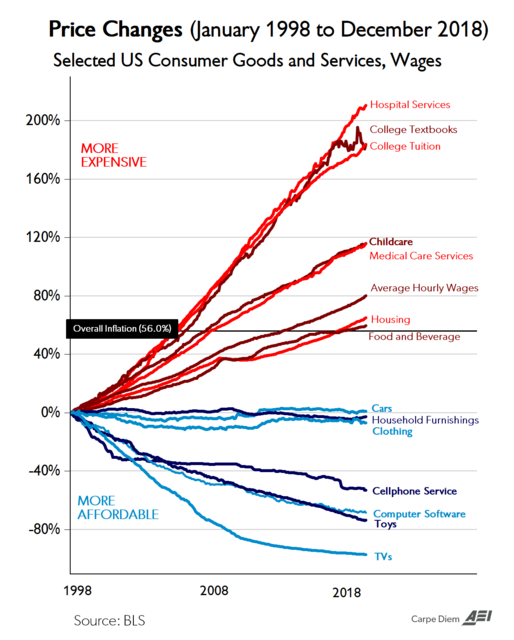

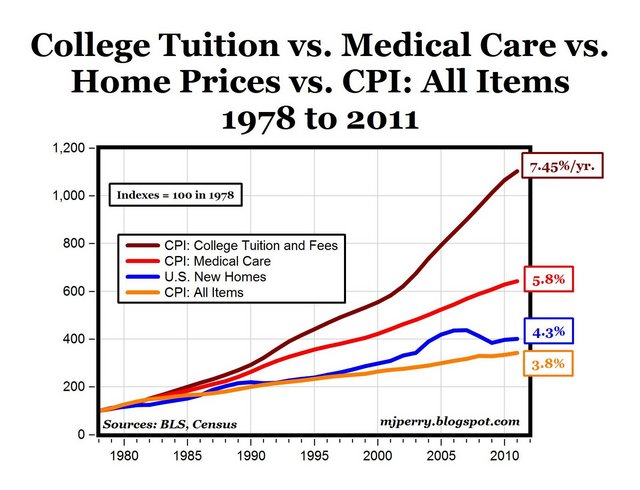

Once student loans move to "free college" for everyone, university tuitions, which are already soaring at two to three times the inflation rate, would race further ahead of all other consumer prices. When I attended the University of Illinois in the early 1980s, the tuition was $1,000 a semester. Now, it's closer to $12,000 a semester. Where'd all the money go?

The Biden administration has misdiagnosed the fundamental problem here. To wit: Colleges and universities have become fat, flabby and inefficient money burners with no accountability. No oversight. No getting rid of bad teachers and professors. No looking under the hood to see where extraneous costs could be axed.

No demand on tenured professors to teach one or two classes a year.

If student loan debt has to be retired, why should taxpayers pick up the tab? Why not force universities with massive endowments, in many cases in the tens of billions of dollars, to use that money to pay off the debts students incurred while they received virtually worthless, useless sociology, gender studies and psychology degrees?

This would incentivize schools to cut their tuitions and their costs, something the academic elites are desperately trying to avoid.

Democrats think that buying votes this November by making college essentially free will win them elections. But there is no free lunch, and there is no free college. It's just a question of who pays the piper. And it shouldn't be YOU.

It would be worth more to have a public college to open the books, and explain how $17,500 in tuition is the real cost of a year of college, and where ‘waste’ is stacked up.

Expensive vs more expensive. Hmmmmmmmmmm.

Don’t forgive the loans, but allow them to be discharged in bankruptcy.

I could have 50K in debt on legal weed, booze, and lap dances and discharge it all in Chapter 7. Why is university special?

Maybe for this exact moment...

Deep State doesn’t care.

Here’s a thought - Many of these colleges and universities have endowments up in the millions, if not billions. Put THEM on the hook for reimbursing the victims of student loan scams, to the tune of $10,000 or $50,000 or whatever figure that AOC and others are clamoring to have forgiven, even up to the entire amount of the loan, in some instances. After all, they were the ones who kept on hiking the tuition and fee rates as the money was flowing freely from the US Treasury, so they should have a little financial constraint heaped upon them.

It is the existence of student loan debt that has made college more expensive because it distorts the market price for a college education by inflating it not to what you can pay but to what you can borrow with gubmint interfered with loans.

Excellent points. Additionally, when universities are rewarded by taxpayer bailouts for deadbeat students, tuition and fees have no ceiling.

mor·al haz·ard

/ˈmôrəl ˈhazərd/

noun

lack of incentive to guard against risk where one is protected from its consequences, e.g. by insurance (bail out).

The entire credit system would be threatened by a student loan bail out. A whole generation would be rewarded for welching on their debt. I assume loan forgiveness would show up on a credit history. Who would lend to them again?

Exactly. I also like the idea of pushing the debt onto the colleges/universities to pay it. Finally, forgiving the debt is another "I'm not responsible" escape for someone who took on the debt. The direct benefit of what they did in school, good or bad, falls on them and they should pay for it. It they can't, they should have their income garnished until the debt is paid in full. If they can't hold a job, how 'bout we export them to Mexico, like they're doing to us?

“In 2018, higher education institutions received a total of $1.068 trillion in revenue from federal and non-federal funding sources. Investments from the federal government were $149 billion of the total, representing 3.6% of federal spending.”

Here’s a good idea. Take the Federal $$$ normally given to universities and use that to pay off student loans.

There ... I fixed it.

Really?

The answers are pretty clear:

-Tenured staff costs hundreds of thousands per Prof, per year.

-Facility costs are out of control.

-Staff is bloated with non-academic staff.

I know people will point to Coaches and Athletics...but you need to look at the “net cost” of those programs. Those with expensive staffs usually generate revenues that far exceed the costs.

In the end, as it is in any business, headcounts and capital expenditures eat up most budgets.

Canceling all extant student loan debt would be a benefit to the nation IF it were accompanied by abolishing the Department of Education and all its functions and a law barring any government money going to any school, at any level, not on a military base outside of the USA.

You are correct - of the three entities involved in higher education (student, higher education(HE), loan provider) only HE has no incentive to control costs. The student must pay up front whatever HE demands, and the loan provider has some competition to control interest rates charged. HE sets their arbitrary prices and has no mechanism or feedback loop to pressure their pricing practices.

College used to be for the most capable, intelligent, driven people to develop the foundation for a professional career in a demanding, intellectual field and academic standards reflected this; although there was always a place for the idle rich to send their kids for a liberal arts degree to culture them, but they paid the bill. Since the '70s academic standards have fallen off in perfect correlation with the value of a diploma in the job market. Now thousands of people who don't belong in college at all incur enormous debts and either drop out, or get a degree that does not get them gainful employment. Strict underwriting standards for education loans would solve all of these problems.

College is now a complete ripoff in most cases. An undergrad in a soft curriculum attends about 1500 hours of lectures with 10 to 200 other students mostly put on by foreign grad assistants who are paid McDonalds wages. Cumulatively the students pay something on the order of $15,000,000 to attend those lectures for which the instructors are paid maybe $100,000 in total.

Letting non-insured get hospital care without payment has driven the cost up for the rest of us (stupid) payers.

And a better one:

You debtors made your bed - now sleep in it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.