Posted on 10/11/2021 7:33:40 PM PDT by SeekAndFind

The covid scare is officially over.

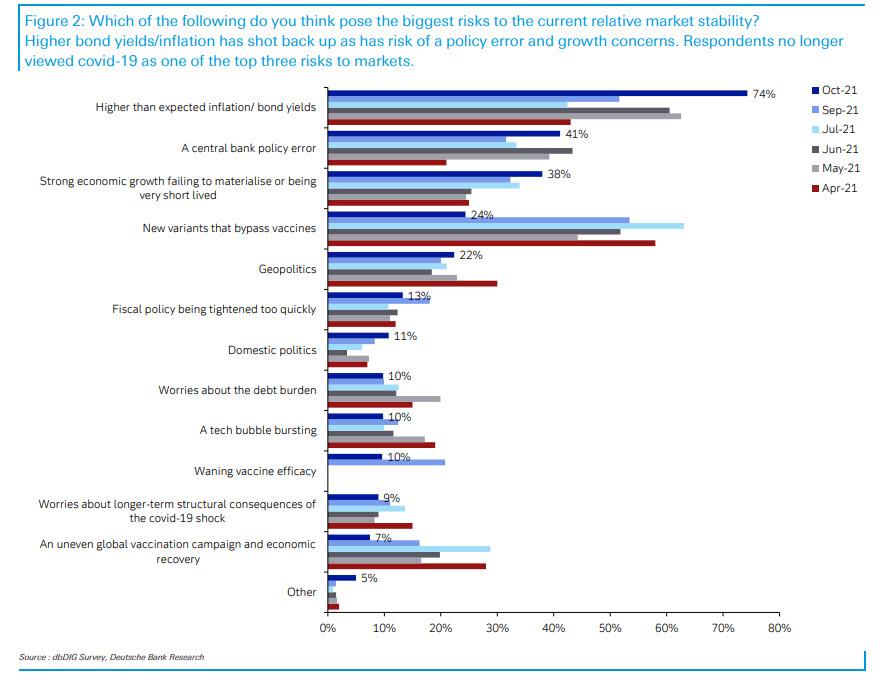

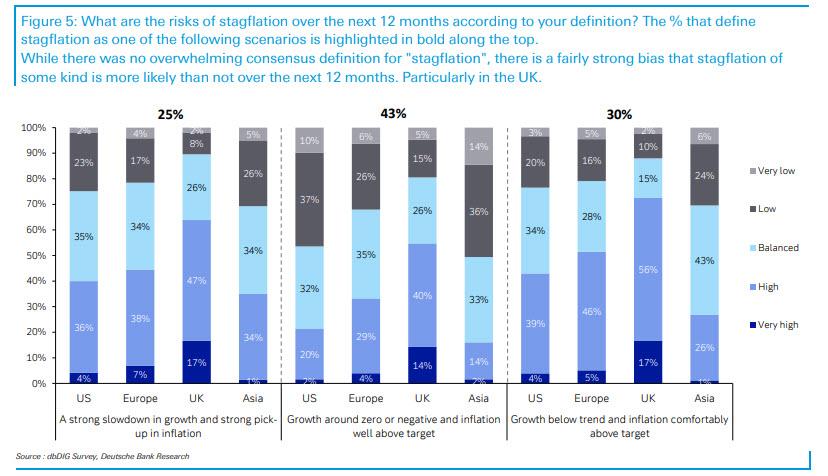

According to the latest monthly survey of 600 global market participants conducted by Deutsche Bank, for the first time since June, the biggest perceived risk to markets is no longer covid. Instead the top three risks are i) higher inflation and bond yields, ii) central bank policy error and iii) strong growth failing to materialize or being very short lived (i.e. stagflation and/or recession). New covid variants that bypass vaccines has slumped from 1st place, which it occupied for the previous three months, to 4th place in October.

Below we present some of the other notable results from the survey.

When asked if there will be an equity correction before year-end, only 29% said no, while solid majority, or 63%, expect a drop between 5 and 10% before year end. Just 8% expect the coming drop to be bigger than 10%.

The most likely catalyst for the coming correction are higher rates. At least that's what the next survey question suggests: a whopping 84% of survey respondents expect the next 25bps move in 10Y yields to be higher, and just 11% lower. Only 5% of the respondents were honest.

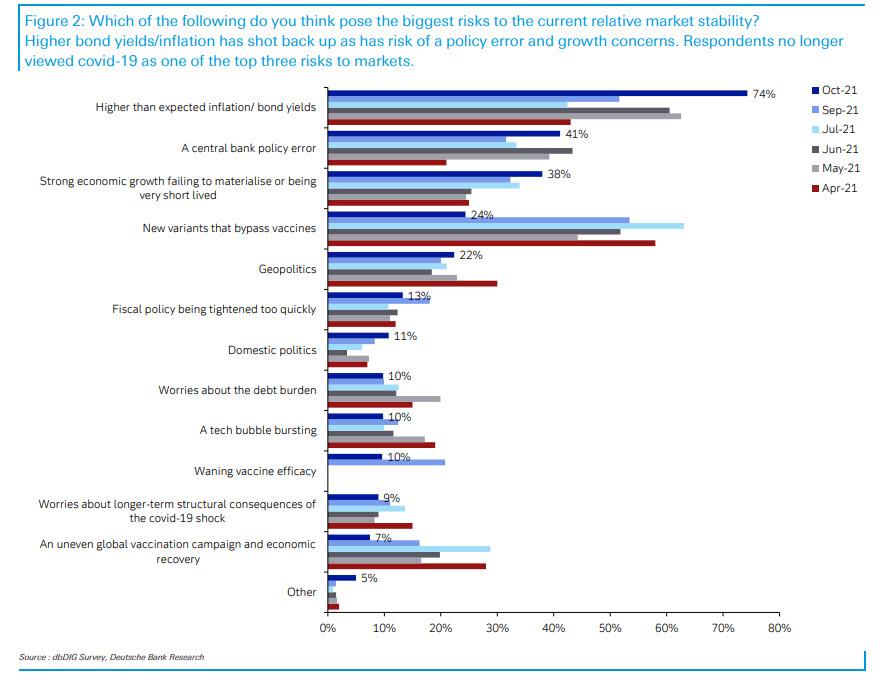

DB then asked respondents if they believe the policy error for major central banks - Fed, ECB, BOE - is being too dovish or hawkish. The risks were seen as high everywhere but the Fed/ECB were seen more likely to keep policy too loose with the BoE expected to err on the hawkish side.

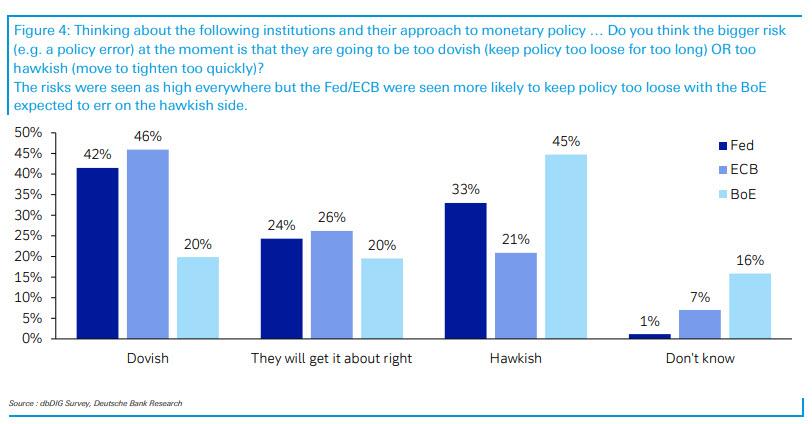

The next question is one we addressed over the weekend, namely what is Wall Street's fluid definition of stagflation. While there was no overwhelming consensus definition for "stagflation", there is a fairly strong bias that stagflation of some kind is more likely than not over the next 12 months. Particularly in the UK.

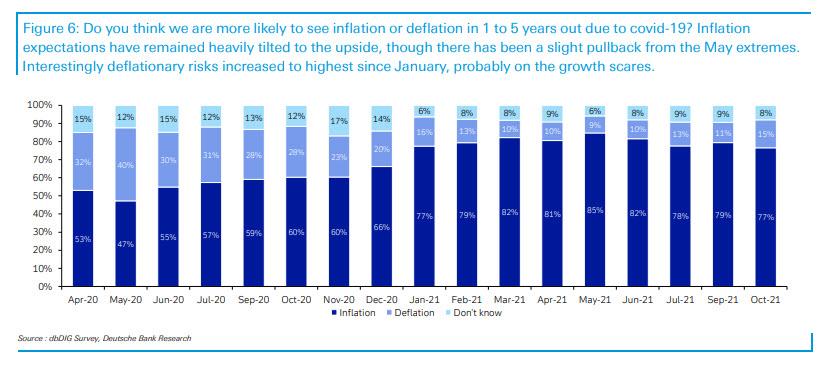

A historic cross-section of responses shows something interesting: while inflation expectations have remained heavily tilted to the upside, there has been a slight pullback from the May extremes: in October, deflationary risks increased to highest since January, probably on the growth scares.

We conclude with a response that confirms that for the most part Wall Steet is still clueless, with 62% still saying that inflation will be "mostly transitory", while just 31% say mostly permanent. The silver lining: that 31% is the highest percentage since May, so there is some hope, even for Wall Street.

Interesting article—meanwhile many companies are on an insane mandatory vaxx campaign.

Today my wife and I went shopping and went to lunch in a exurban area in northwestern CT—no masks anywhere—good to see.

they’re morons: no mention of failing energy supplies bringing economies to a halt and no mention of collapse of transportation supply lines and economies due to worker shortages caused by “mandatory” vax requirements ...

If you think the stock market sees all and knows all, I woudl cite Enron, Bernie Madoff, and Theranos.

Wondered how long it would take them to figure out the Covid fear porn had started to work against the Leftist agenda not for it.

The Stock Market is a snapshot of the wealthy’s given mood for a given day.

COVID is so 2019.

The idiot in the White House, his communist puppet masters, and the entire RAT party are the biggest threats to the stock market.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.