Posted on 09/18/2021 9:06:12 AM PDT by doug from upland

In recent years, long-term trends in economic inequality have attracted growing attention from social scientists, which also reflects civil society’s increasing awareness of the deepening economic disparities. In this context, particular attention has been paid to the share of the total income or wealth earned/owned by the top of the distribution – usually the top 1%, 5% or 10% among individuals or households. The share of the top richest is both interesting per se (as it is informative of “how rich” the better-off are), and as an indicator of the overall trends in economic inequality.

New time series of wealth concentration (spanning the twentieth and at least part of the nineteenth century) have recently been produced for a variety of countries by scholars like Thomas Piketty. These works have increased considerably our knowledge of the time changes in wealth inequality and in the share of the top rich, adding to pre-existing studies that had covered a few countries or areas only, particularly Britain and the U.S.

Even more recently, comparable data for the preindustrial period has become available. To a significant degree, this is the result of the activities of the ERC-funded project EINITE – Economic Inequality across Italy and Europe, 1300-1800. This project has collected, systematically and with a uniform methodology, information about long-term trends in wealth inequality and in the share of the top rich for many ancient Italian states as well as for a few other areas of Europe, from Catalonia to the Low Countries. These works, which whenever possible cover the entire period since circa 1300 to 1800, allow us to extend the series of the share of wealth owned by the top rich by about five centuries.

The available evidence suggests that overall, during the entirety of the early modern period (ca. 1500-1800) the rich tended to become both more prevalent and more distanced from the other strata of society. The only period during which the opposite process took place were the late Middle Ages, and particularly the century or so following the Black Death epidemic of 1347-52. For example, around 1500 in Italy the rich (defined as those households owning at least 10 times the wealth of the median household) were about 3-5 per cent of the total population. By 1800, their prevalence had doubled. In the same span of time, the share of wealth held by the top 10 per cent had grown from about 45-55 per cent to about 70-80 per cent.

The information provided for the late medieval and early modern periods also places in a somewhat different perspective recent findings about how the conditions of the rich have changed in the last two centuries. There seems, indeed, to be very solid ground to argue that the tendency for wealth to concentrate in a few hands in nineteenth century Europe was in fact only the final part of a much longer process, which had started around 1450.

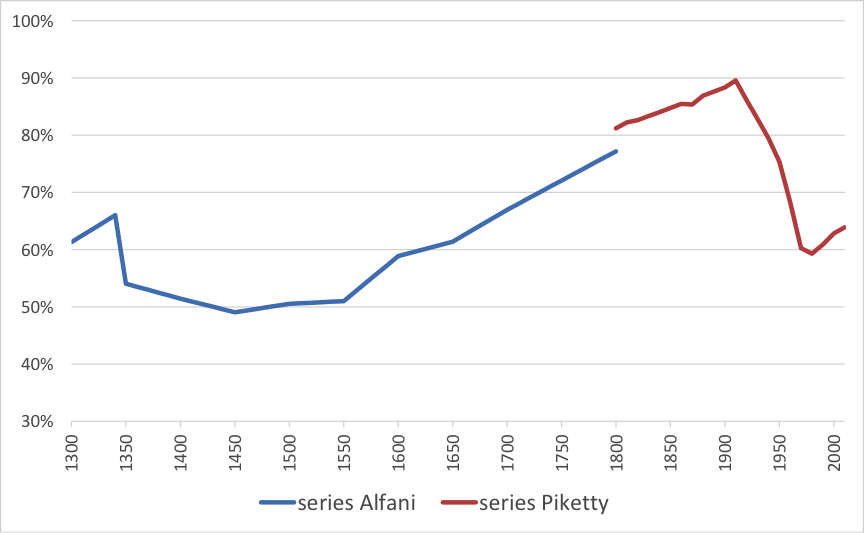

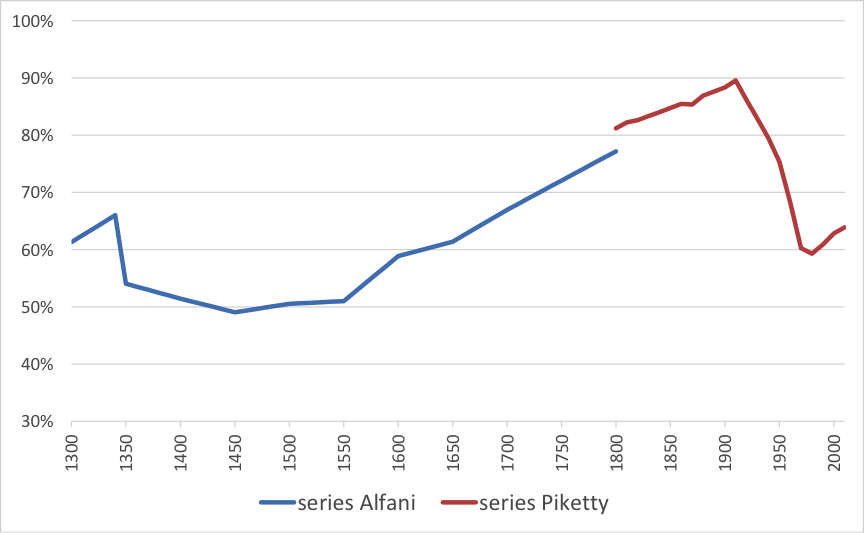

In particular, the share of the wealth owned by the top 10 per cent which I reconstructed for 1800 seems to have approached the European average at 1810, a figure recently placed by Piketty at slightly over 80 per cent (see Figure 1). The increase in economic disparities continued until the eve of World War I, when the top 10 per cent among the rich owned about 90 per cent of the overall wealth. The two world wars, as well as the shocks which occurred in-between, determined a sharp contraction in the share of wealth owned by the richest part of the population. The trend changed again from the 1980s, and the share of the top 10 per cent has increased significantly in the last decades, going back to about the same levels that seem to have characterised Western Europe on the eve of the Black Death (i.e. about 65 per cent).

Figure 1. The share of wealth of the top 10% rich in Europe, 1300-2010

Source: Alfani, The top rich in Europe in the long run of history, Vox 15 January 2017 The time series presented in my paper are relevant to current debates on very long-term changes in economic inequality and in the relative position of the rich. Indeed, they suggest that in the last seven centuries of European history the general tendency has been for inequality to increase, without any trace of a “spontaneous” reduction in inequality levels of the kind hypothesised by Simon Kuznets about 60 years ago.

This is surely a point on which more research is needed (if we are to correctly assess the causes and implications of the very long-run tendency for wealth to concentrate in a few hands). However, the only two phases of significant inequality decline in the last seven centuries seem to have had little of spontaneous. On the contrary, they have been triggered by some of the main shocks recorded in human history: the Black Death in the fourteenth century and the two world wars in the twentieth. We can only hope that for the future, the tendency for inequality to grow can be contained without the occurrence of other large-scale catastrophes.

The very unique aspect of the American experiment was the ability to move up and down the social/economic scale.

This has been different from every other country. Think about it.

Now what has reduced our ability to move up and down?

A free nation that runs by freedom at work - The Market Economy Free from Government Interference - THE FREE MARKET ECONOMY (please quit using the Marxist term “capitalism” for the Free Market Economy) - counters that tendency through open access to markets and open competition between players.

The Great America Story - not the acts of government but the acts of individuals free from government interference - which, as Adam Smith published the same year as America was born, is the Wealth of Nations.

Those who spend $0.99 of every $1.00 they earn, gain money.

Those who spend $1.01 of every $1.00 they earn, lose money.

Those who have, can use it to earn more.

Those who have not, can not use it to earn more.

And so “inequality” emerges.

And so those who have not, become beholden to those who have.

Such is the way of the world.

Long term? Think 10 years. Divide ALL the wealth evenly at one time and let the laizze faire take over. Guess where we’ll all be in 10 years.

Republicans need to get back to its roots and make it the Party of Lincoln again. Study Oliver Cromwell’s rebellion. It was composed of Protestant Puritans who became The Pilgrims who became America.

Unfortunately, Joy and Nicole’s audiences are not “little.”

My deranged SIL watches them.

PATRIOTS AWAKE!!!

People who spend every penny they can get their hands on to buy Escalades, bling and hoes will never have wealth no matter how much of other peoples’ money you steal and give to them.

Unfortunately, Joy and Nicole’s audiences are not “little.”

My deranged SIL watches them.

*************************************************

Audience of the two loons not small? Compared to what?

What few people understand is the variability of human abilities. The top earners are hundreds of times smarter than the average person.

In previous centuries, brilliant men could not use their abilities to make huge fortunes. Today, they can.

> Divide ALL the wealth evenly at one time and let the laizze faire take over. Guess where we’ll all be in 10 years. <

Good observation. And that’s why communists hate free economic systems.

Old saying:

Capitalism: Some people are poor.

Communism: Everyone is poor.

Perhaps better:

Capitalism: Some people are (relatively) poor.

Communism: Except for the elite, everyone is poor.

It is common for someone to start in the bottom 10%, work their way into the top 10%, leave a fortune to their children, only to have their great-grandchildren fall back into the bottom 10%, at least temporarily.

Assuming the people in the top and bottom are always the same is a very bad assumption.

It is not the money so much that has created the problems we face. It is the desire for political power, and the changing of the ruling class from predominantly Christian to predominantly atheist/agnostic/pagan.

When your ruling class despises you, and believe a great reduction in population is necessary, bad things happen.

This is surely a point on which more research is needed (if we are to correctly assess the causes and implications of the very long-run tendency for wealth to concentrate in a few hands). However, the only two phases of significant inequality decline in the last seven centuries seem to have had little of spontaneous. On the contrary, they have been triggered by some of the main shocks recorded in human history: the Black Death in the fourteenth century and the two world wars in the twentieth...............................

Total digression but, Doug have you been watching “American Crime Story Impeachment”?

This is exactly the point. A fair percentage of people who are in the bottom 20% are in the top 20% twenty years later. There is A LOT of income mobility in a free market economy.

A good read is "Economic Facts and Fallacies" by Thomas Sowell.

It has been that way since the dawn of time. Even with animals it works that way. If you have 10 people and put them in the same place they will not all divide everything equally. Any variation in size strength or intelligence will give one or another a comparative advantage. Those who have advantages will exploit their advantages and then use them to reinforce their position. Higher place on a hill, rock wall, better spears, and getting the less advantaged to work for them. How do you think villages get chiefs and shamans?

Part of the problem is the outsourcing of almost all basic industries other than software, healthcare and financial sectors. Combined with allowing almost limitless import of what is for all intents and purposes slave labor, this creates an outflow of money from the Middle Class to foreign countries and to the financial and tech sectors.

Financial and tech sector middle management and above already come from wealthy families, so you have two circulating paths for movement, one in the upper 10% income strata, and another for everyone else, with insufficient crossover between the two.

My family is an outlier, but shouldn’t be. My parents and two of us siblings are immigrants from Canada. Mom and Dad started a small business that never generated more than $150K per year in income. Oldest child pursued military and civilian aviation. I’m middle child and pursued public safety. Younger brother is U.S. born and pursued software engineering. All of us lived in high cost of living areas.

Parents are 85+ years old, us kids are in our 50s. We now represent four households each well over one million dollars net worth. Living within our means, stable marriages, single family real estate and buy and hold stock investing are all it took for each of us.

My theory on why families like ours are increasingly rare is the absolute travesty of public “education.” None of us learned anything about how to succeed in marriage, finance or any other aspect of real life from our school years. And today’s schools are absolute intellectual toilets compared to ours.

It's part of the "economy of scale." Large amounts of money tend (on the average) to earn a higher return on investment than small amounts.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.