Posted on 03/14/2021 6:48:46 PM PDT by SeekAndFind

Now that the $1.85 trillion Biden stimulus is officially being deployed with tens of millions of stimmy checks being sent out this weekend to household across the nation, BofA's Jared Woodard writes that the "most important question" in for investors in 2021 is "what will US households do with their extra money as the economy fully reopens?" or in other words, where will all those stimmy checks go. And while the consensus is that the record “savings glut” will be spent, will the consensus be wrong again? Here, BofA sees two possible outcomes:

For what it's worth, Woodward notes that he previously already expressed some hesitation about the "Big Spending" view last month. To explore this further he looked at the distribution of cash among US households.

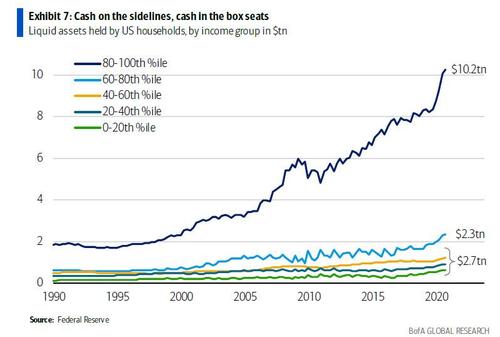

As of Q3 2020 (latest distributional data), the top 20% of households had $10.2tn in liquid assets. The next 20% had $2.3tn, and the bottom 0-60% combined had just $2.7tn. That includes checking accounts, CDs, and money market funds; it doesn’t include equities or bonds.

What about all o f the post-COVID stimulus, where did that go? From the end of 2019 through September 2020, liquid household assets rose $2.2tn. This number is what monetarists and inflation hedgers are so excited about. Clearly, spending $2tn rapidly into a $21tn economy would be a recipe for a big boom.

But again, and as we have shown every quarter when we discuss the household balance sheet (which just last week was reported to hit a record $130 trillion as of Dec 31, 2020) the data shows a very skewed situation. The top 20% saw their cash increase by $1.5tn since Covid hit vs. just $0.7tn for everyone else. The top 1% alone saw cash assets rise by nearly as much as the bottom 80% of the country combined. Updated through today, these numbers would reflect even more inequality, as many low-income households had to use their cash during the difficult winter to cover urgent spending needs.

As Woodard then politely puts in, "In a consumption-based economy like the US (70% of GDP), inequality isn’t just a topic for political debate, it’s a mathematical problem."

Whether a given dollar gets spent or saved depends on who’s holding it. One Boston Fed study found that in normal circumstances the bottom 20% of households were likely to spend $0.97 of every dollar earned, while the top 20% spent just $0.48 of every extra dollar. In other words, if the goal is to boost economic activity, sending money to people who will just sit on it may not be very effective.

That’s why BofA believes that a glut of cash on the balance sheets of already-wealthy households is unlikely to boost inflation in a sustained way.

How they’ll spend it

So much for the theory, what about reality? Here, too, there is a problem as recent data confirms that households are still saving much more than usual, even as vaccine distribution accelerates:

To get a clearer picture, at the end of February Bank of America surveyed more than 3000 people about how they would use another stimulus check.

When the BofA team then compared consumer plans for 2021 stimulus money with 2020 uses they reported, the financial category saw the largest increase (+1.7% to investing, +0.8% to debt payoffs, and just -0.2% to cash saving).

Needless to say, a rebound in spending (even dramatic in its scope) among high-income households won’t suffice. Why? Because leisure, restaurant, and related travel spending only accounted for 4% of GDP pre-COVID. And work-from-home lockdowns could mark a peak in higher-end consumer spending, as workers returning to offices have less time to shop online.

Sure, there are some caveats to this survey: maybe people don’t know their own spending patterns that well, or maybe plans will change as springtime hopes yield a mask-ripping summer. Even then, however, BofA's Woodard notes that after a one-time surge of enthusiasm, if most savings are stuck with wealthy households unlikely to spend, and the bottom 80% devote their excess cash to debts, savings, and stocks anyway, it’s not clear who will be doing all the sustained, voracious consumption markets now are pricing in.

Why is all of this important?

Because as BofA explains, having priced in a dramatic rebound in inflation in coming months on the back of anticipated surges in spending, the market may be disappointed as the "fiscal liquidity trap" proves to have a far stronger gravity than most pundits and politicians expect. It would also mean that inflation - after an initial burst higher in mid-2021 - will collapse, and is why BofA expects that year-end core CPI will be just 1.7% as the upcoming June CPI spike fades. Here are some other reasons why Woodard believes that the market is in for a major disinflationary shock in the second half of 2021.

1. Supply disruptions are temporary. Supply-chain bottlenecks, semiconductor shortages, and manufacturing delays today are likely to be relieved as the labor force returns to work. High prints in manufacturing price indexes (e.g. ISM) largely reflect high commodity prices and therefore headline, not core inflation;

2. Structural job losses. Post-pandemic work-from-home could mean smaller rebounds in restaurants, in-person retail, and business travel. Progress on AI & automation could mean fewer industrial jobs to return to, especially at the low end. Before the pandemic, the Bureau of Labor Statistics projected the number of low-wage jobs to grow >5% over the next decade; now, there may be a net decline of 0.5%, bad news for 13% of low-wage workers still unemployed;

3. Union membership is near record lows, just 11% of the workforce today vs. 26% in 1953. Unions are politically almost homeless, with modern Democrats relying less on union votes and more on big tech donors; within the GOP, even “populist” senators haven’t endorsed the unionization vote at Amazon in Alabama.

4. Capex is coming. In the unlikely event wage growth does accelerate sharply at the low end, companies can accelerate R&D to prevent labor from gaining bargaining power. BofA expects corporate capex to rise 13% in 2021. Note that deflationary tech capex now accounts for nearly 30% of the S&P 500 total, a record high (Exhibit 13);

5. The baby bust. Already-plunging global birth rates accelerated lower: e.g. the Brookings Institution estimates 300,000 fewer babies born in the US this year because of the pandemic. Global central banks have called this one of the single greatest causes of lower GDP growth and falling interest rates.

* * *

Let's assume BofA is right and spending on goods and services disappoints overwhelmingly. One potential implication is that there would be far more in stimmy checks going into the stock market. But how much?

Recall that one week ago DB's Jim Reid asked just this, i.e., "How Much Money Will Biden's New Stimulus Inject Into The Market", and wrote that while rising yields are a threat to all risk assets, "it’s worth highlighting that a large amount of the upcoming US stimulus checks will probably find their way into equities."

Then, like BofA, he referred to a survey conducted by DB's chief equity strategist Binky Chadha polling online brokerage account users which suggested they would invest around 37% of future stimulus checks in the stock market (this is well above the 9% response from the similar BofA poll). This is a material force because as Reid notes, "behind the recent surge in retail investing is a younger, often new-to-investing and aggressive cohort not afraid to employ leverage."

What does this mean quantitatively? Here is Reid's math:

"Given stimulus checks are currently penciled in at c.$405bn in Biden’s plan, that gives us a maximum of around $150bn that could go into US equities based on our survey. Obviously only a proportion of recipients have trading accounts, though. If we estimate this at around 20% (based on some historical assumptions), that would still provide around c.$30bn of firepower – and that’s before we talk about any possible boosts to 401k plans outside of trading accounts."

Reid's conclusion: "stimulus checks could accelerate the large inflows into US equities seen in recent months after many years of weak flow data. Will this be enough to offset any impact of higher yields? Expect this push/pull to continue for some time."

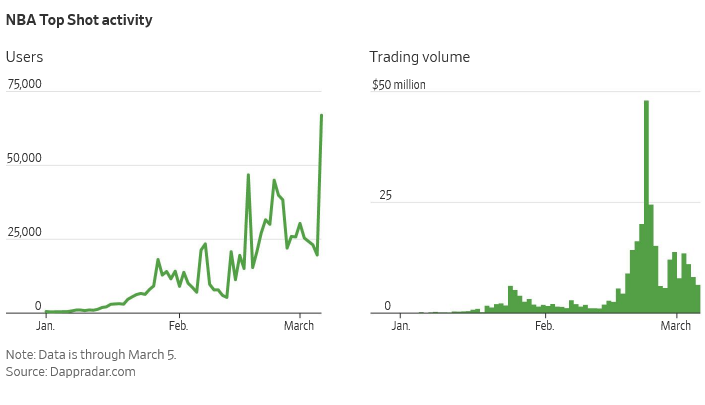

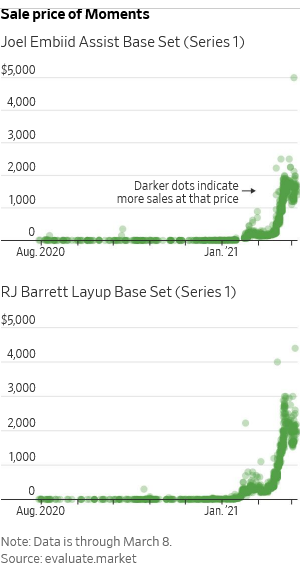

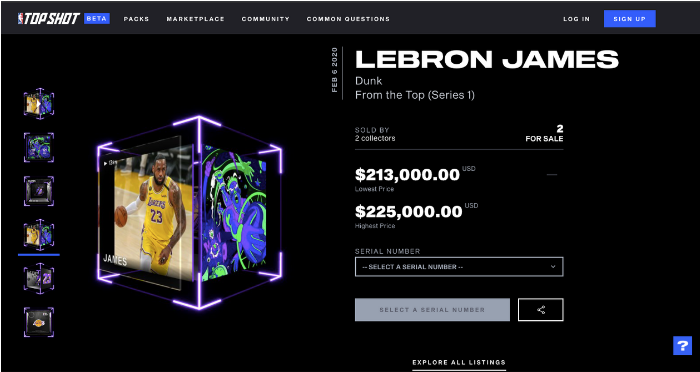

Now add to this assessment, BofA's skepticism which, if correct, would likely mean even more money being allocated toward risk assets, whether blue chips, meme stocks, cryptos or - the latest get rich quick rage - NFTs. This take is bolstered by a recent report from Bloomberg which similarly notes that while many cash-strapped families will use funds from the $1.9 trillion pandemic-relief bill to cover rent or past-due accounts, "another cohort may use the $1,400 payments to ignite the stock market’s next retail frenzy."

“I probably will take about half of it to invest into stocks,” said Iyana Halley, a 28-year-old actor who recently appeared in NBC’s television drama “This Is Us.” The Los Angeles resident remains on the fence about which equities to buy, but has been keeping a close watch on social media and seeking guidance from a friend she trusts. Actress Iyana Halley

Actress Iyana Halley

“I want to see what will make the most sense, where I can get the most out of my money,” Halley said in an interview. “I’m still new to the stock-market world, so trying to figure stuff out.”

Traders are also hoping to figure it out as soon as possible, because the retail buying may come as soon as Monday once the stimulus checks received over the weekend are invested, giving the Nasdaq 100 Index new wind after it fell into a correction earlier this month amid a crash for some of the market’s most speculative names.

The checks “could offer a short-term ‘shot in the arm’ to a market that was otherwise looking run-down and vulnerable to a sell-off,” said Sam Stovall, the chief investment strategist at CFRA Research.

“Stimulus checks will almost certainly drive more retail buying,” said Eric Liu, co-founder of Vanda Research, a firm that tracks retail flows in the U.S. “The social media attention has remained strong.”

Tyler Hopkins, a 26-year-old computer technician for a school district an hour east of Los Angeles, spent about half of his two previous pandemic stimulus payments on stocks including GameStop Corp. and non-fungible tokens. He plans to buy more shares of retail favorites when the latest payment hits his bank account.

"I’ve been buying crypto and stocks for a while now, but the stimmys helped pay some bills and I put the rest of them into investing," Hopkins said.

So while one can debate about the precision, one thing is clear: tens if not hundreds of billions from the latest Biden Bonanza will end up in the market. Yet for all the excitement that the stimulus payments are stirring up among younger traders looking to make a killing, some investment professionals have been wringing their hands. They worry that unsophisticated newbies buying stocks they heard about from memes or online forums like WallStreetBets could take already stretched valuations even higher.

“You could say it’s like gasoline on a fire,” said Kimberly Woody, a senior portfolio manager at GLOBALT Investments. It’s “participation from a lot of folks that really just don’t know what they’re doing.”

To be sure, the latest investing spree will merely cap off a retail mania that has been raging for almost a year now. The gamification of investing and consumers seeking entertainment during pandemic lockdowns led to massive surges in stocks generally shunned by the long-term investor community, from companies like Gamestop, AMC Entertainment Holdings and headphone maker Koss Corp. Those bets helped spark massive rallies that featured dizzying bouts of volatility.

* * *

Not everyone will spend their stimmy chasing momentum in the latest meme stock however: Halley, the Los Angeles actor, is aware of how dicey it is taking a flyer on the fringes of the stock market, so she’s hedging her bets. She plans to spend the other half of her stimulus on acting classes.

“I think with stocks or any kind of investment, it’s always going to be a risk,” she said, much to the amazement of financial professionals many of whom realize something Halley does not: the stock market is the final bubble, the one that is now "too big to fail", and whatever happens the Fed can never let it burst...

The middle class will pay down debt.

The ghetto will buy gin and cigarettes.

I guess they could ask all their Democratic buddies in government, managing pension funds, owning construction companies, all the other places 91% of it will get wasted and stolen.

That would be a start.

I’m sure every dollar will be tracked and accounted for. No waste at all. Not on Bidens watch.

Smith & Wesson

A ton of it is being invested in companies to shore up retirement funds while serving off as a payoff to big tech for the support in the election of Biden.

Dirty Dirty Pay-off while looting us. Will it be enough money printing to make everyone loose everything?

Lots of people from all walks are buying guns.

10 years ago I found an online document that listed the amount, address and who received Obama’s bajillion dollar stimulus in my county.

The amounts were in the $40,000-$80,000 range and were given to obscure charities I’d never heard of before with addresses in the minority side of town a couple of which were listed as MLK Blvd.

Is there a third option?

C. Pay down on debts, then buy Swedish vodka and menthol Marlboros.

Iyanna Haley is a pleasant looking, young lady.

If she interviewed with a professional appearance like that, she would likely get the job.

Eat your heart out Nikki Minaj!

I’m trying to imagine losing a big opportunity, business and or career over this national hysteria and spectacle the Democrats have produced and directed. Oh, here’s your 1400 bucks to make up for all that! Good luck!

Ok, so I just learned something new. I knew Bitcoins were unique but fungible. They can be collected as unique items but not traded because the private key can't be "forgotten". Your proof that you own some value on the blockchain is your ability to sign a transaction with the private key. But if you want to give that value to someone else you have to transact, i.e. sign with your private key. The value is transferred to the recipient's public key or address. You can't transfer the private key because you can't prove you have 't kept a copy.

Here's what I think NFT is. With NFT the token is transfered by a contract on the blockchain. The transaction has a fee in some cryptocurrency and by signing the transaction you are paying the fee and transferring The NFT transfer transaction transfers the NFT from the seller's address to the recipients address. What I have not yet found is an explanation of the payment. Is it part of the transaction or a separate transaction such that when the buyer sees the payment on a different, unrelated address, they complete the transfer of the NFT.

Short version: NFT is yet another digital bubble, a binary beanie baby.

Easy.

Americans & illegal aliens > Amazon.com > China

Equal measures of illegal drugs, fast food, and Netflix subscriptions.

$100 of mine will go to FR. I’m doing ok financially

Where will the money end up?

First of all, Hunter needs to get a shot at it, since he always does with a piece to “the big guy.”

Second in line is Nancy.

Most of what’s left will go to the DNC

A pittance will go to the sources stipulated in the bill.

Uppers, lower parts kits and optics.

Biden's stimulus makes Obama's look like chump change.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.