Posted on 01/29/2021 7:44:19 PM PST by SeekAndFind

Something bad is about to go down at Robinhood.

One day after the company drew down on its bank lines and obtain a $1 billion rescue capital investment, the company found itself in lockdown mode, allowing just a handful of shares to be bought at a time, effectively shutting down in all but name (it couldn't risk another day of furious public outcry and massive client departures if it blocked trading completely).

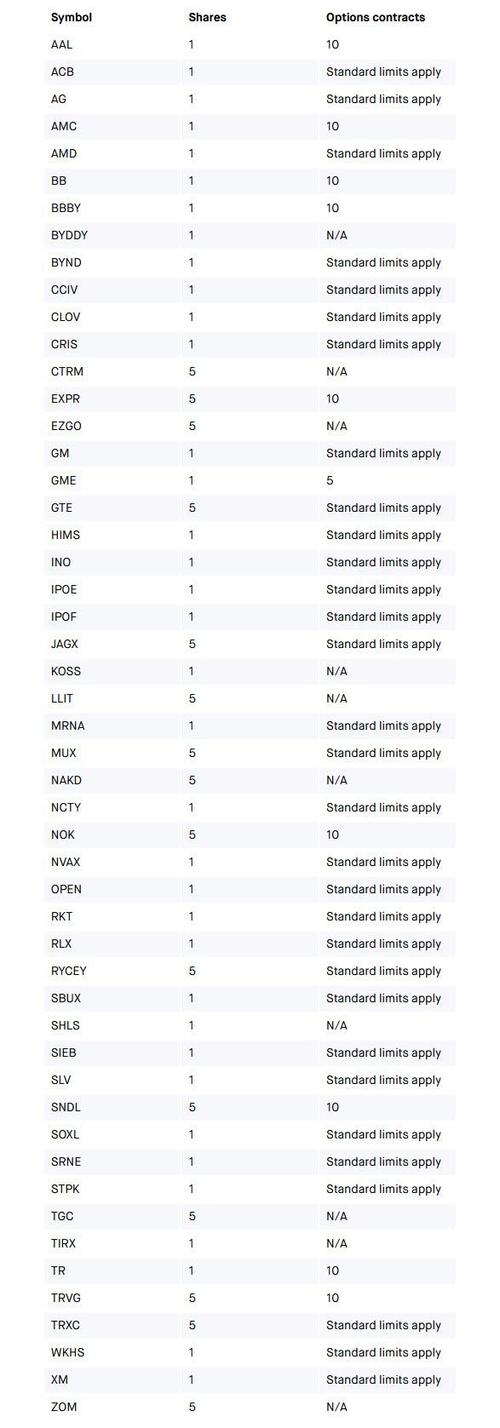

However, just before the close, things got downright surreal when in a blog post the broker - which should probably change its name from Robinhood to Suit - made a shocking announcement: going forward, customers will be subject to maximum aggregate limits in 51 securities of which 14 are capped at position limits of just 5 shares, while allowing total holdings in 36 securities to be just one share!

In other words, as of this moment, no client is allowed to one more than 1 share in names like GME, AMC, AG, BBBY, BYND, WKHS and many others. Even boring, low vol names like GM and SBUX are limited to just one share.

This is what the blog post said:

"The table below shows the maximum number of shares and options contracts to which you can increase your positions. Please note that these are aggregate limits for each security and not per-order limits, and include shares and options contracts that you already hold. These limits may be subject to change throughout the day."

Panicked clients who are wondering if this means that their current holdings which exceed 1 laughable share will be forcefully liquidated can breathe for now: the company said that "outside of our standard margin-related sellouts or options assignment procedures, your positions will not be sold for the sole reason that you are currently over the limit. However, you will not be able to open more positions of each of these securities unless you sell enough of your holdings such that you are below the respective limit." (we expect that to change on Monday, if the company is still around.)

In other words, virtually nobody can buy any new securities.

The company also disclosed that no fractional shares can be bought going forward as "fractional shares are currently position closing only for all of the securities listed in the table above. This means you can sell and close your fractional positions, but you can't open new fractional positions. However, you can still open new whole share positions according to the limits listed above."

Why is this happening? The most likely reason is that between DTC, clearinghouses and other regulatory entities, Robinhood was found to be in another capital deficiency position - even with the billions raised overnight - and it is being forced to delever.

This likely means that Robinhood is as of this moment, scrambling to obtain even more capital, although we somehow doubt it will be just as easy to "take from the rich" as it was late last night especially since the client exodus is surely accelerating.

It also means that we may have to have another "Lehman Weekend" situation on our hands, only this time it will be a "Robinhood Weekend", and an urgent acquisition from a strategic buyer may be required to prevent the worst case outcome. We only hope that the billions in funds held in custody for clients is segregated should the company collapse (pinging Jon Corzine here).

In any case, expect a lot of Robinhood related news over the weekend.

* * *

And as a postscript, while we expect that the turmoil will be contained at Robinhood, whether in the form of new capital infusion, a takeover, or bankruptcy, there is the possibility that the liqudity shortfall goes as far as the clearinghouses. What happens then? Below we excerpt from a monthly letter written by Horseman's Russell Clark who had a good recap of "what if":

Pre-financial crisis, banks and clearinghouses were part of one big and messy system. Banks mainly traded with other banks as it was cheaper, but every now and then they would trade through a clearinghouse. There were two types of trades. Circular trades, which are trades where each bank has a position, but the system has a flat position, and directional trades, where the system would match up buyers who wanted to take a view on future movements of financial markets. Directional trades are more dangerous; risk will be less evenly distributed as it will have no offsetting trades.

When Lehman went bust, LCH, the biggest interest rate derivative clearinghouse, found they only needed one third of the initial margin to cover losses. This encouraged regulators to move clearinghouses to the center of the financial system. However, this has caused two big problems.

Firstly, clearinghouses have no real "skin in the game". They act like a bookie, that takes bets from punters, and transfers money from winners to losers. But how much risk should they take? What is the correct level of initial margin? Clearinghouses used to piggyback on bank's risk measures, but without banks to guide them, how should they set risk? Clearing houses and regulators chose to use a backward-looking model, with risks set from market data from between 3 and 10 years in the past. This has caused the markets to have a built-in momentum model which amplifies cycle both ways. Hence, many of the normal trading rules don't apply. There will be no signs of problems in the market until right at the last moment. Markets are no longer discounting mechanisms and have become more akin to momentum models.

Secondly, banks are now deeply capital constrained, and at the start were very reluctant to move old trades to a centrally cleared model. This problem was resolved through a carrot and stick approach. The stick is uncleared trades carry a capital charge, and the carrot is that the exchanges offer very attractive "netting". What netting means is that banks can give details of all their trades to a third party, and any circular trades can then be netted off thus requiring less margin. LCH claim to have done a quadrillion of compression trades or netting in the last year, this is more than twice the notional of all outstanding interest rate derivatives.

The problem should be apparent. Clearinghouses were safe because, if there was a problem, the circular trades netted off on settlement. But by aggressively netting off at the margin stage they are no longer as safe. In fact they are very risky. This was highlighted by the near failure of a small clearinghouse in Europe last year. Using BIS data on the penetration of central clearing, and pricing of interest rate derivatives as a proxy of initial margins, I would say that initial margin in the system needs to rise by about 6 times to make the system "safe". Looking at previous periods of rising initial margins in 2000-2002 and 2007-2009, the pro-cyclicality of claringhouses should be obvious.

Finally, cash hoarding and repo market problems could be a sign of counterparties beginning to worry about clearinghouses. If initial margins rise significantly, the only assets that will see a bid will be cash, US treasuries, JGBs, Bunds, Yen and Swiss Franc. Everything else will likely face selling pressure. If a major clearinghouse should fail due to two counterparties failing, then many centrally cleared hedges will also fail. If this happens, you will not receive the cash from your bearish hedge, as the counterparty has gone bust, and the clearinghouse needs to pay from its own capital or even get be recapitalised itself. One way to think about it is that the financial crisis only metastasized when MG failed, because at that point, everyone suddenly became un-hedged, and everyone needed to sell.

Revolting peasants are not invited to the party.

No - the positions are actually held by a separate custodian.

No, not the SOLE reason. The other reason will be that you peasants have dared to challenge our mighty patron.

Robinhood steals from the middle class and gives to corrupt white liberal ‘elites’...

I totally agree with you.

Robinhood customers could panic, and start selling, causing a run on a cash strapped organization. If they immediately invested those funds in Game Stop stock at a different brokerage, the stock price might stay high. They’d have to pay their customers top dollar.

I’ll bet a lot of RH’s customers are pee-o’d and nervous right now.

RH promised its customers a vehicle to level the playing field with the big guys, when, in fact, they were shearing them with HFT scrapes and selling their personal information.

When push came to shove, they pushed their retail customers under the bus, and protected their HFT partners.

Every debt ridden country this century has experienced a currency crisis, Not if but when. Look at how those countries handled it, ( Argentina, Venezuela, Brazil, ....) nationalizing retirement funds. They started “ administering” pensions, retirement funds, ....the least evil ones did not out right take the money, but instead limited ( capped) withdrawals, i.e., allowed $1K, 2K , $500 Max per month in withdrawals....that said, we are not there just yet-

Wait till we experience our currency crisis, it has already started, our USD has dropped 12 percent last year (2020), we are at 89/90, add another 1.7 trillion next month gets the race to the bottom started...

They can make solar panels.

Then why do they need cash? Are they holding unsettled trades?

If all they are doing is acting as an accounting for customer holdings at a remote entity, then what do they care? The clearinghouse could be backed up, limiting the trades they’ll take, thatvwpukd cause RH to limit customer activity, but how would that drain Robinhood?

They are very, very angry now. I also heard they are so desperate and broke, that they all went over to Wall Street Bets and are following their trades now.

Warning: “strong language at beginning”

https://www.bitchute.com/video/iZ7m84GsJnRo/

F BBB. That pandering outfit gave $1 million to bLM and then bragged about it

Ya right?

Irony peaks in 2021? What could be more so?

Potato president offers promise though.

Haha.

Next time, FR should do this.

These crooks will be spinning then. Imagine not being able to show up all coked out in the morning to steal.

These scum lords and newscasters are the same sort. If a guillotine is used, i hope its a rusty one.

LOL! Hilarious.

They are getting their comeuppance now:

You are reading too much into that.

A "position" is not just a "complex" bet - it is any bet.

Regards,

Good decision. I smell a crash coming, and sold off 2/3rds of my stock holdings. I'm still making money on the remaining 1/3rd but it's a gamble on how long the market can last before a crash. Decided I didn't want to lose it all, will be okay if the remaining 1/3rd goes down in flames because of selling off most. Can't be greedy.

bookmark

Word is they are after big money for Bridge Loans to reconcile trades now.

Restricted trades.

From % to 100% collateral per clearing.

If the big Bridge Loans come we might know who’s behind the hedge curtain.

If a frenzy Bailout look at every member of DC and Fairfax.

This Robinhood place is starting to sound a lot like another trading company from a bit ago.. Enron. Hope they have the same fate.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.