Skip to comments.

Investment Management Firm CEO Jeff Gundlach: Trump Will Win Next Week, And By 2027 “There Will Be Some Sort Of Revolution”

Truly U.S.A. News ^

| 10/28/2020

| Tyler Durden

Posted on 10/28/2020 8:11:33 AM PDT by SeekAndFind

Back at the start of 2016, when nobody else would even consider such an outcome, DoubleLine Capital CEO Jeff Gundlach shocked the economic, financial and political establishments when during the January Barron's roundtable of that year, he predicted that Donald Trump would become the next US president. He was right.

Fast forward to today when one week before the elections, and in an environment when most polls predict that Biden will crush Trump and where Nate Silver gives Trump just as 13% chance of defeating Trump, Jeffrey Gundlach is predicting another victory for President Donald Trump.

As Financial Advisor magazine reported, during a Tuesday webcast as part of Schwab’s 2020 IMPACT conference, Gundlach said that despite polls, analysis and betting odds that suggest otherwise, Trump is likely to outpace former Democratic vice president Joe Biden in the contest.

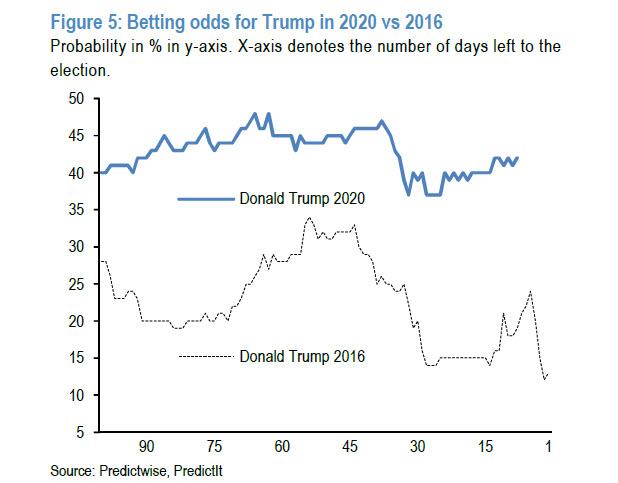

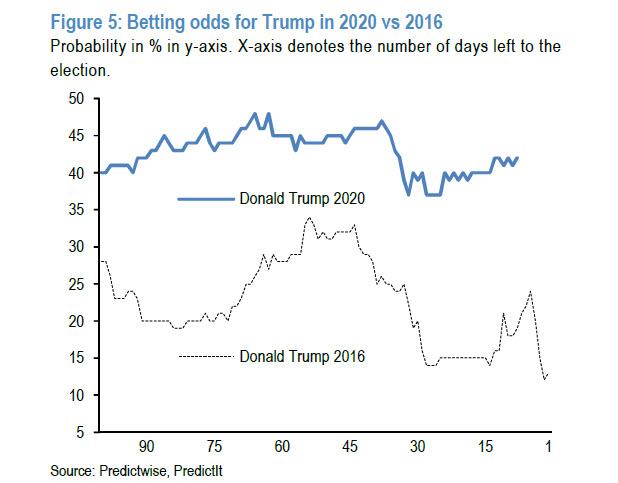

"The polls right now say he isn’t going to win, but they said that four years ago," said Gundlach referring to the following chart.

"Mind you, my conviction is way lower than it was four years ago. But back in [that period], when Trump was little more than an asterisk in the betting odds, I predicted he was going to win. This one is much more murky, but in my eyes, it favors a Trump win."

Addressing the elephant in the room, Gundlach said that public political polls are often "designed to create impressions" rather than illustrate reality, said Gundlach, and shouldn’t be trusted (for more on this read our post from 2016 "New Podesta Email Exposes Playbook For Rigging Polls Through "Oversamples"). He also argued that many Trump voters are unwilling to engage with pollsters and the media because they fear retribution for their political beliefs, also known as the "shy voter" phenomenon according to which "Over 10% Of Trump Voters Won't Admit Preferences To Pollsters." Biden also faces an enthusiasm problem, said Gundlach.

Gundlach then went on to crush hopes of a Blue Wave, arguing that Republicans will likely keep the Senate regardless of who wins – mainly because of uncertainty around Biden. "Some people will hedge their bets and split their vote towards retaining the Republican Senate because they view Biden as risky," said Gundlach, who noted that Trump is often portrayed as riskier than Biden. And yet, in the four years of his presidency, there have been no international conflicts, despite some outrageous and bellicose language.

"You might dislike Trump or some of his policies, but risk is not what you’re getting with him, particularly compared to turning the presidency over to another party, and particularly when that party’s candidate isn’t saying what some of his policy positions are."

If Gundlach is wrong, and Biden wins the election and eventually rolls back or eliminates the corporate tax reduction from 2017’s Tax Cuts and Jobs Act, U.S. equity valuations would increase sharply, said the DoubleLine CEO, but he added that the reduction in after-tax earnings would mean that stock prices would not appreciate. Interest rates, volatility and inflation would also rise, said Gundlach.

"Markets don’t like certainty, and with Trump, I think you have more certainty,” said Gundlach. “With Biden, you have peak uncertainty because there’s been very little information given to the public.”

Gundlach clarified that he doesn’t think Biden is a socialist, but that pressured by the Democratic Party’s base, his administration would pursue higher taxation and “socialist policies,” but it’s hard to be sure because Biden has changed many of his positions over his long political career.

The opposite is true of Biden’s running mate, California Senator Kamala Harris, who Gundlach called “one of the most left-leaning people in all of the Senate” who is not shy about sharing her opinions.

Gundlach then said that Americans should consider the all too real possibility that a Biden victory means that at some point within the next four years, Harris will ascend to the presidency.

"We have to discount the probability of outright socialist policies with outrageous amount of deficit spending,” said Gundlach. "That would pose a big problem for stock and bond markets."

Yet no matter who the winners is on Nov 3, Gundach said that 2020 is just another in a series of election cycles that have increased in their tumult and oddity.

At this point Gundlach went "full Zero Hedge", and predicted that by 2027, economic inequality, strained by fiscal and monetary policy, would come to the point of some sort of revolution, which would put the 2024 presidential election directly in the path of massive social, economic and political change. Which, incidentally, is more or less everything that we have been saying for the past 12 years.

"When I said that I think Trump is going to win in 2016, I also said that if you think 2016 is weird, just wait for 2020,” said Gundlach.

"Well, if you think 2020 is weird, just wait until 2024. You ain’t seen nothing yet."

TOPICS: Business/Economy; Culture/Society; News/Current Events; Politics/Elections

KEYWORDS: elections; jeffgundlach; revolution; trump

Navigation: use the links below to view more comments.

first 1-20, 21 next last

To: SeekAndFind

When DoubleLine Capital talks people.... What? Who??

To: SeekAndFind

Fast forward to today when one week before the elections, and in an environment when most polls predict that Biden will crush Trump and where Nate Silver gives Trump just as 13% chance of defeating Trump Nate Silver is a far left Dem Party hack.

He's not even pretending to be an unbiased prognosticator any more.

He is a bought and paid for Dem Party propagandist.

He might as we officially join the Biden

campaign propaganda and disinformation department and be done with it.

To: Army Air Corps; Drew68

4

posted on

10/28/2020 8:19:42 AM PDT

by

KC_Lion

To: Professional

For thoe who don’t know, Jeff Gundlach founded Doubleline Capital, along with Philip Barach and 14 other members of Gundlach’s senior staff from The TCW Total Return Fund.

Barach was Gundlach’s co-manager of the $12 Billion TCW Total Return bond fund.

In a February 2011 cover story, Barron’s called him the “King of Bonds”. In 2012, he was included in the 50 Most Influential money managers list of Bloomberg Markets magazine.

To: SeekAndFind

So he’s almost as accurate as the former bond king Bill Gross?

To: SeekAndFind

“Well, if you think 2020 is weird, just wait until 2024. You ain’t seen nothing yet.”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Can’t wait, we’ll have freepers who claim to be supporters of the Constitution backing ineligible candidates.

7

posted on

10/28/2020 8:23:58 AM PDT

by

Lurkinanloomin

(Natural Born Citizens Are Born Here of Citizen Parents|Know Islam, No Peace-No Islam, Know Peace)

To: SeekAndFind

Money paragraph from the article:

“Addressing the elephant in the room, Gundlach said that public political polls are often “designed to create impressions” rather than illustrate reality, said Gundlach, and shouldn’t be trusted (for more on this read our post from 2016 “New Podesta Email Exposes Playbook For Rigging Polls Through “Oversamples”). He also argued that many Trump voters are unwilling to engage with pollsters and the media because they fear retribution for their political beliefs, also known as the “shy voter” phenomenon according to which “Over 10% Of Trump Voters Won’t Admit Preferences To Pollsters.” Biden also faces an enthusiasm problem, said Gundlach.”

To: Professional

To: SeekAndFind

“Markets don’t like certainty...”

Whaaat?! That’s the opposite of what I always heard. Anyone else ever hear this?

10

posted on

10/28/2020 8:29:08 AM PDT

by

D_Idaho

("For we wrestle not against flesh and blood...")

To: Lurkinanloomin

11

posted on

10/28/2020 8:30:03 AM PDT

by

JCL3

(As Richard Feynman might have said, this is reality taking precedence over public relations.)

To: SeekAndFind

Nate Silver gives Trump just as 13% chance of defeating Trump, OK so then Trump wins?

12

posted on

10/28/2020 8:32:22 AM PDT

by

usurper

( version)

To: D_Idaho

RE: “Markets don’t like certainty...”

Either he was having a Joe Biden moment there, or the writer needs an editor.

To: D_Idaho

“Markets don’t like certainty...” i'm pretty sure it's a typo... there was another typo in the article about Trump beating Trump...

14

posted on

10/28/2020 8:35:34 AM PDT

by

latina4dubya

(when i have money i buy books... if i have anything left i buy 6-inch heels and a bottle of wine...)

To: D_Idaho

“Markets don’t like certainty...” Whaaat?! That’s the opposite of what I always heard. Anyone else ever hear this? Almost certainly a typographic error.

In context, it makes no sense.

A typo.

15

posted on

10/28/2020 8:38:30 AM PDT

by

marktwain

(President Trump and his supporters are the Resistance. His opponents are the Reactionaries.)

To: SeekAndFind

... Gundlach ... predicted that by 2027 ... would come to the point of some sort of revolution, which would put the 2024 presidential election directly in the path of massive social, economic and political change.This is right up George Soros's alley. Soros has been scheming against the U.S. for the past 2 1/2 decades. Soros says the U.S. is the only roadblock stopping him from achieving his globalist vision.

Soros donated $32 Billion of his $40B personal wealth to his "Open Society" foundations which stated that Soros has been concentrating his huge "donations" on the U.S. since the mid-1990s.

Soros's Open Society focuses its U.S. funding on placing Soros-approved individuals throughout the media, law enforcement (e.g., soft-on-crime DAs), academia, government, progressive/activist organizations, and politics. Soros says the U.S. is the "enemy" of his globalist Open-Society vision, so he's obsessed with destabilizing & dismantling the U.S.

Soros's Open Society foundations cap the percentage of a progressive organization's funding that comes from his Open Society foundation to 33%. Soros and his Open Society claim they don't get involved in the daily operations of the hundreds of activist organizations they fund. So they presumably can claim plausible deniability. Britain and Soros's home country of Hungary both blame Soros for destabilizing their respective countries. Plausible deniability.

To: marktwain

“Markets don’t like certainty...”I fully agree with this statement. Financial markets are always thrilled with destabilized global uncertainty, the more frantic uncertainty, the better. For example, let's say inflation is wildly fluctuating up and down like a yo-yo from day to day. All corporations love that, thus so does Wall Street.

As the old Wall Street saying goes: Markets (and corporations) love brain-splitting massive uncertainty.

To: SeekAndFind

When the arrests of the funders of this treasonous activity

are rounded up and sent to prison, this ends.

When the payroll sheets are tabulated, and there are knocks

on thousands of people’s doors, this ends.

When universities lose federal funding and professors are

goose stepped out of their ivory towers, this ends.

Those folks out there on the streets aren’t going to continue

unfunded, no sugar daddy to bail them out.

Universities aren’t going to continue with their treasonous

ways, if they are headed out of business.

One other thing that the government can do, is refuse to

recognize any degree issued from a ‘terrorist’ training

institution.

Try walking into court with a client, when the judge will

not recognize you as an attorney.

Go get yourself a degree at a university that pushes

terrorism, and then watch what happens when you seek

employment.

Between November 4th and the end of the year, there better

be some activity out of the Justice Department.

If not, the nation’s sane populace is going to be furious.

18

posted on

10/28/2020 8:58:34 AM PDT

by

DoughtyOne

(If you're neverTrump at this point, drop the charade, you're just never the United States.)

To: SeekAndFind

Yes; like Bill Gross, Grundlach was the “bond king” until he wasn’t. In the past five years the Barclay average of bond funds has outperformed Gundlach’s Total Return bond funds each year.

19

posted on

10/28/2020 8:59:09 AM PDT

by

riverdawg

(Wells Fargo is my bank and I have no complaints.)

To: D_Idaho

Who speaks for “The Market”? Traders and speculators do not like certainty and favor markets with change and volatility. Investors prefer certainty.

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson