Skip to comments.

The Forgotten Depression of 1920

Mises Institute (first published in the Fall 2009 issue of The Intercollegiate Review). ^

| 11/27/2009

| Thomas E. Woods, Jr.

Posted on 01/02/2020 8:24:17 AM PST by Maceman

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-30 last

To: South Dakota

Like the weimar republic?Do you see high inflation and high unemployment, like the Weimar republic?

No you don't.

21

posted on

01/02/2020 10:38:56 AM PST

by

DannyTN

To: DannyTN

Jobs are coming back to the USA because of the tax cuts allow money to come back to the USA with out the excess theft by the government.

22

posted on

01/02/2020 11:23:49 AM PST

by

jimpick

To: jimpick

Tariffs are playing a big role too.

They need to be much higher.

I think the current level of tariffs have slowed the offshoring, but hasn’t brought back very many jobs yet.

23

posted on

01/02/2020 11:31:27 AM PST

by

DannyTN

To: READINABLUESTATE

My own father often said that in the late 20s "a man couldn't carry $5 worth of grocery's".

Inflation is a real thief.

From the 1940s

1920s store advert.

At the depths of the Great Depression, my Grandfather built his own home (two bedrooms with indoor plumbing) by himself with adobe bricks made locally (Tucson). He was employed full time as well. How?

He was willing to move his family to where he could find work.....

24

posted on

01/02/2020 12:03:18 PM PST

by

ASOC

(Having humility really means one is rarely humiliated)

To: DannyTN

Did the Weimer republic have the Fed manipulation ?

To: ASOC

I roofed a house about 20 years ago for a elderly lady. She said the same thing. Her husband started 3 businesses during the depression. One was installing metal roofs on barns. She said that they had to turn work away because they could not get enough people that would travel to put the roofs on.

26

posted on

01/02/2020 2:04:55 PM PST

by

jimpick

To: South Dakota

Did the Weimer republic have the Fed manipulation ?Not directly, the Fed is a U.S. institution.

The Weimar Republic (WR) had a lot of issues. They had heavy reparation payments imposed by the allied forces. They also were forced by the Allies to grant the Allies most favored nation status. That means they were limited in their ability to raise tariffs and protect their own economy. They suffered from a lot of capital flight. Hence the high unemployment.

To meet their obligations they resorted to issuing additional money, which is generally pointed to as the primary cause of hyperinflation. But the root cause was a stalled economy.

The end of the Weimar Republic coincided with the Great Depression. So no doubt, the U.S. FED tightening the money supply in the U.S. to try to match gold, with the resulting deflationary depression which spread world wide, didn't help the Weimar Republic at all.

There is a significant difference in what the WR did and what the Federal Reserve does. The WR printed money to meet their budget deficits. The U.S. printed money to keep liquidity in the system and to bolster the economy, not specifically to fund the budget deficits.

Are the budget deficits a problem? Yes. And they may eventually lead us down the path of the Weimar republic. But that is not the Federal Reserve's fault. That is Congress's fault.

Congress can overspend and borrow whether we are on the gold standard or fiat money with the Federal Reserve. The same Congress that overspends now, would have no problem borrowing with a promise that your children will pay it back in gold. And the Biden's would still get their children paid off for delivering US Aid in gold.

Here you can see the amount of reparations REQUIRED OF the WR. 900% of gdp!

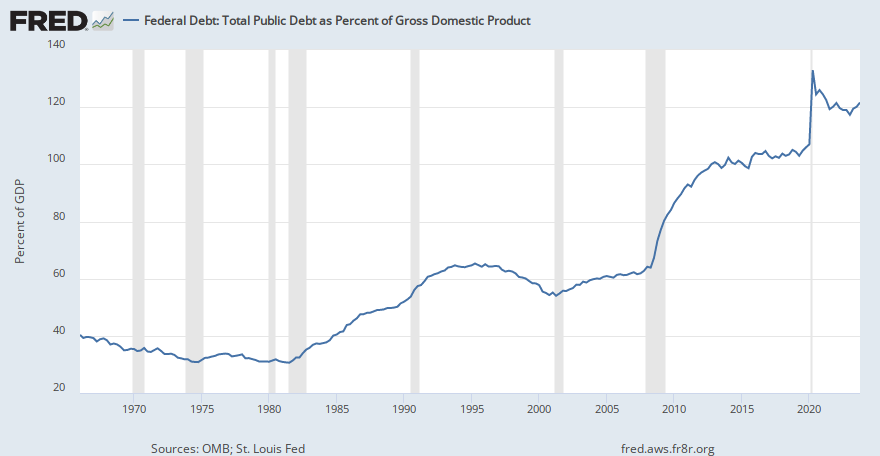

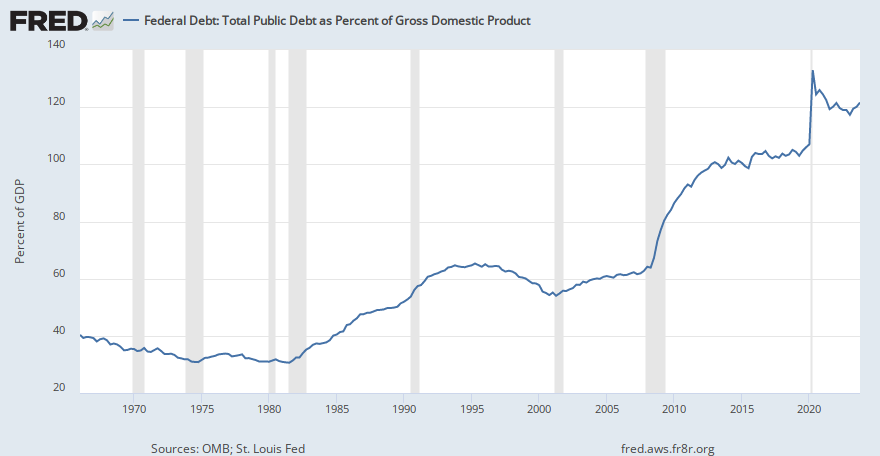

Here you can see that U.S. Debt has nearly reached Post WWII levels of 120%. But it has started to level out, thanks to a strong economy. No thanks to reduced spending. We have time to turn the ship. Our military is rebuilt. The border wall is going up. I suspect Trump will focus on reducing size of government offset by some infrastructure spending in his second term. But he needs a congress that will work with him. So we got to throw the rats out.

Here you can see how closely the WR hyperinflation was linked with the expansion of the Monetary base.

You would think that if we were going to have inflation from the past quantitative easing, we would have already seen it.

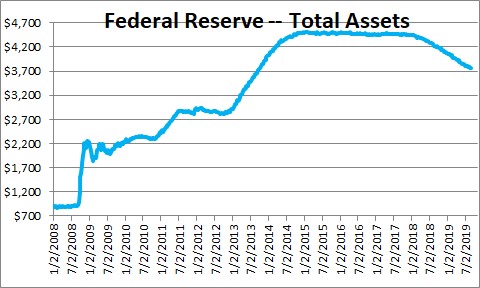

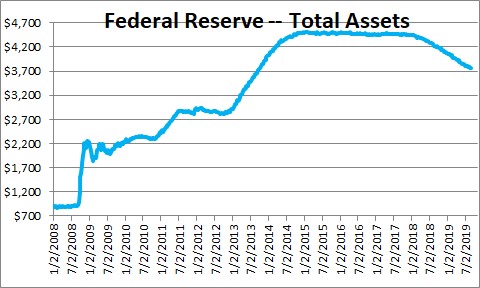

Here you can see the growth in our monetary base and that it too has reversed.

And here you can see the corresponding reduction in the FED balance sheet. (Unprinting)

Is it a problem that an organization like the FED has the power to wreck the economy? No, not really. The incentives are there for the Fed to do the right thing. And it shows in results. We've not had a depression since the 1930's. And short term variation in purchasing power of the $ has remained much lower than under the gold standard.

Long term variation is all in one direction, inflation. That might produce a scary looking 50 to 100 year chart. But it's really only a problem if you intend to hide cash in your mattress for 50 years.

Conclusion:

- The Federal Reserve has been great for the economy, avoiding depressions for 90 years and counting.

- Budget deficits are not the Federal Reserves fault and can happen without the Fed and on the gold standard.

- The Federal Reserve can indeed unprint money just as easily as they printed it, as demonstrated in the graphs above.

- If you're going to read anti-fed conspiracy crap, you should read the debunking materials too and then look for yourself which is true.

- And I'm not saying you do, but If you happen to subscribe to the austrian school of economic thought. Go find a country where it is successfully applied before suggesting it here.

27

posted on

01/02/2020 2:11:34 PM PST

by

DannyTN

To: DannyTN

The Federal Reserve can indeed unprint money....

...

They did so on a Monday in 1929

To: South Dakota

The Federal Reserve can indeed unprint money. They did so on a Monday in 1929Don't confuse Federal Reserve actions with Market actions.

The Federal Reserve is not the only entity that creates money or that can destroy money. Every time a loan occurs, it creates money. Every time a loan is paid off or cancelled it destroys money.

That Monday you refer to was market action destroying dollars, although it was in response to prior tightening by the Federal Reserve.

Think money multiplier effects. So the Fed tightens money. Banks in response don't renew loans, refuse to issue new ones, or call in issued ones. Stocks fall, Brokerages call margin accounts (which are loans) stocks fall more. People panic and sell. stocks fall, more margin is called. People run on banks, banks call more loans. Vicious stuff.

But now the FED monitors that. Steps in making more liquidity available so banks can meet capital requirements stopping bank runs. No Fed = no chance to stop it. Depression. Failed businesses, failed banks, high unemployment, foreclosures, economic mess, soup lines.

29

posted on

01/02/2020 10:54:50 PM PST

by

DannyTN

To: Maceman

They could not possibly understand it if they would read it. Far too wordy, unnecessarily complex and highbrow for them.

Waste of time to expect this would sway them.

Von M is right but spends too much time in the weeds.

Gooberment does not produce anything. It is merely overhead. The less of it the better. Private money cant be hoarded though and it is if not wasted on fancy. Too much money in the hands of too few and not actively employed for gain is waste. We now have that and to correct that by rapid redistribution in any form is inflationary. So, the rich get richer.

30

posted on

01/12/2020 8:00:07 PM PST

by

Sequoyah101

(We are governed by the consent of the governed and we are fools for allowing it.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-30 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson