Skip to comments.

The Deutsche Bank Death Watch Has Taken A Very Interesting Turn

themostimportantnews.com ^

| November 5, 2019

| Michael Snyder

Posted on 11/05/2019 8:26:38 AM PST by LesbianThespianGymnasticMidget

The biggest bank in Europe is in the process of imploding, and there are persistent rumors that the final collapse could happen sooner rather than later. Those that follow my work on a regular basis already know that this is a story that I have been following for years. Deutsche Bank is rapidly bleeding cash, they have been laying off thousands of workers, and the vultures have been circling as company executives desperately try to implement a turnaround plan. Unfortunately for Deutsche Bank, it may already be too late. And if Deutsche Bank goes down, it will be even more catastrophic for the global financial system than the collapse of Lehman Brothers was in 2008. Germany is the glue that is holding the EU together, and so if the bank that is right at the heart of Germany’s financial system collapses, the dominoes will likely start falling very rapidly.

There has been a tremendous amount of speculation about Deutsche Bank over the past several days, and so let’s start with what we know.

We know that Deutsche Bank has been losing money at a pace that is absolutely staggering…

Deutsche Bank reported a net loss that missed market expectations on Wednesday as a major restructuring plan continues to weigh on the German lender.

It reported a net loss of 832 million euros ($924 million) for the third quarter of 2019. Analysts were expecting a loss of 778 million euros, according to data from Refinitiv. It had reported a net profit of 229 million euros in the third quarter of 2018, but a loss of 3.15 billion euros in the second quarter of this year.

If you add the losses for the second and third quarter of 2019 together, you get a grand total of nearly 4 billion euros.

How in the world is it possible to lose that much money in just 6 months?

If all they had their employees doing was flushing dollar bills down the toilet for 6 months, it still shouldn’t be possible to lose that kind of money.

When investors learned of Deutsche Bank’s third quarter results last week, shares of the bank went down about 8 percent in a single day.

Overall, the stock price has lost over a quarter of its value over the past year.

Unless you enjoy financial pain, I have no idea why anyone would want to be holding Deutsche Bank stock at this point. As I have previously warned, it is eventually going to zero, and the only question remaining is how quickly it will get there.

We also know that Deutsche Bank has been laying off thousands of workers all over the world…

On July 8, 2019, thousands of Deutsche Bank employees across the globe arrived at their offices, unaware that they would be leaving again, jobless, just a few hours later. In Tokyo, entire teams of equity traders were dismissed on the spot, while some London staff were reportedly told they had until 11am to leave the bank’s Great Winchester Street offices before their access cards stopped working.

The job cuts, which totalled 18,000, or around 20 percent of Deutsche Bank’s workforce, were the flagship element of a restructuring plan designed to save the ailing German lender.

The day before those layoffs happened, most of those employees would have probably told you that Deutsche Bank is in good shape and has a very bright future ahead.

Just like we witnessed with Lehman Brothers, there is always an effort to maintain the charade until the very last minute.

But the truth is that anyone with half a brain can see that Deutsche Bank is dying. There have been so many bad decisions, so many aggressive bets have gone bad, and there has been one scandal after another…

In April 2015, the bank paid a combined $2.5bn in fines to US and UK regulators for its role in the LIBOR-fixing scandal. Just six months later, it was forced to pay an additional $258m to regulators in New York after it was caught trading with Myanmar, Libya, Sudan, Iran and Syria, all of which were subject to US sanctions at the time. These two fines, combined with challenging market conditions, led the bank to post a €6.7bn ($7.39bn) net loss for 2015. Two years later, it paid a further $425m to the New York regulator to settle claims that it had laundered $10bn in Russian funds.

At this point, it is just a zombie bank that is stumbling along until someone finally puts it out of its misery.

Money is so tight at Deutsche Bank that they have even cancelled the Christmas reception for retired employees…

Times change. Once upon a time (2001, in fact), Deutsche Bank was able to book stars like Robbie Williams for its staff Christmas party, with a Spice Girl turning up too just because it was such a great party. Now, according to the FT, Christian Sewing has even cancelled the daytime coffee-and-cake Christmas reception for retired employees.

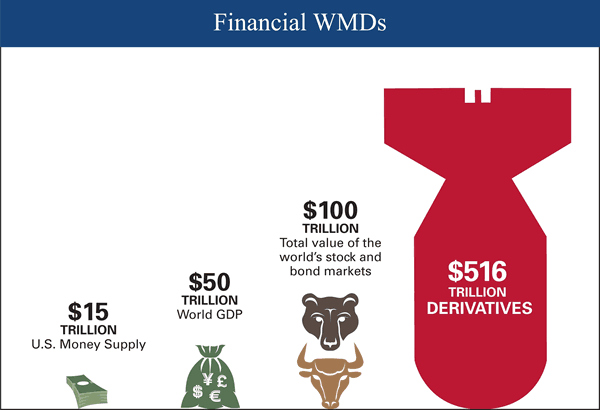

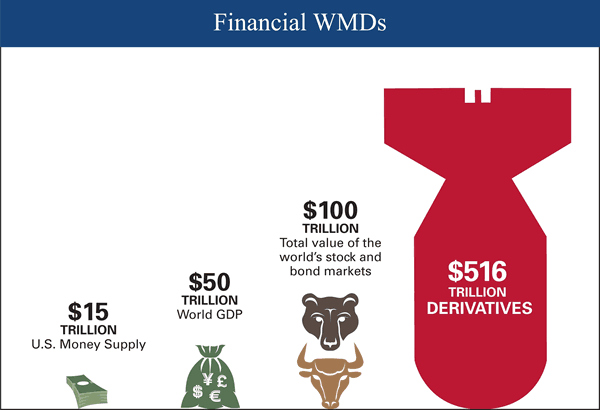

Of course saving a few bucks on coffee and cake is not going to make a difference for a bank with tens of trillions of dollars of exposure to derivatives.

Deutsche Bank is the largest domino in Europe’s very shaky financial system. When it fully collapses, it will set off a chain reaction that nobody is going to be able to stop. David Wilkerson once warned that the financial collapse of Europe would begin in Germany, and Jim Rogers has warned that the implosion of Deutsche Bank would cause the entire EU to “disintegrate”…

Then the EU would disintegrate, because Germany would no longer be able to support it, would not want to support it. A lot of other people would start bailing out; many banks in Europe have problems. And if Deutsche Bank has to fail – that is the end of it. In 1931, when one of the largest banks in Europe failed, it led to the Great Depression and eventually the WWII. Be worried!

Sadly, most Americans can’t even spell “Deutsche Bank”, and they certainly don’t know that it is the most important bank in all of Europe.

But those that understand the times we are living in are watching Deutsche Bank very carefully, because if it implodes global financial chaos will certainly follow.

TOPICS: Business/Economy; Foreign Affairs; Germany; News/Current Events

KEYWORDS: bank; deutsche; deutschebank; dsj02

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-52 next last

To: LesbianThespianGymnasticMidget; COUNTrecount; Nowhere Man; FightThePower!; C. Edmund Wright; ...

At no point in history has any government ever wanted its people to be defenseless for any good reason ~ nully's son

The biggest killer of mankind

Nut-job Conspiracy Theory Ping!

To get onto The Nut-job Conspiracy Theory Ping List you must threaten to report me to the Mods if I don't add you to the list...

21

posted on

11/05/2019 9:24:37 AM PST

by

null and void

(Convicted spies are shot, traitors are hanged, saboteurs are subject to summary execution...)

To: Paladin2

22

posted on

11/05/2019 9:31:58 AM PST

by

Karoo

To: null and void

23

posted on

11/05/2019 9:42:48 AM PST

by

Nifster

(I see puppy dogs in the clouds)

To: DoodleDawg

High risk investments coming back to bite them. Just the opposite. To make their capital requirements they have to hold so much cash and so many zero or negative yielding government bonds that they'll never make any money.

When the Eurozone goes into recession, I think they're doomed.

To: LesbianThespianGymnasticMidget

For Germany, Deutsche Bank is Goldman Sachs, Lehman Brothers, Merrill Lynch and Morgan Stanley rolled into one. It is too big to fail.

25

posted on

11/05/2019 10:22:38 AM PST

by

Zhang Fei

(My dad had a Delta 88. That was a car. It was like driving your living room.)

To: LesbianThespianGymnasticMidget

For all those thinking Deutsche Bank’s demise won’t affect things in the United States...keep in mind that DB is the counter-party to more derivative contracts than any other bank in the world. While exposures vary, all the major banks in the US have substantial counter party risk if Deutsche Bank goes under.

26

posted on

11/05/2019 10:30:49 AM PST

by

mac_truck

(aide toi et dieu t'aidera)

To: Captain Peter Blood

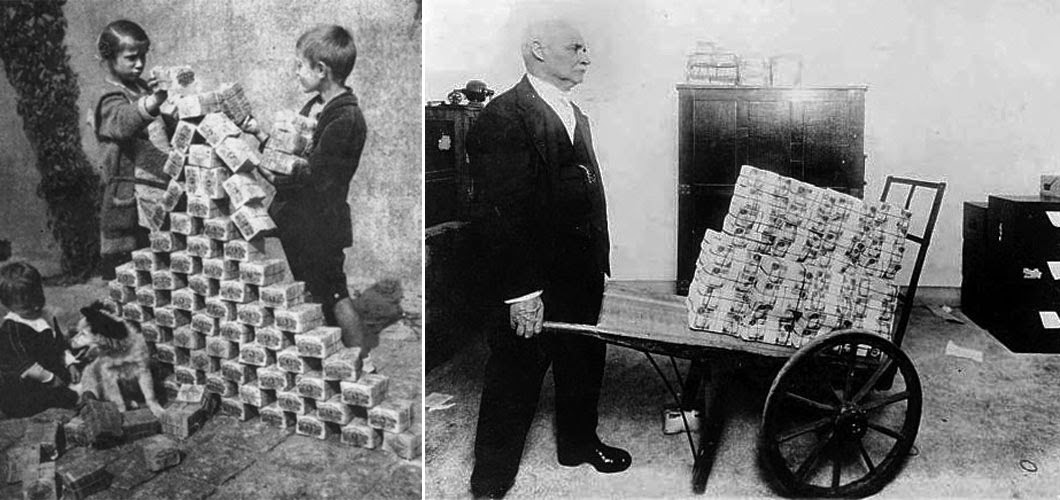

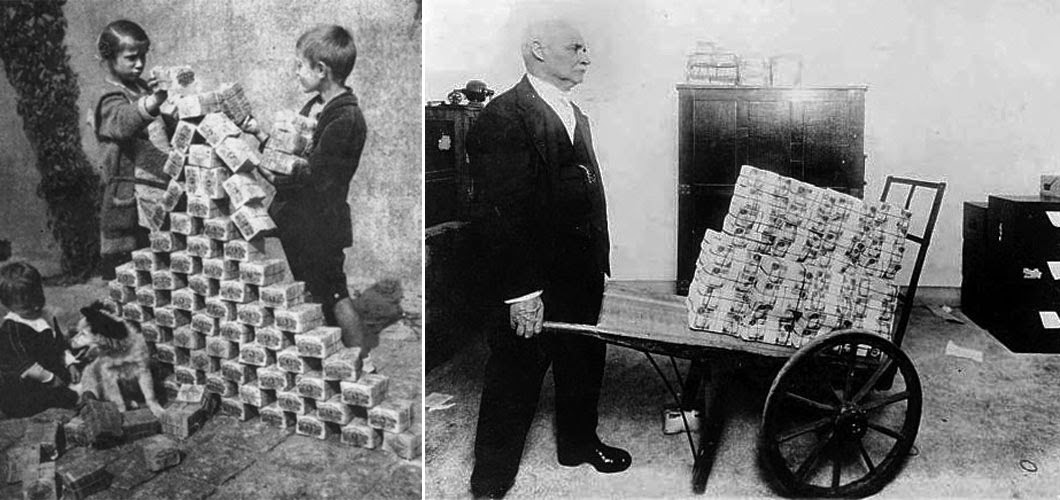

Germans been here before. I hope they do not start another war....

27

posted on

11/05/2019 11:09:07 AM PST

by

minnesota_bound

(homeless guy. He just has more money....)

To: minnesota_bound

It won’t be the native Germans that will start & fit it. They’ll either have their heads down or be in detention camps. Their new Middles Eastern immigrant refugee pals will be the ones who sill start something.

28

posted on

11/05/2019 11:12:15 AM PST

by

Reily

To: LesbianThespianGymnasticMidget

29

posted on

11/05/2019 12:04:22 PM PST

by

sergeantdave

(Teach a man to fish and he'll steal your gear and sell it)

To: LesbianThespianGymnasticMidget

The European banks were more indebted than the American banks when they were bailed out by TARP in 08. In addition to toxic real estate debts (it was as inflated in most of Europe as in the US), they also had a whole lot of toxic sovereign debt.....just think about all those loans to the PIIGS which will never be paid back - not to mention Italy, France, Belgium, etc.

What they did is simply not recognize the losses. They kept lots of assets on the books that were worthless or nearly so at their book values hoping to slowly bleed the losses out over time. That was always likely to fail. There would come a reckoning for some of them and they’d have to admit to the true scale of their losses. If Deutsche Bank goes down it will be a huge kick in the balls for the entire German and EU economies.

Brexit can’t happen soon enough.

30

posted on

11/05/2019 12:18:27 PM PST

by

FLT-bird

To: null and void; Roman_War_Criminal; metmom; Syncro; Karliner

[ Germany is the glue that is holding the EU together, and so if the bank that is right at the heart of Germany’s financial system collapses, the dominoes will likely start falling very rapidly. ]

Germany, eh? They could call their new Global Currency "the Mark" or something like that. Seems like I've read something to that effect, somewhere.

31

posted on

11/05/2019 12:30:43 PM PST

by

SaveFerris

(Luke 17:28 ... as it was in the days of Lot; they did eat, they drank, they bought, they sold ......)

To: All

I believe the European Union will be the basis for the Fourth Beast - IMHO (significant gov’t - a world gov’t)

Daniel 7:7-8 King James Version (KJV)

7 After this I saw in the night visions, and behold a fourth beast, dreadful and terrible, and strong exceedingly; and it had great iron teeth: it devoured and brake in pieces, and stamped the residue with the feet of it: and it was diverse from all the beasts that were before it; and it had ten horns.

8 I considered the horns, and, behold, there came up among them another little horn, before whom there were three of the first horns plucked up by the roots: and, behold, in this horn were eyes like the eyes of man, and a mouth speaking great things.

Daniel 7:23 King James Version (KJV)

23 Thus he said, The fourth beast shall be the fourth kingdom upon earth, which shall be diverse from all kingdoms, and shall devour the whole earth, and shall tread it down, and break it in pieces.

32

posted on

11/05/2019 12:32:21 PM PST

by

SaveFerris

(Luke 17:28 ... as it was in the days of Lot; they did eat, they drank, they bought, they sold ......)

To: dfwgator

33

posted on

11/05/2019 12:37:43 PM PST

by

AAABEST

(NY/DC/LA media/political industrial complex DELENDA EST)

To: Karoo; Gamecock; Larry Lucido; SkyPilot; Roman_War_Criminal; null and void; dfwgator

[Nov 15th?]

I'll go with 11/11.

For different reasons.

Altogether!

(actually just a little repeatedly-occurring confirmation bias - having categorized it as such, I can't seriously say that means anything - so we'll put it in the ho-hum file, LOL)

(but since you mentioned November 15th.....)

34

posted on

11/05/2019 12:39:02 PM PST

by

SaveFerris

(Luke 17:28 ... as it was in the days of Lot; they did eat, they drank, they bought, they sold ......)

To: deadrock; LesbianThespianGymnasticMidget

[Sadly, most Americans can’t even spell......

All part of the plan.]

Well, that certainly explains rap and publik skools.

35

posted on

11/05/2019 12:41:42 PM PST

by

SaveFerris

(Luke 17:28 ... as it was in the days of Lot; they did eat, they drank, they bought, they sold ......)

To: minnesota_bound

Thanks for posting - keeping a copy to that pic link

36

posted on

11/05/2019 12:53:31 PM PST

by

SaveFerris

(Luke 17:28 ... as it was in the days of Lot; they did eat, they drank, they bought, they sold ......)

To: LesbianThespianGymnasticMidget

Uh-oh. Better bail them out, so that they can use the new cash to buy even more derivatives and put themselves in the hole even further. #MoralHazard

37

posted on

11/05/2019 1:29:22 PM PST

by

Tolerance Sucks Rocks

(Show me the people who own the land, the guns and the money, and I'll show you the people in charge.)

To: pepsi_junkie

A derivative is simply a bet on how an economic indicator or some other event will go. If the event goes your way, you win. On the other hand, such as in an economic recession, a war or some other institution’s collapse, if a bunch of your bets go the other way, you lose, your lenders lose, and the trickle-down effect can, on a large enough scale of bets, cause the collapse of an entire economy.

Current exposure to derivatives across the world, last time I read, was as high as 1.4 quadrillion dollars.

38

posted on

11/05/2019 1:32:29 PM PST

by

Tolerance Sucks Rocks

(Show me the people who own the land, the guns and the money, and I'll show you the people in charge.)

To: mac_truck

So our banks are using Deutsche Bank assets as hedges to potentially bad derivatives. Do I have that right?

39

posted on

11/05/2019 1:33:50 PM PST

by

Tolerance Sucks Rocks

(Show me the people who own the land, the guns and the money, and I'll show you the people in charge.)

To: Tolerance Sucks Rocks

So our banks are using Deutsche Bank assets as hedges to potentially bad derivatives. Not exactly...the Deutsche Bank $48 trillion dollar derivative portfolio is a large un-exploded bomb left over from the last financial crisis.

American banks are in much better shape than they were in 2007-2008, and Dodd/Frank has worked to some extent to make things more stable...but the Europeans papered over their financial problems and its unknown what systemic reaction would occur if Deutsche Bank were to fail.

This chart is a little dated (2016) but gives some idea whats going on.

40

posted on

11/05/2019 2:28:21 PM PST

by

mac_truck

(aide toi et dieu t'aidera)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-52 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson