Posted on 08/16/2019 8:39:42 AM PDT by SeekAndFind

Loosely defined, a macro tourist is somebody who knows little to nothing about the global economy, economic data, or the direction of that data. But they run from headline to headline to explain the latest development—kind of like a tourist to France who, seeing the Eifel Tower, thinks he has seen “France,” and knows everything there is to know about “France.”

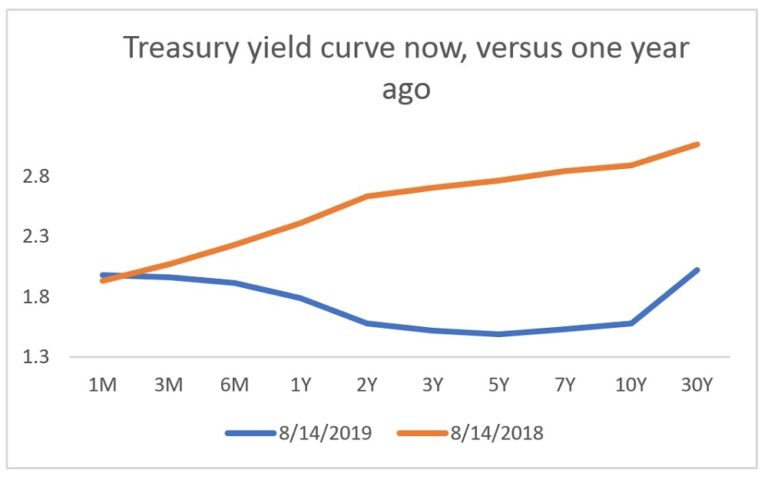

To say the macro tourists were out in full force on August 14 would be an understatement. For the first time since 2006-07, before the financial crisis, the yield (annual return) an investor gets for buying a 10-year Treasury was less than the yield an investor gets for buying a two-year Treasury. In finance-speak, the “yield curve” was inverted.

The “yield curve” (see chart) simply means the U.S. government’s cost of borrowing at different lengths of debt maturity. In normal times, just like you or I, it costs more for the government to borrow at longer maturities. The 10-year government bond thus “yields” a higher rate to an investor than the two-year government bond.

But when global growth is slowing, longer-term Treasury yields fall. This is because investors are seeking the relative safety of Treasurys—they buy more, bidding up the price, which means the government’s cost of borrowing goes lower. It’s also because slower future growth, where investment opportunities will yield less, means an investor is willing to accept a lower return for holding the Treasury.

Because of what an inverted yield curve says about future growth, and because banks are less willing to lend when the yield curve is inverted (banks make money borrowing at short maturities and lending at longer maturities), it is an ominous signal.

The S&P 500 Index fell by nearly 3 percent, and #TrumpRecession trended on Twitter, a website filled with idiocy. Everyone from California Democrat Ted Lieu to Ben Shapiro to the small but highly visible in the corporate media crowd of Never-Trumpers became experts.

Generally, these pundits have no idea what they are talking about. Another measure of the yield curve, the three month-10 year Treasury spread—which is more predictive than the two year-10 year Treasury spread—has been negative for months. You didn’t see a bunch of punditry about that when it first went negative in March.

That’s because everyone is being political. The left wants a recession because they hate President Trump, and they are economically illiterate to boot. Hillary Clinton once said the Bush tax cuts caused the 2008 financial crisis, which is ridiculous. And today’s Democrat policies would make any recession we did have far worse, via the government increasing taxes and further cannibalizing the private sector.

Yet there are elements of the establishment GOP, including Never-Trumpers, who hate Trump almost as much as the left does. They are dying to say “I told you so” to Trump voters in Middle America. In their estimation, tax cuts and a steady hand are a magic growth elixir, and if taxes are cut a recession is nearly impossible, unless you have a stupid “populist” president intent on starting trade wars with our “trading partners.”

The financial media, too, has been acting like the entire economy and stock market is being driven by the trade war with China. This goes beyond needing a new headline every half hour to border on dishonesty. For example, the media has repeatedly blamed the trade war for low soybean prices, even though prices have been low since 2014, and even though there is a big non-trade explanation for China demanding less soybeans.

It should come as no surprise that the Never Trumpers, the left, and the corporate media are completely wrong. People are so fixated on trade in order to politically harm the president that they are missing, or even lying about, the bigger picture.

The global economy isn’t healthy, and everything isn’t hunky dory. But the trade issue is the icing on the cake, not the main story.

America is still the cleanest dirty shirt out there. We aren’t causing the yield curve inversion. The U.S. economy has actually been outperforming most of the rest of the world, and the 25 percent tariff the White House placed on $250 billion of annual Chinese imports hasn’t shown up significantly in consumer prices, even though the establishment promised it would.

In fact, they said that the United States would fare worse than China in a trade war. So far, they’ve been completely wrong.

Yes, the new proposed tariff of 10 percent on the remaining $300 billion of Chinese imports is trickier, as this basket of goods is more consumer oriented—which explains the White House’s reluctance to go full bore on tariffs on the entire $300 billion basket.

But generally, the U.S. economy is not under strain from the trade war. Compared to the rest of the world, the United States is relatively isolated from global trade. Trade makes up only about 10 percent of our gross domestic product, and our trade deficit actually reduces our overall GDP, while trade makes up more than 40 percent of Germany’s GDP.

We’re so big, and so self-sufficient, that we mostly trade with ourselves. So despite the constant headlines blaming every market drop on Trump’s (legitimate) trade spat with China, trade doesn’t really explain what’s going on.

To save its rapidly slowing economy, China engaged in a massive stimulus effort in 2015-16, possibly the biggest ever measured in terms of money spent and credit created. That stimulus flowed through the global economy, especially Europe, and created a “synchronized global upswing” that lasted until 2018.

By early 2018, however, that stimulus had exhausted itself, and the world—with the exception of America—began to slow. This slowdown lasted until now, and doesn’t look to be over.

Even the stock market drop on Wednesday should be seen in this light. The stock market didn’t drop Wednesday because of curve inversion, it dropped because economic data out of Europe and China overnight was absolutely terrible—which is also what caused longer maturity Treasury yields to drop even further, which is what caused the curve inversion.

Germany’s economy just contracted in the second quarter, and has flatlined for about a year now, and Chinese industrial output growth dropped to a 17-year low. All this is occurring while there is no trade war between the United States and Germany, or between Germany and China. In fact, China cut tariffs on German imports to soften the blow of the American trade dispute. Yet Germany’s economy is going to the tank.

Things are so bad that Europe and China can’t grow without government stimulus, and even that avenue has likely hit a dead end.

China is already sitting on a mountain of debt, the byproduct of previous government stimulus efforts. Its corporate debt load is the highest in the world, relative to GDP, and an astonishing percentage of Chinese firms are now taking out loans just to pay interest on the debt they have already incurred.

Chinese household leverage has rapidly ballooned as well. Already since May, three smaller Chinese banks have failed. There will probably be more, bigger failures to come. And China can’t stimulate, at least not like last time, because that would put its currency under immense pressure, and there is a chance China is already short on dollars, which it needs to prop up its currency to buy oil and food from overseas.

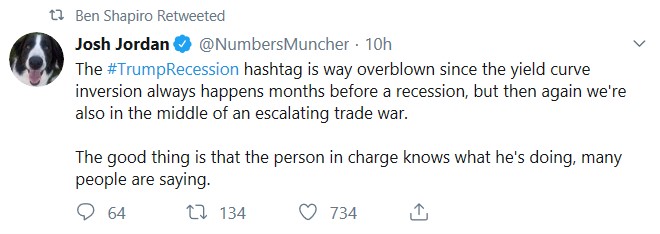

In Europe, the banking system is in shambles, hurt by the negative deposit rates engineered by central planners at the European Central Bank (ECB), also a bygone stimulus effort gone awry. And euro-area financial stocks have been sliding ever since early 2018 (when China’s stimulus ran out). To add insult to injury, Europe’s population growth is ultra-low, unless it imports migrants, and the euro gives Germany an unfair export advantage, even while it handicaps southern Europe’s beleaguered economies.

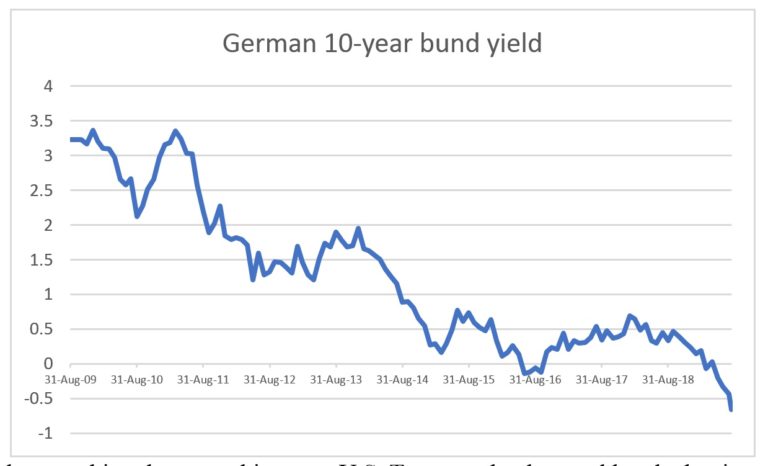

As a result of this slow European and global growth, German bund yields have been sliding deep into negative territory. Even though Germany’s 10-year bund yields about -0.66 percent, and the U.S. 10-year Treasury yields about 1.58 percent, when a German investor hedges his dollar exposure he ends up making the same thing on a U.S. Treasury that he would make buying the negative-yielding German bund (the explanation of this is beyond the scope of this article). In other words, all this stuff is moving together.

What happens next really revolves around the credit cycle. The credit cycle means that when debt is being created, you get rising demand, rising production, and thus rising economic growth. But once you have too much debt, when firms and consumers are overextended, you get deflation—people and firms spend less as they pay off what they owe, and some even go bankrupt.

If the trade war is a ten, the credit cycle is a hundred. In a normal capitalist system, credit cycles are the natural course of things. The problem is that the Federal Reserve, and central banks globally, have exacerbated the credit cycle, creating a huge debt bubble. In an attempt to fix a Great Recession caused by too much debt, quantitative easing (QE) created even more debt to fix it. That doesn’t make sense.

As a result, there was no deleveraging after the recent global financial crisis. Today, global debt stands at a whopping $250 trillion, almost 220 percent of global GDP, a record. Since QE began, $10 trillion alone in offshore (non-U.S.) dollar-denominated debt has been created.

Debt is helpful when kept in check, but in excess it breeds economic instability. Central banks can keep it going, but that breeds low growth and less dynamism. Sound familiar?

Thankfully, in America after the Great Recession, our consumers are less levered, but the leverage is now in U.S. corporations. And debt is even worse in China, which has so far been—and will likely be—the epicenter of any global slowdown.

There are Never Trumpers and DC establishment types who will blame anything bad that happens on tariffs, and thus Trump. They are doing this out of political reasons, not because they actually understand things more than you do.

But it is interesting that in the last decade, while central banks created this mess, you didn’t hear a peep from the elites or most of the folks who now make up “Never Trump.” You also didn’t hear a peep from this crowd over the last three decades, while China was allowed to grow into the monstrosity that it is today. Trade is good, but getting screwed over by China for 20 years is not. This isn’t rocket science.

It is quite possible that much of our political and media “elite” really isn’t that elite. Maybe they’re just a bunch of self-serving macro tourists.

Because, some times negative indicators are nothing more than relentless economic sabotage by people who want to remove Trump by any means necessary

Excellent, well written and easy to gasp even for n economic novice.

The Red-Eye radio guys (gary & eric) do this. They claim they’re conservatives but never miss an opportunity to blame things on Trump.

Agreed!

Bookmark

That was a pretty good read.

Nails It – Economic Analyst El-Erian: The Era of “De-Globalization” is Here!

The Conservative Treehouse ^ | 08/16/2019 | Sundance

Posted on 8/16/2019, 10:58:42 AM by SeekAndFind

Finally, an economic analyst gets prime-time media pundits to listen as he describes the fundamental difference between the U.S. “Economy” (Main Street) and the U.S. “Markets” (Wall Street). Charles Payne understands most of this, but El-Erian has it nailed.

Allianz Group chief economic advisor, Mohamed El-Erian, accurately describes what is happening in an era where deglobalization is taking place. The U.S. economy is strong; however, the multinationals on Wall Street -invested overseas- are exposed. Thus there’s a disconnect and accompanying market volatility.

There is nothing that China and the EU can do to stop the de-globalization process; and efforts to stimulate their economy, more quantitative easing (pumping money) while the global supply chains are being shifted, are futile.

The more a nations’ economy is dependent on exports, the more exposure they have to the inherent downsides of de-globalization. U.S. companies that are invested in these nations will lose their investment over time; some rapidly. This will keep the stock market volatile, yet the Main Street USA economy is thriving.

President Donald Trump has purposefully stalled the process of globalization, and is resetting global supply chains. This is bringing massive amounts of wealth back into the United States.

In essence Titan Trump is engaged in a process of: (a) repatriating wealth (trade policy); (b) blocking exfiltration (main street policy); (c) creating new and modern economic alliances based on reciprocity (bilateral deals); and (d) dismantling the post WWII Marshall plan of global trade and one-way tariffs (de-globalization).

http://freerepublic.com/focus/f-news/3772287/posts

There are indeed many more things than trade wars holding back economic growth, such as: environmental extremism; a rotten educational system: immigrants who are unproductive due to lack of skills and ability to speak good English; a legal system that plunders productive people and investments; continued tax discrimination against savings and investment; restrictive land use controls; and job-destroying minimum wage laws. Trump needs to be talking about these drags on growth, rather than blaming it all on the Fed and the Chinese.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.