The problem is not a single .25% rate increase, but a series of .25% increases at the same time the Fed is offloading its balance sheet.

when it was growing its balance sheet liquidity was added to the financial system. Stocks went up. Now with the offloading, the Fed is in uncharted territory and increasing rates at the same time. The combination is the problem.

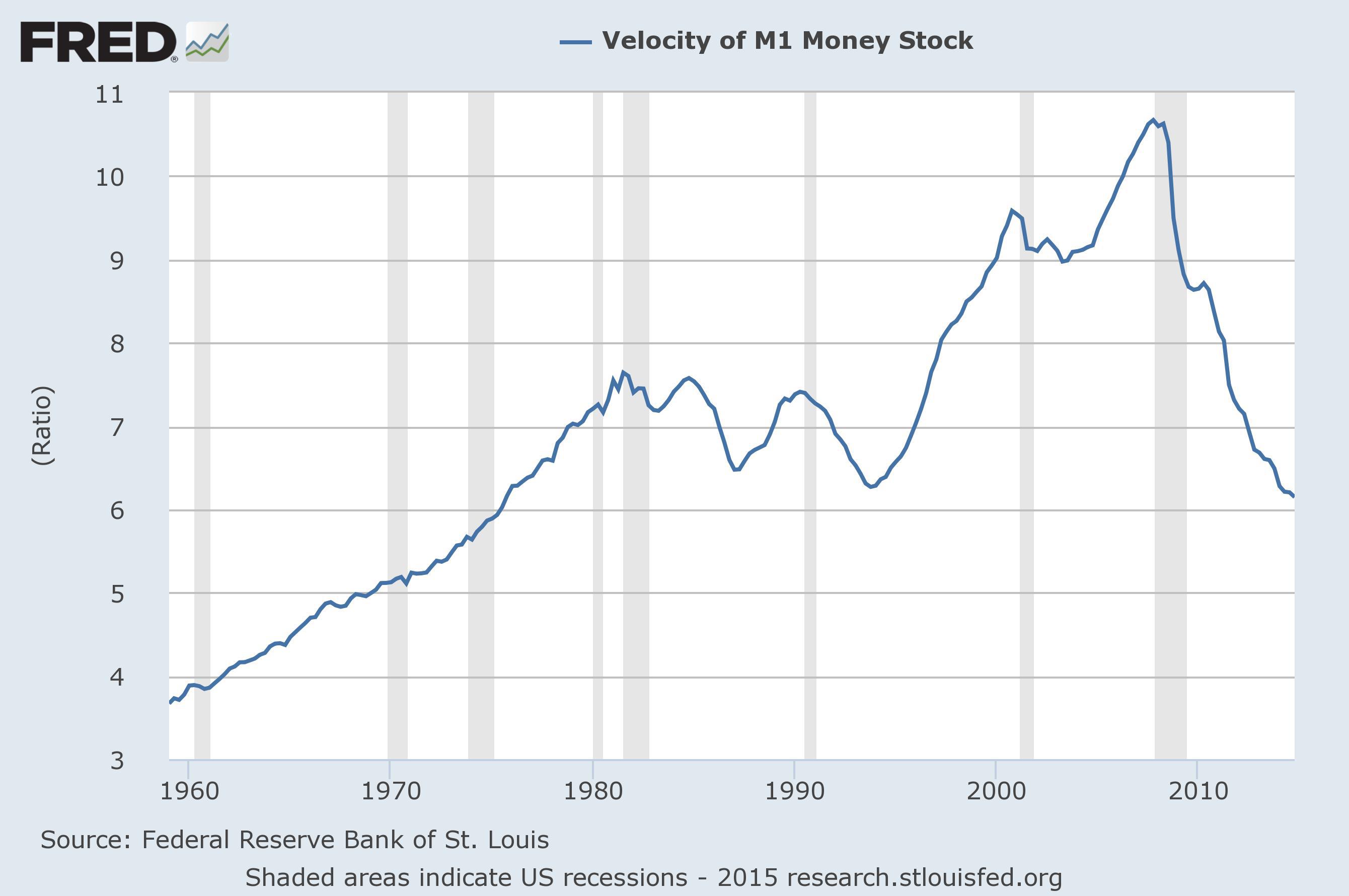

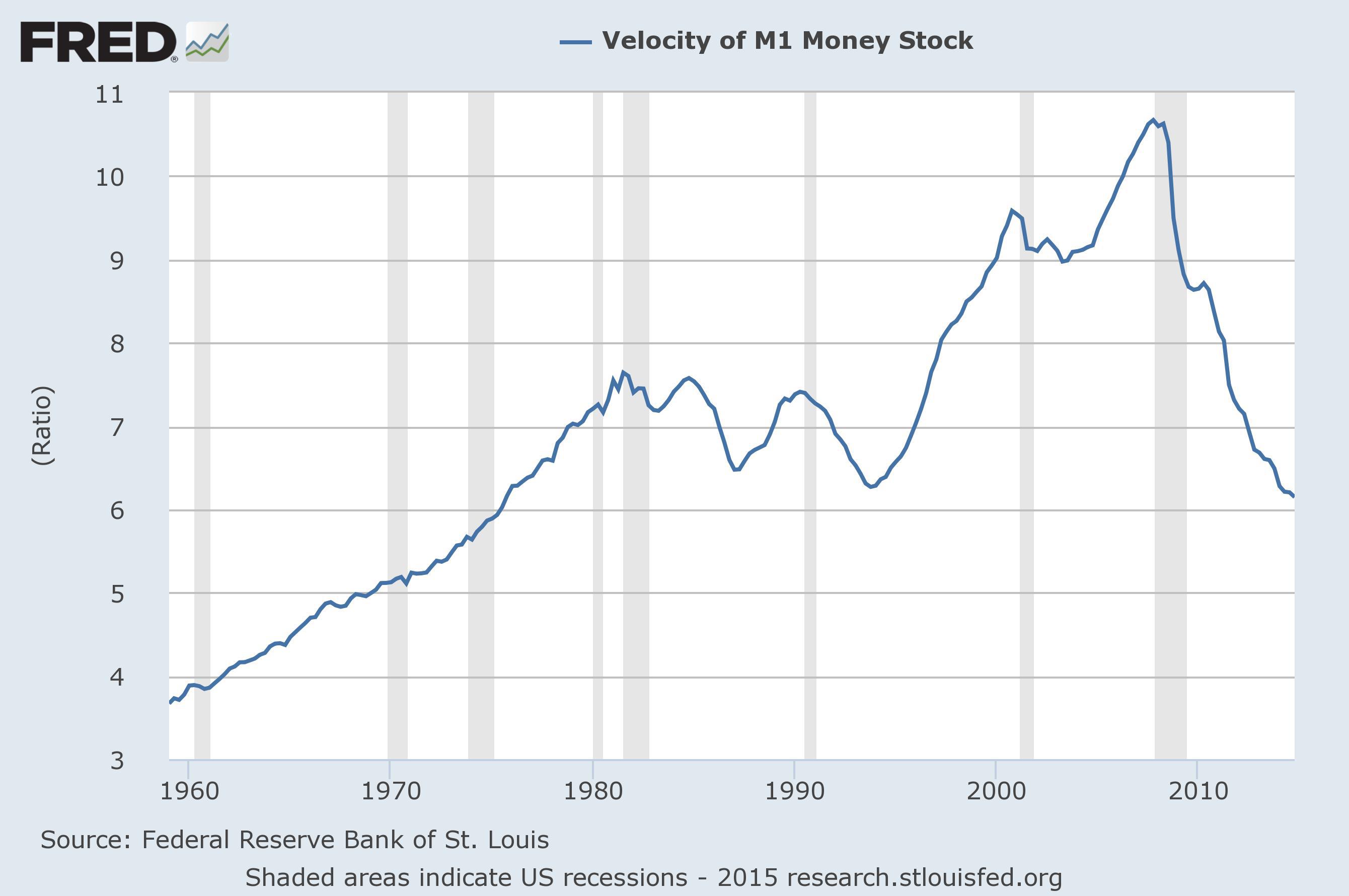

This is what the FED was looking at when they established the policy of winding down the QE process starting in 2016:

I'm no economist, but that looks like a classic "liquidity trap" to me ... where growing liquidity had the opposite of its intended effect. Basically, reducing interest rates to near 0% actually resulted in investors sitting in cash and earning nothing on the money.