Skip to comments.

Dow falls 500 points, dragged down by Apple

CNN Business ^

| 11/19/2018

| By Paul R. La Monica, CNN Business

Posted on 11/19/2018 11:21:14 AM PST by Red Badger

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-120 last

To: Regulator

Actually I think it’s far worse then that.

As long as Ichabod Geek is in charge of Apple, they’re living on borrowed time. The sales momentum they have is from the last push that Jobs made, and they have only Jony Ive to come up with anything beyond tweaks to their existing products.

Which means they’re IBM on the way down the slide. On the day Steve Jobs died, before anyone knew he was going to die, AAPL was trading at a split adjusted $50.53. All of the gains since then are attributable to that "Ichabod Geek" management style and Jony Ive’s designs. That’s a 461% growth over Steve Jobs level. . .

IBM is still # 34 on the Fortune 500 list. . . Just below Comcast and ahead of Dell.

101

posted on

11/20/2018 6:23:51 PM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: ProtectOurFreedom

Thanks. This thread reminded me of that and I was just looking at the Apple site for the battery replacement program. Start here:

Apple Support

Click on "Battery & Charging" then “Battery Replacement.”

102

posted on

11/20/2018 6:34:54 PM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: EVO X

If Apple is go to grow their iPhone sales, they have to take market share from someone else. By now everyone is locked into their phone ecosystem. It will take a major screw up to jump ship. I recently upgraded to an iPhone XS from a 5S. I didn’t even look at the Android phones.

Nearly 1 in 5 (US) Android Users Plan to Get a 2018 iPhone

Half of existing iPhone users also want to upgrade

Aug 30, 2018 06:46 GMT — By Bogdan Popa The 2018 iPhone generation is projected to be the most successful since the iPhone 6, according to analyst estimates, and now a new survey shows that a significant part of the existing Apple userbase is indeed planning to upgrade.

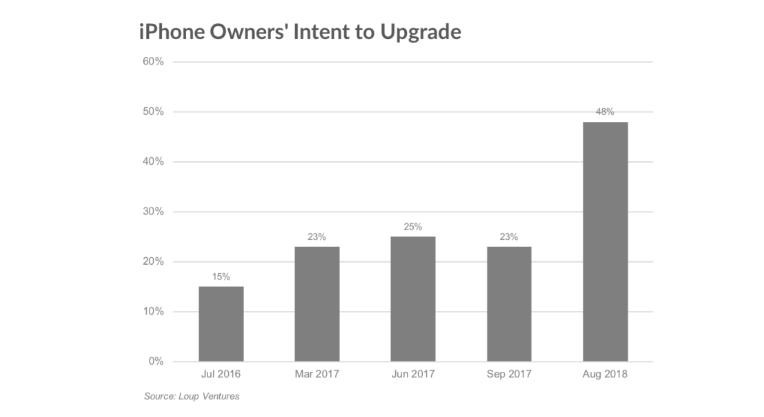

While it’s too early to tell whether a super-cycle is indeed possible or not, a survey conducted by Loup Ventures reveals that out of 540 US consumers surveyed, 48 percent said they indeed plan to get a new iPhone this year.

This is up from 25 percent a year ago, so the prospects of three new iPhones, out of which one could be more affordable, could convince more customers to upgrade.

However, the analyst firm warns that this is just an estimate and the actual number of customers upgrading may vary, as several factors are involved in making a decision, like the price of the new iPhones.

“This 48% is an outlier, and therefore should be tempered (intent to buy vs. actual purchase conversion varies cycle to cycle), but the survey is nonetheless a positive indicator of upcoming iPhone demand,” the firm says.

More Android switchers

Also interesting is that the number of Android customers who are planning to upgrade to new iPhones has improved from 12 percent a year ago to 19 percent. This means Apple could eat up from Android’s market share across the world, especially if a cheaper iPhone version is indeed released.

“There is greater interest in this upcoming iPhone cycle than we had anticipated,” the survey notes. “iPhone is entering a period of stability (0% to 5% unit growth for the next several years) driven by 805m+ active iPhones with a high (90%) retention rate.”

Apple’s new iPhone unveiling is projected to take place next month, and people familiar with the matter said September 12 is very likely to witness the debut of all three devices. Sales, however, are anticipated to begin in September only for the two OLED versions, while the more affordable LCD model could hit the market in October or early November.

103

posted on

11/20/2018 6:55:04 PM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: SunkenCiv

Obviously I was talking about how small the Apple dividend is in relation to the share price, and it is tiny -- though it's getting larger as a percentage due to the fall in the share price. And regarding the MacBooks, I wasn't referring to MacBook Airs as a separate line. And BTW, it wasn't my intent to nettle you. Didn’t think you did, nor did I mean to come across as nettled, just not feeling well breathing Pardise in with every breath I take here in Sacramento. . . The entire town is moving here in the smoke. Hack, hack, hack. It makes one quite irritable. Sorry ‘bout that.

104

posted on

11/20/2018 7:02:16 PM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: Swordmaker

105

posted on

11/20/2018 7:15:39 PM PST

by

SunkenCiv

(and btw -- https://www.gofundme.com/for-rotator-cuff-repair-surgery)

To: dfwgator; Regulator

Apple is now in a mature market, the days of high growth are over. Your facts are a bit lacking on that end. . .

106

posted on

11/20/2018 7:31:04 PM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: SunkenCiv

How close is the fire? We’re safe from the fire as it’s sixty to eighty miles from here, but the smoke is really bad from there to here to Stockton 50 miles south of us (my major client there had to leave town due to not being able to breathe), all the way to San Francisco, 75 miles from here. Air quality is listed as dangerous. . . and we are breathing the remains of 11,000 buildings, more than 70 dead and cremated people countless animals, burned poison oak, and who knows how much toxic substances. Visibility has been quite limited.

107

posted on

11/20/2018 7:47:40 PM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: Swordmaker

I should have checked the FB of an old friend from here, seems like he mentioned living near the big fire from last year, don't remember where that was. He travels a lot.

108

posted on

11/20/2018 8:09:28 PM PST

by

SunkenCiv

(and btw -- https://www.gofundme.com/for-rotator-cuff-repair-surgery)

To: Swordmaker

To: MountainWalker

Within a few years, new iPhone announcement day will be met with as nearly as little fanfare as new Surface tablet announcements.

https://www.gsmarena.com/apple_dialing_down_on_iphone_production_struggles_to_forecast_sales-news-34290.php SHEESH! How many times do I have to say this? This SAME SOURCE was posting an almost identical article one year ago almost to the day, including the "one-third cut of all iPhone models" claim. . . and every iPhone that is going to be sold in the next month for the Christmas Season was already manufactured in September and October and is already in the pipeline. The one-third cut is the expected reduction number for the next quarter when sales drop by one-third over the previous quarter. These reduced order numbers are reported EVERY YEAR AT THIS TIME! The ignorati in the press take them as somehow being unusual that Apple will sell fewer iPhones in the first calendar quarter of the year which has no important holidays, than they will in the fourth calendar quarter which includes Christmas. They are idiots who can’t grasp the difference between the two quarters. . . and so are those who repost their drivel.

Such negative articles about Apple get them lots of clicks. . . Despite the fact they have no real truth in them.

110

posted on

11/21/2018 1:11:46 AM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: Swordmaker

Thanks for all your cheerleading. Having been in a Mac startup back in the Dark Ages, and being surrounded as I am by Apple employees here in my coastal neighborhood, I get this crap all the time. So I understand your zeal...pays for a lot of home remodels around here. And people buying German cars they shouldn’t.

But all the nice bar charts and other paraphernalia won’t bring back Joe Cool. And I don’t mean John Draper...

So you just keep groovin’ on CAGR trends and stock splits. But to me, they’ve crested the pass and....they’re on the backside. Cuz as the banal studio dweeb once crooned, we haven’t had that feelin’ here since ‘69.

Jobs was not creative. We all know that. He was a poacher: ask Adele Goldberg. Or Paul McCartney...

But he was hip and knew how to throw a bunch of things together that fit the dominant rap. And most importantly, he understood technology for the rest of us: we all wanted to go to the moon, but we knew we weren’t gonna get a Saturn V in our driveway. So a Mac would do...

And that ain’t the Leftard SJW Berkeley B-school guys at that place now.

They have years before they become just another TaTa/Infosys job shop doing systems integration contracts for some banking conglomerate. But as Big Bad Bezos said, the Reaper comes for all.

So have fun man, and be seein’ you.

To: Swordmaker

So please tell us how is AAPL’s P/E at all extraordinarily unusual? How does it represent something indicative of growth? How does it represent anything indicative of maturity? You are a never ending source of entertainment. The thread is based on an one of the numerous articles recently about the indisputable fact that Apple's massive drop in market value has managed to drag down all three major indices. But instead of blaming Apple like most here, I questioned the value of all of the tech leaders. The quote you chose from my post clearly demonstrates this, “This may have been reasonable when Google, Apple, Amazon and others were in their growth stage, but these companies have become massive and are all fully mature or nearly so.”

When I singled out Apple, it was a quote that gave them credit for dragging the indices upward before their recent unfortunate drop in value, ““Apple makes up about 4% of the S&P 500, which is weighted by market value, and roughly 5% of the price-weighted Dow Jones Industrial Average. It accounted for nearly 13% of the S&P 500’s total return for the year through September, according to S&P Dow Jones Indices, trailing only Amazon.“

I even said in post 88, “Apple's P/E ratio peaked at the end of September; with the ongoing correction in values it has dropped by around 30%. So it is not that far out of line with their historical norms as long as their sales continue to grow, but if it looks like their sales have peaked... then the price of their stock could easily drop to values that matched their typical P/E ratios in 2011 to 2016.

I have been on my very best behavior in this thread. But even when the truth about a situation is plain as day you seem to have difficulty with Apple even being grouped with other companies in the tech sector. But I get it... to you Apple is God and no observation other than full on praise to your God can be uttered by the minions.

Apple reached a trillion dollar market cap back in August, the first company in the tech sector to do so. If that isn't a sign of “maturity” I do not know what is. Amazon, Microsoft, Google and Apple have all reached massive market capitalization. They have all become huge, fully mature companies. It is unreasonable to assume that these companies will continue to grow at the same rates that they have in the past. So in that respect it is very reasonable to assume that Apple's valuation in the future will likely fall in line with the more conservative P/E ratios they were valued at between 2011 to 2016. If that were the case then Apple's recent decline could have further to go before finally bottoming out...

I am obviously not a financial expert or an expert on Apple products. My observations are all simple and unsophisticated. I have had fun sparring and irritating the master over the years, much of what I know about Apple I have learned from you. I am not sure that I have benefited you in any way, but that is what we are here for.

To: Regulator; fireman15

Thanks for all your cheerleading. Having been in a Mac startup back in the Dark Ages, and being surrounded as I am by Apple employees here in my coastal neighborhood, I get this crap all the time. So I understand your zeal...pays for a lot of home remodels around here. And people buying German cars they shouldn’t. Not cheerleading, just factual correction of misrepresentations.

Your reply says more about YOU than it does about Apple or Steve Jobs. You just drip holier-than-thou envy, Regulator, that just denies facts. Charts and CAGR trends are about presenting those facts in easily understood ways. . .

But you prefer your false to fact myths such as Steve Jobs and Apple stole its name from the Beatles and the claim that somehow a company making and selling computers was competing with a record label and infringing its trademark. . . An impossibility when the two businesses are in completely different industries. If you had seen Apple’s original company logo, there’d be no question it had no relation to the Beatles. It was a faux woodcut of Isaac Newton sitting beneath an APPLE TREE.

Another falsehood you apparently prefer is the myth that Steve Jobs stole the Mac GUI from Xerox which actually bears little in common with from Xerox’s OS and their GUI and Smalltalk when the historic facts do not support that myth at all as Steve and Apple PAID Xerox and the Palo Alto Research Center for the privilege of visiting PARC for two eight hour sessions, one visit with just Jobs and Jef Raskin and another with Jobs, Raskin, and a select team of developers, allowing the visitors to use anything they learned on their visits.

Apple’s contract with Xerox paid with one million shares of pre-IPO Apple Common Stock valued at over $6 million for that access and the information they learned including the rights to use it. After the 1980 when Apple stock started trading on the NASDAQ, Xerox sold that stock for a $10 million profit. Had Xerox had the foresight to keep those million shares until today they’d be worth around $10 billion, 140% of Xerox’s current market cap of about $6 billion. The rules of the PARC visit were that the Apple engineers could look, ask questions, but take no notes. . . and use anything they learned.

Apple was already working on their own GUI under team leader Jef Raskin, who had written his doctoral thesis in 1967 on WYSIWYG and GUI interfaces, and who was the one who suggested to Jobs that his Apple team should visit PARC for inspiration. PARC itself used many of Raskin’s ideas.

Side by side comparison of Apple’s AppleTalk and the Mac GUI with Xerox’s Smalltalk and the Xerox Star GUI show major design differences as well as some similarities. Apple has live icons, drag and drop, drop down and nested sub-menus, a much more metaphorical user interface, and an "infinitely reachable" screen menu, all of which are missing from the Xerox Star GUI.

Apple hired many of the researchers from PARC. . . with Xerox’s blessings.

More than a decade after the PARC visit and the success of the Macintosh computer, when Apple was suing Microsoft for stealing Apple’s GUI to make its first iterations of Windows, a new Xerox CEO unaware of the history initiated an infringement suit against Apple based on this myth. Xerox’s suit was tossed out when Apple produced the original contract with Xerox showing the agreements about the PARC visits, showing the stock transfers, and the permissions to use anything Apple learned. The judge in the case sanctioned the Xerox attorneys for bringing a frivolous, unfounded case.

But as Big Bad Bezos said, the Reaper comes for all.

That may be the only factual thing you’ve said. Would it would come quicker for Bezos.

113

posted on

11/21/2018 11:04:30 AM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: Swordmaker

Uh huh.

Good to see you peddling the company line. Lotsa folks make sure to do that, good for job security.

Pretty humorous to me.

Listen, like I said, be seein’ you.

To: fireman15; Regulator

You are a never ending source of entertainment. The thread is based on an one of the numerous articles recently about the indisputable fact that Apple's massive drop in market value has managed to drag down all three major indices. But instead of blaming Apple like most here, I questioned the value of all of the tech leaders. The quote you chose from my post clearly demonstrates this, “This may have been reasonable when Google, Apple, Amazon and others were in their growth stage, but these companies have become massive and are all fully mature or nearly so.” Nice try at denigrating me with the left-handed ads hominem.

I don’t care how many articles have been published in the echo chamber since they are ALL based on the same single Asian unnamed "knowledgeable" source familiar with the products, first cited on the Nikkei Exchange Report, which has a history of publishing bogus "news," that has produced the same bogus claim of reduced iPhone orders for the THIRD CONSECUTIVE YEAR in mid-November claiming weak current iPhone sales as the reason for these "reduced" orders over the number ordered for the current quarter. The facts later come out that these are NOT reduced orders based on current poor sales at all, but the normally expected order rates due to the major differences in the quarterly sales cycle, but THOSE FACTS are not included in these overly-hyped articles. The articles start feeding on themselves and echoing each other and anal-cysts pile on. . . But when you read them, you find that the core is always the same single, unnamed, unattributed source on parts for a single model of the iPhone product mix.

I have been on my very best behavior in this thread. But even when the truth about a situation is plain as day you seem to have difficulty with Apple even being grouped with other companies in the tech sector. But I get it... to you Apple is God and no observation other than full on praise to your God can be uttered by the minions.

No, I don’t consider Apple a "God" and your attributing such to me is another ad hominem attack to denigrate my factual comments. I do know a lot more about those facts than do you and frequently correct the myths you and others post, sometimes out of ignorance but all too often some post them out of malice.

I have no problem having AAPL considered a TECH stock and grouping it with true tech stocks, because Apple primarily designs, manufactures and sells technological gear and makes the vast majority of its profits from technology sales.

But I have a serious problem considering:

- Facebook, an online free membership social club and propaganda organization which sells no products but makes its profits entirely by selling ADVERTISING, monetizing online games, and some streaming video subscriptions.

- Amazon, a primarily an online retail store selling third party manufactured and consignment products as well as streaming movie and television content through purchase or subscription. Profit is entirely from retail sales with a very small component of tech devices.

- Netflicks, a company whose entire profit model is streaming movies and television programming, some original, paid by membership subscription, indistinguishable from a cable franchise.

- Google/Alphabet, an online search engine company which is primarily an ADVERTISING COMPANY that makes the vast majority of its profits (90% plus) by selling advertising and information about its users.

as "tech" companies. . . They aren’t.

What they are is online .com companies, commerce companies which does not per se make them "tech" companies but companies that use tech to facilitate their business models. . . but they are only peripherally tech companies, because they don’t sell, manufacture, or even design tech as their primary business. Using tech doesn’t make them tech. If that were the case, then DirecTV, Comcast, Ally Bank, Breitbart, Yahoo, Egghead, eBay, and a host of other online .com business are "tech" companies merely because they use tech to facilitate their business models. It would be just as logical to call them "brick and mortar" businesses because they also have some physical location that facilitates their business models.

I am obviously not a financial expert or an expert on Apple products. My observations are all simple and unsophisticated. I have had fun sparring and irritating the master over the years, much of what I know about Apple I have learned from you. I am not sure that I have benefited you in any way, but that is what we are here for.

You’re right. You don’t know very much about Finance. I do. I have a degree in Economics with a minor in Finance. . . so I do know more.

I take issue with your claims that what is happening is a "correction" when you don’t know what you’re talking about. AAPL was never in the price area, and is not now, where a "correction would be expected or necessary.

People who can look at Apple’s charts and then claim Apple stopped growing or has peaked are blind or is using wishful thinking. There’s been a steady upward trend line for the past ten years, punctuated by a couple of extraordinary, outlying upward spikes due to completely explicable sales events. . . but no signs of peaking. It may yet occur, but Apple experienced double digit growth in the past fiscal year. People who myopically focus on just one sector of the company’s product mix, such as the iPhone, fail to see the fact that Apple sells an ecosystem, not just single products.

These myopic anal-cysts insist on comparing the amazingly profitable Apple, a single company, against an entire operating system industry, adopted for free by over 1,000 other manufacturers who essentially make no profits, and denigrate the only company that makes a profit for NOT doing the same things the unprofitable companies are doing!

That makes ZERO SENSE, but that is the state of Wall Street Analysis these days: "if Apple would only do the same thing as all the Android manufacturers are doing their stock would be more valuable.” Insane. . . but that’s the thrust of most anal-cysts’ advice. "Build cheap phones and compete on price, introduce more models more frequently and include lots of gimmicky new features. Oh, and don’t forget to include lots of useless, battery-draining, extra pixels on the screen that no one can discern."

115

posted on

11/21/2018 1:12:52 PM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: Swordmaker; Regulator

Nice try at denigrating me with the left-handed ads hominem. And I honestly thought that I was being nice.

Apple investors have lost over $200 Billion dollars in the last 6 weeks. It is no wonder that you are a bit on the testy side. I do admire your honey badger like fighting skills when backed into a corner of your own making. But it doesn't take a “degree in Economics with a minor in Finance” to do the math on that one. No amount of your sophisticated high falutin’ jackassery has any hope of painting a pretty picture out of a $200 Billion dollar loss.

Neither of us know if Apple has peaked or not. You may have superior education and knowledge but your bias colors your predictive abilities to the point that they are essentially no better than a coin flip.

To: fireman15

Apple investors have lost over $200 Billion dollars in the last 6 weeks. It is no wonder that you are a bit on the testy side. I do admire your honey badger like fighting skills when backed into a corner of your own making. But it doesn't take a “degree in Economics with a minor in Finance” to do the math on that one. No amount of your sophisticated high falutin’ jackassery has any hope of painting a pretty picture out of a $200 Billion dollar loss. AAPL goes down, AAPL goes up. It does it over and over. We investors are not worried and Warren Buffet is taking the opportunity to buy AAPL at bargain pricing as are a lot of others as panicky weak willed ignoratti bail because they don’t remember the history and are doomed to lose. Those that hold have lost nothing. We just look at it as a buying opportunity . . which is why those who wrote those articles did so.

In the darkest hour of Apple’s ‘white-knuckle period,’ some investors are loving it

Wednesday, November 21, 2018 · 2:02 pm “Apple’s stock was down $8.88, or 4.8%, yesterday, and the stock is down 23.7% since its peak in early October,” Jim Edwards writes for Business Insider. “AAPL is doing so badly it’s dragging down the rest of the tech-heavy NASDAQ, too.”

“We are in one of those unusual periods where there are more questions about Apple’s future than there are certainties,” Edwards writes. “Historically, only fools bet against Apple. Yet the ‘fools’ are winning. Anyone who bought the stock before the launch of iPhones XS, XS Max, and XR is now poorer.”

MacDailyNews Take: Only if the dupes sold at a loss in an uninformed panic. Those are the only fools.

“At least one investor is clear: Buy aggressively on the dip,” Edwards writes. “There will be no future bump in iPhone sales. But the average selling price of an iPhone has risen $220 since 2008, or 40%. The future is all about revenue growth. In addition, services revenue (apps, music, and so on) was up 17% year-on-year in Apple’s Q3 earnings this year. As Apple’s existing “installed base” of iPhones continues to grow — it will hit 1 billion phones by the end of the year, according to Bank of America Merrill Lynch analyst Wamsi Mohan and his team — the market for those services will also grow

117

posted on

11/21/2018 4:37:26 PM PST

by

Swordmaker

(My pistol self-identifies as an iPad, so you must accept it in gun-free zones, you hoplaphobe bigo)

To: Swordmaker

I hope that your optimism about Apple's future works out as well in the future as it has in the recent past. You know more about Apple on just about every level than anyone else that I have communicated with and your education and background in the computer business make your optimism more than just a whim.

To: martin_fierro

Apple Inc (AAPL) closed Wednesday, November 21, 2018 at $176.78, $56.69 off its all-time high of $233.47, and $26.54 above its $150.24 52 week low. It went ex-dividend on 11-8-2018, and at Wednesday's closing price, that works out to a 1.51% yield.

Here are some topics from the FRchives to keep the "downfall of Apple" sky-is-falling in perspective:

Connect Any Hard Drive to an iPad Pro [RavPower Filehub] | StateofTech | November 9, 2018 [Amazon item #B07JQ9CYVH shown, B016ZWS9ZE B07K6MPMRZ B0769TD8TV also available]

![Connect Any Hard Drive to an iPad Pro [RavPower Filehub] | StateofTech | November 9, 2018](https://i.ytimg.com/vi/y6BH_-m5-ZQ/maxresdefault.jpg)

The RavPower works on 2018 iPad Pro, earlier iPad models, other pad devices, for that matter, laptops, etc.The RavPower products (there are three models on Amazon) are cheaper than the next option, the Gnarbox (sub- $60), and also are wireless routers (not VPNs).

A few years ago I bought a similar product made by Monster off the clearance bin at the wholesale club, less than $30, maybe less than $25. It's about two feet from me, battery is shot, should still run off one of those supplementary batt packs for mobile phones. It worked acceptably as an in-house "cloud" (I think there was a smart phone app for remote access), but the single USB is for power, and the storage expansion is its microSD slot. IMHO, these nice little boxes should have a microUSB (or USB-C) for power, and one or more USB ports (and maybe a microSD slot) for storage expansion. And as long as I'm wishing, they should work as a secure, but app-less, in-house NAS.

Connect Any Hard Drive to the iPad Pro 2018 | USB-C | Gnarbox | 4K | Darryl Carey | November 18, 2018 [Amazon item #B01NB0Q9QP shown]

The Amazon page for the Gnarbox notes, "Compatible with Action Cameras, DSLRs, and Drones. GNARBOX is compatible with Android and iOS phones and tablets. It does not work with Windows based mobile devices. Currently, tablet applications are not optimized or customized. Back up 128GB of footage at up to 4GB/min to the GNARBOX, then auto-organize your footage by date and camera. Edit and share 4K videos and RAW photos from mobile phone or tablet." And it costs about $300.

The HooToo wireless travel router is about $20, and works similarly, but I haven't seen a vid review for it. [Amazon item #B00HZWOQZ6]

119

posted on

11/23/2018 7:54:49 AM PST

by

SunkenCiv

(and btw -- https://www.gofundme.com/for-rotator-cuff-repair-surgery)

Friday, November 23, 2018

172.29 -4.49 (2.54%) - Nov 23, 1:00 PM EST

172.01 -0.28 (0.16%) - Nov 23, 3:21 PM EST After hours

52 Week Range 150.24 - 233.47

233.47-172.29=61.18

(source Yahoo finance)

120

posted on

11/23/2018 5:14:32 PM PST

by

SunkenCiv

(and btw -- https://www.gofundme.com/for-rotator-cuff-repair-surgery)

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-120 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

![Connect Any Hard Drive to an iPad Pro [RavPower Filehub] | StateofTech | November 9, 2018](https://i.ytimg.com/vi/y6BH_-m5-ZQ/maxresdefault.jpg)