Skip to comments.

BREAKING: US Senate Passes Historic Tax Reform Package, 51-49

Townhall.com ^

| December 2, 2017

| Guy Benson

Posted on 12/02/2017 1:37:52 AM PST by Kaslin

click here to read article

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 421-426 next last

1

posted on

12/02/2017 1:37:53 AM PST

by

Kaslin

To: Kaslin

To: Kaslin

The corporatist entities are getting something here and some people will end up paying higher taxes.

Big business wants cheap labor in this country plus a welfare state us little folks pay for just like the folks in Canada have to do right now.

I support Trump on his immigration views and expect delivery down the road on keeping cheap labor out of the USA.

I’m willing to accept this “deal” that the “deal maker” in the White House has come up with.

But I am not willing to accept cheap labor importation front door through DACA or other means or back door through H1 visas or any other “work permits” etc. etc. etc.

3

posted on

12/02/2017 1:45:31 AM PST

by

Nextrush

(Freedom is everybody's business: Remember Pastor Niemoller)

To: Kaslin

"...and the finalized legislation includes a (paid for) amendment sought by Maine's Susan Collins that mirrors the House-passed SALT (state and local tax deduction) compromise."

Boo!

4

posted on

12/02/2017 1:45:35 AM PST

by

familyop

("Welcome to Costco. I love you." --Costco greeter in the movie, "Idiocracy")

To: Kaslin

Still not a done deal. The House and Senate bills are different and need to be reconciled.

5

posted on

12/02/2017 1:56:12 AM PST

by

iowamark

To: Kaslin

I guess that makes it official.. I will be paying more in taxes according to their tables. I am subsidizing the uber wealthy, as usual and thise people with six kids.

When their six kids have grown, they will just love subsidizing, or will they?

Punished for being truly middle class,,

6

posted on

12/02/2017 1:59:25 AM PST

by

momincombatboots

(White Stetsons up.. let's save our country!)

To: momincombatboots

What table are you looking at?

7

posted on

12/02/2017 2:04:48 AM PST

by

Wayne07

To: Kaslin

Corker Porker

8

posted on

12/02/2017 2:05:38 AM PST

by

BigEdLB

(To Dimwitocrats: We won. You lost. Get used to it.)

To: Wayne07

The published tables on the senate site. After reconciliation who knows! I don’t have a lot of faith in the process.

9

posted on

12/02/2017 2:07:11 AM PST

by

momincombatboots

(White Stetsons up.. let's save our country!)

To: momincombatboots; Scotswife; nopardons; Mariner

I guess that makes it official.. I will be paying more in taxes according to their tables. I am subsidizing the uber wealthy, as usual and thise people with six kids. When their six kids have grown, they will just love subsidizing, or will they? Punished for being truly middle class,, Yup - you and other families that are losing the Personal Exemption.

"Doubling" the Standard Deduction is not "double" because of that.

The GOPe destroyed or capped almost every measly tax deduction we had (mortgage interest, SALT taxes, medical expenses, student loans, employment tuition benefits, etc.) all so the GOPe donors and corporations could make out like bandits. And someone had to "pay for" their huge tax cut in a revenue neutral budget - you and me. They soaked the middle class.

Those deductions (some like SALT have been in the Tax Code since 1913 to prevent double taxation) are not gone - FOREVER! We will never get them back. Taxes, however, can and will go up at the will of our Federal Masters.

Thanks a ton. MAGA is dead to me.

10

posted on

12/02/2017 2:34:07 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

11

posted on

12/02/2017 2:34:39 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

Thanks for posting. I got a lot of hateful comments from other Freepers because they like being subsidized.

I did like parts of the plan, but it’s truly spenderiffic. No wonder the senate supported it. If they can steal and spend, it’s gonna happen.

12

posted on

12/02/2017 2:39:28 AM PST

by

momincombatboots

(White Stetsons up.. let's save our country!)

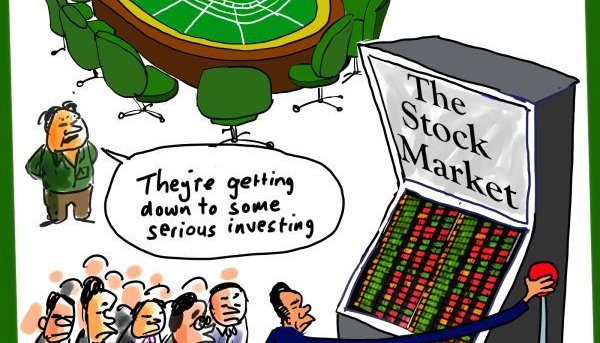

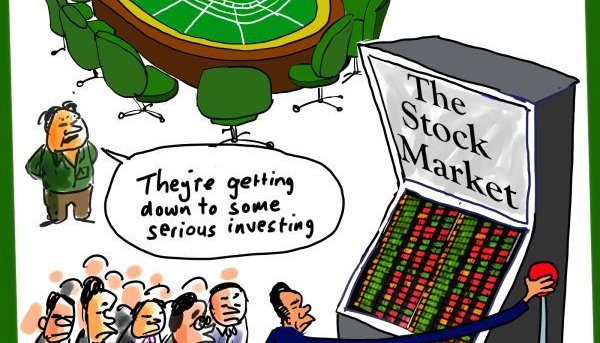

To: Kaslin; Rome2000

This picture was from 3 days ago.

He is celebrating the market going nuts in anticipation of the corporates getting their tax break on the backs of middle and upper middle class taxpayers.

The flawed assumption of this entire enterprise is that by giving the corporations a massive tax break from 35% to 20%, they will "reinvest" that money.

Maybe some of it - but I believe most corporations will simply use it to buy back their own stock (as they have historically done).

The Goldman Sachs snake oil agents who wormed their way into the White House did their job.

The casino will pay out big - until it doesn't.

"We will massively cut taxes for the middle class, the forgotten people, the forgotten men and women of this country, who built our country....Tax relief will be concentrated on the working and middle class taxpayer. They will receive the biggest benefit and it won't even be close."**

Donald Trump, Scranton PA, Oct 2016

**Except for you middle class in NY, NJ, CA, IL, CT, WA, MA, and other states....and except for you middle class who deduct medical expenses, and except for large families who rely on the Personal Exemption, and except for you young people who deduct student loan interest, and except for you middle class who deduct mortgage interest, and except for you men who have to pay alimony, and except for you school teachers who deduct paying for school supplies out of your own pocket, and except for graduate students, and except for college students who get tuition benefits from parental employment, and...

13

posted on

12/02/2017 2:47:50 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: momincombatboots; nopardons; Mariner; Drago

I got a lot of hateful comments from other Freepers because they like being subsidized. I did like parts of the plan, but it’s truly spenderiffic. No wonder the senate supported it. If they can steal and spend, it’s gonna happen. I have never seen Free Republic so divided on any one issue as this tax bill.

The GOPe could have simply cut taxes for everyone or made the tax cut more fair.

They chose instead to pick "winners" and "losers."

Those of us losing, and who dared object, have been derided and called every name in the book, including "Communists", "A$$holes", "Stupid", etc.

The GOP will probably lose the House in 2018. The campaign commercials about Republicans raising taxes on many families so that corporations could get massive tax cuts will write themselves. And the democrats don't even need to lie this time.

14

posted on

12/02/2017 2:54:14 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

Looking at the new brackets and rules for Child Tax Credit - it looks like we temporarily avoid a huge increase until each child ages out at 18.

In 2007 & 2008 we saw how the housing industry affects our overall economy. I wonder what ripple affect there will be now.

To: SkyPilot

It certainly would be helpful to have more discussion on what a “subsidy” really is. Holy moly.

To: Scotswife

This was a page from the bill that was handed out before the vote.

Yes, that is hand scrawling in the margins with last minute changes.

McConnell was so eager to jam this garbage bill through that they staffers didn't even have time to go into Microsoft Word and change the verbiage before they sent it to the copiers.

And this legislation will affect our nation for decades to come.

I thought we used to scream bloody murder when the Democrats did this with ObamaCare and other bills - jamming them through without even knowing what was in the final bill?

Oh well, what are standards if they can't be double standards?

17

posted on

12/02/2017 3:06:42 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

GO TAKE SOME EFFING MEDICINE! There isn’t a tax bill yet. You’re beginning to pi$$ me off with your nutball ranting! SKY PILOT, BS, SKY IS FALLING PILOT!

To: Scotswife

It certainly would be helpful to have more discussion on what a “subsidy” really is. The people who are "winners" in this bill already screamed at us what a "subsidy" is. If we have to pay higher taxes so they get lower taxes, then we are losing our deductions - and they were "subsidizing" us all along.

Like we were on welfare or something by claiming tax deductions that allowed us to keep more of our own money from Washington.

19

posted on

12/02/2017 3:09:07 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: vette6387

GO TAKE SOME EFFING MEDICINE! There isn’t a tax bill yet The House and Senate have both passed their bills. It's all over now but the crying.

The two bills have to go to Conference - or not. There is talk of Ryan simply allowing the passed Senate bill to go to the House floor for a vote as early as next week.

Even if it goes to Conference - there is going to be a bill along the framework that is in both of them - and at this point the bills are very, very similar. Both of them cut the corporate rate and send the tab to the middle class by destroying or capping our deductions.

Sorry you are SO UPSET AND SCREAMING AT ME IN CAPITOL LETTERS!

But both the House and Senate (now passed) bills are pieces of garbage that betrays many of us.

20

posted on

12/02/2017 3:13:50 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 421-426 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson