Skip to comments.

The Senate Tax Proposal Delivers Benefits Directly to the Middle Class

U.S. Senate ^

| November 21,2017

| Katie Niederee & Julia Lawless

Posted on 11/21/2017 1:28:06 PM PST by Brown Deer

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-103 next last

To: Brown Deer

The tax plan needs to be fair for as many taxpayers as possible, not just the “average” taxpayer. That’s especially the case for low-income taxpayers. In any case, please provide a precise link to the table that gives your numbers. It’s not that I doubt your numbers but that will allow me to look at other related numbers and look for other data such as a distribution table, if one exists.

81

posted on

11/28/2017 10:13:31 AM PST

by

remember

To: remember

82

posted on

11/28/2017 1:01:52 PM PST

by

Brown Deer

(America First!)

To: Brown Deer

83

posted on

11/28/2017 2:22:48 PM PST

by

remember

To: remember

I'm well aware of the SOI Tax Stats tables.

BULLSHIT! You wrote, "It’s not that I doubt your numbers but that will allow me to look at other related numbers and look for other data such as a distribution table, if one exists."

The fact is, these statistics have been published by the IRS for many years and are very easy to find.

The tax plan needs to be fair for as many taxpayers as possible, not just the "average" taxpayer.

Once again, you are touting nonsense. The tax plan needs to be fair for "MOST" people, not extremely rare cases! Taxes need to go DOWN and spending needs to go DOWN and we need to stop supporting the LAZY people in this country with welfare!

84

posted on

11/28/2017 3:26:26 PM PST

by

Brown Deer

(America First!)

To: Brown Deer

To paraphrase Shakespeare, you doth protest too much, methinks. You made a mistake in a simple tax calculation, wrongly assuming that the tax rate on all of $13,000 of income was 10 percent under the Senate bill. I therefore ask you for your numbers and calculations on your next attempt at math and you go ballistic. Put up you numbers and calculations or I suggest that we end this conversation.

85

posted on

11/28/2017 4:01:53 PM PST

by

remember

To: remember

...you doth protest too much...

Yes, you do. Keep on trolling...

86

posted on

11/28/2017 4:15:43 PM PST

by

Brown Deer

(America First!)

To: remember

Over and over again, you kept repeating this, "

The tax plan needs to be fair for as many taxpayers as possible, not just the "average" taxpayer."

But in your very first post, your link actually showed a savings for all taxpayers who do not itemize - 70% of all taxpayers. Then you decided to go a step further to find a few of the remaining taxpayers whose taxes might go up, and surely you did find a few circumstances under the right conditions, within the remaining 30% - probably well under 5% of all taxpayers.

But you want it to be fair for as many as possible? Really?

You showed your true colors here, by saying, "

In addition, I would contend that we cannot afford another tax cut."

87

posted on

11/28/2017 7:27:23 PM PST

by

Brown Deer

(America First!)

To: Brown Deer

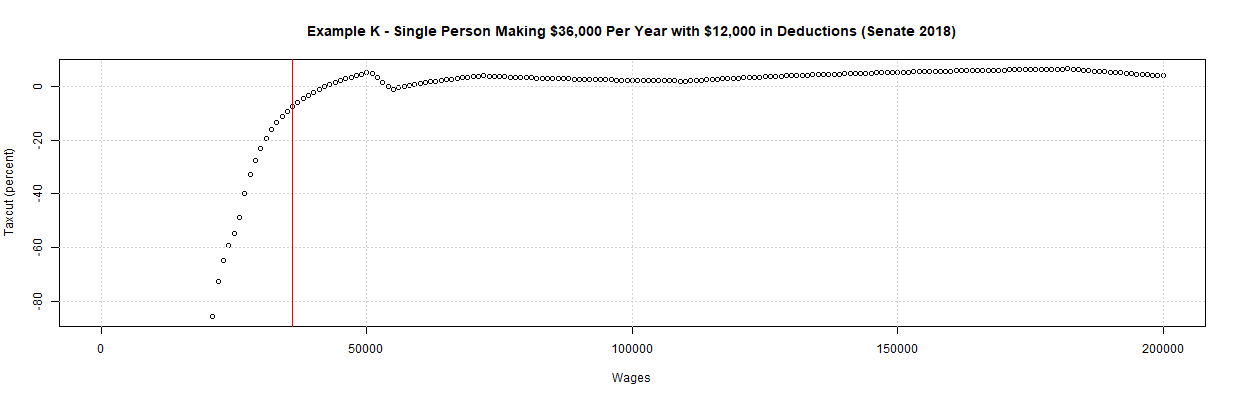

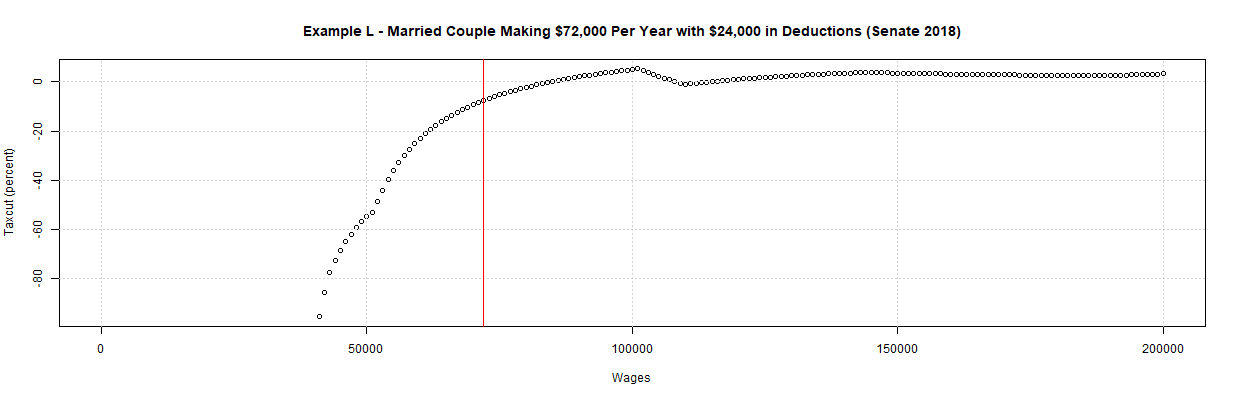

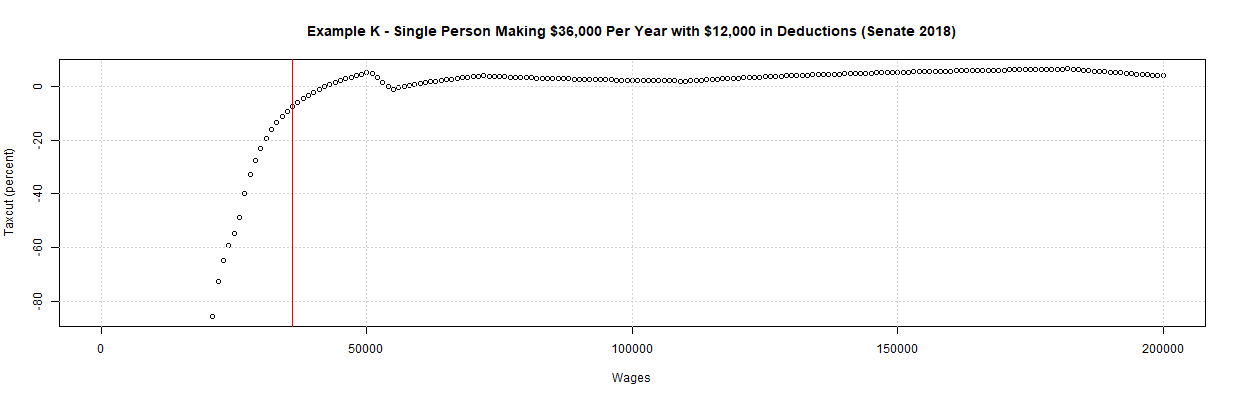

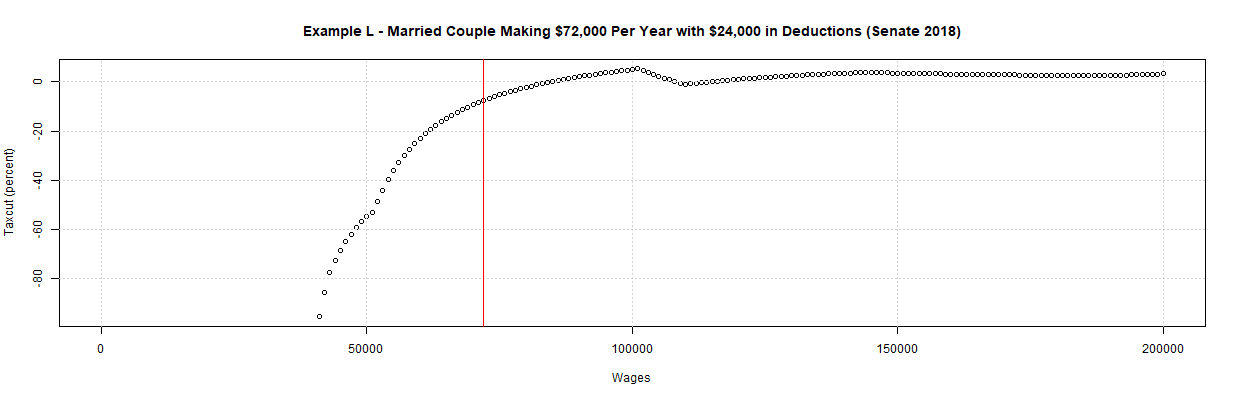

Under current law for 2017, a single taxpayer, with total income of $25,000 gets a $6350 deduction and a $4350 exemption for a $14,600 taxable income, giving him a $1728 tax bill. So I guess you have no intention in giving the numbers and calculations by which you got the above numbers? Anyhow, following are a couple of examples of taxpayers whose itemized deductions are one-third of their incomes and whose taxes will go up 7.5 percent.

You showed your true colors here, by saying, "In addition, I would contend that we cannot afford another tax cut."

Yes, I also believe that we should not be rewarding ourselves and our donors with tax cuts and leaving the bill to future generations when we have a climbing federal debt like the one shown in the graph in message 79 above. Does that climbing debt look sustainable to you?

88

posted on

11/28/2017 11:30:32 PM PST

by

remember

To: IWONDR

speaking of deductions, we go out to the casino occasionally...last yr we won several small "jackpots"... a jackpot being anything over $1200...you pay taxes then and there...you claim it on your income...but you also get to deduct your losses up to the level of winnings IF you itemize...

so last yr our deductions what with SALT,interest,charity etc were over $20,000..

God forbid we win any jackpots because we'll never get to claim our losses, even after paying taxes on the winnings...

89

posted on

11/28/2017 11:39:42 PM PST

by

cherry

To: rbmillerjr

you are wrong....those of us really thinking about these changes see the bigger picture and the bigger picture is they want the corporate taxes to be permanent and the so called middle class tax "cuts" to be time limited...

bait and switch...and why so many are falling for it is beyond me...

but we gots to help out the rich and the wall streeters....

90

posted on

11/28/2017 11:44:41 PM PST

by

cherry

To: remember

Anyhow, following are a couple of examples of taxpayers whose itemized deductions are one-third of their incomes and whose taxes will go up 7.5 percent.

and yet, still a big RED FLAG!

91

posted on

11/29/2017 12:10:15 PM PST

by

Brown Deer

(America First!)

To: remember

Yes, I also believe that we should not be rewarding ourselves and our donors with tax cuts...

92

posted on

11/29/2017 12:23:40 PM PST

by

Brown Deer

(America First!)

93

posted on

11/29/2017 12:25:55 PM PST

by

Brown Deer

(America First!)

To: remember

94

posted on

11/30/2017 7:46:19 PM PST

by

Brown Deer

(America First!)

To: Brown Deer

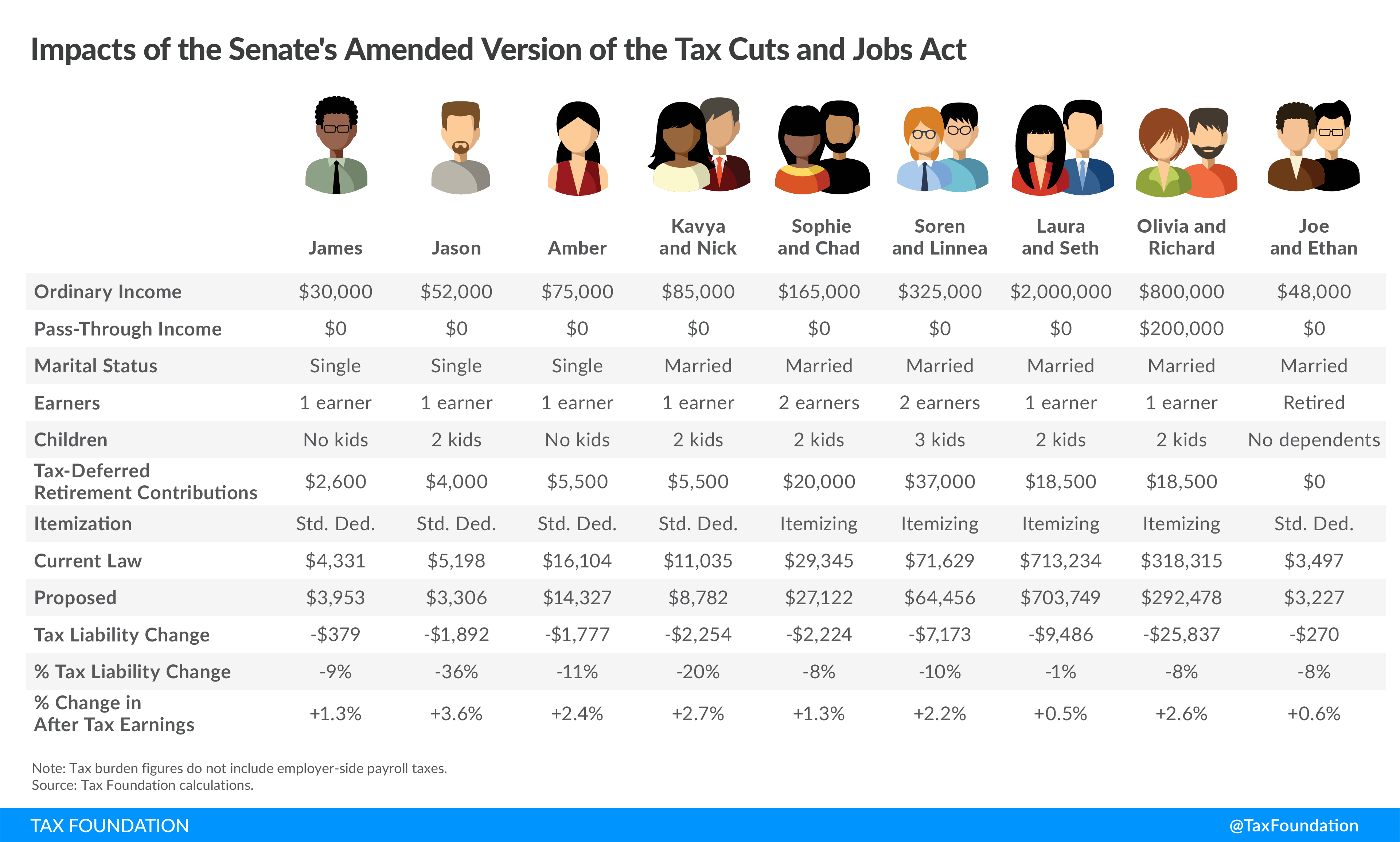

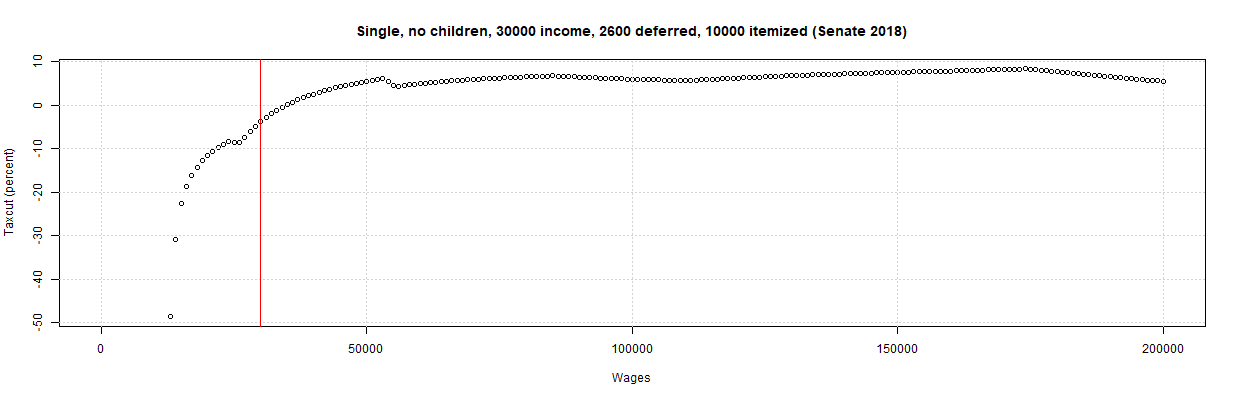

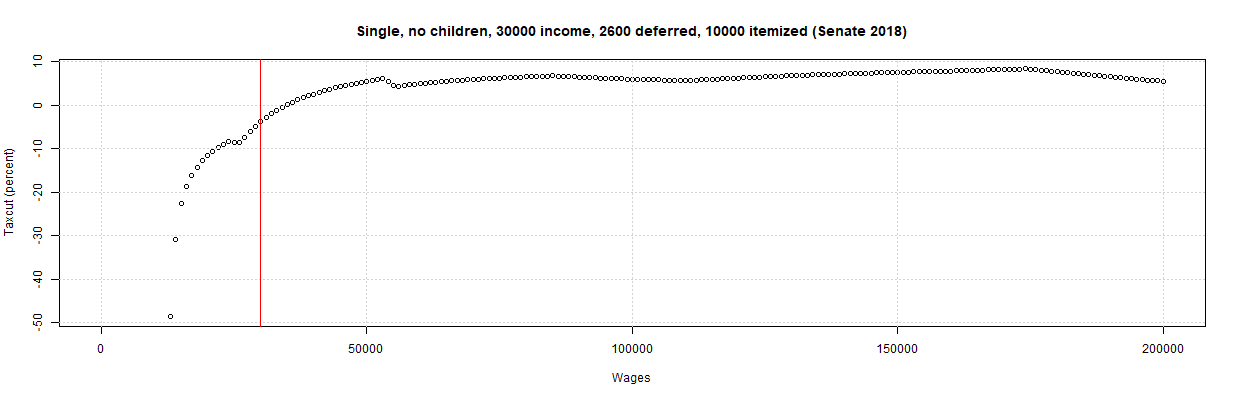

Clever how the Tax Foundation had all of the lower-income taxpayers taking the Standard Deduction, even under current law where the Standard Deduction is just $6500. Once again, the $30,000 taxpayer gets a tax increase if he committed the crime of buying a house or has a serious medical condition. Anyhow, anyone who wishes to change the parameters on some of the Tax Foundation's examples can do so at

https://econdata.shinyapps.io/taxcuts/.

Single, no children, 30000 income, 2600 deferred, 10000 itemized

Names Taxes Released After_Tax

1 Current 2018 3806.250000 4331 26193.7500000

2 Senate 2018 3952.500000 3953 26047.5000000

3 Change 146.250000 -379 -146.2500000

4 % Change 3.842365 -9 -0.5583393

95

posted on

12/01/2017 1:22:00 PM PST

by

remember

To: remember

Some of the most frequently-repeated attacks from the Left against the plan are either entirely unsupported by evidence, rest on out-of-context data points that seem to have been deliberately cherry-picked in order to mislead people.

96

posted on

12/01/2017 3:49:46 PM PST

by

Brown Deer

(America First!)

To: Brown Deer

97

posted on

12/01/2017 5:15:19 PM PST

by

remember

To: remember

The graph is heading downward...

and your next link points to liberal #fakenews

98

posted on

12/02/2017 2:30:48 PM PST

by

Brown Deer

(America First!)

To: Brown Deer

The graph is heading downward... You haven't looked at many budgets, have you? The budget, Republican or Democrat, almost always projects improvement in the debt. I blogged about this looking at the outlays projected in the Bush budgets at this link. Note the vertical line that has "Actual" on the left and "Estimate" on the right in the graph. The graph to the left is useful for seeing the actual history of the debt up to the present. The graph to the right is useful for looking at the President's claimed priorities.

If you look at the graphs at this link, you'll see that Trump contends that this turnaround in the debt will be caused by drops (as a % of GDP) in Defense, Income Security, and Health (chiefly Medicaid). He's already reversed himself on Defense, I think. To be fair, the graphs at this link showed that Obama contended that the turnaround would be caused by a continued recovery in revenue. Of course, no President totally gets his way and/or the forecast turns out to be overly rosy. Hence, you can only look at the projections as a statement of priorities.

and your next link points to liberal #fakenews

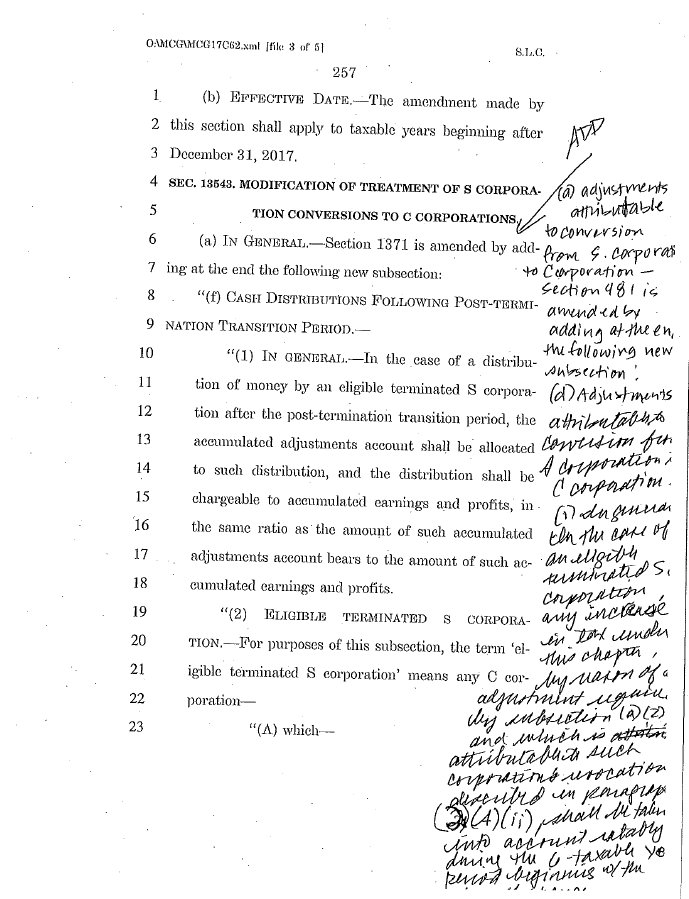

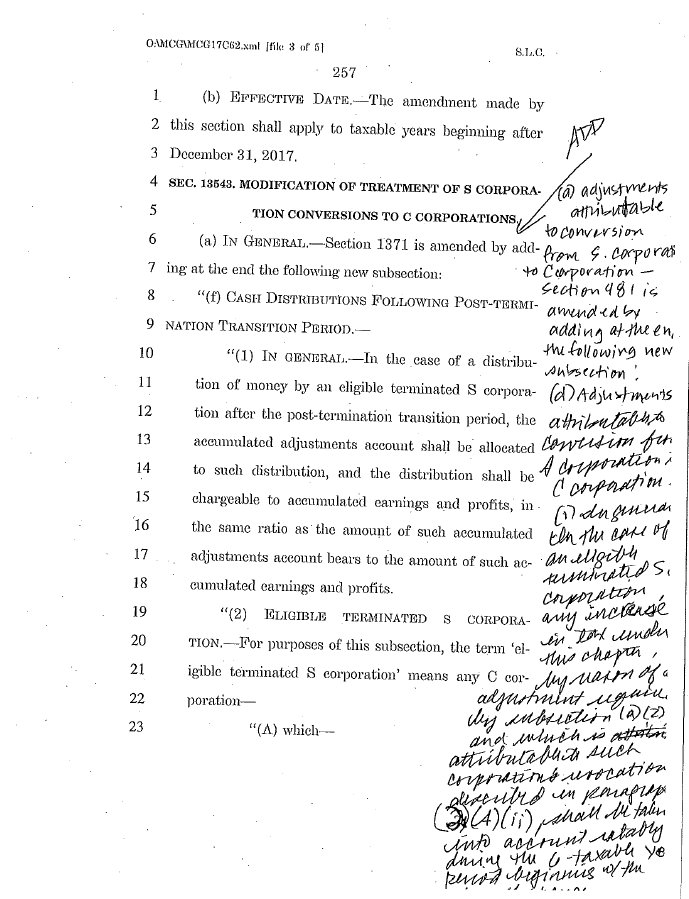

Kind of like the following show a page from the conservative #faketaxbill ?

99

posted on

12/02/2017 3:48:42 PM PST

by

remember

To: remember

and you continue to out yourself as a left-wing liberal...

100

posted on

12/02/2017 4:10:07 PM PST

by

Brown Deer

(America First!)

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-103 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson