Over and over again, you kept repeating this, "

The tax plan needs to be fair for as many taxpayers as possible, not just the "average" taxpayer."

But in your very first post, your link actually showed a savings for all taxpayers who do not itemize - 70% of all taxpayers. Then you decided to go a step further to find a few of the remaining taxpayers whose taxes might go up, and surely you did find a few circumstances under the right conditions, within the remaining 30% - probably well under 5% of all taxpayers.

But you want it to be fair for as many as possible? Really?

You showed your true colors here, by saying, "

In addition, I would contend that we cannot afford another tax cut."

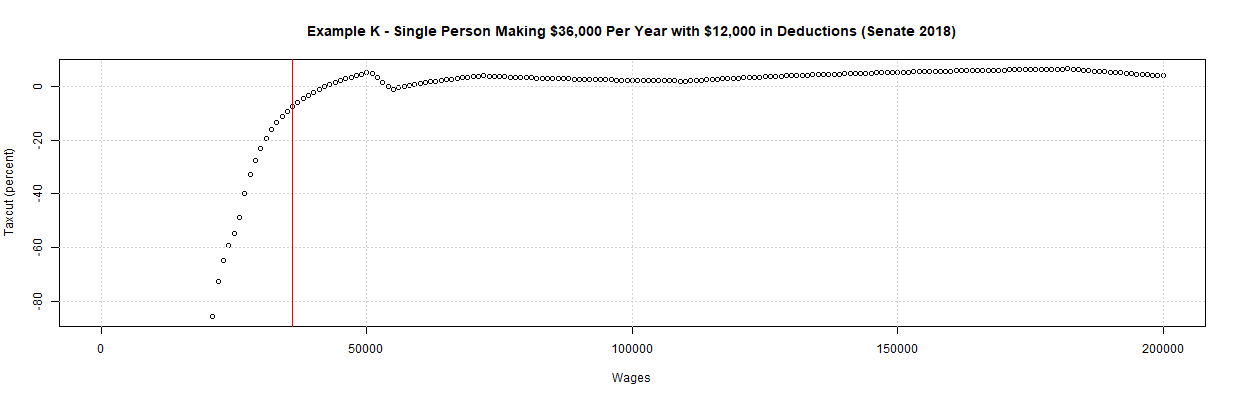

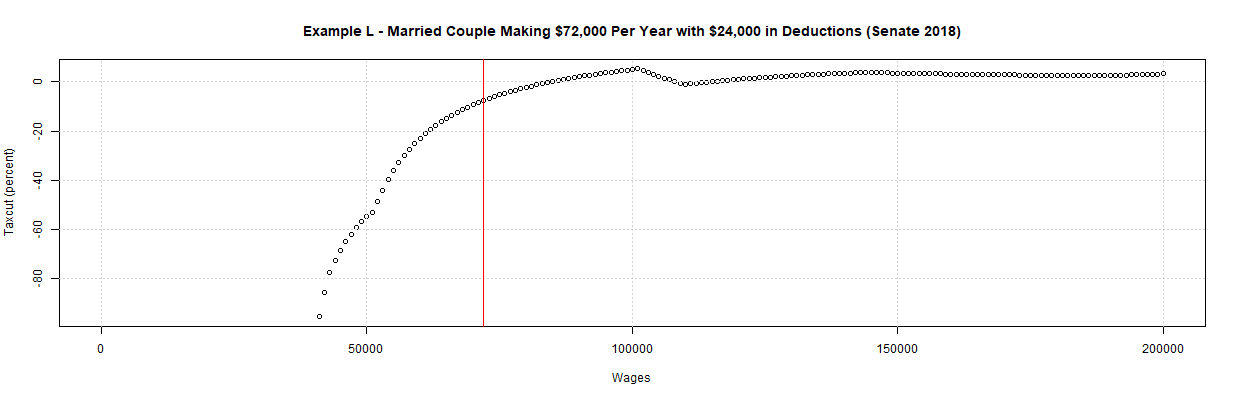

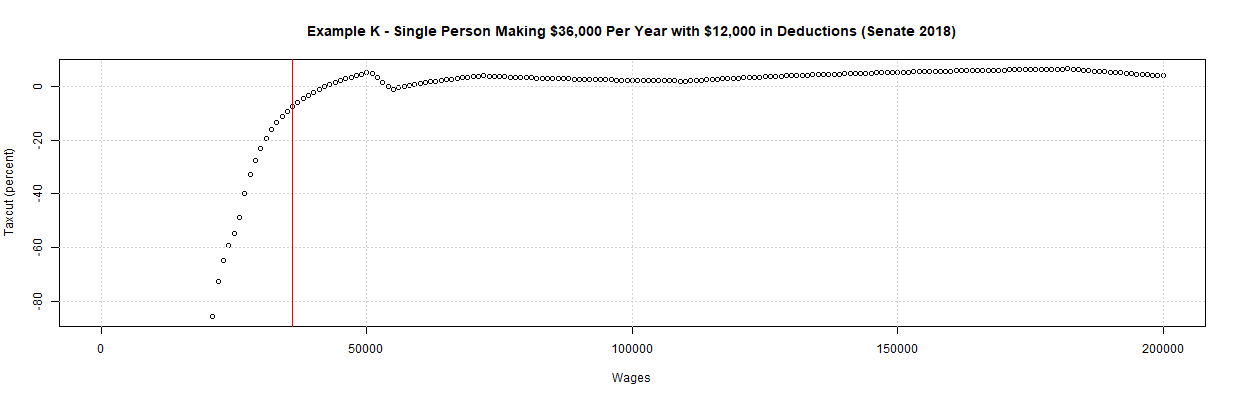

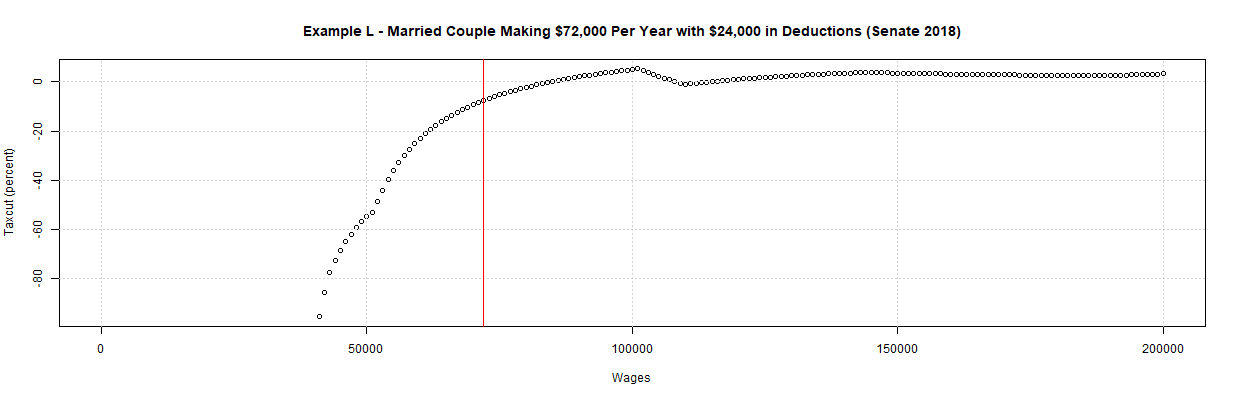

Under current law for 2017, a single taxpayer, with total income of $25,000 gets a $6350 deduction and a $4350 exemption for a $14,600 taxable income, giving him a $1728 tax bill. So I guess you have no intention in giving the numbers and calculations by which you got the above numbers? Anyhow, following are a couple of examples of taxpayers whose itemized deductions are one-third of their incomes and whose taxes will go up 7.5 percent.

You showed your true colors here, by saying, "In addition, I would contend that we cannot afford another tax cut."

Yes, I also believe that we should not be rewarding ourselves and our donors with tax cuts and leaving the bill to future generations when we have a climbing federal debt like the one shown in the graph in message 79 above. Does that climbing debt look sustainable to you?