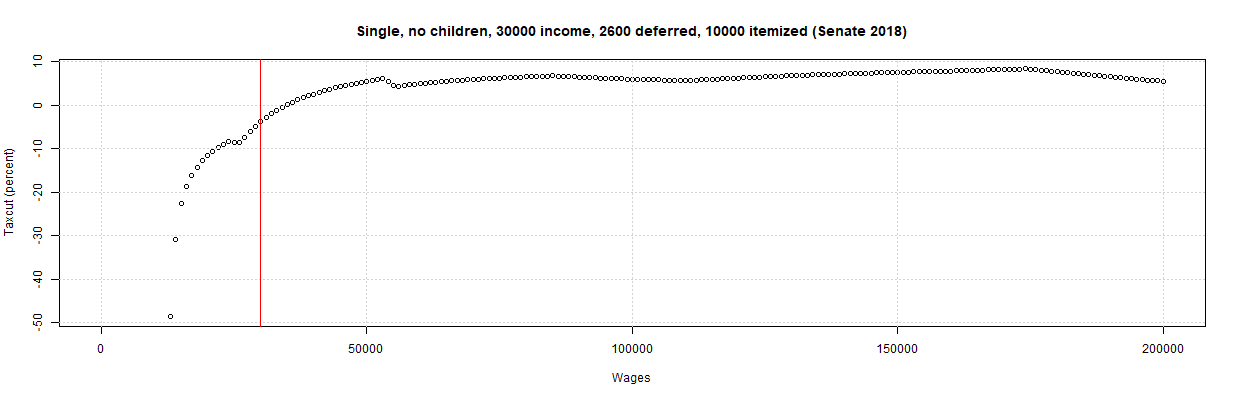

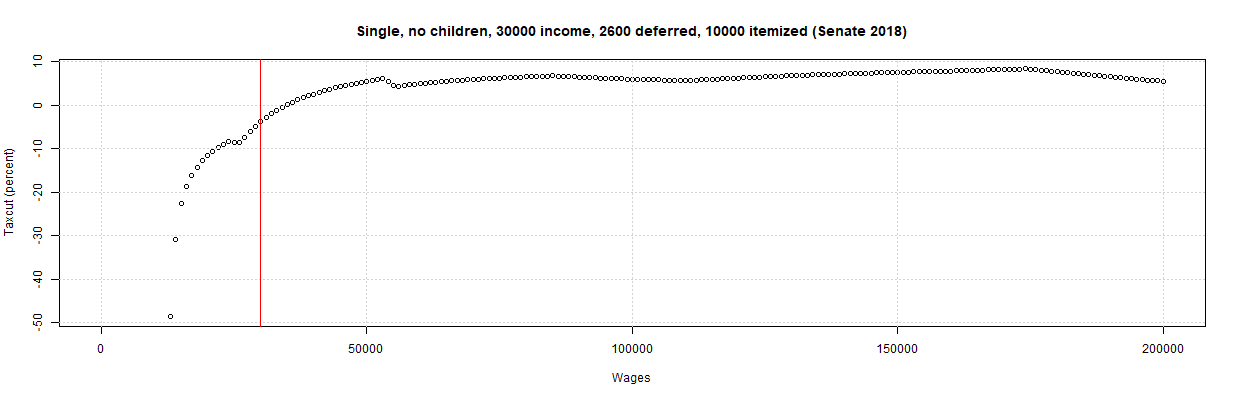

Clever how the Tax Foundation had all of the lower-income taxpayers taking the Standard Deduction, even under current law where the Standard Deduction is just $6500. Once again, the $30,000 taxpayer gets a tax increase if he committed the crime of buying a house or has a serious medical condition. Anyhow, anyone who wishes to change the parameters on some of the Tax Foundation's examples can do so at

https://econdata.shinyapps.io/taxcuts/.

Single, no children, 30000 income, 2600 deferred, 10000 itemized

Names Taxes Released After_Tax

1 Current 2018 3806.250000 4331 26193.7500000

2 Senate 2018 3952.500000 3953 26047.5000000

3 Change 146.250000 -379 -146.2500000

4 % Change 3.842365 -9 -0.5583393