"The single most significant, inter-galactic, extra-celestial, interplanetary, and spiritual force behind the global stock market rally is the decline of inflation to rates not seen in over thirty years. While many industrial nations, including the U.S., have imposed anti-growth and anti-saving tax increases in recent years, fiscal drag has been offset by a steady decline of inflation. Inflation is a tax on  money, wealth creation, income, and work effort. Inflation is a devastating tax on savings. But low inflation is a tax cut. By enhancing the value of financial assets, price stability rewards patient savers and investors. It is a stimulant to capital formation, new business start-ups and growth. Growth does not cause inflation, low inflation causes growth."

money, wealth creation, income, and work effort. Inflation is a devastating tax on savings. But low inflation is a tax cut. By enhancing the value of financial assets, price stability rewards patient savers and investors. It is a stimulant to capital formation, new business start-ups and growth. Growth does not cause inflation, low inflation causes growth."

The above passage was written in 1996, right in the middle of Bill Clinton's economically successful presidency. Looked at in isolation, and with 1996 very much in mind, many would understandably conclude that the person behind the words was a Democrat promoting the virtues of the Clinton economy. But as readers can perhaps guess based on this column's title, the writer was Larry Kudlow, a prominent and very public Republican.

Despite long wearing his GOP leanings very much on his sleeve, Kudlow has always been quick to throw bouquets in the direction of the Democrats when their policies have favored economic growth. And when it came to a dollar the health of which is crucial to prosperity, Bill Clinton and his Treasury secretary Robert Rubin were excellent. Not only did Rubin regularly mouth the stock line about how "a strong dollar is in the best interest of the United States," he backed it up. Not once during Rubin's Treasury tenure did a substantial Treasury official ever jawbone the Japanese about the value of the yen. This non-action signaled to investors that Rubin's dollar talk was more than rhetoric, and the greenback remained strong on the way to a booming economy. Good money is the ultimate lure for the investors whose capital commitments drive economic growth. Kudlow understood this well, and gave the Clinton administration its proper due.

Notable is that this wasn't the last time that Kudlow would cross the economic aisle. Three months ago Kudlow and Brian Domitrovic published JFK and the Reagan Revolution. In the book, the authors lay out the economic policies of the John F. Kennedy administration as a way of showing how similar they often were to Reagan's. In particular, Kennedy ultimately settled on tax cuts paired with a stable dollar as the path to economic growth. Two decades later Reagan brought a similar policy mix to the White House.

All of this rates discussion in light of the promising news that Kudlow is being eyed by the incoming Donald Trump administration as the next Council of Economic Advisers Chairman. Kudlow is not afraid of good ideas, nor does he dismiss good policies solely because they come from the Democratic Party. This on its own is important, but arguably the bigger story behind the stories just told is that Kudlow plainly understands what inflation is. This matters simply because most credentialed economists don't. If the non-Ph.D in Kudlow takes over the CEA, economic policy talk from Washington will at long last be reasonable.

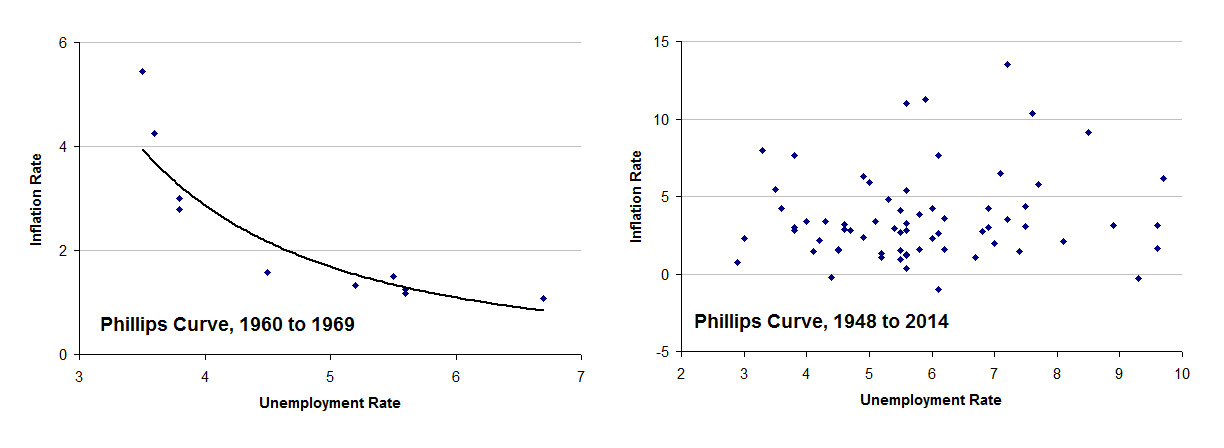

Indeed, while my first memories of Kudlow are from the late 1980s when he was an occasional (and very entertaining) guest on The McLaughlin Group, my favorites are from the late 1990s/early 2000s. Back then the now Senior Contributor at CNBC would come on the business channel each Friday after the stock market's close. Depending on the day he would either debate Bill Wohlman or Jacob Schlesinger, and as the late 90s were defined by soaring economic growth, the subject was normally inflation thanks to the broadly held view among credentialed economists that prosperity is the driver of it. Kudlow was thankfully having none of what was mindless, and each Friday he would eviscerate his Philips Curve-embracing opponents. In no way worshipful of the non-wisdom that has infected the economics profession, Kudlow would calmly rip to shreds the impoverishing belief so popular among economists that too many people employed and too much economic growth have an inflation downside.

The very notion that growth causes inflation is laughable. Figure that the first laser printer cost $17,000, the first mobile phone $3,995, the first calculator over $400... What this tells us is that economic growth is the greatest enemy inflation has ever known. Kudlow laid out why the latter is true in the passage that begins this column. When currencies are stable, the very investment that leads to price-crushing productivity enhancements becomes much more aggressive. Conversely, when money is being devalued, inflation becomes quite a bit more careful; thus slowing the natural price declines that always occur alongside economic growth. Good money is conducive to the investment that boosts economic growth all the while bringing down the prices of most everything. Kudlow understands this well, and will bring this common sense to a CEA that has too often embraced what is senseless.

Sadly, it's not just on the subject of inflation that credentialed economists have lost their way. Too see why this is true, ask most any economist what ended the Great Depression. Almost to a man and woman the reply will be World War II. Economists quite literally believe a war that killed 800,000 able-bodied Americans, that maimed many more, that exterminated potential customers and workers around the world, and that destroyed staggering amounts of wealth had a growth upside. Given the comically obtuse view among economists that consumption drives economic growth, they believe wars are stimulative simply because they put people to work - in the business of killing. Nothing could be more economically depressing than war simply because it's about the destruction of production, the shrinkage of the division of labor that renders productivity exponentially greater, the devastation of savings necessary for entrepreneurs to innovate, and worst of all, the destruction of the human capital essential to all economic advancement. Yet this is what economists believe. And that's but one of many examples of a profession that is no longer serious.

To economists, a strong currency is problematic because it makes "exports" too expensive. That Japanese exports to the U.S. soared alongside the yen's surge against the dollar during the 70s and 80s doesn't concern a profession that is near monolithic in its certainty about what is monumentally foolish. Economists are convinced that we can consume without producing first, that we're more prosperous the more impoverished our neighbors are, that an "economy" that is always and everywhere just a collection of individuals can't routinely grow beyond 3% simply because models designed by the Federal Reserve say it can't. The problem there is that in an economy of individuals and businesses, both quite frequently grow quite a bit more than 5, 10, or even 100% on an annual basis. Having little real world experience to speak of, economists believe that human action can be modeled, controlled, and that it has limits.

Thankfully Kudlow believes little of what economists believe almost unanimously. Because he doesn't, Kudlow has the chance to finally make the CEA reasonable, rational, and most important of all, a source of good ideas. Kudlow doesn't need charts, equations and statistics to explain what is common sense: the individuals who comprise an economy can grow much more rapidly the more that the barriers to their production are reduced or abolished. Along these lines, Kudlow intimately understands (I know because he taught it to me in his first book, American Abundance) that economic growth is as blindingly simple as government reducing the tax, regulatory, trade tariff, and unstable money barriers to production. If Kudlow is the CEA Chair, economic research from Washington will finally become real. And relevant.

The popular retort beyond the obnoxious one about Kudlow not being a Ph.D economist (thank goodness he isn't one!) is that he didn't predict the financial crisis. Ok, but of course he didn't. Indeed, no one predicted the financial crisis. If they tell you they did, they're lying.

What's too often forgotten by the left and right is that the crisis was not caused by a moderation of housing prices, or the collapse of a few banks. Lest we forget, economies and markets always and everywhere gain strength from periods of weakness. They do simply because corrections are the only way for investors to starve bad ideas so that good ones can attain more capital. Without economic recessions and market corrections, the U.S. economy would be eternally stagnant simply because the proverbial Webvans of commerce would never go out of business so that they could be replaced by Google and Facebook. Simply put, resources are limited. Corrections ensure that what's limited is always being directed to higher uses.

What this hopefully reminds the reader is that the 2008 housing moderation and collapse among certain financial institutions did not cause a financial crisis. Nor could it have. What caused the crisis was the federal government's - yes, the Republican Bush administration - intervention in what was healthy. Absent the bailouts and bailout policies that changed by the day, absent the curbs on short selling that blinded markets desperate for clarity, and absent the massive growth of government that the bailouts foretold, there would have been no "crisis." Kudlow didn't predict what no one predicted simply because he could not have known how the Bush administration, the Bernanke Fed, and the U.S. Congress would respond to what was healthy. Readers should never forget that economic and market strength springs from weakness. The crisis back in 2008 was that politicians and government officials were seeking to blunt the very market corrections that were necessary for the economy and markets to regain their health. There's your crisis that no one predicted.

The main thing is that in modern times the economics profession has become ridiculous. Because it has, it needs a shakeup. Kudlow has the potential to provide just that simply because he doesn't embrace much of what has made economics so modernly ridiculous in the first place. Larry Kudlow would bring rationality to what is absurd, and that's why it's essential that he be named Chairman of the White House's Council of Economic Advisers.