Skip to comments.

Dow 19,000: Will the Fed’s Coming Rate Hikes Kill This Bull Market?

The Fiscal Times ^

| November 23, 2016

| Anthony Mirhaydari

Posted on 11/25/2016 2:14:29 AM PST by expat_panama

Dow 19,000!

We’ve crossed that mark for the first time — and the S&P 500, Nasdaq Composite and Russell 2000 small-cap index are all at record highs as well. The last time all four major stock market averages hit new highs at the same time was December 31, 1999.

Wall Street could hardly be more excited as it looks ahead to the fiscal stimulus it expects to see from a Trump administration.

Never mind that a large percentage of the equity market isn't participating in the advance. Or that Trump's fiscal plans are expected to double the national debt. Or that interest rates have exploded higher on inflation fears.

Most importantly, stock bulls distracted by Trump are ignoring the rising policy hawkishness at the Federal Reserve — the purveyor of cheap money that's sustained this bull market since it began in 2009.

The market is predicting 95 percent odds of an interest rate hike before the end of the year...

...the market expects two rate hikes in 2017, up from expectations for a single hike before Trump's electoral victory. In Deutsche Bank's view, this re-pricing has "room to run" and will likely result in more rate hikes being priced in.

But an aggressive end to the greatest experiment with ultra-cheap money in human history isn't going to be painless — and that danger is being ignored. The interest rate hikes would put an end to a 34-year bull market in bonds. A repricing of risk across the entire spectrum of financial assets is coming. And it could upend the president-elect’s spending plans, as higher interest rates would put increased pressure on the national debt.

Trump, who was frequently critical of Yellen's low-rate regime on the campaign trail, may soon regret his calls for her to turn hawkish.

(Excerpt) Read more at thefiscaltimes.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; investing; stocks

My take:

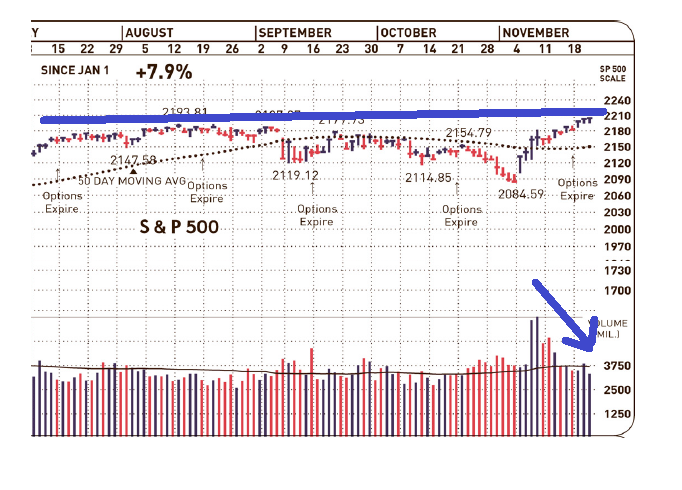

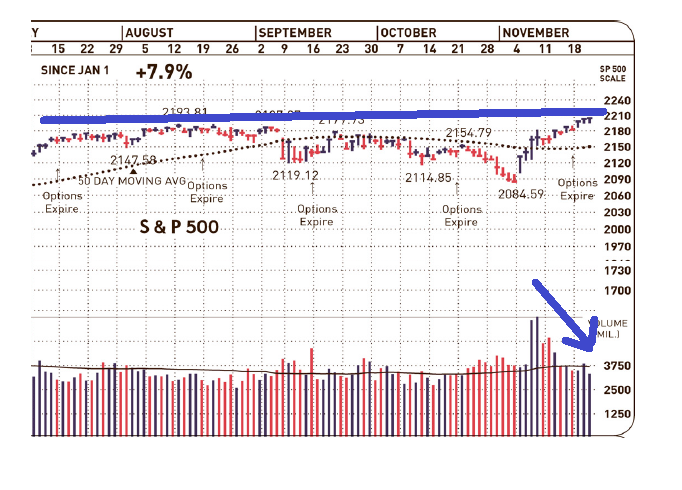

This is not a "bull market", in fact it's hardly even what I'd call a 'rally'.

Someone please show how this is nothing more than just a two-week uptrend barely up to a resistance level that's been there for a half a year --and trading volume's been running for the door!

To: expat_panama

If the rates don’t normalize soon, the asset bubble will pop.

2

posted on

11/25/2016 2:15:55 AM PST

by

AU72

To: expat_panama

And gold. GOLD! GOLD! Gold has fallen out of bed since the Trumpnami.

Lookie here!!

It's a conspiracy, I tell ya!!!

3

posted on

11/25/2016 2:27:48 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Any Permabull will tell you the race to the top is run by the few that the stout of heart to lead /s

Actually I have heard that but stout of heart does not particularly mean wise of heart.

4

posted on

11/25/2016 2:31:34 AM PST

by

Gasshog

(Clinton denies... Except to see a lot of this)

To: expat_panama

Another take from the piece is that today’s market levels reflect 1 - 2 rate hikes are “built in” to the current price levels.

Market participants will prolly continue run it up in anticipation of a more robust/profitable economy until the fed acts.

More like “buy the rumor, sell the fact”?

5

posted on

11/25/2016 2:39:06 AM PST

by

thinden

To: expat_panama

Commodity prices though have mostly been on the upswing since September, with copper prices, a key industrial demand indicator, up dramatically since late October. Various international order book and demand indexes and indicators are also up recently.

With Trump and the GOP Congress intending major individual and corporate tax reductions and cuts in regulation, a wave of US economic expansion and increased demand for money and borrowing seem certain. The Dow should remain strong even as competition and rising interest rates change the economics of borrowing and make for new winners and losers.

To: thinden

rate hikes are “built in” to the current priceimho this is the most likely scenario. Maybe by say, Feb. we'll know a lot more about where policy is going, of course by then market prices will have that already "built in" too....

To: expat_panama

Looks market participants feel increased economic growth & profits can absorb 100 basis points hike from fed.

if signs indicate 3 - 4% growth is realistic, the market could continue to rally while looking at another 100 bp tightening??

savers could come back into the markets as rates rise??

8

posted on

11/25/2016 5:12:01 AM PST

by

thinden

To: expat_panama

Or that Trump's fiscal plans are expected to double the national debt.Seriously? Who expects that? Paul Krugman?

9

posted on

11/25/2016 6:11:53 AM PST

by

Sicon

("All animals are equal, but some animals are more equal than others." - G. Orwell)

To: expat_panama

The bubble’s been kept going by ZIRP far longer than most cocaine addicts stay productive while using their blow. Sooner or later......

To: expat_panama

Problem is that everyone is looking at a capital gains tax cut from 35% to 15%—meaning that the every US company is suddenly that much more profitable without anyone doing anything. Hard to talk the market down under those circumstances.

11

posted on

11/25/2016 6:55:30 AM PST

by

ckilmer

(q e)

To: ckilmer

a capital gains tax cut from 35% to 15%—It's possible that more people would believe it we could see DJT announce that now as current policy say, like here.

To: Eric Pode of Croydon

bubble’s been kept going by ZIRPLots of people say that but so far we haven't heard from anyone who believes it enough to say how they've shorted the S&P for Dec. '16 like they did last year.

To: Sicon

Trump's fiscal plans are expected to double the national debt.Seriously? Who expects that?

What he's said is that he's got lots of big spending planned and that the deficit will shrink because the economy will grow faster than spending. Let's see if he first gets his ideas put into law, and then we'll see if folks like us who work for a living can create enough wealth to make this happen like he's promised.

To: expat_panama

It’s a re-organization of assets.

Yields on bonds will go up. The Fed will raise, and Trump will increase federal borrowing some.

What happens though depends on the resulting growth. If there is deregulation and opportunity then the yields won’t matter.

15

posted on

11/25/2016 7:32:52 AM PST

by

mrsmith

(Dumb sluts: Lifeblood of the Media, Backbone of the Democrat/RINO Party!)

To: expat_panama

16

posted on

11/25/2016 7:45:11 AM PST

by

ckilmer

(q e)

To: ckilmer

Tx,

This is what I was saying about not having any hard numbers now that the election’s over. The site you linked was his old pre-election campaign page —note how the news updates stop at election day. The link I posted was his post-election dot-gov page where he turns promises into policy. For example you can see how one change is he’s no longer wanting to leave NAFTA.

Maybe in a few days he’ll update the new site to include numbers, altho my guess is he’s now thinking how to get his ideas past congress so the numbers will be subject to revision for some time to come.

To: expat_panama

Liberal historians will laud ex president Obama with leaving office having the market at record highs.

If after inauguration the Dow adjusts down slightly liberals will say Trump inherited record highs from Obama and let them slip.

Mark my words.

18

posted on

11/25/2016 11:50:01 AM PST

by

weston

(SO HERE'S THE STORY: As far as I'm concerned, it's Christ or nothing!)

To: expat_panama

19

posted on

11/25/2016 12:14:09 PM PST

by

ckilmer

(q e)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson