You are of course correct, but there is a third plan:

Good luck explaining any of this to the "where's MY money, which is in MY account" crowd.

No money has been taken from SS. All the money collected from the payroll tax is deposited immediately into T-bills. Benefits are paid and any surplus is retained in the SSTF in the form of non-market, interest bearing T-bills. There is currently more than $2 trillion in the SSTF.

SS is a pay as you go system with today's workers paying for today's retirees. SS has been running in the red since 2010, i.e., the benefits collected exceed the revenue collected. The shortfall is made up by redeeming the T-bills in the SSTF by the General Fund. The SSTF will be exhausted by 2034, at which time, by law, benefits will be reduced to the revenue collected.

SS is going broke for several reasons. In 1950 there were 16 workers for every retiree; today, it is three and by 2030 there will be two workers for every retiree. The retirement of the baby boomers, 10,000 a day for the next 20 years, and the fact that people are living longer means that the system is unsustainable unless you raise taxes, reduce benefits, or a combination of both.

The SS DI Trust Fund goes bust in 2016.

You are of course correct, but there is a third plan:

Good luck explaining any of this to the "where's MY money, which is in MY account" crowd.

Thanks for explaining the correct situation. Not that facts matter so much anymore. The laments have been repeated so often that most accept them as gospel by now.

The only other option would be to invest in something that would have a better return than non-negotiable T Bills. Maybe it could be turned back to the states and a Retirement Trust set up similar to the Teacher’s Pension Program - sure wouldn’t want anyone in Washington involved in investing retirement money.

Actually it’s not really a retirement system, come to think of it. It was set up as insurance. Best way to look at it is as a kind of disability insurance - in case something happens and you are no longer able to work - you would have some money coming in.

If this was a private system, the benefits and premiums would be adjusted annually based on actuarial data and benefit frequency. So the new policies would be different for each period of adjustment.

Since it’s Government, no such adjustment happens, and they have been able to promise much without worry knowing that there will be no accounting till down the road.

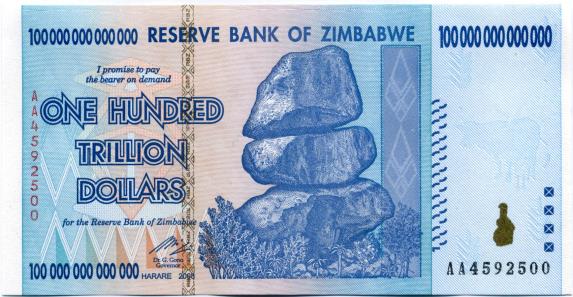

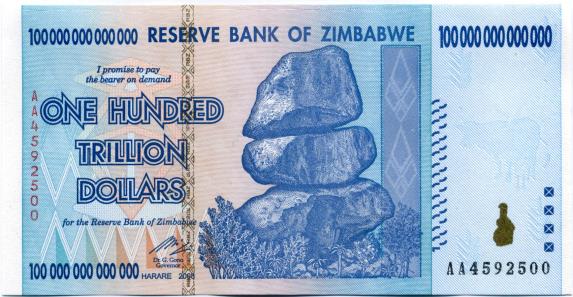

Meanwhile they are busy printing money which results in a cut in buying power, and is thus just the same as cutting benefits, but they can pretend you are still getting the same benefit.

It’s pathetic really. If they do nothing, it’s an automatic 25% cut when the Trust Fund runs out(approximately, IIRC).