Skip to comments.

Forget QE, Wall Street’s new drug is the stock buyback

MarketWatch.com ^

| July 17, 2015

| Wallace Witkowski

Posted on 07/17/2015 8:44:25 AM PDT by upbeat5

With the Federal Reserve’s quantitative-easing program out of the picture, share buybacks are now the preferred way to boost stock prices in the face of softening earnings. But like QE, it is unclear how long the buyback boom can last.

In the first quarter of 2015, companies in the S&P 500 index SPX, -0.05% returned more money to shareholders than they earned. The last time that happened was in the fourth quarter of 2008, when the entire S&P 500 reported a slight loss for the quarter but still spent $110 billion on dividends and buybacks.

“This is not a normal trend,” said Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. “This is a large amount of money being returned with the majority of it in buybacks.”

In the first quarter, S&P 500 companies spent $237.69 billion on dividends and buybacks, while reporting operating earnings of $228.36 billion, according to data compiled by Silverblatt.

(Excerpt) Read more at marketwatch.com ...

TOPICS: Business/Economy; Culture/Society; Miscellaneous; News/Current Events

KEYWORDS: buyback; stock; stockmarket; street; wall

This is one of the reasons that the Fed does not want to raise interest rates.

1

posted on

07/17/2015 8:44:25 AM PDT

by

upbeat5

To: upbeat5

I like buybacks. A company can show a loss and still have a strong cash flow...and if your own stock looks like a good buy, get it.

2

posted on

07/17/2015 8:49:33 AM PDT

by

RoosterRedux

(WSC: The truth is incontrovertible; malice may attack it, ignorance may deride it, but in the end...)

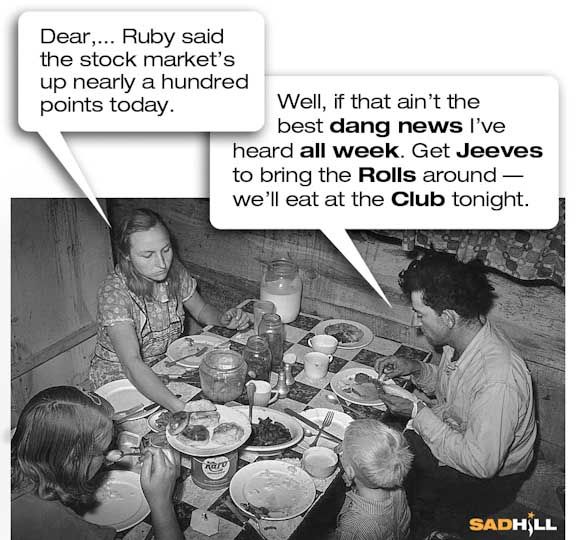

To: All

3

posted on

07/17/2015 8:51:59 AM PDT

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: RoosterRedux

Better to take cap gains than dividend income.

Buybacks also mean that the company can’t find enough places to spend profits effectively... or won’t create new jobs to spend profits effectively.

To: Sequoyah101

“Buybacks also mean that the company can’t find enough places to spend profits effectively... or won’t create new jobs to spend profits effectively.”

I think our anti-business climate in America makes it very difficult for companies to find new business opportunities to invest in.

As far as creating jobs is concerned, that’s not an objective of businesses. Their job is to find moneymaking ideas which, by the way, will require additional employees.

5

posted on

07/17/2015 9:48:32 AM PDT

by

cymbeline

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson