Posted on 07/08/2015 7:34:47 AM PDT by SeekAndFind

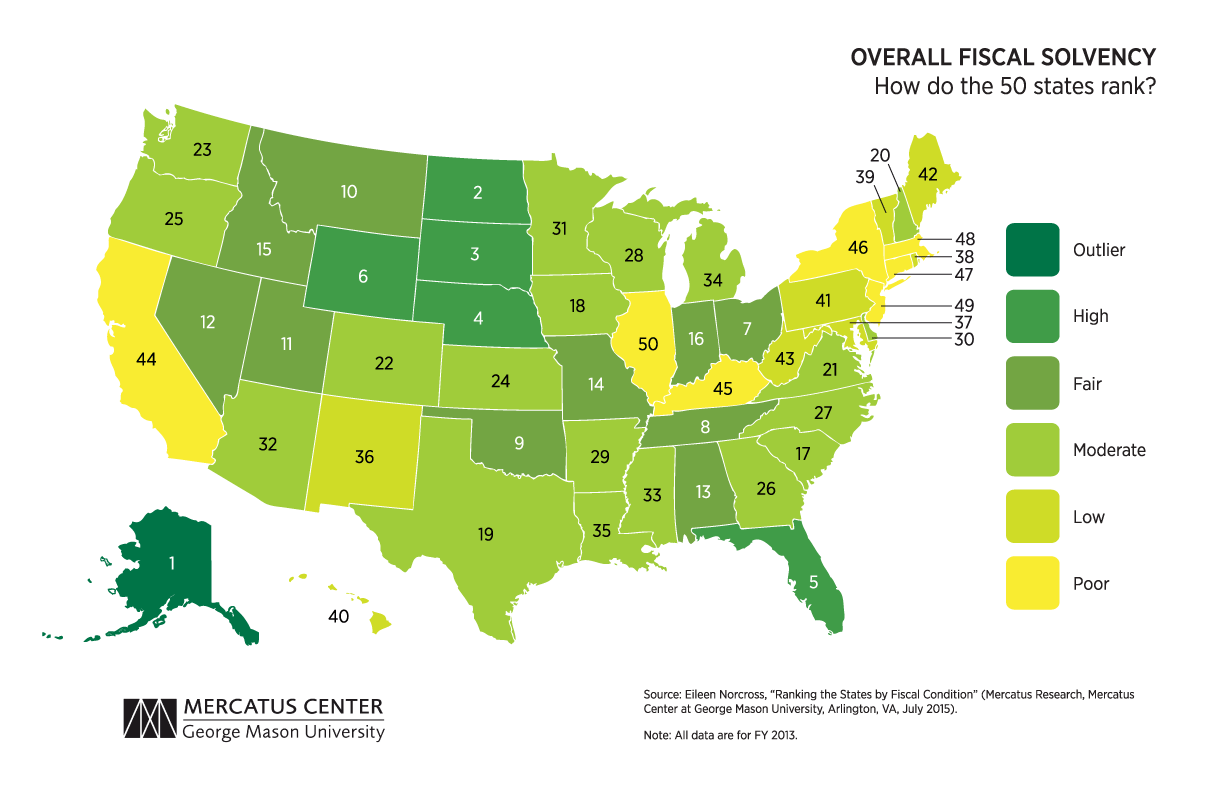

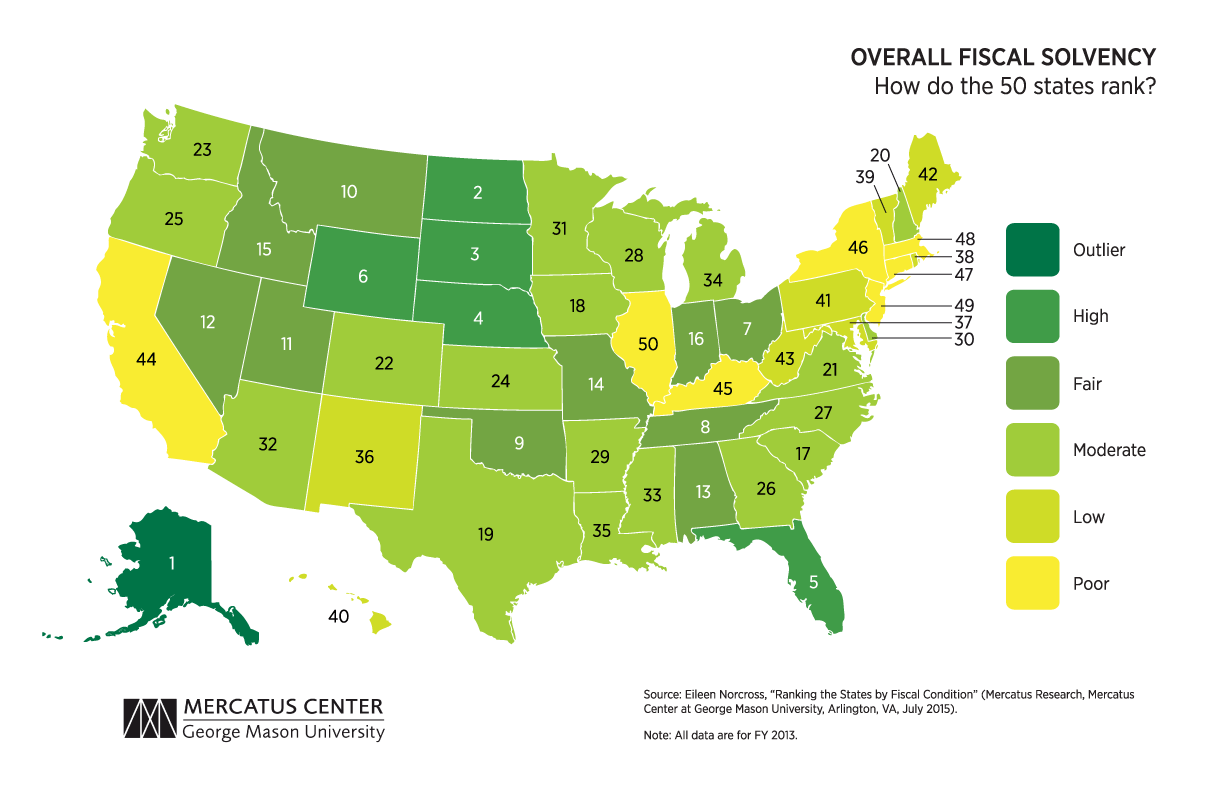

Rural states with a history of conservative leadership generally fare better than urban ones with a history of progressive leadership — but there are exceptions in this latest study by George Mason University, ranking the 50 states in terms of their governments’ financial health.

The Mercatus Center, a pro-market think tank at George Mason, released this year’s version of “Ranking the States by Fiscal Condition,” a remarkably well-named look at how each of the 50 states is faring when it comes to stewardship of public funds.

Alaska tops the rankings, with the Dakotas, Nebraska and Florida rounding out the top five.

Illinois is dead last, followed (led?) by New Jersey, Massachusetts, Connecticut and New York. California is just two spots farther up the rankings at No. 44.

Here’s how Mercatus explains its criteria for tallying the list:

… Senior [George Mason] Research Fellow Eileen Norcross ranks each US state’s financial health based on short-and long-term debt and other key fiscal obligations, including unfunded pensions and health care benefits. The study, which builds on previous Mercatus research about state fiscal conditions, provides information from the states’ audited financial reports in an easily accessible format, presenting an accurate snapshot of each state’s fiscal health.

… This ranking of the 50 states is based on their fiscal solvency in five separate categories:

- Cash solvency. Does a state have enough cash on hand to cover its short-term bills?

- Budget solvency. Can a state cover its fiscal year spending with current revenues? Or does it have a budget shortfall?

- Long-run solvency. Can a state meet its long-term spending commitments? Will there be enough money to cushion it from economic shocks or other long-term fiscal risks?

- Service-level solvency. How much fiscal “slack” does a state have to increase spending should citizens demand more services?

- Trust fund solvency. How much debt does a state have? How large are its unfunded pension and health care liabilities?

Pensions loom large in determining a state’s relative fiscal health, Mercatus observes. “Notably, nearly all states have unfunded pension liabilities that are large relative to state personal income, indicating that all states need to take a closer look at their unfunded pensions, which represent a significant portion of each state’s economy,” the report summary states.

Both last-place Illinois and first-place Alaska — along with Mississippi, New Mexico, Nevada, Kentucky, Hawaii and Ohio — rate poorly when their public employees’ post-employment benefits are taken into account. And mounting payments to meet the future demands of pensioners represents the biggest single threat to the fiscal well-being of most low-ranking states in the study.

“High deficits and debt obligations in the forms of unfunded pensions and health care benefits continue to drive each state into fiscal peril,” Mercatus notes. “Each holds tens, if not hundreds, of billions of dollars in unfunded liabilities — constituting a significant risk to taxpayers in both the short and the long term.”

FWIW...OH #7??? Any improvement of the state’s fiscal health has been at the expense of cities and towns. We’re all being starved of the money needed to maintain local obligations.

The terrible thing is that the Lefties screw up the state that they’re living in and come to a Conservative state that is doing much better, then ruin it with their Dem voting

“Pensions loom large in determining a state’s relative fiscal health, Mercatus observes. “Notably, nearly all states have unfunded pension liabilities that are large relative to state personal income, indicating that all states need to take a closer look at their unfunded pensions, which represent a significant portion of each state’s economy,” the report summary states.”

I would think a lot of jobs could be done by the private sector, thereby eliminating a great deal of the pension problems.

“High deficits and debt obligations in the forms of unfunded pensions and health care benefits continue to drive each state into fiscal peril,” Mercatus notes. “Each holds tens, if not hundreds, of billions of dollars in unfunded liabilities — constituting a significant risk to taxpayers in both the short and the long term.”

Ominous.

Public employee pensions are major factors behind the downfall of Detroit, several California cities, GREECE and soon — Puerto Rico and Chicago.

Ominous indeed.

Good to see, as I’m a public employee in Alaska. We saw the fiscal crisis coming more than 10 years ago, and the legislature went ahead and fixed it when times were flush. Teachers used to have the traditional all-expenses state-funded pension that’s breaking most states now, but the state switched over to a 401k-style pension plan that has been working well so far. Alaska is now in a financial decline due to lower oil prices and reduced extraction, and there’s a lot of angst about it, but the pensions are safe. Maybe thinking about having savings for the future comes from living in the Arctic.

I’ll bet the cops are corrupt in those liberal States too... all this stuff runs hand in hand.

The usurper is from the lowest of the low states, Hawaii and Illinois, yet some felt he could run the country.

Corruption in politics is directly correlated with these rankings. When criminals rule, we pay the price as citizens.

Good to see Wisconsin and Michigan with better rankings.

After looking at this chart, and living in Tennessee, without a state income tax, I was curious to see how the other 8 states were on their fiscal condition.

The conclusion was more than surprising:

All 9 states, that do not have a state income rank, are in the top 23 of fiscally healthiest states.

9 states do not have a state income tax:

Alaska (1); South Dakota (3); Florida (5); Wyoming (6); Tennessee (8); Nevada (12); Texas (19); New Hampshire (20) and

Washington (23)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.