Posted on 02/07/2015 8:46:52 AM PST by Kaslin

Just as Detroit is coming out of bankruptcy, the entire county is about to go under.

This will be especially aggravating because Detroit pensioners are already extremely upset with the pension haircuts they received.

In the "too late to complain now" category, Wayne County now seeks to overturn the Detroit bankruptcy settlement. Lawyers will have a field day with this setup.

Cries of Betrayal

Crain's Detroit Business reports Pension Cuts, Interest Paybacks from Bankruptcy Prompt Cries of Betrayal.

Pension checks will shrink 6.7 percent for 12,000 Detroit retirees beginning in March. Making matters worse, many also must pay back thousands of dollars of excess interest they received.Simple Math Lesson (Yet Again)

It’s a bitter outcome of Detroit’s record $18 billion municipal bankruptcy for David Espie, 58, who will repay the city $75,000 in a lump sum while his $3,226 monthly pension is cut by $216.

As retirement costs swallow larger portions of U.S. city budgets, Detroit’s bankruptcy plan resolved a pension crisis with creative strokes, though at a cost to retirees who thought their benefits were untouchable.

“I feel betrayed,” said Espie, who may abandon plans to move to Alabama.

In addition to absorbing pension cuts, almost 11,000 retirees and current employees must repay an estimated $212 million in excess interest they accrued in a city-run savings plan, which is separate from the pension fund. The annuity plan guaranteed a 7.9 percent annual return even when the pension lost money, and employees also received bonus interest in some years.

They can either pay the money back in a lump sum or have it deducted gradually from their monthly pension check with 6.75 percent interest.

Henry Gaffney, 61, a retired bus driver, said he’ll pay back $56,000 of the $300,000 he saved by deducting $428 from his monthly $3,100 pension check for 19 years. He said he pays $375 more for health insurance each month.

“I may have to find a part-time job,” said Gaffney, former president of Detroit’s bus-driver union. “I guess the city wants us to work until we’re dead

Wayne County is threatening to unravel a breakthrough deal that settled Detroit's bankruptcy case unless it receives land or more than $30 million — money the city needs to bankroll Detroit's revitalization.Too Late

The fight could undo a hard-fought bankruptcy settlement the city reached with its fiercest bankruptcy creditor, bond insurer Syncora Guarantee Inc.

image: http://3.bp.blogspot.com/-fOjPe9oWfIg/VNUgABMEjMI/AAAAAAAAcWg/uu81tVeQnac/s400/Wayne%2BCounty.png

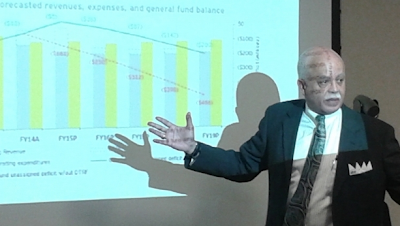

Wayne County needs to close a $70 million budget deficit, shore up pension plans that are nearly $1 billion underfunded and keep its general fund from running out of money in 2016, county Executive Warren Evans said of a recent financial review.Solvency Crisis

Evans announced Thursday the county has averaged about a $50 million annual deficit over the past three years in its general fund budget, which had $49 million of pooled cash last September and could be in a liquidity crisis as early as August, before the fall property tax collection.

An independent financial outlook report prepared for the county by Ernst & Young LLP found that the nearly $500 million general fund is creating a $50 million to $70 million structural debt each year for the county, which already had $159 million accumulated budget deficit at the end of fiscal 2013.

But perhaps most critical is an $850 million unfunded liability in the defined benefit pension plans for the county, which had more than 2,000 full-time employees in 2014. Pension plan contributions, retiree health care costs and some debt service are expected to drain a combined $92 million from the general fund in fiscal 2015.

Evans said the county pension plans were 95 percent funded about 10 years ago, but were only about 45 percent funded in 2013 and are on pace to be 39 percent funded by around 2023 without corrective action.

Local governments need to be reorganized, there is no reason major cities shouldn’t be independent of any county, we urban dwellers don’t need an extra layer of government to tax and oppress us.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.