Skip to comments.

Energy Boom Can Withstand Steeper Oil-Price Drop

Wall Street Journal ^

| Oct. 29, 2014

| RUSSELL GOLD, ERIN AILWORTH and BENOÎT FAUCON

Posted on 10/30/2014 8:14:49 AM PDT by thackney

Some Smaller U.S. Producers Are Likely to Face Pinch From a More-Modest Decline

Oil prices would need to fall at least another $20 a barrel to choke off the U.S. energy boom, industry experts say, though some smaller American producers would face serious problems from a more modest decline.

Small and midsize companies—not global giants—are behind the surge in U.S. oil output, which hit 8.97 million barrels a day earlier this month, according to federal statistics. Some of these drillers have taken on a lot of debt, which was easier to justify when oil was going for as much as $107 a barrel just four months ago.

U.S. crude closed Wednesday at $82.20 a barrel, and far less in some parts of the country where few pipelines are available to move it to refineries. Lower oil prices mean drillers will have less cash to cover their borrowings, especially if crude prices tumble more.

So far, American companies haven’t reacted to the recent oil-price drop: The number of drilling rigs searching for onshore oil in the U.S. has risen slightly since oil prices peaked June 20.

The Organization of the Petroleum Exporting Countries seems to be betting that will change soon. Abdalla Salem el-Badri, OPEC’s secretary general, predicted Wednesday that if current prices hold, half of the U.S. oil that is fracked from shale formations will be uneconomic, leading companies to stop producing it.

That view is at odds with most U.S. forecasters, who say output can remain steady at current prices because companies have cut their costs by finding ways to produce oil more efficiently. For example, the amount of oil coming from each new well in South Texas has nearly doubled since 2012, federal data show.

...economist of ConocoPhillips , said oil prices would need to fall to $50...

(Excerpt) Read more at online.wsj.com ...

TOPICS: News/Current Events

KEYWORDS: energy; oil

1

posted on

10/30/2014 8:14:49 AM PDT

by

thackney

To: thackney

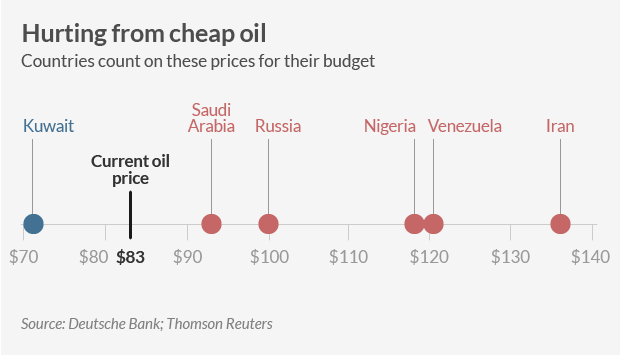

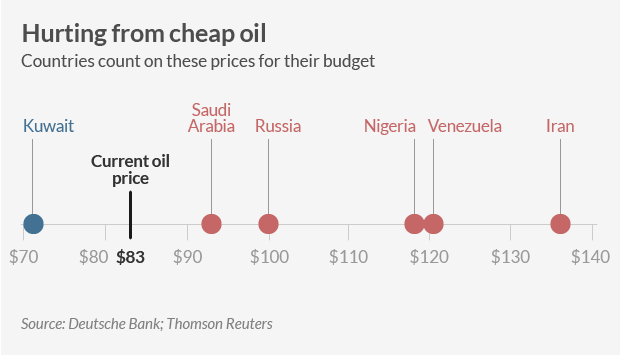

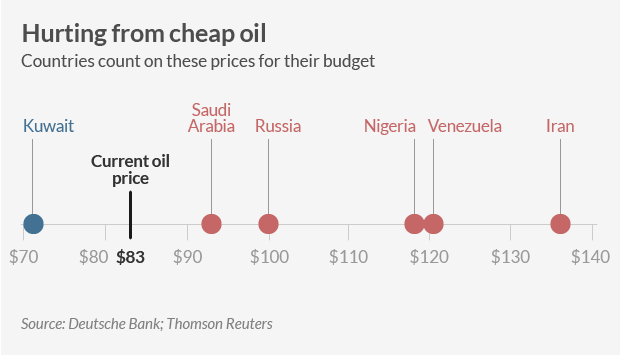

These countries are getting killed by cheap oil

http://money.cnn.com/2014/10/30/investing/cheap-oil-prices-hurt-iran-venezuela-saudi-arabia/ Oil is selling for roughly $83 a barrel on the global market. That's bad news for Iran, Nigeria, Venezuela, Russia, and Saudi Arabia, among others. They need the black stuff to trade at far loftier levels in order to balance their budgets.

Iran's budget, for example, is built on oil at $135 dollars per barrel, according to data from Deutsche Bank and Thomson Reuters compiled by DoubleLine Capital.

Russia has oil budgeted at $100, while Saudi Arabia will break even at $95 per barrel.

“All the oil producers are feeling it. Now the question is who can withstand it the most,” said Phil Flynn, an energy analyst at the Price Futures Group.

Drill or die: Flynn claims that energy producing nations will continue to pump up production because they don't want to risk losing market share.

“It's like a staring contest of who can last the longest selling oil below their budget point. Whoever can hold out longest is going to win,” he said. “They're eating at each other.”

2

posted on

10/30/2014 8:17:23 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: thackney

Drill or die...Do we get a say in this?

3

posted on

10/30/2014 8:22:09 AM PDT

by

Obadiah

(None are more hopelessly enslaved than those who falsely believe they are free.)

To: Obadiah

You can have a say. Not sure anyone at OPEC will care to listen.

4

posted on

10/30/2014 8:29:38 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: thackney

Venezuela and Iran especially will have to split with OPEC soon by boosting production to hold their paradise of despotism together.

5

posted on

10/30/2014 8:34:45 AM PDT

by

shove_it

(The bigger the government, the smaller the citizen -- Dennis Prager)

To: thackney

“That view is at odds with most U.S. forecasters, who say output can remain steady at current prices because companies have cut their costs by finding ways to produce oil more efficiently.”

Leave it to Americans to figure out how to cut costs. It’s become our manufacturing culture.

Maybe we’re able to withstand lower prices than the Saudis thought? Maybe their gamble is going to backfire and they’ll end up the big losers?

6

posted on

10/30/2014 8:35:54 AM PDT

by

ryan71

(The Partisans)

To: shove_it

7

posted on

10/30/2014 8:38:02 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: thackney

How soon before Barry turns the EPA loose on the industry to invoke even more asinine rules that will aid the foreigners? I don’t care if they all fail I am growing weary of the global market and how it usually screws us because we have to be PC.

To: thackney

Gotta hope the low oil prices are hurting ISIS, too.

9

posted on

10/30/2014 8:51:57 AM PDT

by

Vision Thing

(obama wants his suicidal worshipers to become suicidal bombers.)

To: thackney

Thanks for the good news.

One of the best kept secrets with the crisises in Iraq/Syria/? and other oil producing countries, is how the price of gasoline and oil in America keeps coming down.

Increased U.S. production is helping to create an oil surplus on world markets, driving down prices despite a myriad of threats to oil supplies, and doing more to crush Russia’s economy than the sanctions imposed by the U.S. and European Union, said Chris Faulkner, chief executive of Breitling Energy.

http://www.washingtontimes.com/news/2014/sep/8/us-oil-surplus-eases-prices-in-global-crises/?page=all

This is also preventing the Opecker Princes from doubling their price on oil to again cause another major economic recession around the world.

10

posted on

10/30/2014 9:05:16 AM PDT

by

Grampa Dave

(Islam/ISIS = The Ebola of religious/political ideologies!)

To: thackney

Captain Kirk: OPEC !

Don’t bet against American innovation and ingenuity.

I bed that Opec’s strategy fails.

To: Resolute Conservative

But Barry, the America haters and the environmentalist can’t have it both ways in that they want to hurt American business, manufacturing by helping our enemies by hurting the oil fracking revolution here in the USA and at the same time going GREEN by forcing EPA MPG standards for cars, trucks therefore reducing demand in which hurts America’s enemies in the end result.

To: thackney

The great part is that over time, China is becoming the #1 oil customer of the middle east.

Yeah the guys with mafia business practices and 1.5b expendable people to enforce them.

Life as a towel head is gonna change significantly in the next decade, and not for the better.

13

posted on

10/30/2014 1:54:40 PM PDT

by

nascarnation

(Toxic Baraq Syndrome: hopefully infecting a Dem candidate near you)

To: thackney

We gassed up for $2.84 today at Murphy’s.

14

posted on

10/30/2014 4:07:41 PM PDT

by

Georgia Girl 2

(The only purpose o f a pistol is to fight your way back to the rifle you should never have dropped.)

To: thackney

What’s now looking to be off the table is 1 million barrel@ year oil increases from 2016-2019.

Still might get another 500k barrel@ day increase in 2015.

The EIA is now looking to be more on the mark about peak US oil production at 9.4 million barrels@ day next year than they were five months ago.

15

posted on

10/30/2014 8:04:23 PM PDT

by

ckilmer

(q)

To: thackney

Lower priced oil however delivers a real shot in the arm to the US economy—and the world economy driving up GDP — which will eventually drive up demand for oil.

But I’ve not seen any studies on how long it takes for lower oil prices to translate into higher demand for oil.

16

posted on

10/30/2014 9:21:00 PM PDT

by

ckilmer

(q)

To: Grampa Dave

how the price of gasoline and oil in America keeps coming down. No secret. That is a global event.

17

posted on

10/31/2014 4:44:19 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: thackney

Wonder if lower oil prices are keeping inflation down in Japan, like here:

http://www.freerepublic.com/focus/f-news/3221630/posts

Japan’s central bank shocks markets with more easing as inflation slows

Reuters ^ | Oct 31, 2014 | Leika Kihara and Tetsushi Kajimoto

Posted on 10/31/2014, 6:39:04 AM by TigerLikesRooster

Japan’s central bank shocks markets with more easing as inflation slows

By Leika Kihara and Tetsushi Kajimoto

TOKYO Fri Oct 31, 2014 10:47am GMT

(Reuters) - The Bank of Japan shocked global financial markets on Friday by expanding its massive stimulus spending in a stark admission that economic growth and inflation have not picked up as much as expected after a sales tax hike in April

18

posted on

10/31/2014 8:08:17 AM PDT

by

Grampa Dave

(Islam/ISIS = The Ebola of religious/political ideologies!)

To: Grampa Dave

I don’t think personal vehicles and the average fuel expense are quite the issue in Japan as in the US.

19

posted on

10/31/2014 8:11:03 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: thackney

The Opeckers have tried this crap before -

they raise prices to increase profits,

then Texas starts drilling,

then they lower prices until it’s no longer cost effective,

Texas stops drilling,

then they raise prices again.

But I don’t think they can beat the cheap extraction costs that fracking affords.

20

posted on

10/31/2014 8:13:11 AM PDT

by

MrB

(The difference between a Humanist and a Satanist - the latter admits whom he's working for)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson