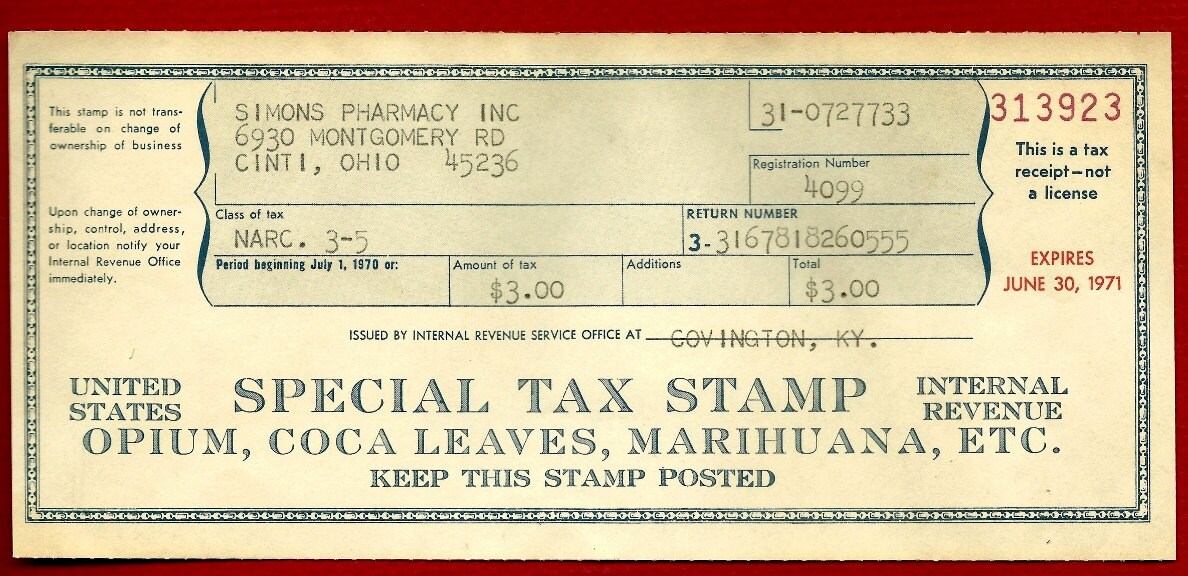

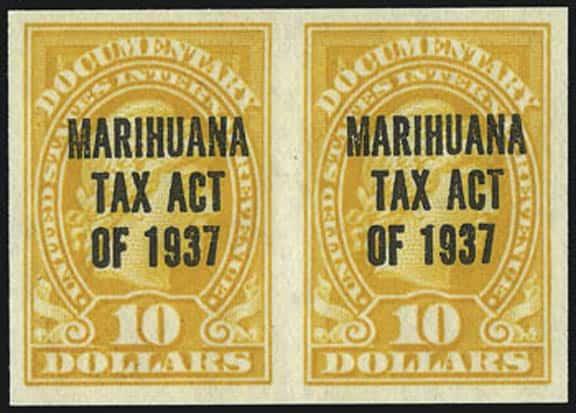

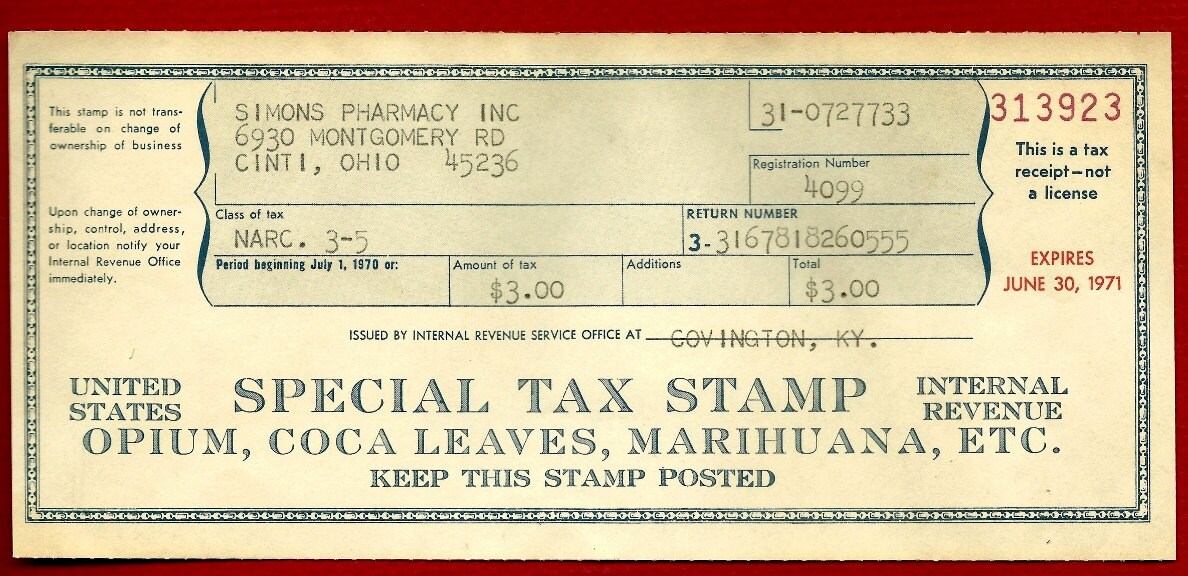

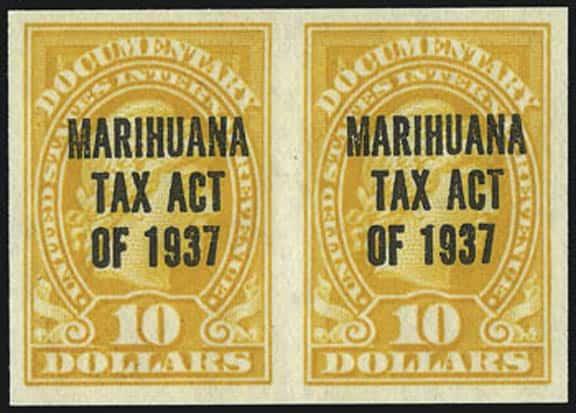

it's not really illegal, you just need the proper tax stamp...

it's not really illegal, you just need the proper tax stamp...

Posted on 07/05/2014 5:43:33 PM PDT by Libloather

(CNN) — Some Colorado marijuana sellers are challenging Uncle Sam. They’re filing a lawsuit — saying the IRS shouldn’t be allowed to collect taxes on marijuana sales because marijuana is illegal under federal law.

Attorney Rob Corry says forcing Colorado’s recreational marijuana businesses to pay violates the United States Constitution.

He has filed a lawsuit in District Court on behalf of clients, some of whom say taxes could be used as evidence in any future prosecution.

“They’re open records and they are admitting to a federal crime. It’s still a federal crime to sell marijuana,” Corry said.

(Excerpt) Read more at fox6now.com ...

IIRC, they brought illegal income under the taxation umbrella as a way to catch gangsters in the Capone era. If they couldn’t catch them for the actual crimes, they could get them on tax evasion.

That's how the got Capone. They got Dillinger with a hail of lead.

Didn’t they finally get Capone for not paying taxes on his illegal earnings?

What a shame to see those dope dealers and pushers jailed for tax evasion. LOL

I expect an Executive Order any day making it legal all around the world!!

I was thinking the Supremes would just call it a “penalty” and move on...

“I believe you have to declare income on unlawful activities.”

Al Capone could confirm this.

“They got Dillinger with a hail of lead.”

Most people don’t know that the Feds managed to waste a couple of innocent bystanders with that little operation.

Likewise for various state and local politicians on the take. The Feds got them for not paying income tax on the bribes and kickbacks.

No profits would mean no taxes on profits.

But then, what would be the incentive to stay in business?

Hmmm... Interesting.

Are you familiar with the Kansas City Union Station Massacre?

I think the final body count was five -- four LEOs and the one criminal who was already in custody. All by "friendly fire". The three perps unleashed a hail of lead, but hit nary a thing -- except the façade of the train station (the bulletmarks are still there).

Fascinating case, trying to sort thru what really happened.

First, as referenced in related threads, please consider the following.

FR: Never Accept the Premise of Your Opponent’s Argument

In a nutshell, the regardless what FDR's Constitutution-ignoring activist justices wanted everbody to think about the scope of Congress's Commerce Clause powers in Wickard v. Filburn, the Supreme Court had arleady historically clarified the following about the federal government's constitutionally limited powers:

The states have not only never delegated to Congress, expressly via the Constitution, the specific power to regulate intrastate commerce, but the Court has also used the example of agricultural production, which is what marijuana is, as an example of intrastate commerce that is off limits to Congress.

The Court has also clarifed that Congress has no power to lay taxes if such taxes cannot be justifed under its constitutional Article I, Section 8-limited powers, intrastate agricultural production not one of those powers.

Regardless that federal lawmakers will argue the idea that if the Constitution doesn't say that they can't do something then they can do it, the Court has also clarified just the opposite, that powers not expressly delegated to the feds via the Constitution are prohibited to the feds.

Note that all the statements above are substantiated below by excerpts from Supreme Court case opinions. Also note that the last excerpt includes the statement about intrastate agriculture as well as powers prohibited to the feds.

”State inspection laws, health laws, and laws for regulating the internal commerce of a State, and those which respect turnpike roads, ferries, &c. are not within the power granted to Congress [emphases added].” —Gibbons v. Ogden, 1824.

“Congress is not empowered to tax for those purposes which are within the exclusive province of the States.” —Justice John Marshall, Gibbons v. Ogden, 1824.

”From the accepted doctrine that the United States is a government of delegated powers, it follows that those not expressly granted, or reasonably to be implied from such as are conferred, are reserved to the states, or to the people. To forestall any suggestion to the contrary, the Tenth Amendment was adopted. The same proposition, otherwise stated, is that powers not granted are prohibited. None to regulate agricultural production is given, and therefore legislation by Congress for that purpose is forbidden [emphasis added].” —United States v. Butler, 1936.r

As a side note concerning the federal government's constitutionally limited powers, please consider the folloiwng. The states would sure be a dull, boring place to grow up and live in if parents were to make sure that their children were taught about the federal government's constitutionally limited powers. /sarc

The IRS has been sending tax bills to marijuana traffickers for years and years-legality of the substance is irrelevant.

That is how the feds busted Al Capone.

For not paying taxes on his ill gotten gains he was sent to prison for tax evasion.

I hope they win, as this could further the push to repeal Amendment 64, which legalized and started this whole mess.

Obviously they never studied how mobsters are charged. The mob has a whole series of front organizations these days to launder their money so they don't get convicted on the tax avoidance charges.

I didn’t know there was a federal sales tax (headline suggests)

it's not really illegal, you just need the proper tax stamp...

it's not really illegal, you just need the proper tax stamp...

The IRS don’t care about legality. They want their cash.

I think they know that this is how they got Capone. The point here is, and the problem which has been pointed out many times by people of all political stripes is that filing a tax return declaring illegal income is a violation of the 5th amendment right against self incrimination. They say they made $1MM selling pot, pay $390,000 in taxes on it, and then 5 years later the feds could throw them in jail and have their own self-sworn and signed “admission” as evidence against them in trial.

I am sure that this fine point has also been adjudicated... but maybe if we are lucky we can get them to amend the tax form so that nothing written on it can be used to incriminate the filer for anything (or at least for anything other than tax evasion). Not posting this to say I agree with the tax scheme, just that this is the way it is.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.