Posted on 05/02/2014 3:19:06 PM PDT by Kaslin

We can't ignore it anymore - the markets are rigged. The LIBOR scandal broke almost two years ago, and the banks found responsible for manipulating that key index are still dealing with lawsuits. Meanwhile, allegations of gold market manipulation have been simmering for over a decade and grew into an inferno after the spot price dropped dramatically last spring.

Yet I'm left wondering what the conspiracy theorists hope to accomplish. Yes, I believe in exposing truth for its own sake and that the individual investor should have the same opportunities in the marketplace as the big institutions. But with these conspiracists, there is often a subtext of, "Because the price is suppressed, buying gold is for suckers." I think this conclusion is precisely wrong.

Even if banks and governments are manipulating the day-to-day price of gold, the metal's long-term fundamentals are stronger than ever. In fact, the reasons for them to suppress the gold price are the same reasons for us to buy gold in the first place.

Let's examine what large institutions may be doing to the gold price and how that affects the long-term gold investor.

Flash Crashes

There are two prominent suspected methods of gold price manipulation. The first is through massive short-selling of COMEX gold futures in the United States. Paul Craig Roberts, former Assistant Secretary of the Treasury under Reagan, is perhaps the best-respected voice calling attention to this controversy.

Roberts argues that large banks, like JP Morgan and Goldman Sachs, wait for periods of low activity in the gold futures market to sell large quantities of futures contracts. This selling drives down the actual spot price of gold, which in turn scares away weak longs and encourages other short-sellers to join in on the action.

These "mini-flash crashes," as they've come to be known, allegedly knock gold down a peg or two right when it is primed for a rally - thereby stealing its momentum. More importantly, Roberts claims, these flash crashes provide support for the US dollar when it looks weak.

The most recent example is a series of mini-flash crashes in March, when the US Dollar Index dropped below the key level of 80. Gold was steadily rising towards $1,400, but after the attack, began falling again. Sure enough, the Dollar Index recovered above 80.

The Foggy London Fix

The other suspected method of gold price suppression is through the London gold fix. This set price is used by large gold owners, including refineries, miners, and central banks, to account for the value of their holdings.The London fix has been around since 1919 and is so old-fashioned it's no wonder it's coming under more scrutiny.

Five member banks of the London Bullion Market Association get on the phone every weekday at 10:30 am and 3 pm London time. They discuss how much gold they and their clients want to buy or sell, then adjust the price until the buy and sell orders are within 50 gold bars of each other. The price is then "fixed" for publication in US dollars, British pounds, and euros.

The whole process can take anywhere from few minutes to over an hour. At any time, the member banks can pause the proceedings to speak with clients. This basically means that information about the gold price trickles into the general market before the fix is officially set.

Economists and academic researchers have begun looking into irregular gold price movements during the afternoon fix, which might indicate collusion to drive gold down. Researchers found that between 2004 and 2013, whenever the gold price made a large move during the afternoon fix, two-thirds of the time it was a decline.

The UK Financial Conduct Authority has started investigating the London fix more closely, while earlier this year a US lawsuit was filed against the five member banks based upon this research. Tellingly, Deutsche Bank has resigned its seat on both the gold and silver fixing boards. While such a seat sold for a million dollars during the last transfer a decade ago, apparently it is now given up for free.

If That's the Fix, Where's the Catch?

I certainly cannot argue that flash crashes and private phone calls between bankers are not suspicious. But what's the real takeaway for the physical gold investor?

The evidence of manipulation for both COMEX gold futures and the London fix are large, downward movements in the price of gold at suspicious times of the trading day. More than anyone else, this is going to affect gold speculators who are looking to turn a quick profit.

I've always warned serious investors against the risky world of gold futures and other paper gold derivatives. Besides the complexity of the market itself, attempting to become a short-term trader puts the small investor in a league with powerful interests and shady practices. As the father of value investing Benjamin Graham was known to say, "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." This means that short-term, the market is like an election or other popularity contest - with all the corruption that implies. But over time, what matters most is underlying value.

[My views on the present undervaluation of gold are well established, so I won't re-hash them here. For those curious, please read through past editions of my newsletter.]

The important question is: could these manipulations affect the long-term value of gold?

The Big Picture

The research suggests that London fix manipulation could have been occurring since 2004. So the claim is that throughout gold's greatest bull market in living memory, banks were colluding to drive the price lower. Clearly they were incapable of stopping gold's rise altogether, if that was truly their intention.

I think it is more likely that either they were simply trying to game the market to buy gold at a discount for their clients, or perhaps they had a vested interest in slowing gold's rise.

Since gold is still widely recognized as a safe haven, investors use it as a gauge of the health of the underlying economy. If gold shot up too quickly, these banks may have reasoned, it could trigger a panic flight from fiat currencies.

In fact, that is what happened in the credit crisis of '07-'08. As we saw, major Western banks quickly turned from highly profitable to completely insolvent. Since then, coordinated government intervention has done its best to re-create the tenuous situation prior to the crash - so the incentive to suppress gold remains.

Paul Craig Roberts has made the same point - the gold price is being manipulated to make the dollar appear stronger, rather than to cripple the gold market. If over the last several years, the Dollar Index had continuously fallen and the gold price steadily risen, it would have undermined the Federal Reserve's claims that quantitative easing had saved us from the brink of collapse. Viewed this way, a self-interested collusion between major banks and their patrons in government makes sense. Imagine if you were facing the destruction of your wealth, power, and status - and had the means to forestall it.

Fortunately for gold investors, forestalling is not the same as correcting. Just as any manipulation prior to the credit crisis didn't prevent it from occurring, today's tactics will not lessen massive public debts nor return value to an inflated currency.

A Second Chance

If gold price manipulation is true, then these banks and governments have done a tremendous favor to those who understand the gold market. Unexpected volatility and bull market corrections shake out those speculators who are trying to make a quick buck or who do not have the courage of their convictions. Investors have been given a multi-year free pass to learn about monetary policy, commodities, and investing while gold waits at affordable prices to be bought.

Perhaps absent these manipulations, gold would have grown into a frenzied mania as the whole Western world attempted to safeguard their wealth at once. In fact, I believe this is a likely outcome as the various schemes that are keeping the West afloat start to come apart.

If you're skeptical of big banks and big government, gold manipulation shouldn't put you off investing in sound money. Instead, consider it as you would a gift horse. Instead of looking it thoroughly in the mouth, smile and graciously accept your good fortune.

You can’t eat gold.

correct

How about we just stop there.

OK out with it, what is your heartburn with this guy...

Today’s economy is a video game played by the people who wrote it, and know all the back doors. Anyone playing who isn’t one of them is part of their entertainment.

If you know there’s a fix, trash the fix and sweep the table.

George Soros knows how to do that, economically. Much to our chagrin, politically.

if the gold price is fixed, how come it goes up and down so much?

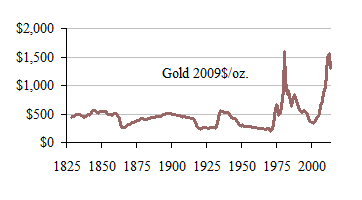

lol! OK, I apologize for slipping off the issues, but my immune system always makes me break out in hives whenever PCR's name comes up. Seriously, what we're talking about here is how the price of gold soared to a peak, and now is falling back--

--just like it did three decades ago. The idea that gold's price is supposed to not go back to $500 this time is unrealistic, and to blame the return to normal on some kind of conspiracy is right out of tin-foil land.

You bet.

Fact is, in real bad times, ya couldn’t swap a chunk of gold for a ham sandwich or a gallon of fuel.

The fix in gold has only one reason. Fort Knox and the New York Fed. has NO GOLD. If it ever came out that the fat lady has sung the show would be over and the curtain would come down. The market right now reminds me of a ship sinking as the band plays “ Nearer to thy O Lord”

The markets are fixed...until it’s you, the shoe repair man, the moonshine distiller, the cattle rancher, and the farmer.

Are you going to trade a beef cow for shoe repair? (No)

Are you going to trade two heads of lettuce for one head of cattle? (No)

Are you going to trade a quart of your best moonshine for a shoe repair? (Maybe)

The point being there will ALWAY be a place for currency of some sort.

Native Americans sometimes used sea shells....was there counterfeits created...no doubt, but the had to go collect those shells => hence, they added value!

I did find a recipe for golden cake.

One of my concerns with gold is just that.

In a time of crisis why would people swap anything for a piece of gold? Since they’re not used to it being “money”, why would they suddenly swap something of real value to them for something they wouldn’t know how to use?

And if its market or inflation ups and downs that a person is trying to protect himself against, then these same people have to admit that gold also goes up and down.

Don’t forget, Peter Schiff is the “best-respected voice” [snort] who said gold will hit $5000/oz. Although in fairness, I think his time-frame hasn’t elapsed.

Is that supposed to be inflation adjusted dollars? Gold was certainly not $500 and ounce in the 19th century. More like $20 an ounce.

People always need a medium of exchange. When fiat money is no good, historically people have used gold and silver. My real problem with gold is it’s worth too much for everyday transactions. How is a pile of gold Eagles going to help you buy a chicken off your neighbor? A silver quarter would be more practical. I suggest stocking a pile of old quarters and dimes, along with your actual survival supplies.

Yes. 2009 dollars.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.