To: Gaffer

Wow!. A wild expansion of the money supply results in inflation. Who could have guessed?

4 posted on

04/15/2014 6:02:34 AM PDT by

Mr. Lucky

To: Mr. Lucky

They’ve been using the T-Bill purchases to legitimize the debt and to purchase Mortgage Backed Securities in the stock market for near 5 years. It was to the tune of $85 billion per month (about half/half). They recently reduced it to $75 Billion....

As a measure of comparison, remember when the Democrats were all pissed off about the Republicans actually holding Obama to his own sequestration promises and they cried like stuck pigs over a one time $85 billion. They’ve blown over $1T a year holding up the stock market and backing the national debt (with electronic promise scrip) and they politic over their own damn promises.

8 posted on

04/15/2014 6:07:29 AM PDT by

Gaffer

(Comprehensive Immigration Reform is just another name for Comprehensive Capitulation)

To: Mr. Lucky

Wow!. A wild expansion of the money supply results in inflation. Who could have guessed?

We’ve only been talking about it here for years. :-D

To: Mr. Lucky

Exactamundo. The Fed has been on an unprecedented money printing binge for five years. There are consequences to actions like this.

To: Mr. Lucky

I thought quantitative easing could go on forever with no noticeable effects too... how odd. Almost like discovering gravity pulls objects down...

21 posted on

04/15/2014 6:30:17 AM PDT by

GOPJ

(MSNBC reporters couldn't spot a criminal if he was at the company Christmas party.)

To: Mr. Lucky

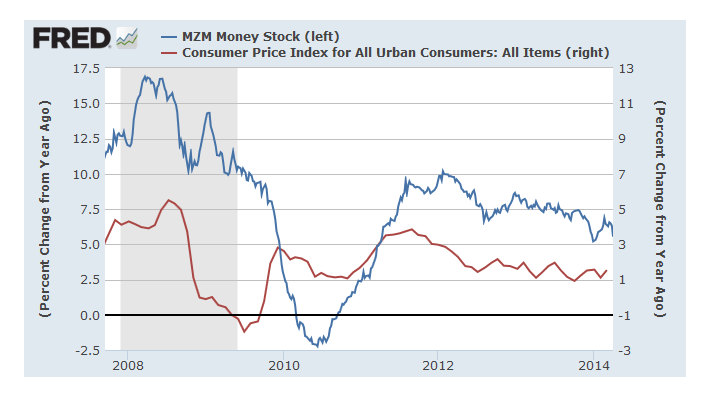

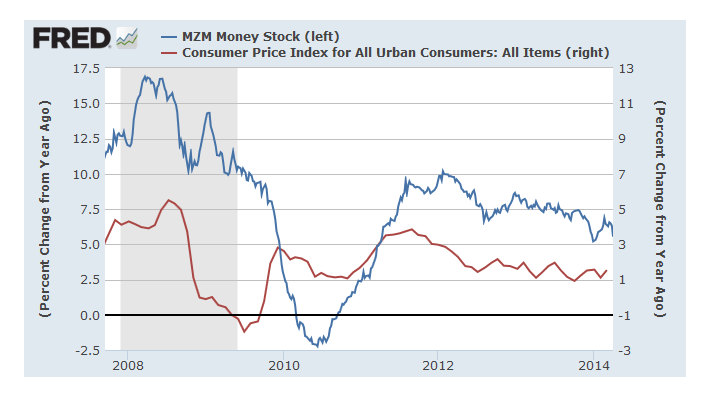

A wild expansion of the money supply results in inflation.That's the idea going around lately; it makes sense that having the gov't print lots of money makes prices and wages soar. Thing to understand is that it's not what's been happening.

Money supply growth used to be 10-15% yearly back when we had an economy, but when the war on business began people laid off employees and the unemployed stopped buying. That crashed prices, and it was the deflation in 2009 that crashed the money supply in 2010:

The wild swings were '08-'11 and since then both money growth and inflation have been winding down.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson