Posted on 06/22/2013 9:29:41 PM PDT by blam

Has the Great Financial Crisis Finally Arrived?

Stock-Markets / Credit Crisis 2013

June 23, 2013 - 05:33 AM GMT

By: Graham Summers

The technical damage from yesterday’s bloodbath was severe.

Spain, which lead the “Europe is saved” party from the lows last year has just taken out its trendline. So much for the “crisis is over” proclamations. We’re heading back down in a big way.

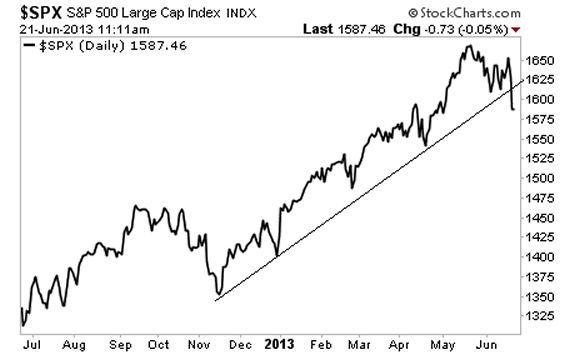

The S&P 500 has also taken out its trendline. QE Forever is dead and buried. What will hold the market up now?

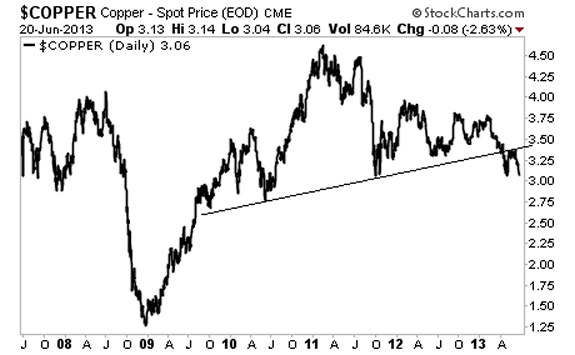

Copper is indicating that the entire post-2009 “recovery” is ending. We’re moving back into the 2008-collapse.

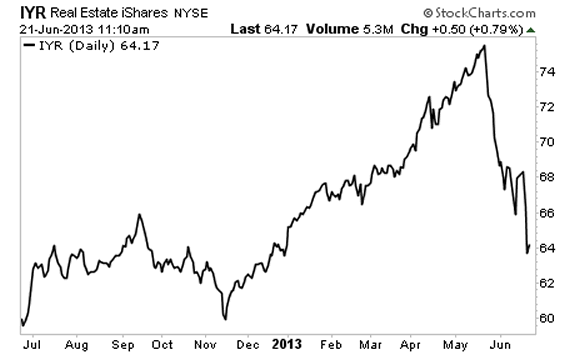

Real estate is totally imploding. Yesterday’s drop saw a very nasty return to “reality.”

This is just the start. I warned Private Wealth Advisory subscribers in our most recent issue that higher rates were coming noting a collapse in bonds in Europe and the emerging market space.

This could easily become truly catastrophic. The world is in a massive debt bubble and the Central banks are now officially losing control. The stage is now set for a collapse that could make 2008 look like a joke.

If you are not preparing in advance for this, the time to get started is NOW.

Hi, Blam! Looks like the collapse has started.

Wonder if Monday June 24, 2013, will be forever known as ‘Black Monday’.

Bush’s fault.

Thanks for posting this, blam.

How? By buying more ammunition? I think it is possible for wars to be caused by economic melt downs.

They are saying another thing that makes for instability is too many have bought on margin and prices are inflated. It's not just Monday. We could be having a lot more of these bad days, not for the faint of heart.

The economy has been a house of cards for longer than I might remember so fearmongering could be a self-fulfilling prophecy.

The Fed relents on tapering, a rebound record high, cheering on CNBC, count to 10000 and then put on your short. Most important is the Bubblevision celebration.

I personally wouldn't short the market with your Franklin. I stink at investing.

this will keep happening until the general public is completely stripped from it’s wealth.

then what?

The bond market is the key to watch. US 10 year T bills have jumped from 1.9 to 2.4 in less then 30 days. Watch the Italian, Spanish and Greek bond yields rise also. If it exceeds 6 percent their gov budgets are not going to be able to service the interest payments to the bondholders. If that happens it is call national default. ECB will be on the hook for more bailout money. Red flags should go up when the yields on these European countries exceed 5 percent. Right now they are at 4.5 percent and trending upwards.

It’s NEVER going to end. As soon as the economy collapses, every retard will blame conservatives for “holding Obama back”. Once all conservatives are exterminated, the retards will eat their own. Then nothing will remain. Wonderful...

BTTT

Red flags should go up when the yields on these European countries exceed 5 percent. Right now they are at 4.5 percent and trending upwards.

.5 percent isn’t much.

I need to invest in a company that makes those flat wheel barrels that you can stack money on top off.

I’m not unsympathetic to your POV, however pessimism short circuits any effort to get fr4om point A to point B.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.