Posted on 06/21/2013 10:31:27 AM PDT by blam

U.S. Treasury Bond Market Implosion Has Officially Begun

Interest-Rates / US Bonds

June 21, 2013 - 06:02 PM GMT

By: Graham Summers

The QE Infinite parade officially ended yesterday when Bernanke hinted at tapering QE later this year or in mid-2014.

I first warned about this in mid-May writing,

"If Bernanke is going to step down (as hinted by his decision to skip out on the Jackson Hole meeting) he’s not going to want to leave with the Fed going at QE 3 and QE 4 full throttle.

Instead his best bet would be to take his foot off the gas a little bit, giving his replacement a little room to maneuver if things get ugly.

This is precisely what Bernanke is trying to do. However, there is another far larger issue at work here.

The primary driver of stocks for the last four years has been the hope of more Fed stimulus. This hope has put a floor under ALL asset prices as market participants KNEW the Fed was involved in the markets. As a result EVERYTHING (stocks, bond commodities, even currencies) has been artificially propped.

By calling for the end to QE 3 and QE 4, the Fed has begun to remove these market props. Which means that the markets are now going to start adjusting to where assets prices REALLY SHOULD BE.

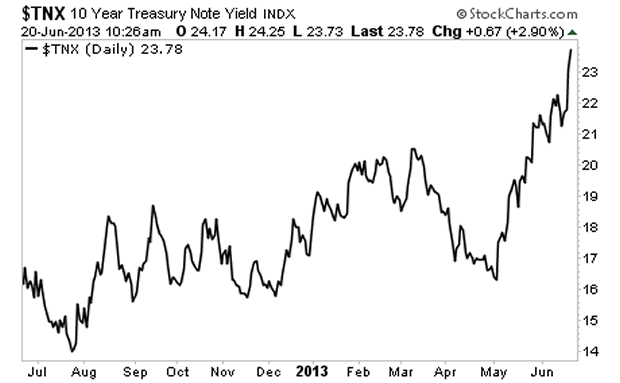

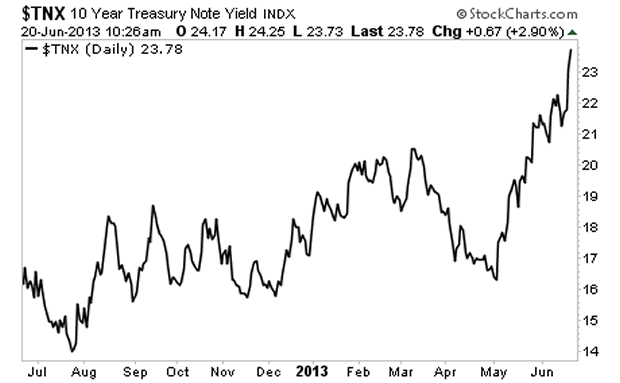

Take a look at the spike in the 10-year Treasury yield:

This is just the start. I warned that higher rates were coming noting a collapse in bonds in Europe and the emerging market space.

This could easily become truly catastrophic. The world is in a massive debt bubble and the Central banks are now officially losing control. The stage is now set for a collapse that could make 2008 look like a joke.

If you are not preparing in advance for this, the time to get started is NOW.

100% correct, but the real question is “When will it really happen?” Like you I have a place to go to, this summer I will have a well to draw all the freshwater I can use, the end of paper money is unstoppable, but how much time do we have? I really thing that we have 10 to 15 years.

Huh, here we thought it was all Bush's fault, or the millionaires and billionaires, or rich white people, investment bankers, free traders. Come on, we all know the cause and we all know the solution.

Blue horseshoe loves TBT

“I would like to prepare but exactly how does one do that.”

Beans, bullets and Bibles?

Well, according to the author of this article, Graham Summers, you should subscribe to the Graham Summers newsletter.

From the article:

"I first warned Private Wealth Advisory subscribers about this in mid-May writing..."

Notice that in the FR excerpt, the phrase "Private Wealth Advisory subscribers" was omitted!

Summers might be right, who knows? But his primary motivation is not to inform you. It's to scare or motivate you into buying something from him.

are the Treasury Bonds purchased at work by payroll deduction in the 80’s & 90’s safe? I have a bunch never cashed out. Internet says they are still drawing 4% interest.

The central banks are buying up enormous quantities of gold which is now below the cost of production. How long can the paper market continue to drive the price down when there is a massive transfer of physical?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.