Skip to comments.

Is There a Shortage of Physical Gold?

Townhall ^

| 04/25/2013

| Michael Shedlock

Posted on 04/25/2013 9:04:03 AM PDT by SeekAndFind

Demand for gold coins has surged following the record price plunge in gold last week. Demand is so high that the U.S. Mint Runs Out of Smallest American Eagle Gold Coin.

The U.S. Mint ran out its smallest American Eagle gold coin after demand surged following the biggest drop in futures prices in 33 years.

Sales of the coins weighing a 10th of an ounce were suspended after demand more than doubled in 2013 from a year earlier, the Mint said today in a statement. Total sales of American Eagles in April have almost tripled from a month earlier, according to Mint data on the website.

On April 15, gold futures in New York plunged 9.3 percent, the most since 1980. Retail sales and jewelry demand soared in India, the world’s top buyer, and China, the second-biggest. Coin sales also surged in Australia.

The Mint also sells 22-karat American Eagle coins of 1 ounce, half an ounce and a quarter of an ounce.

The U.S. Mint suspended sales of silver coins in January for more than a week because of lack of inventory. Sales of the coins jumped to a record that month.

Bullish or Bearish?

It's possible to make a bullish or bearish argument out of this shortage. The bullish argument is simple: demand is strong. The bearish argument is small investors are a contrarian indicator just as they were with silver in January.

I am not taking a short-term stance one way or another, so don't ask. I do like my chances longer-term as I explained at the Wine Country Conference. See Mike “Mish” Shedlock: A Brief Lesson in History.

Shortage of Physical Gold?

Some writers have spun this story into the message there is a shortage of physical gold. No there isn't. There is a temporary shortage of certain coins, no more no less.

Divergence Between Physical Gold and Paper Gold?

Other writers have noticed the price premium on small denomination coins and concluded there is some sort of "divergence between physical gold and paper gold".

Once again, that's nonsense. Premiums on small denomination coins is not the same a general premium on physical gold itself.

How do I know?

Easy: If I went to buy or sell at GoldMoney (and GoldMoney only deals in physical metals with allocated, audited storage), I would pay the same small markup as before, based on the current futures price.

Here is another way to tell. Go buy or sell a one ounce bar and see how much it costs or how much you can get. Here's a hint: your selling price will not fetch $1900 as it once did, nor would it cost you over $1900 to buy.

Smackdown by Naked Shorts?

Many claim blatant manipulation by naked shorts. Mercy! Under this theory, shorts piled on to the tune of 163,000 gold futures. Really?

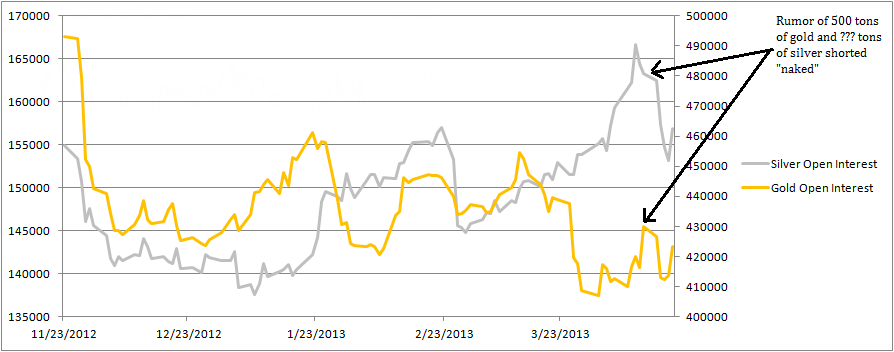

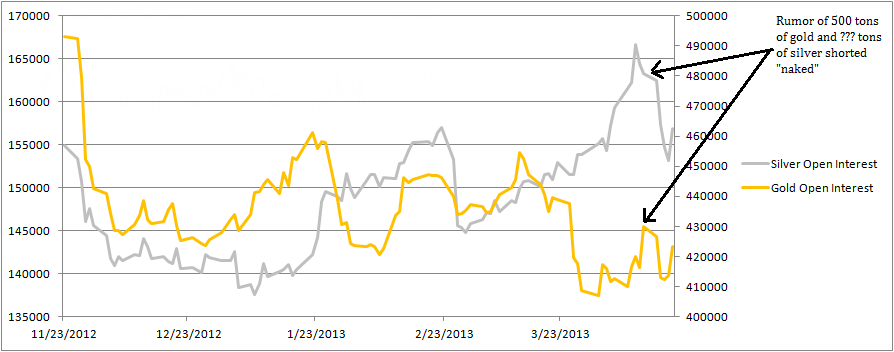

Keith Weiner tackles that theory for the Acting Man Blog in The Last Contango. Here is the pertinent chart.

Weiner asks "If someone had sold 163,000 futures to cause the price to drop, then wouldn’t the open interest [in futures] have risen? If Santa went down chimneys, wouldn’t there be soot on his red and white uniform?"

The answer to both questions is of course "yes". Instead, the chart shows a 16,000 open interest drop in gold futures and a 12,000 drop in silver futures.

Ignore the Hype in Both Directions

Bulls blame every drop on manipulation and frequently tout preposterous price targets. Bears cite jewelry demand and other nonsense as if it's important (and it isn't).

It is best to ignore the hype and silliness on both sides.

Fundamentally, what has changed? I suggest nothing.

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: gold; goldchart; goldshortage; physicalgold; shortage

Navigation: use the links below to view more comments.

first 1-20, 21 next last

To: SeekAndFind

Even if gold is in jewelry, it's still in country and it's not going away. Stuff doesn't rust worth a darned.

Those ancient Hindu temples with $45 billion in gold ~ they're still in India. Folks know where the gold is.

2

posted on

04/25/2013 9:07:47 AM PDT

by

muawiyah

To: SeekAndFind

The Gold market is full of fraud and manipulation. Small gold coins are probably harder to counterfeit with titanium. The paper “gold” is probably as convoluted ad derivatives and as easily manipulated.

3

posted on

04/25/2013 9:10:18 AM PDT

by

mountainlion

(Live well for those that did not make it back.)

To: SeekAndFind

Shortage of precious metals. Shortage of ammo.. When do the food shortages start?

To: Obama_Is_Sabotaging_America

They did a test to see what would happen here in Silicon Valley in 2008 I believe. All of a sudden, rice was suddenly nowhere to be found in the world, we were led to believe.

Two years or so later, I think a test on lentils in India was done as well.

Like everything else we’re waiting for, it will come with no reason and no warning, like the Cyprus bank robbery.

5

posted on

04/25/2013 9:24:13 AM PDT

by

jiggyboy

(Ten percent of poll respondents are either lying or insane)

To: SeekAndFind

I was reading up on the possibility of the physical transmutation of mercury, which we have in abundance as waste from the oil companies, into gold, with the use of gamma radiation, and the conclusion reached was that the energy required would make the cost of the gold about $18,000/ounce.

However, this would be “basic science laboratory transmutation.” Technological production of transmuted gold could likely improve this efficiency considerably.

For example, the idea of gamma radiation passing through a single “thin sheet” of mercury, resulting in a small number of gold molecules, would be inefficient, since most mercury molecules would be missed. However, having that radiation pass through a thousand layered sheets raises the odds of a productive collision considerably.

To: yefragetuwrabrumuy

Well, while your zapping mercury, I think I’ll take a look at silver. Something very interesting going on there.

To: SeekAndFind

The argument that there can ever be a "shortage" of physical gold is pretty funny. It's like any other commodity: the price will rise to meet the demand for whatever quantity exists. We won't "run out," but we may be priced out.

To: jiggyboy

They did a test to see what would happen here in Silicon Valley in 2008 I believe. All of a sudden, rice was suddenly nowhere to be found in the world, we were led to believe.Maine Potato Default

They had quaint ideas about crime. (Love the tire prices.)

9

posted on

04/25/2013 9:46:41 AM PDT

by

Stentor

To: mountainlion

The Gold market is full of fraud and manipulation. Small gold coins are probably harder to counterfeit with titanium. Umm... I think you mean tungsten?

10

posted on

04/25/2013 9:47:37 AM PDT

by

Sparticus

(Tar and feathers for the next dumb@ss Republican that uses the word bipartisanship.)

To: Bernard Marx

Yes; but might be; in any event; a time for audit at Fort Knox.

11

posted on

04/25/2013 9:48:36 AM PDT

by

cricket

(Push Back Lib Agenda's; Lib propaganda; Lib/Marxist PC; Lib Leaderhship)

To: SeekAndFind

http://www.tulving.com/goldbull.html

Tulving has much more in stock now. Hideous markups ($5/oz - usually at spot) for junk silver, but otherwise markups look like they have for years.

12

posted on

04/25/2013 9:51:05 AM PDT

by

Atlas Sneezed

(Universal Background Check -> Registration -> Confiscation -> Oppression -> Extermination)

To: Mushroom Gravy

Pretty big minimums too! A tube of qty.40 1/2oz gold coins, 20 oz total weight is out of the price range of people who’d like to buy a couple small coins.

13

posted on

04/25/2013 9:57:23 AM PDT

by

Jack Black

( Whatever is left of American patriotism is now identical with counter-revolution.)

To: mountainlion

"with titanium"

Tungsten is much closer to the density of Au.

14

posted on

04/25/2013 10:18:47 AM PDT

by

Paladin2

To: mountainlion

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/4/25_Sinclair_-_This_Is_The_Beginning_Of_The_End_For_The_Gold_Shorts.html

http://www.goldmoney.com/gold-research/alasdair-macleod/physical-gold-vs-paper-gold-waiting-for-the-dam-to-break.html?gmrefcode=gata

15

posted on

04/25/2013 11:07:12 AM PDT

by

SVTCobra03

(You can never have enough friends, horsepower or ammunition.)

To: SeekAndFind

Max Keiser dismembers Joe "Weaselthal" of Business Insider and interviews Andrew Maguire. Skip to the interview if your not interested in Max and his girl Stacy.

Keiser Report: Stalinism of NYSE (E436)

16

posted on

04/25/2013 11:20:44 AM PDT

by

Stentor

To: Jack Black

Yes, they do very large volume low mark-up. it’s for comparison only. it’s where the coin dealers can buy to replenish their stock. But I suspect they prefer to underpay for what walks in instead.

www.gainesvillecoins.com is good for low volume buyers.

17

posted on

04/25/2013 11:39:27 AM PDT

by

Atlas Sneezed

(Universal Background Check -> Registration -> Confiscation -> Oppression -> Extermination)

To: SeekAndFind

The Mint also sells 22-karat American Eagle coins of 1 ounce, half an ounce and a quarter of an ounce.Anyone got scaled pic of a quarter ounce of gold? I'd be afraid it would fall into a crack in the drawer or something.

18

posted on

04/25/2013 11:47:04 AM PDT

by

TangoLimaSierra

(To the left the truth looks like Right-Wing extremism.)

To: TangoLimaSierra

Never mind. Found one. A little bigger than I thought.

19

posted on

04/25/2013 11:53:23 AM PDT

by

TangoLimaSierra

(To the left the truth looks like Right-Wing extremism.)

To: Sparticus

Umm... I think you mean tungsten?

I think you are right,

20

posted on

04/25/2013 1:09:32 PM PDT

by

mountainlion

(Live well for those that did not make it back.)

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson