Posted on 04/21/2013 8:03:09 AM PDT by blam

Gold Price Forecast Drop Target $787.40

Commodities / Gold and Silver 2013

April 21, 2013 - 04:00 PM GMT

By: Brian Bloom

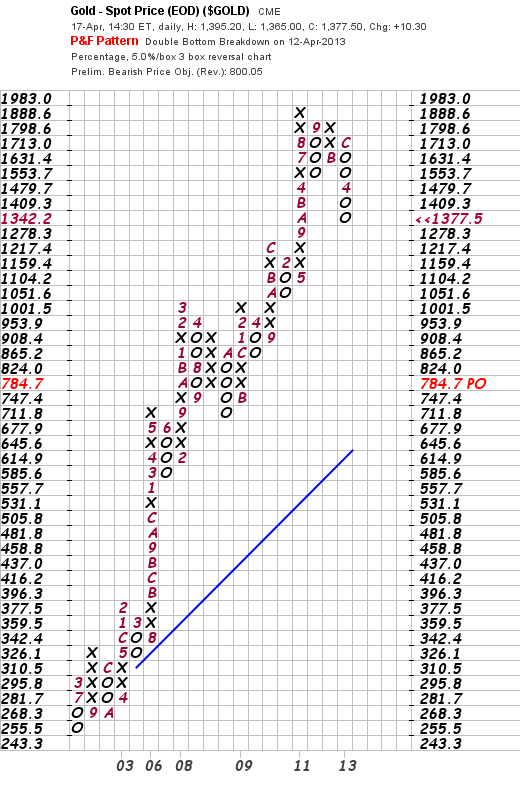

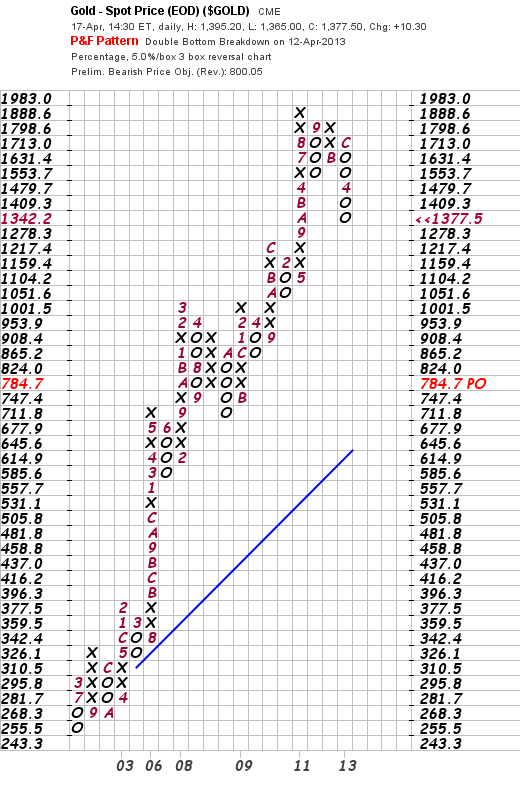

The unemotional 5% X 3 box reversal P&F chart below (courtesy stockcharts.com) shows a measured move target for gold at $787.40.

No time horizon is capable of being forecast.

Too few understand that:

· the Fed’s purchases of existing government debt does not add to the money supply and, therefore, it is not inflationary. (I read a scathing “expose” of Dr Bernanke’s stupidity and it was clear that the person attacking him did not understand the bookkeeping entries. )

· the slowing velocity of money across the planet serves to place a drag on both the money multiplier and the increasing money supply. Therefore, the Fed’s printing of money is losing its potency to drive the US economy, which is potentially deflationary.

· the underlying reason for the Cyprus deal structure was that the Greek public debt would have had to have been marked to market if the deal was not done in that way. If one of the two banks had been liquidated, the value of Greek sovereign debt would have become transparent. In turn, this would have triggered a cascading domino collapse of supposedly solvent banks who would have been forced to mark to market

· this situation of keeping sovereign debt on the books at full value is not sustainable. At some point, European sovereign debt will have to be marked to market. Should this happen, it will certainly be deflationary

· the people who will benefit most from deflation are the mega wealthy; the people who will have access to both income and cash in an environment of falling asset prices.

With these facts in mind, the above chart becomes believable, but I stress that the time it might take is unknowable. I have been blogging for eleven years trying to explain the real drivers of the economy. After due consideration, for me to continue blogging now will be pointless. My two fact-based novels make constructive suggestions. If people are interested in my thoughts in that regard then they should read those novels.

For gold to go under the equivalent of $1000/oz, I think we would need to see a one world/basket of currencies with gold confiscation. The one thing fiat currency has over metals is its legal status as currency. However, there is still too much competition among the banksters and global powers when it comes to monetary policy.

There are a lot of evil greedy folks on top, but I don’t believe that they can act harmoniously and in concert against the little people. The people on top still like to compete against each other.

Datapoint for you:

Two days ago, I was at a subcontractor’s facility. Among other things, he electroplates silver on industrial items such as circuit breakers.

I asked him what he did when the silver price “dropped” last week.

“Well, I picked up the phone and ordered as many ounces of silver anodes as I could afford.”

The salesman for one of the largest silver anode suppliers in the world told him, “Good thing that you called now. After we pull your order, OUR WAREHOUSE IS GOING TO BE EMPTY!”

Have you personally purchased some Kitco PMs for delivery since the price drop?

Or is their PM “availability” at 4.5% over spot listed only to solicit phone and internet inquiries, where they switch you over to “other investment opportunities?”

If you haven’t ordered it and had it sent for delivery, I’d be suspicious of their actual availability at 4.5% over spot.

Yep. GMTA.

I don’t see where it says only shipping out side of USA.

I haven’t purchased from Kitco since the drop but I have purchased from them before. I had to get a cashiers check for the total amount, sent it to them and then within about a week an a half my metal arrived.

.. now I understand why those radio ads offering to trade your soon-to-be worthless dollars for their gold. Golly gee.

Goldbug ping.

Why are gold Mine stocks being hit so hard?

Um, but the Fed's purchases [from its member banks] supply them with cash which they use to buy new debt. Those dollars then enter the economy through the government's spending. Highly inflationary.

Does this guy even know what he's talking about?

The central banks and the governments of the world still have some breathing room, there are still a lot of carrots out there. For how long, depends on how quickly we descend into the abyss from here. Of course by the time they do go beyond the IQ of the carrot, getting physical metal will be next to impossible.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.