Posted on 03/10/2013 6:21:43 AM PDT by 1rudeboy

There are two basic approaches to fixing our crappy economy.

The first approach is called "austerity."

This logic for this approach rests on the theory that our economy is crappy because our government is spending more than it takes in and that the resulting deficit is creating "uncertainty." Once this deficit spending is reduced, this theory goes, uncertainty will ease, and confidence will return. And then our economy can recover in earnest.

The second approach is called "stimulus."

The logic for this approach rests on the theory that our economy is crappy because consumers are unemployed and broke and have little money to spend. Because consumers have little money to spend, this theory continues, the government should take up the slack and deficit-spend until unemployment drops and consumers have more money to spend. This government spending, in other words, will keep the blood flowing until the patient is healthy again.

Five years ago, economists were locked in a fierce debate about which approach was better--"stimulus" or "austerity."

Thankfully, that question has now been answered.

The "stimulus" approach is better.

Importantly, this question has not just been answered theoretically.

It has been answered empirically.

(Excerpt) Read more at businessinsider.com ...

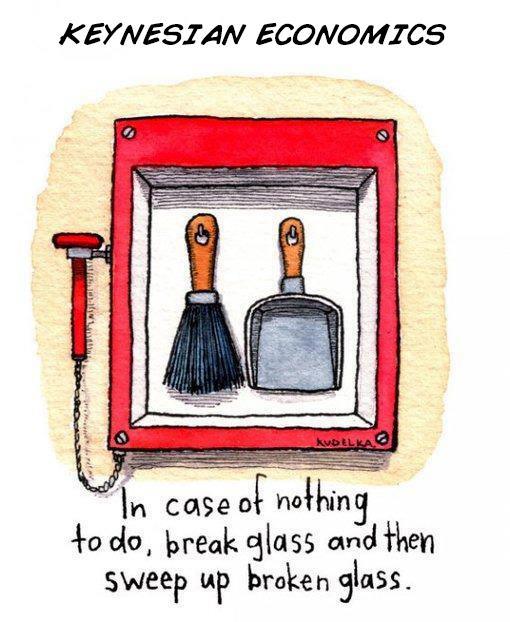

Then replace tools and glass.

Return to step one.

What this “genius” doesn’t understand is that in the short term, austerity hurts, but works in the long term - a place we haven’t gotten to yet.

Even worse, in the short term, “stimulus” works (because the market is being flooded with fiat money) - but it is disastrous in the long term by significanlty de-valuing currency - and in the long term, collapsing the economy.

And we haven’t gotten there yet either.....

The result of Marxist-induced short-term thinking and a culture that wants immediate gratification - as well as avoiding any sacrifice or pain for the long term good.

DUH!

The solution is not austerity, but a radical decrease in the size of government and the repayment of debt though forced indentured servitude of liberals and the lazy. Let's call it workfare.

It also just happens to be fair to the productive.

This article is partially correct. The trick is in what you stimulate. If you line contributors pockets with cash, sending money to so-called green projects that employ few people, and reward the unemployed for not working, that is not “stimulus”. If you put the money towards large long-lasting public infrastructure projects that employ significant numbers of people, not only during their construction, but in their operation and maintenance, that is stimulus. This would include transportation and energy transport systems. Taking coal and other energy systems away are anti-stimulus projects.

Another way of saying it is that spending can keep the economy going in the short run, but the short run would not matter if people had adequate savings. They don’t because it has been penalized. Investment is what creates long run strength and that has been discouraged by both monetary and fiscal policies. So we are left to creating new lamer bubbles between new crises.

Energy transport is private. The only thing the government can do (and does regularly) is get in the way.

So cutting a gigantic bloated government, spending 50% more than it takes in, by a mere few point in growth is now economic austerity?

I have a bridge to sell Mr. Blodget if he really believes that.

If ‘stimulus’ worked, we’d have a booming economy after Obama...The WORST economic recovery in 60 years says otherwise!

Nope, sorry. Communist economies never created a middle class. Someone needs to read Thomas Sowell’s book “Basic Economics”.

Untill then, see the following link. “Cutting Government Would Boost The Economy”.

http://reason.com/archives/2013/03/10/cutting-government-would-boost-economy

I will agree that spending on roads is a legitimate governmental function.

This is the so-called proof/evidence the author cites for approving Keynesian economics.

Seems to ME to be an exagerrated view of the approach. GDP is being used to "prove" the economy is better: a growing GDP, we are told, is proof of a better economy.

But the growth is solely due to government taking wealth away from the private sector!

Such type of growth isn't optimal or even desirable--it is anti-growth in the long run!

Look, why not just SHUT DOWN the private sector and allow the government to spend ALL the money, and MORE--print it up....as Bernanke has been doing....

Will we see prosperity? No.

The argument that Europe "has" tried austerity seems to be a bit ridiculous, too...Europe has only turned that way, and with fits and starts, after many more years of going down the path of socialism...America hasn't been as bad as Europe, though the Clown and his predecessors Nixon, Johnson, and FDR were trying mightily to shove us down that path.

Both “austerity” and “stimulus” do more harm than good when done by governments to stimulate economic growth.

Think of John Doe as the patient and Uncle Sam as the doctor. John Doe is flat on his back and sick in bed, unable to work and certainly unable to pay the doctor.

Under “austerity” therapy, the doctor would just leave John Doe alone to rest until he was well again. If he gets better on his own he can go back to work and pay the doctor. If he doesn’t get better right away, the temptation is for the doctor to monkey around with more “treatments” and “gimmicks” that will run up the bill. If John dies, the doctor gets nothing.

Under “stimulus” therapy, the doctor forces his sick patient to work to buy his own food and medicine to make him get well so he can work and pay the bill. If the patient is unable to work, the doctor steals food and medicine from his other patients or from John to give to him, which causes John to owe a lot more. If the doctor gives John too much of the wrong kind of medicine, he will stay sick and could even die.

As you can see from this analogy, the best outcome is for the quack doctor to do nothing but make the patient comfortable so he can get better on his own.

No, in the austerity case the doctor tells the patient to lose weight.

I’m always up for an education, so please correct me where I’m wrong.

Isn’t government spending one of the elements of GDP? By increasing government spending you haven’t really directly increased economic production, making GDP an faulty indication of the health of the economy. It’s like a self-fulfilling prophecy.

The author also says, “...this approach rests on the theory that our economy is crappy because our government is spending more than it takes in and that the resulting deficit is creating ‘uncertainty.’”

That’s not right either. Government spending is taking capital from the market that it would otherwise use to grow/expand. Austerity slows that bleed from the market. It’s like the supporters of “Stimulus” think that taking gas out of your car and pouring it on the road will make your car go farther.

The “stimulus” approach is better.

Stimulus aimed at giving huge amounts of cash to international bankers has done nothing short term except to inflate the stock market and fill the personal pockets of the crooks.

The government is not all-controlling. The economy recovered despite, not because, of policy.

“What looks like a recovery, a rally or an increase in consumer confidence may just be the effect of elites passing money among themselves.”

Socialism Is Legal Plunder - Bastiat 1801=1850

BIG GOVERNMENT IS CRONY SOCIALISM

Cut, cut, CUT! Death by a million cuts. Pick any one of their tiniest programs (Big Bird gets you a million angry bird march on D.C.) and cut it. Listen to the socialists whine. How about social security (built on the backs of dead Americans)? They even insulated it from discussion by labeling it “the third rail”. Look at the firestorm when President Bush wanted to allow you to put some of your confiscated funds into the market. I could go on and on...

Pick one. Any one. Cut it out.

Plunder and Death - Socialism/Totalitarianism 2.0

live - free - republic

That's false.

The economy is "crappy" because the government takes too much out of the private sector. The entire budget of the United States could be borrowed -- all deficit spending. But if the level of spending was low enough, business could still expand.

The deficit is almost beside the point. It's the level of spending.

What this “genius” doesn’t understand is that in the short term, austerity hurts, but works in the long term - a place we haven’t gotten to yet.Even worse, in the short term, “stimulus” works (because the market is being flooded with fiat money) - but it is disastrous in the long term by significantly de-valuing currency - and in the long term, collapsing the economy.

The economy is NOT improved by enlarging a dependent class of non-producers!

The “proof” is that the U.S. economy still sucks!

There is NO merit in contrasting European austerity with U.S. stimulus, as it proves nothing, given the long standing socialist nature of those European economies.

The “Uncertainty” present in the U.S. economy derives from a growing regulatory burden, compounded with the threat and reality of ever increasing taxes.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.