Skip to comments.

Mitt Romney suggests cutting mortgage interest deduction on eve of presidential debate

News Day ^

| October 2, 2012

| THE ASSOCIATED PRESS

Posted on 10/02/2012 7:52:58 PM PDT by RaisingCain

In an interview Monday night with Denver TV station KDVR, Romney said, "As an option you could say everybody's going to get up to a $17,000 deduction. And you could use your charitable deduction, your home mortgage deduction, or others — your health care deduction, and you can fill that bucket, if you will, that $17,000 bucket that way. And higher income people might have a lower number."

A Romney adviser said changes in other areas — a taxpayer's personal exemption and the deduction or credit for health care — would also be taken into account if deductions were limited as Romney suggested. Combining changes to those two areas with the limit on deductions would maintain Romney's goal of keeping tax burdens the same for wealthy and middle income taxpayers, the adviser said.

(Excerpt) Read more at newsday.com ...

TOPICS: Business/Economy; News/Current Events

KEYWORDS: breaking; obamaeconomy; obamafailure; obamarecession; romneyryan2012

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-85 next last

To: Red Badger

But you want to deduct your mtg interest ON TOP of your standard deduction? Sounds pretty loop-holey to me, my FRiend.

How much are your property taxes? Very low I’d have to imagine.

Standard is, what 5800 single and twice that for married filing jointly. If your mtg. interest and property taxes and state income taxes don’t exceed that, well, what can you do? Take the higher, standard deduction.

Seriously if those three things are below the standard deduction for your filing class you should be very happy!

61

posted on

10/02/2012 9:58:17 PM PDT

by

jocon307

To: tallyhoe

Flat tax no deductions and everybody pays!I prefer a national sales tax. Thus even if you are on welfare you have "skin in the game" if taxes go up. If the basic national sales tax goes up, those on welfare are not given additional compensation due to the increase in taxes. That is real "skin in the game."

62

posted on

10/02/2012 9:58:36 PM PDT

by

cpdiii

(Deckhand, Roughneck, Mud Man, Geologist, Pilot, Pharmacist. THE CONSTITUTION IS WORTH DYING FOR!)

To: RaisingCain

Fiddling with the tax code while Rome burns. Bleh.

63

posted on

10/02/2012 10:07:34 PM PDT

by

EternalVigilance

(If your only choice is evil, you've either died and gone to hell, or you're a Republican.)

To: RaisingCain

“A simpler tax system?”

Truly, it should be simpler.

I’ve prepared my own taxes forever and now I’m actually a part time paid preparer for a major tax prep chain whose name I will not say (like I was on a game show!).

The tax code is ridiculously complicated, there are all sorts of income limits (but not THE SAME income limit) for various deductions. There are all sorts of convoluted accommodations that have been made due to the dissolution of the standard family unit (see: qualifying relative, qualifying child, earned income tax credit, head of household filing status). There are all kinds of crazy credits that might/might not come into play.

And bear in mind, I’m only qualified to do a return for an individual or family. I’m not doing any returns for businesses, other than those who are self-employed.

As a bookkeeper I did do EMPLOYER payroll tax returns (Federal, NY and NJ) for many years. Those are also ridiculously complicated with all sorts of income limits (but not THE SAME income limits), etc.

I’m very smart, and obviously I’m into this stuff. In fact there’s real thrill I get when I start out with a nice, blank 1040 and am ready to solve the puzzle of what Mr. & Mrs. X owe to Uncle Sam.

But, in all reality, it shouldn’t be that way. It shouldn’t be a puzzle and it shouldn’t require a person to be “smart” or “into it”.

As Free Americans it should be simple and easy for each of us to determine how much we need to “kick in” for our government to keep running for another year.

And let me state for the record, I am 100% unwilling to pay one penny more than I already pay.

So, work it out. It’s such a knot now I’m pretty sure the price of simplicity is already in there, somewhere.

64

posted on

10/02/2012 10:13:51 PM PDT

by

jocon307

To: jocon307

We have no state income tax in Florida, our property taxes are fairly low, being keyed to the real estate value of the property, and have a homestead exemption for the first $25k value.

Since we have no state income tax to deduct, they allow us to use the state sales tax instead, which is 6%, 0% on food and medicines, but only a portion of it can be claimed, and you have to have receipts for all of the claimed part.

Overall, you are right, I am happy in Florida, taxwise.

But, here in Florida, the local County Government sets the millage rates. AND the local county Board of Education has taxing authority separate from the county government. AND so does the county Fire Districts. Each of these taxing authorities are elected officials and can be removed at the next election. I live in an unincorporated area, but if I lived in a town, then they have taxing authority as well. The state taxes phone, nat gas, cable and electrical services and gasoline, tobacco, beer, wine and liquor, just like most states do.

That is why we have so many yankees moving here everyday.......

65

posted on

10/02/2012 10:24:01 PM PDT

by

Red Badger

(Is it just me, or is Hillary! starting to look like Benjamin Franklin?.................)

To: Red Badger

“Since we have no state income tax to deduct, they allow us to use the state sales tax instead, which is 6%, 0% on food and medicines, but only a portion of it can be claimed, and you have to have receipts for all of the claimed part.”

I don’t think you are right bot the receipts. There are tables you can use to determine your sales tax deduction, depending on your state/locality (if there is a local sales tax, like, for example, NYC has) and income. Of course, if you make a major purchase like a car or something on which you paid sales tax, yes, you’d need a receipt for that.

I’m for a flat tax, right of the top, on any earned income. Even if it cost me my part time job.

Even my rich liberal boss was for this.

I suppose if he and I are both for it, it will never happen, but it should is a good guess.

66

posted on

10/02/2012 10:33:57 PM PDT

by

jocon307

To: jocon307

I agree, we should have a flat tax for everybody. Everybody should pay something. When you have a huge percentage of voters that pays no taxes, essentially, you invite corruption into the system.

I am reminded of the episode of the original Star Trek (A Cut of the Action) where they went to a planet whose governments were based on the 1920’s gangster wars in Chicago (where else?). In one scene, Oxmix (Vic Tayback) was The Boss of his district and a young woman came in complaining about the electricity in her building needing some work. She said something like, “I pay my 10% cut and for what? This kind of service?” Then Oxmix said, “Get out, I’ll take care of it!”.

If everyone pays their ‘cut of the action’ people would be more responsible for whom they vote.........

67

posted on

10/02/2012 11:01:55 PM PDT

by

Red Badger

(Is it just me, or is Hillary! starting to look like Benjamin Franklin?.................)

To: cpdiii

Flat tax no deductions and everybody pays! I mean everybody even welfare!!!

68

posted on

10/02/2012 11:25:01 PM PDT

by

tallyhoe

To: CharlesWayneCT

“You eventually spend every dollar you make — or else you lose it somehow. It’s not useful as wall decoration.”

Cain’s tax plan encourages savings and promotes the really big buys. No one is going to be spending every penny they take in unless they’re like the U.S. government with a severe debt problem.

“Under the current tax system, you got taxed when you earned it. If you then replace part or all of the income tax with a sales tax, those people who have money in the bank that was already taxed will now pay tax again when they spend that same money. “

Which is already the situation, except we’re paying for the taxes the federal government imposes on businesses through the cost of goods we buy.

To: MNJohnnie

“Let face it, a certain number of you will condemn anything Romney does.”

And you will support ANYTHING the GOP nominee does.

70

posted on

10/03/2012 2:56:50 AM PDT

by

KantianBurke

(Where was the Tea Party when Dubya was spending like a drunken sailor?)

To: Attention Surplus Disorder

He should get pounded over this one.

To: Lib-Lickers 2

In theory, yes, but in reality what will happen is he will get the elimination of mortgage deductions through, but the tax rates will stay the same, resulting in massive tax hikes for the middle/upper middle class. High earners cant deduct but so much anyway and low earners get so many credits, they dont pay. This will hike taxes on homethe owning families with household incomes between $60k and $120k... essentially the republican base.

To: RaisingCain

Mr. Romney touting of this and RomneyCARE,

goes along with his absence each week.

Does he want to unconsciously LOSE?

73

posted on

10/03/2012 4:46:18 AM PDT

by

Diogenesis

(Vi veri veniversum vivus vici)

To: plain talk

flat tax, mitt. no deductions Congressmen and Senators will NEVER give up their primary source of income

74

posted on

10/03/2012 5:03:02 AM PDT

by

Roccus

To: KantianBurke

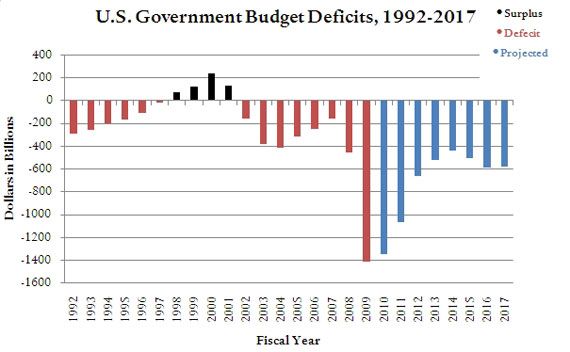

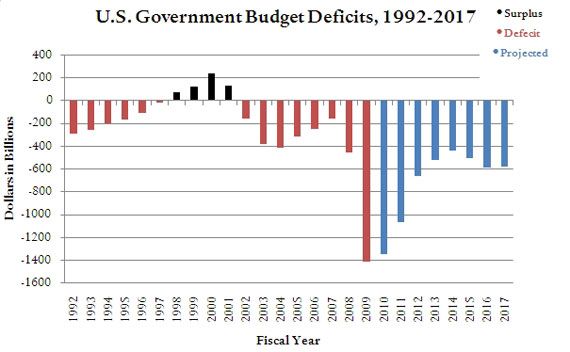

FY 2007 was the last Bush/GOP Congress FY 2011 was last Obama/Dem Congress

When you insist on blaming Bush for this chart, you display yourself completely ignorant of any facts. Congress, not the Executive sets the budget.

When you then add that to your habitual interjection of sophomoric ad homine attacks in your posts, you merely make succeed in making yourself look not only stupid but childish as well.

75

posted on

10/03/2012 8:53:33 AM PDT

by

MNJohnnie

(Giving more money to DC to fix the Debt is like giving free drugs to addicts think it will cure them)

To: RaisingCain

What are you going to do with your money, if you don’t eventually spend it? Are you going to burn it? Use it to paper your walls?

The only point of HAVING money is to temporarily track the product of your labor, so you can later convert it into goods and services you want.

Sure, we save up — for retirement, to buy a house, to live well in our old age.

I guess you might save up your money so you can give it to your kids. But then they will spend it. If you convert your money into something of personal value, it’s just paper.

And this argument obscures the point. Let’s say you spend two years saving up to buy a new car with cash, for $30,000. You had to make $45,000 to save $30,000, because you are in the 33% tax bracket.

Now, just before you buy your car, we change to the 9/9/9 plan. You go to buy your $30,000 car. But you can’t, because in order to buy the $30,000 car now, you need $32,700 (The 30,000, plus the 9% sales tax).

So that $2700 is additional tax on the money that was already taxed. The final plan may be good or bad on its own merits, but the transition from an income tax to a sales or value added tax harms those who have saved money.

To: RaisingCain

actually it is just setting an alternative min tax for all.

IOW no more class of takers everyone can do “whatever” for tax deductions up to a point.

it is an option for discussion. It is more honest than free phones for everyone!

77

posted on

10/03/2012 9:15:04 AM PDT

by

longtermmemmory

(VOTE! http://www.senate.gov and http://www.house.gov)

To: MNJohnnie

Your idiotic chart deliberately undercounts Dubya's big spending ways. How? By not taking into account the destructive recession which began on HIS watch and led to Obama's election. TARP anyone? As for your silly justification "Oh it was Congress' fault" - Dubya had the veto pen. Care to explain why that schmuck never used it to control said spending? You bots sing the same old tunes it's like its still 2004 and Medicare Part D just passed.

78

posted on

10/03/2012 1:59:31 PM PDT

by

KantianBurke

(Where was the Tea Party when Dubya was spending like a drunken sailor?)

To: KantianBurke

Thank you for proving my point.

Perhaps if you tried to make an intellectually coherent rational response once in while people might start taking your posts seriously.

79

posted on

10/03/2012 2:07:57 PM PDT

by

MNJohnnie

(Giving more money to DC to fix the Debt is like giving free drugs to addicts think it will cure them)

To: MNJohnnie

Coward. Try addressing any of the points raised.

80

posted on

10/03/2012 2:10:21 PM PDT

by

KantianBurke

(Where was the Tea Party when Dubya was spending like a drunken sailor?)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-85 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson