Skip to comments.

Study: Tax Cuts for the Rich Don't Spur Growth

CNBC ^

| 09/17/12

| Robert Frank

Posted on 09/17/2012 4:27:59 PM PDT by sirchtruth

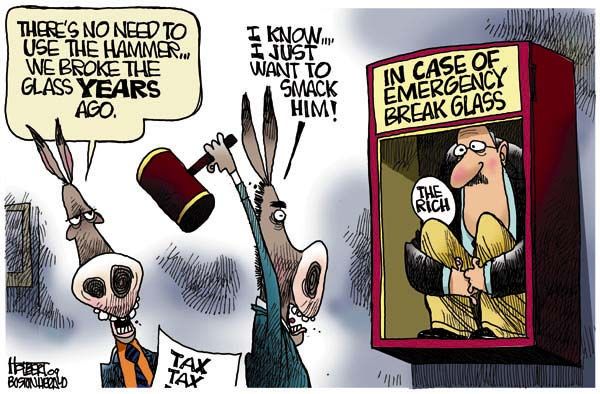

Cutting taxes for the wealthy does not generate faster economic growth, according to a new report. But those cuts may widen the income gap between the rich and the rest, according to a new report.

A study from the Congressional Research Service -- the non-partisan research office for Congress -- shows that "there is little evidence over the past 65 years that tax cuts for the highest earners are associated with savings, investment or productivity growth."

In fact, the study found that higher tax rates for the wealthy are statistically associated with higher levels of growth.

(Excerpt) Read more at finance.yahoo.com ...

TOPICS: News/Current Events

KEYWORDS: poor; taxes; wealthy

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-51 next last

To: mo

You could ask John F KennedyGood call!! ;-)

21

posted on

09/17/2012 4:41:05 PM PDT

by

sirchtruth

(Freedom is not free.)

To: svcw

Bwahahahaha.

Yes, it IS non-partisan in the sense that it’s ignoring the Growth the JFK tax cuts caused right along with the Growth the Reagan tax cuts Caused.

“There has never been a Nation that has taxed itself into prosperity.” Winston Churchill

22

posted on

09/17/2012 4:41:38 PM PDT

by

To-Whose-Benefit?

(It is Error alone which needs the support of Government. The Truth can stand by itself.)

To: sirchtruth

If you tax ALL income (not just that of the rich) at 100%, we still have a gaping deficit. If taxing everybody at 100% does not solve the problem, taxing the rich at 100% does even less to solve the problem.

A heavily-graduated income tax is plank #2 of the Communist Manifesto, but don't you DARE call them COMMUNISTS.

|

|

The Ten Planks of Karl Marx's Communist Manifesto

(and How Statists Implement Them) |

|

- Abolition of private property rights (via high property taxes, restrictive zoning laws, "fair housing" edicts, environmental and "wetlands" regulations, UN Agenda 21, etc.)

- Institution of a heavily graduated income tax (by calling it "taxing the rich")

- Abolition of all rights of inheritance (through a confiscatory estate tax on "the rich")

- Confiscation of the property of enemies of the state (through lawless application of asset forfeiture and eminent domain)

- Centralization of credit into the hands of the state (Federal Reserve, Federal Trade Commission, TARP, etc.)

- Centralization of the means of communication and transportation into the hands of the state (FCC, DOT, FEMA, etc.).

- Consolidation and subjugation of all major industries to central government control (FDA, EPA, OSHA, ICC, NLRB, EEOC, etc.)

- Mandatory labor union membership (public-sector unions, unionization of 21-million Obamacare health care workers, automatic withholding of forced union dues, "card check," etc.)

- Equitable redistribution of all wealth (TANF, SSI, EITC, SNAP, etc.)

- Free public education (and food and health care and cell phones and Internet access, etc.)

|

|

23

posted on

09/17/2012 4:42:31 PM PDT

by

E. Pluribus Unum

(Government is the religion of the sociopath.)

To: sirchtruth

...but...but...Why aren't we all rich like we should be if taxes cause wealth.?

We should be pretty well off by now, don't you think?

24

posted on

09/17/2012 4:42:43 PM PDT

by

Aevery_Freeman

(All Y'all White Peoples is racist!)

To: sirchtruth

Tax cuts for the rich probably don’t spur growth as much as many would like to believe......HOWEVER, that doesn’t mean they’re bad.

If you really want to spur growth, combine those same tax cuts with the elimination of the tax on manufacturing, eliminate the ridiculous regulation on the same, produce cheap energy for industry, pass right to work laws.

Tax cuts for the rich just gives them money to invest elsewhere and who can blame them. Give them a reason to invest in America.

25

posted on

09/17/2012 4:42:56 PM PDT

by

cripplecreek

(What does it profit a man if he gains the whole world but loses his soul?)

To: sirchtruth

Increasing costs spurs growth... so that's how it works!

26

posted on

09/17/2012 4:45:31 PM PDT

by

uncommonsense

(Conservatives believe what they see; Liberals see what they believe.)

To: sirchtruth

In fact, the study found that higher tax rates for the wealthy are statistically associated with higher levels of growth.Is this article a figgin parody?! Everything claimed in this word arranging B.S. is the exact opposite of reality!

Sheer stupidity!

27

posted on

09/17/2012 4:47:52 PM PDT

by

sirchtruth

(Freedom is not free.)

To: sirchtruth

They also found that water does not cause drowning. And there is no correlation between the wood, bears and doodie.

28

posted on

09/17/2012 4:51:04 PM PDT

by

jdsteel

(Give me freedom, not more government.)

To: AdmSmith; AnonymousConservative; Berosus; bigheadfred; Bockscar; ColdOne; Convert from ECUSA; ...

29

posted on

09/17/2012 4:52:16 PM PDT

by

SunkenCiv

(https://secure.freerepublic.com/donate/)

I totally agree with this . We may not like to admit it but most of the wealthy just sit on their money. How many are entrepeuners

30

posted on

09/17/2012 4:54:35 PM PDT

by

Hones

To: sirchtruth

Congressional Research Service Wrongly Implies Lower Tax Rates Don’t Strengthen Economy

Curtis DubaySeptember 17, 2012

The Congressional Research Service (CRS) set out to make a convincing case that lower income tax rates do not strengthen the economy. It failed, but in so doing, it called into question the quality of CRS analysis and the institution’s credibility as non-partisan.

The CRS is supposed to provide expert, objective, non-partisan research analysis to Congress. Most of the time, the CRS performs this function admirably and diligently; the longstanding episodic exception has been in tax policy. The most recent example of this partisan divergence is a report setting out to do the impossible: use historical data to argue that lower rates do not encourage stronger economic growth and, by implication, that higher marginal tax rates such as those espoused by President Obama do not discourage economic growth.

The CRS report presents a slew of periods between 1945 and 2010 comparing the top marginal income tax rates and capital gains rates with economic growth rates. From these correlations the author concludes that lower rates do not correlate with stronger economic growth.

In fact, these stylistic correlations prove nothing. In short, the economy is more complicated than this simplistic approach can acknowledge. For the analysis to prove anything, it needed to account for countless other economic and policy factors, many specific to a given period, and determine how those factors influenced economic growth in the period in question. With this as background, the analysis would then have to isolate the effect lower rates had on growth.

http://blog.heritage.org/2012/09/17/congressional-research-service-wrongly-implies-lower-tax-rates-dont-strengthen-economy/

31

posted on

09/17/2012 4:56:48 PM PDT

by

kcvl

To: sirchtruth

What this argument fails to incorporate is that it isn't a matter of whose wealth is taxed. It is a matter of pulling capital out of an economy.

The rich don't put their wealth in their mattresses...it is reinvested with or lent to others.

So when taxes are increased on the so-called rich, the rich don't suffer. The capital to pay for the taxes is taken from those who want to borrow it or from those whose projects need it as investment.

As a Socialist/Communist/Collectivist, Obama doesn't understand this. His is a linear world in which he must take away from some to give to others. Obama wants the wealthy to suffer so that the poor can thrive. That never happens, but that false concept of "fairness" is dominant in Communism.

Communism doesn't work because it ignores the human desire to create. Communism doesn't work because it destroys the human desire and will to create.

Communism is a war on creativity and invention...it is a war on individual humanity.

Communism is a hive mentality!

32

posted on

09/17/2012 4:59:50 PM PDT

by

RoosterRedux

(Obama: "If you've got a business -- you didn't build that. Somebody else made that happen.")

To: sirchtruth

First of all, where in the history of the United States was there a tax cut just for the rich? An a priori test of what's being jokingly referred to as research can't even form a testable hypothesis due to the compound effects of tax cuts at other brackets. Looking at savings rates in isolation is also a joke, since it is additional demand for goods and services associated with a tax cut that spurs growth, not increased savings. (The assumption, I guess, is that increased savings leads to more capital formation. This does no good unless that new capital is plowed back into the system as investment, and that only occurs if demand is rising. What fool invests in plant and equipment when he has 40% idle capacity as it is?) If I had any of these clowns in my econ class, they'd have to retake the course before I'd unleash them on the next econ course.

33

posted on

09/17/2012 5:03:30 PM PDT

by

econjack

(Some people are as dumb as soup.)

To: 103198

34

posted on

09/17/2012 5:13:04 PM PDT

by

103198

To: Hones

I totally agree with this . We may not like to admit it but most of the wealthy just sit on their money. How many are entrepeunersWould you like an economics lesson because I'm sure one will be provided on this thread soon enough...Like maybe post#31.

Who do you think the "wealthy" are in this country?

35

posted on

09/17/2012 5:17:04 PM PDT

by

sirchtruth

(Freedom is not free.)

To: Reverend Wright

ok, so let me get this straight... according to liberals, taxing cigarettes reduces smoking, taxing gasoline reduces driving, taxing carbon will save the earth but raising income and capital gains taxes has no economic effect ?

Government taxes what it wants to stop or get rid of. Makes sense. /sarc

36

posted on

09/17/2012 5:38:21 PM PDT

by

PieterCasparzen

(We have to fix things ourselves.)

To: sirchtruth

I see..

BAD=Letting the rich keep their own money

GOOD=Giving the rich people's money to the government

37

posted on

09/17/2012 5:55:36 PM PDT

by

evad

(Deception & Lying. It's what they do.. It's ALL they do... And they won't stop.. EVER!!)

To: griswold3

The two years with the largest amount of income taken from citizens by U.S. taxing authorities are 2000, and 2007 at just below 37%. Following each year the country experienced a recession.

To: All

39

posted on

09/17/2012 6:00:48 PM PDT

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: sirchtruth

So much for the Kennedy and Reagan tax cuts.

Must have been a right-wing fantasy.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-51 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson