Skip to comments.

100% of U.S. Jobs Added Since 2010 Have Been Self-Employment,... (shortened title)

Townhall.com ^

| June 16, 2012

| Mike Shedlock

Posted on 06/16/2012 5:12:25 AM PDT by Kaslin

Here are some charts from Reader Tim Wallace that help explain my report a few days ago that 23% of Small Business Owners (Approximately 6.21 million) Report "No Pay for a Year"; New Zealand, Singapore, US, Best Places to Start and Run a Business

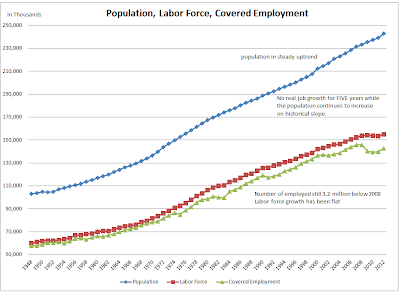

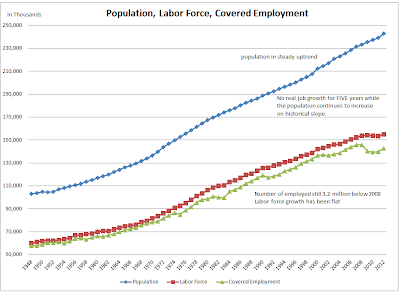

The first chart below shows actual employment of covered workers compared to the civilian population and labor force. Covered employees are those eligible for unemployment benefits (working or not). Some are currently collecting those benefits.

In the following charts, "covered employment" or "net employment" refers to those with benefits and currently working.

Population, Labor Force, Covered Employment

click on any chart for sharper image

Self-employed workers and contractors are not eligible for unemployment benefits even though they have to contribute to state unemployment insurance schemes. It believe it is government-sponsored fraud to have to pay unemployment insurance when there is no chance of ever collecting it.

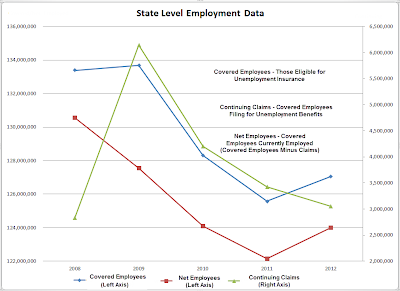

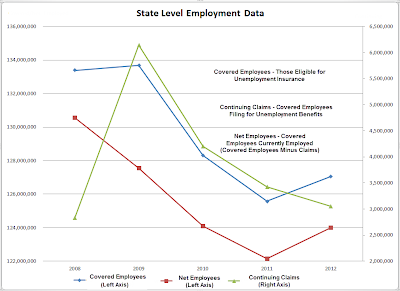

The next chart shows state level employment data. Net covered employees (those currently with a job covered with unemployment benefits) was calculated by subtracting continuing unemployment claims from the pool of all covered workers.

Covered Employees, Net Covered Employees, Continuing Claims

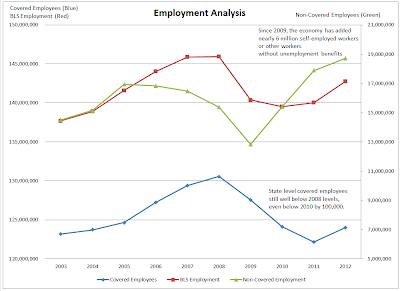

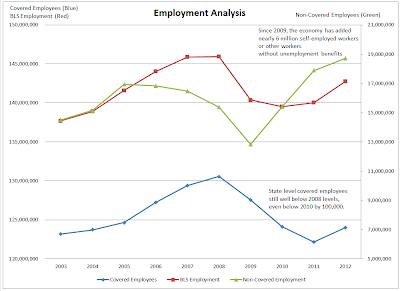

The next chart compares BLS employment numbers to net covered employees (those actually working).

BLS Employment , Covered Employment, Non-Covered Employment

Notice the widening gap between covered employment and employment as reported by the BLS. In 2008 and again in 2010 the difference between BLS employment and Covered Employment as noted by the green line (right axis) was about 15 million.

This month the difference is nearly 19 million. The table below shows the precise numbers.

| Year |

Covered Employees |

BLS Employment |

Non-Covered Employment |

| 2003 |

123,193,833 |

137,687,000 |

14,493,167 |

| 2004 |

123,717,669 |

138,867,000 |

15,149,331 |

| 2005 |

124,663,546 |

141,591,000 |

16,927,454 |

| 2006 |

127,217,409 |

144,041,000 |

16,823,591 |

| 2007 |

129,399,094 |

145,864,000 |

16,464,906 |

| 2008 |

130,553,967 |

145,927,000 |

15,373,033 |

| 2009 |

127,539,427 |

140,363,000 |

12,823,573 |

| 2010 |

124,096,266 |

139,497,000 |

15,400,734 |

| 2011 |

122,146,266 |

140,028,000 |

17,881,734 |

| 2012 |

123,996,700 |

142,727,000 |

18,730,300 |

Since 2010, the economy has added 3.23 million jobs according to the BLS. Of those 3.23 million jobs, 3.33 million (slightly greater than 100%) have been self-employment, contractor, family-business jobs, or other jobs with insufficient wages and therefore ineligible to collect unemployment insurance.

Since 2009 the numbers look much worse. In that timeframe the economy added 2.36 million jobs according to the BLS. Of those 2.36 million jobs, 5.91 million (250%) were self-employment or jobs otherwise not covered by unemployment insurance benefits.

Unemployment insurance benefits vary state to state. Bouncing around between temporary jobs may also make one ineligible, especially if there are lengthy lapses between jobs.

Inquiring minds may be interested in Unemployment Insurance Eligibility FAQs for Connecticut. You need to consult rules for your state.

Non-Covered Employment Percentage Hits All-Time High

| Year |

"Non-Covered Employment" |

| 2003 |

10.5% |

| 2004 |

10.9% |

| 2005 |

12.0% |

| 2006 |

11.7% |

| 2007 |

11.3% |

| 2008 |

10.5% |

| 2009 |

9.1% |

| 2010 |

11.0% |

| 2011 |

12.8% |

| 2012 |

13.1% |

Non-Covered Employment in the above table means any job that does not provide unemployment insurance benefits.

Notes About Unemployment (From the Link at Top)

Bear in mind, that making money or receiving a paycheck is irrelevant to the BLS when they compute the unemployment rate. If you work as little as 1 hour, whether you collect a paycheck or not, you are considered employed.

In addition to the 6.21 million business owners with no paycheck, factor in those selling trinkets on EBay out of desperation and collecting a few dimes in the process.

Also factor in all those starting multi-level marketing schemes and calling it a business. How many get sucked into that losing proposition every year? Yet, to the BLS, it's a job if you worked any hours.

The ease of starting a business in the US is a great thing. Unfortunately, making money in a small business startup is not so easy.

Historic trends suggest half of small businesses will fail within 5 years, and I highly suspect future trends will be much worse.

See article for additional stats on working with no pay as well as a county-by-country comparison as to the best places to start and run a business.

Also note that Doing Business offers economic rankings of 183 countries on numerous categories including starting a business, ease of doing a business, getting construction permits, etc.

Conclusion

6.21 million working without pay in conjunction with the reported boom in self-employment looks rather believable in light of excellent charts from reader Tim Wallace.

Factor in disability fraud (see 2.2 Million Go On Disability Since Mid-2010; Fraud Explains Falling Unemployment Rate; Will Higher Disability Taxes Fix the Problem?) and the realistic conclusion is the unemployment rate is much higher than reported while the alleged recovery is much weaker than reported.

TOPICS: Business/Economy; Culture/Society; Editorial; Politics/Elections

KEYWORDS: economy; elections; jobs; selfemployed; selfemployment; smallbusinesses; unemployment

1

posted on

06/16/2012 5:12:35 AM PDT

by

Kaslin

To: Kaslin

You are just FULL of good news today aren’t you.

To: Kaslin

What are we gonna do with 800,000 new lawn guys and house cleaners?

3

posted on

06/16/2012 6:19:25 AM PDT

by

moovova

To: Kaslin

There is a whole underground economy. People collecting unemployment and food stamps and working under the table for cash. They are self employed as well and killing the legitimate businesses that actually follow the laws.

To: moovova

What are we gonna do with 800,000 new lawn guys and house cleaners? Issue them drivers licenses and register them to vote under Motor Voter?

After all, that's the main idea, isn't it?

5

posted on

06/16/2012 7:49:49 AM PDT

by

Gritty

(Obama says, I can be anything I want to be as long as you chumps dream your dreams-Mark Steyn)

To: Gritty

What I don’t know is how many of them are voting already.

Without knowing that it’s difficult to know what the incremental change will be.

To: Kaslin

A friend of mine started a computer education business (tutoring senoir citizens). He got laid off from CompUSA, so he started that. He got a license, so he is paying taxes.

7

posted on

06/16/2012 8:08:14 AM PDT

by

ExCTCitizen

(If we stay home in November '12, don't blame 0 for tearing up the CONSTITUTION!!)

To: Kaslin

The vast majority claiming self employment are doing so to defraud the IRS earned income credit and making work pay deductions. The IRS is nothing more than another form of welfare. It’s a cottage industry wherein people that pay absolutely no taxes can actually get 3 to 5k or more in a ”refund.”

8

posted on

06/16/2012 8:12:12 AM PDT

by

IBIAFR

To: Kaslin

Excellent article. Thanks for posting it.

9

posted on

06/16/2012 8:29:51 AM PDT

by

Innovative

(None are so blind that will not see.)

To: Gritty

” After all,that’s the main idea,isn’t it?”

Afraid you are correct.

10

posted on

06/16/2012 12:34:37 PM PDT

by

moovova

To: Kaslin

100% of U.S. Jobs Added Since 2010 Have Been Self-Employment So Obama used the BLS household survey numbers that include almost anything that moves as employment (you don't even have to have income).

Sometimes during the years recovering from the 2000 recession conservative talk show hosts would use the household numbers (they showed hundreds of thousands every month) and ignore the official BLS establishment survey that showed as few as 16,000 jobs created the same month. Those 16,000 were actual hires by companies among the 400,000 businesses surveyed.

11

posted on

06/16/2012 11:08:29 PM PDT

by

WilliamofCarmichael

(If modern America's Man on Horseback is out there, Get on the damn horse already!)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson