Posted on 03/15/2012 6:09:29 AM PDT by SeekAndFind

“Obama Defends Energy Policies” is the headline over a Reuters dispatch in respect of gasoline prices. It reports on the president’s launch of what the British wire service characterizes as “the most comprehensive defense to date of his energy policies.” It says the president is “pushing back against election-year attacks from Republicans” who say his energy policies “are to blame for high gas prices that are eroding his popularity with voters.” The problem with all this is that it’s not the energy policies that are driving up gasoline prices. It’s the monetary policies, and if the Republicans can’t manage to get that point into focus, it’s hard to see how they can put the rest of the monetary debate to their advantage.

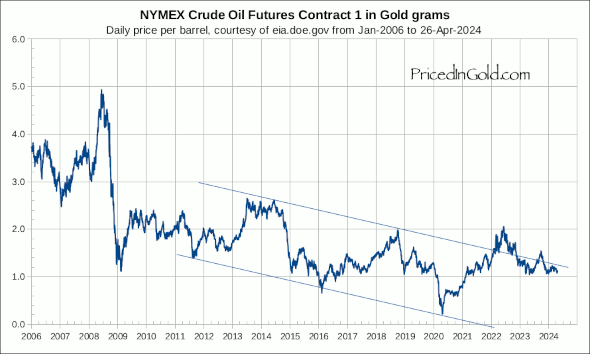

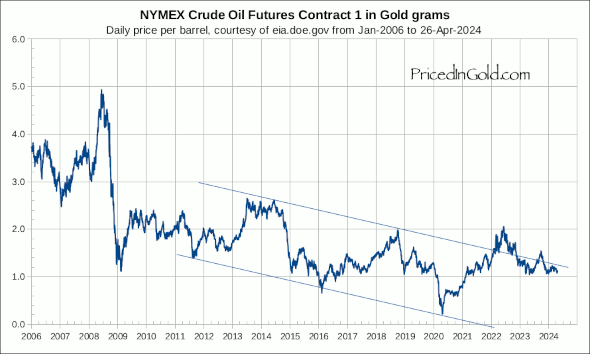

The fact is that priced in specie — gold or silver — the value of gasoline has been plunging. After Mr. Obama used his weekly radio address to declare that to rectify rising gasoline prices there was, as he put it, “no silver bullet.” Our point was that a gallon of gasoline was selling at the time for fewer grains of silver than it was selling for when Mr. Obama (or, for that matter, Mr. Bush) had acceded to the presidency. Gasoline at the pump was selling for 1/6 of an ounce of silver when Mr. Obama was sworn in. Today, the value of the same gallon of gasoline has fallen to less than a 10th of an ounce of silver. Measured in gold, the value of gasoline has also been plunging.

In other words, it’s not the gasoline that’s been going up. It’s the dollar that’s been going down. Americans, however, don’t hold their money in gold or silver. They generally hold their money in accounts denominated in dollars, and the dollar has been getting weaker.

(Excerpt) Read more at nysun.com ...

Still trying to figure out how to drive my car with wind and solar. What freaks!

Here is another thing to think about. EVERYTHING that is plastic is made from a byproduct of Crude Oil. If we go to solar and wind for energy will it produce a byproduct that we could use to make everything that is now plastic.

It’s both IMO. The Obama/Bernanke devaluation of the dollar is why the Oil that is traded in dollars is so much more expensive today, as well the Obama policy disallowing us to drill domestically.

Put a windmill on the roof of your car,

problem solved.

/obamaphysics

And why is the dollar weak??? Try Fed Gov trying to borrow by printing money and loaning money to banks to buy US Treasuries that are leftover after each monthly auction because private and foreign buyers refuse to buy. Deficit spending propped up by printing money to loan to private entities such as Wall Street bankers to buy left over US T Bills to prop up failing banks is the main drive why the US is printing money at the behest of the Fed Reserve. Consequence is very low interest rates for savers and inflation in all commodities such as food and fuel.

And why is the dollar weak??? Try Fed Gov trying to borrow by printing money and loaning money to banks to buy US Treasuries that are leftover after each monthly auction because private and foreign buyers refuse to buy. Deficit spending propped up by printing money to loan to private entities such as Wall Street bankers to buy left over US T Bills to prop up failing banks is the main drive why the US is printing money at the behest of the Fed Reserve. Consequence is very low interest rates for savers and inflation in all commodities such as food and fuel.

Gold and silver have of course been rising above the rate of inflation largely due to poor fiscal policies and the economic situation. By that standard, the cost of food, housing, etc., has been dropping rapidly.

Some of the increase in gas can be traced to the declining value of the dollar, but not the majority of it.

RE: The Obama/Bernanke devaluation of the dollar

I have DIVERSIFIED my portfolio OUT of the dollar since 2010 ( even since Bernanke said he was going to keep interest rates near zero for YEARS ). Aussies and Loonies were a great bet then and still are now.

WHY WOULD I PUT MONEY IN US DOLLARS AND MAKE LESS THAN 1% IN INTEREST WHEN I CAN GET CLOSE TO 4% IN AUSTRALIAN DOLLARS?

Think of how many investors think this way...

So yes, Mr. President - it is your economy causing it.

Is that an argument to go back to the Gold standard?

BTW, Gold and Silver prices have tanked the last two days...

No. But a bit of perspective on oil and the associated pricing.

So I should just tell the clerk at the local gas station that due to the decline of the dollar, I am going to fill my tank but I am only going to pay you $1.75 a gallon instead of the pump price of $3.95. That will go over well. It doesn’t matter what the reasons are, I am paying more for gas regardless of the reasons.

The Bureau of the Mint better start designing $10,000 notes so consumers won’t have to bring baskets full of money to the store to buy a loaf of bread.

Does anyone know where I can get a wheelbarrow that looks like a giant wallet? Might need ot to carry bread money in.

Get Ethanol out of our gas.

Good idea! BTW, there is a website that lists stations that sell real gas. It’s puregas.org (or com, I never can remember which).

Now that Obama is going to release oil from the Strategic Oil Reserve, where do the revenues from the sale of that oil go? Obama’s slush fund? The treasury?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.