Posted on 10/25/2011 8:53:31 PM PDT by smoothsailing

Gary Langer

October 25, 2011

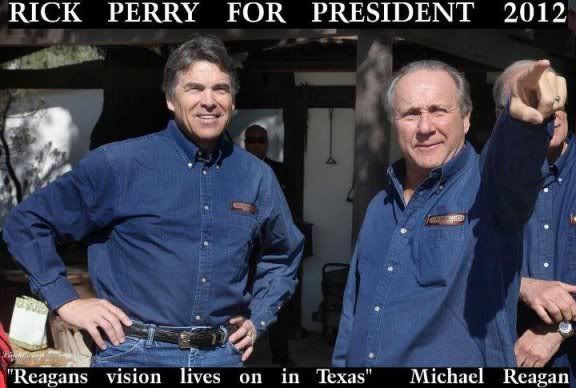

A flat tax like the one proposed today by Republican presidential candidate Gov. Rick Perry engenders a split decision in public opinion — if not the warmest reception, a better one than the public’s broader disapproval of his rival Herman Cain’s 9-9-9 plan.

While a flat tax divides the nation overall, moreover, it resonates most strongly in a group of particular interest to Perry – “very conservative” Americans, a key GOP voting group. They hold favorable views of a flat tax by a broad 68-28 percent in this ABC News/Washington Post poll,....

...As noted, very conservative Americans express a favorable opinion of a flat tax plan by a vast 40-point margin. The same group, by contrast, only divides on 9-9-9, with 46 percent seeing it favorably, 49 percent unfavorably.

(Excerpt) Read more at abcnews.go.com ...

*

It is simpler, it doesn’t require a new national tax and the “opportunity” zones that will require a new bureaucracy and another smack at federalism.

The flat tax makes infinitely more sense than that “9-9-9” BS that would add yet another tax and yet another federal bureaucracy to collect it!

Or that “fair” tax scheme that is so bad its supporters have to lie about the actual tax rate - or maybe they just flunked fifth-grade math...

It’s a real shame Perry doesn’t have the mental equipment necessary to defend a flat tax in a debate.

I like the Perry plan too.

Does it touch corporate taxes?

The Forbes plan is okay, its Perry I have no like for.

LOL! I damn near hit “Perry” coming up my drive tonight!

"Overall, the Perry flat tax plan would be a boon to long-term economic growth and increasing the competitiveness of the U.S. in the global economy. While it could be criticized for not immediately replacing the current system with a simpler tax code, it does offer taxpayers the opportunity for "self-help tax reform." In this way, it allows taxpayers the choice between the current complicated tax code and a simpler, single-rate tax code.

From a political perspective, the optional nature of the plan frees politicians from taking on the special interests directly. These special interest provisions will decrease in importance as people gravitate to the new simplified tax system.

The plan will undoubtedly be criticized for not being revenue neutral in the short run. But it is clear that the authors put economic growth and competitiveness ahead of revenue neutrality. Considering the state of the economy today, that is probably a good decision."

Please list the things you like about Forbes Plan and do not like about Perry's Plan.

•Cut the corporate income tax rate to 20 percent while eliminating most tax provisions: The plan would lower the current 35 percent corporate income tax rate to 20 percent while eliminating most corporate tax deductions. The R&D tax credit would be retained and corporations would be able to fully expense their capital investments.

Assessment: This part of the plan would instantly make the U.S. one of the most attractive places for investment in the world. Cutting the federal corporate tax rate to 20 percent would bring the overall U.S. rate to roughly 25 percent when accounting for state taxes. This would bring the U.S. rate in line with the OECD average of 25 percent and the Chinese rate of 25 percent. Cutting the corporate tax rate will have a significant and lasting impact on long-term economic growth.

The old code would wither away over time.

IF you'd rather NOT be pinged FReepmail me.

IF you'd like to be added FReepmail me. Thanks.

*****************************************************************************************************************************************************

9 percent > 20 percent I’m afraid.

Interesting poll numbers, smoothsailing.

So I guess we have these three choices:

1. Herman Cain - Fair Tax

2. Rick Perry - Flat Tax

3. Barack Obama - Fat Tax

From the looks of things... I think we can be confident we will win the election in 2012!

The 9% sales tax in Cain’s 999 makes it DOA.

Btw, its “<” for less and “>” for more.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.