Skip to comments.

Brace Yourself: US, Euro Banks About to Go Down Again

Townhall.com ^

| September 7, 2011

| Mike Shedlock

Posted on 09/07/2011 7:12:06 AM PDT by Kaslin

As noted previously, it is crystal clear to everyone but bankers and brain-dead analysts that banks need to be recapitalized, in Europe and the US as well.

The crucial question is "how?".

In 2008, US taxpayers bailed out AIG (Goldman Sachs really), Fannie Mae, Citigroup, Bank of America and scores more financial corporations of all sizes, too numerous to mention.

Why?

Ben Bernanke, Hank Paulson, Tim Geithner, Larry Summers, and a parade of bankers and ex-Goldman employees all said this had to be done to spur lending. It was a lie. The bailouts were nothing but a gigantic transfer-of-wealth scheme from the poor to the wealthy.

Banks are not lending because they are still capital impaired, even after the massive bailouts and Fed reflation efforts. Worse yet, corporations do not want to expand because the underlying problem of consumer debt has not gone away.

Similar Setup in Europe

A similar setup is underway in Europe, except it's sovereign debt not mortgages in the spotlight. As in the US, the ECB will not agree to let bondholders take a substantial hit, even though it is perfectly obvious Greece will default.

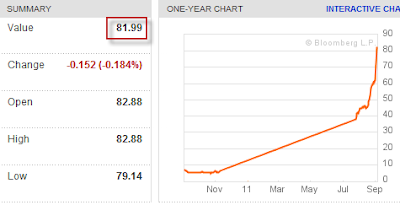

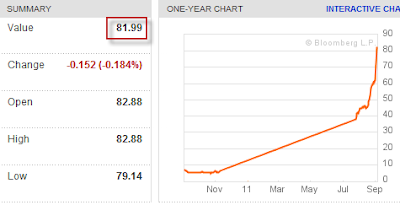

Greek 1-Year Yield Hits 82%

If 82% interest rates do not scream default, nothing does.

Yet Trichet and the Central Banks do nothing but insist on more austerity measures for Greece.

Yes, Greece has structural problems and they need to be fixed, but where is the written rule "Investing is Winning"?

Investing and Speculation have Risks

Investing and speculation have risks. Those who take risks should take responsibility, not taxpayers.

I salute Iceland and its taxpayers for telling the ECB, the IMF, and the rest of Europe to go to hell. The Icelandic economy is now in repair.

Eurozone Torture

In sharp contrast, Greece, Spain, Ireland, and Italy have nothing but torture to look forward to for the rest of the decade if taxpayers have to foot the bill for stupid loans made by banks.

The rationalization "we need to bail out the banks so they can make loans" has been disproved in spades. Of course anyone with any common sense knew it was a lie in the first place.

Will Bondholders Be Bailed Out Again?

Whether bondholders get bailed out again is the critical question. John Hussman picks up the discussion in An Imminent Downturn: Whom Will Our Leaders Defend?

The global economy is at a crossroad that demands a decision - whom will our leaders defend? One choice is to defend bondholders - existing owners of mismanaged banks, unserviceable peripheral European debt, and lenders who misallocated capital by reaching for yield and fees by making mortgage loans to anyone with a pulse. Defending bondholders will require forced austerity in government spending of already depressed economies, continued monetary distortions, and the use of public funds to recapitalize poor stewards of capital. It will do nothing for job creation, foreclosure reduction, or economic recovery.

The alternative is to defend the public by focusing on the reduction of unserviceable debt burdens by restructuring mortgages and peripheral sovereign debt, recognizing that most financial institutions have more than enough shareholder capital and debt to their own bondholders to absorb losses without hurting customers or counterparties - but also recognizing that properly restructuring debt will wipe out many existing holders of mismanaged financials and will require a transfer of ownership and recapitalization by better stewards.

In game theory, there is a concept known as "Nash equilibrium" (following the work of John Nash). The key feature is that the strategy of each player is optimal, given the strategy chosen by the other players. For example, "I drive on the right / you drive on the right" is a Nash equilibrium, and so is "I drive on the left / you drive on the left." Other choices are fatal.

Presently, the global economy is in a low-level Nash equilibrium where consumers are reluctant to spend because corporations are reluctant to hire; while corporations are reluctant to hire because consumers are reluctant to spend. Unfortunately, simply offering consumers some tax relief, or trying to create hiring incentives in a vacuum, will not change this equilibrium because it does not address the underlying problem. Consumers are reluctant to spend because they continue to be overburdened by debt, with a significant proportion of mortgages underwater, fiscal policy that leans toward austerity, and monetary policy that distorts financial markets in a way that encourages further misallocation of capital while at the same time starving savers of any interest earnings at all.

We cannot simply shift to a high-level equilibrium (consumers spend because employers hire, employers hire because consumers spend) until the balance sheet problem is addressed. This requires debt restructuring and mortgage restructuring (see Recession Warning and the Proper Policy Response ). While there are certainly strategies (such as property appreciation rights) that can coordinate restructuring without public subsidies, large-scale restructuring will not be painless, and may result in market turbulence and self-serving cries from the financial sector about "global financial meltdown." But keep in mind that the global equity markets can lose $4-8 trillion of market value during a normal bear market. To believe that bondholders simply cannot be allowed to sustain losses is an absurdity. Debt restructuring is the best remaining option to treat a spreading cancer. Other choices are fatal.

Greek debt races toward default

On Friday, the yield on one-year Greek debt soared to 67% [Mish note: On Monday it hit 82% as shown above]. Europe is demanding greater and greater austerity as a condition for additional bailouts, but austerity has already resulted in a depression for the people of Greece, and a loss of tax revenues that has paradoxically but very predictably resulted in even larger budget deficits.

To see the one-year yield leaping suddenly to 67% is an indication that we should brace for a very serious turn of events almost immediately.

One problem appears to be that European banks are eagerly volunteering for a 21% haircut on the debt (which is trading far less than that on the open market), but only in exchange for shifting the debt covenants from Greek law to more binding international law. This would be a bad deal for Greece, because it would essentially impose further severe austerity on the Greek people in return for a debt reduction that would still leave the debt/GDP ratio well above 100% and growing. Greece should reject this, because a larger default is inevitable, and it would serve the country best to maintain as much control over the size of the default as possible. Ultimately, my impression is that it would serve Greece best to exit the Euro, but it appears too late for this to be graceful.

What is particularly unfortunate is that all of this is unfolding in a very predictable way, but the constant attempts to ignore reality and defer the inevitable restructuring is imposing enormous costs on the public. As Ken Rogoff and Carmen Reinhart wrote two years ago in their book This Time It's Different, "As of this writing, it remains to be seen whether the global surge in financial sector turbulence of the late 2000s will lead to a similar outcome in the sovereign debt cycle. The precedent [a close historical overlap between banking crises and external debt crises in data from 1900-2008] however, appears discouraging on that score. A sharp rise in sovereign defaults in the current global financial environment would hardly be surprising."

Stimulus

By the way, unlike Hussman, I think the best stimulus measures would come from structural changes such as scrapping prevailing wage laws, slashing military spending, and ending collective bargaining of public unions, combined with a serious overhaul of Medicare.

If we are going to revamp infrastructure, it should be done sensibly and at the lowest cost possible to taxpayers. That means scrapping Davis-Bacon for sure.

Should Greece Exit the Euro?

Hussman writes "Ultimately, my impression is that it would serve Greece best to exit the Euro, but it appears too late for this to be graceful."

One might wonder what the consequences of that action might be.

In Euro break-up – the consequences UBS addresses that very issue. It's a 21 page PDF that interestingly begins with the statement "The Euro should not exist".

That's a true statement but the reason as UBS explains "the Euro as it is currently constituted – with its current structure and current membership – should not exist. This Euro creates more economic costs than benefits for at least some of its members – a fact that has become painfully obvious to some of its participants in recent years."

Simply put, currency unions without fiscal ties have never worked and the Eurozone as it exists today will not work either.

The report goes through an analysis of the costs if a strong nation pulls out (say Germany) and a weak nation pulls out (say Greece).

In the case of Germany leaving, the report states "If a strong economy like Germany leaves the Euro there arenon-currency trade consequences. The exit from the European Union raises potential trade barriers and border disruption. Further, the exit causes a growth shock to the rump Euro, which undermines the export potential."

This is the same conclusion of Michael Pettis as noted in Long-Term Outlook for China, Europe, and the World; 12 Global Predictions. Here are predictions 10-11.

10. Spain, other PIIGS Leave Euro

Spain will leave the euro and will be forced to restructure its debt within three or four years. So will Greece, Portugal, Ireland and possibly even Italy and Belgium.

The only strategies by which Spain can regain competitiveness are either to deflate and force down wages, which will hurt workers and small businesses, or to leave the euro and devalue. Given the large share of vote workers have, the former strategy will not last long. But of course once Spain leaves the euro and devalues, its external debt will soar. Debt restructuring and forgiveness is almost inevitable.

11. Germany Will Not Voluntarily Share Costs

Unless Germany moves quickly to reverse its current account surplus – which is very unlikely – the European crisis will force a sharp balance-of-trade adjustment onto Germany, which will cause its economy to slow sharply and even to contract. By 2015-16 German economic performance will be much worse than that of France and the UK.

For one or two years the deficit countries will try to bear the full brunt of the adjustment while Germany scolds and cajoles from the side. Eventually they will be unable politically to accept the necessary high unemployment and they will intervene in trade – almost certainly by abandoning the euro and devaluing. In that case they automatically push the brunt of the adjustment onto the surplus countries, i.e. Germany, and German unemployment will rise. I don’t know how soon this will happen, but remember that in global demand contractions it is the surplus countries who always suffer the most. I don’t see why this time will be any different.

Do monetary unions break up without civil wars?

UBS tackles an interesting question "Do monetary unions break up without civil wars?"

It takes enormous stress for a government to get to the point where it considers abandoning the lex monetae of a country. The disruption that would follow such a move is also going to be extreme. The costs are high – whether it is a strong or a weak country leaving – in purely monetary terms. When the unemployment consequences are factored in, it is virtually impossible to consider a break-up scenario without some serious social consequences.

Past instances of monetary union break-ups have tended to produce one of two results. Either there was a more authoritarian government response to contain or repress the social disorder (a scenario that tended to require a change from democratic to authoritarian or military government), or alternatively, the social disorder worked with existing fault lines in society to divide the country, spilling over into civil war. These are not inevitable conclusions, but indicate that monetary union break-up is not something that can be treated as a casual issue of exchange rate policy

The likelihood of civil war seems remote.

However, I agree with the UBS statement "it is virtually impossible to consider a break-up scenario without some serious social consequences"

Investing in a break-up scenario

Inquiring minds may be wondering how to play this from an investment standpoint. UBS concludes ...

Our base case for the Euro is that the monetary union will hold together, with some kind of fiscal confederation (providing automatic stabilisers to economies, not transfers to governments).

But what if the disaster scenario happens? How can investors invest if they believe in a break-up, however low the probability? The simple answer is that they cannot. Investing for a break-up scenario has not guaranteed winners within the Euro area. The growth consequences are awful in any break-up scenario. The risk of civil disorder questions the rule of law, and as such basic issues such as property rights. Even those countries that avoid internal strife and divisions will likely have to use administrative controls to avoid extreme positions in their markets.

The only way to hedge against a Euro break-up scenario is to own no Euro assets at all.

Zero Hedge offers more comments in UBS Quantifies Costs Of Euro Break Up, Warns Of Collapse Of Banking System And Civil War

Warnings Everywhere

In case you missed it, please consider Trichet Warns Heads of States; Italian President Warns "Markets Lost Confidence in Italy"; IMF Warns again on Bank Capitalization; Mish Warns Trichet

Breakup or Not, Avoid Euro Assets

UBS does not think a breakup will happen. I think a breakup is quite likely, as does Michael Pettis. Timing is uncertain.

Regardless, avoidance of Euro assets seems wise for multiple reasons.

- The ECB and Eurozone governments seem hell-bent on protecting bondholders and imposing severe austerity measures. Those will impede growth in Europe.

- Trichet will be gone in October and will be replaced by Italian central bank head, Mario Draghi. Draghi will act to protect Italy and that may not be good for the rest of Europe.

- Draghi is an ex-vice chairman and managing director of Goldman Sachs International. I presume we can guess whether he will act to protect banks and bondholders or promote growth.

- Recapitalization of European banks is coming and it is likely to be painful, perhaps more painful than needed actions in the US.

TOPICS: Business/Economy; Editorial; Foreign Affairs

KEYWORDS: bailout; euro; europe; mish

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

1

posted on

09/07/2011 7:12:08 AM PDT

by

Kaslin

To: Kaslin

The GoldManSack needs to go down.

2

posted on

09/07/2011 7:13:42 AM PDT

by

Paladin2

To: Kaslin

Our banking system got “recapitalized” by the US Treasury Secretary selected by Goldman Sachs, the US Congress and the US taxpayer

So, who is going to “recapitalize” the European banks?

Please don’t tell me “all of the above”

3

posted on

09/07/2011 7:17:09 AM PDT

by

silverleaf

(Common sense is not so common - Voltaire)

To: Paladin2

goldman sachs was involved in the 1929 crash and 1930s mess.

4

posted on

09/07/2011 7:20:20 AM PDT

by

ken21

(ruling class dem + rino progressives -- destroying america for 150 years.)

To: Kaslin

Given that we've now learned about the Fed's $ 1.5 trillion in emergency loans (often with lousy or NO collateral) to overseas banks and financial institutions..and that ic an't believe that Bernake would DARE to do it again..and many others feel the same way..one has to figure that the markets have already priced that into the equation..

What the author understates is that the yields on Greek bonds..67% and probably going up..means that the bonds themselves are only worth 1/3 of their face value..and that the banks that hold them will have to mark to market..or soon write them completely off...otherwise there is no longer any such thing as GAAP...

5

posted on

09/07/2011 7:21:52 AM PDT

by

ken5050

(Save the EARTH...it's the ONLY planet with CHOCOLATE!!!)

To: Kaslin

This article seems to have a socialistic slant to it.

In sharp contrast, Greece, Spain, Ireland, and Italy have nothing but torture to look forward to for the rest of the decade if taxpayers have to foot the bill for stupid loans made by banks.

Oh really? Nothing about socialist welfare states overspending in their wealth-distribution schemes, stealing from the rich to buy votes from the poor? (Instead the article howls about bank bailouts being a massive wealth transfer from poor to rich. A fair point, but one-sided.)

Banks are rational entities that want to make a profit and stay in business. If they made bad loans in a systematic fashion, you can be sure that government coercion and intimidation was at the back of it.

6

posted on

09/07/2011 7:24:32 AM PDT

by

Liberty1970

(Proud to be a bitter, clinging barbarian hobbit!)

To: Kaslin

“Worse yet, corporations do not want to expand because the underlying problem of consumer debt has not gone away.”

Wrong. They do not want to expand due to future regulatory and taxation uncertainty from Washington...

7

posted on

09/07/2011 7:25:33 AM PDT

by

stefanbatory

(Insert witty tagline here)

To: silverleaf

From my understanding, the European Central Bank is buying up as much of the Greek debt as it can. Which is just like how Bernanke bought up all of the Federal government’s bonds in Q1 and Q2.

And the Germans are furious about it.

8

posted on

09/07/2011 7:28:21 AM PDT

by

gogogodzilla

(Live free or die!)

To: Kaslin

On a related note...

How long will it be until Bank of America finally goes tits up?? I think they are gone by New Years, but they could hold on a bit longer than that...but ultimately I think their problems are so severe that they cannot survive.

9

posted on

09/07/2011 7:29:42 AM PDT

by

Bean Counter

(Obama got mostly Ds and Fs all through college and law school. Keep saying it.....)

To: ken5050

I think the EU should guarantee payout of all Greek bonds. That way I can invest all my savings into 1-year Greek bonds that are offering 81.99% interest.

So $100,000 after one year would net me $181,999.

I would take out as many gigantic loans as I could to invest in that!

:-P

10

posted on

09/07/2011 7:32:14 AM PDT

by

gogogodzilla

(Live free or die!)

To: gogogodzilla

Are we up to 81% already?

11

posted on

09/07/2011 7:41:05 AM PDT

by

ken5050

(Save the EARTH...it's the ONLY planet with CHOCOLATE!!!)

To: gogogodzilla

Greece may be digestable for the Germans, but swallowing Italy will be like a python eyeing an elephant, won’t it?

Not to mention Spain, Portugal and maybe even France

For the Germans it would be easier to just invade and occupy the rest of Europe again, open up work camps for the lazy bums to produce something for a living (or send em to Russia to work the oilfields), and be done with it

12

posted on

09/07/2011 7:48:04 AM PDT

by

silverleaf

(Common sense is not so common - Voltaire)

To: ken5050

It was in the original article, just look at the graph.

13

posted on

09/07/2011 7:54:00 AM PDT

by

gogogodzilla

(Live free or die!)

To: Liberty1970

[If they made bad loans in a systematic fashion, you can be sure that government coercion and intimidation was at the back of it. ]

You left out government collusion as well. Crony capitalists always make money.

14

posted on

09/07/2011 7:54:38 AM PDT

by

DaxtonBrown

(see Surviving Civil War II on amazon.com written by me!))

To: Kaslin

hmmmm....and thus does the blueprint for an Obama Second Term begin to unfold...

-Obama agrees to bail out the banks again to avert a “major world economic catastrophe”.

-Republicans in Congress stupidly and pliantly go along

-Linguini-spined GOP POTUS candidate refuses to criticize the decision

-Meanwhile the American voting public goes absolutely ape-doo over it, particularly when the banks start jerking them around again on mortgages and credit cards to try and recover their losses.

-A fire breathing populist wannabe in the Ross Perot mold jumps into the race as a third-party anti-banker candidate and reruns the William Jennings Bryan campaigns of the late 19th century.

-Obama slides into office again on a thin plurality of Socialists in a 3-way split.

About the only way this breaks positive for Barry I reckon.

To: silverleaf

Recapitalizing means adding capital, something of value an asset, into the banks in this case. What of value was added? A transfer of promissory notes to be paid off by future generations is all I saw. So the asset added was labor of others. We're all wage slaves now. Uncle Sam could have given the banks millions of acres of federal land with mineral rights but oh no, that would take from the government when it's so much easier to take from the people.

16

posted on

09/07/2011 8:06:56 AM PDT

by

dblshot

(Insanity: electing the same people over and over and expecting different results.)

To: Bean Counter

And if they are TBTF, where does that leave us?

To: gogogodzilla

That’s Obama’s latest deficit reduction plan..print $1 Trillion..and invest it in Greek bonds at 81%..pay off the deficit in 13 years..

18

posted on

09/07/2011 8:18:30 AM PDT

by

ken5050

(Save the EARTH...it's the ONLY planet with CHOCOLATE!!!)

To: gogogodzilla

Getting paid in a year is the fly in your ointment.

19

posted on

09/07/2011 9:04:20 AM PDT

by

shove_it

(It's either Obama or America. There cannot be both.)

To: silverleaf

“Our banking system got “recapitalized” by the US Treasury Secretary selected by Goldman Sachs, the US Congress and the US taxpayer”

TARP didnt lose much money, but the Govt added trillions in debt to reflate the collapsing bubble. Great. Now we hvave create MORE DEBT to keep it going.

Govts that did that like Greece are now at the end of their rope. They can be bailed out by ‘strong countries’ ... but USA is the worlds #1 economy, we are putting money into the IMF that is doing the bailouts...

but who will bail out USA? More Fed money printing??

That’s where the merry-go-round stops.

20

posted on

09/07/2011 9:38:10 AM PDT

by

WOSG

(Cut the spending! Perry/Rubio 2012)

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson