This man is crazy, and is a part of why we are in trouble. Someone needs to draw him with a WWII wheelbarrel filled with deutshmarks.

Navigation: use the links below to view more comments.

first 1-20, 21-32 next last

To: Tulsa Ramjet

Print me a 10 million could ya? C’mon Alan...

2 posted on

08/08/2011 8:22:41 AM PDT by

listenhillary

(Look your representatives in the eye and ask if they intend to pay off the debt. They will look away)

To: Tulsa Ramjet

We know the evil Greenspawn is a complete asshat. He dated Baba Wawa.

3 posted on

08/08/2011 8:23:41 AM PDT by

IbJensen

(God made idiots. That was for practice. Then he made politicians.)

To: Tulsa Ramjet

To: Tulsa Ramjet

Invest in wheelbarrows.

5 posted on

08/08/2011 8:25:24 AM PDT by

mnehring

To: Tulsa Ramjet

I could make better decisions than this guy, and all I have to go on is common sense and an understanding of supply and demand.

To: Tulsa Ramjet

7 posted on

08/08/2011 8:26:43 AM PDT by

expatguy

(The Expat Needs Beer Money - Cough Up!)

To: Tulsa Ramjet

Greenspawn KNOWS that currency is NOT MONEY..

Yet he said this anyway... i.e.. propaganda..

Agitprop for the rubes.. Are you a RUBE?..

8 posted on

08/08/2011 8:27:16 AM PDT by

hosepipe

(This propaganda has been edited to include some fully orbed hyperbole...)

To: Tulsa Ramjet

his libertarianism gave way to andrea mitchell’s statism.

9 posted on

08/08/2011 8:27:45 AM PDT by

ken21

(ruling class dem + rino progressives -- destroying america for 150 years.)

To: Tulsa Ramjet

He’s right. And the BBA is a very BAD idea. Going back to gold or gold-silver or gold-metals-basket would be a great thing.

But to get there we first may need to blow the greenback to Kingdom Come.

11 posted on

08/08/2011 8:30:01 AM PDT by

bvw

To: Tulsa Ramjet

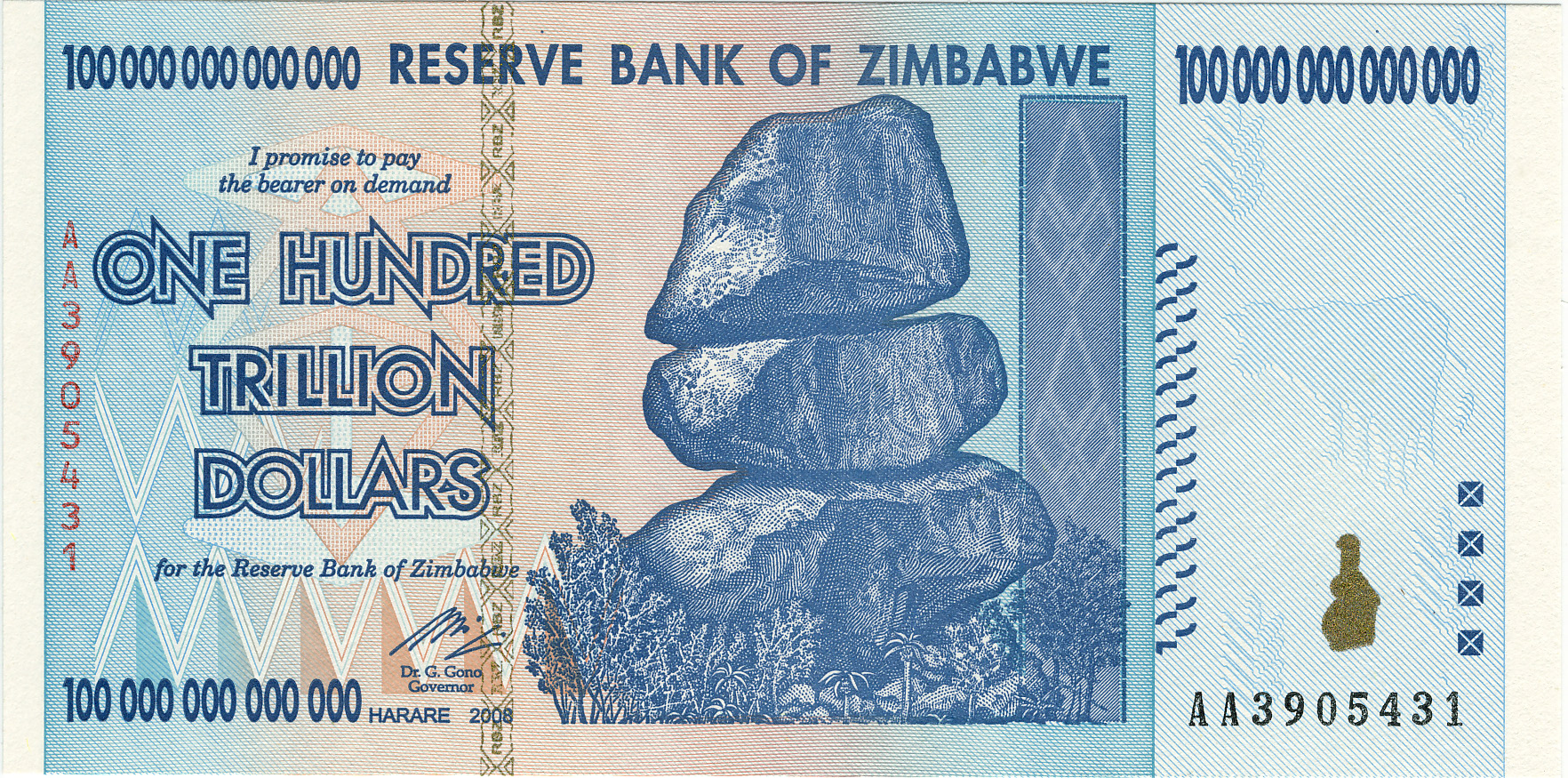

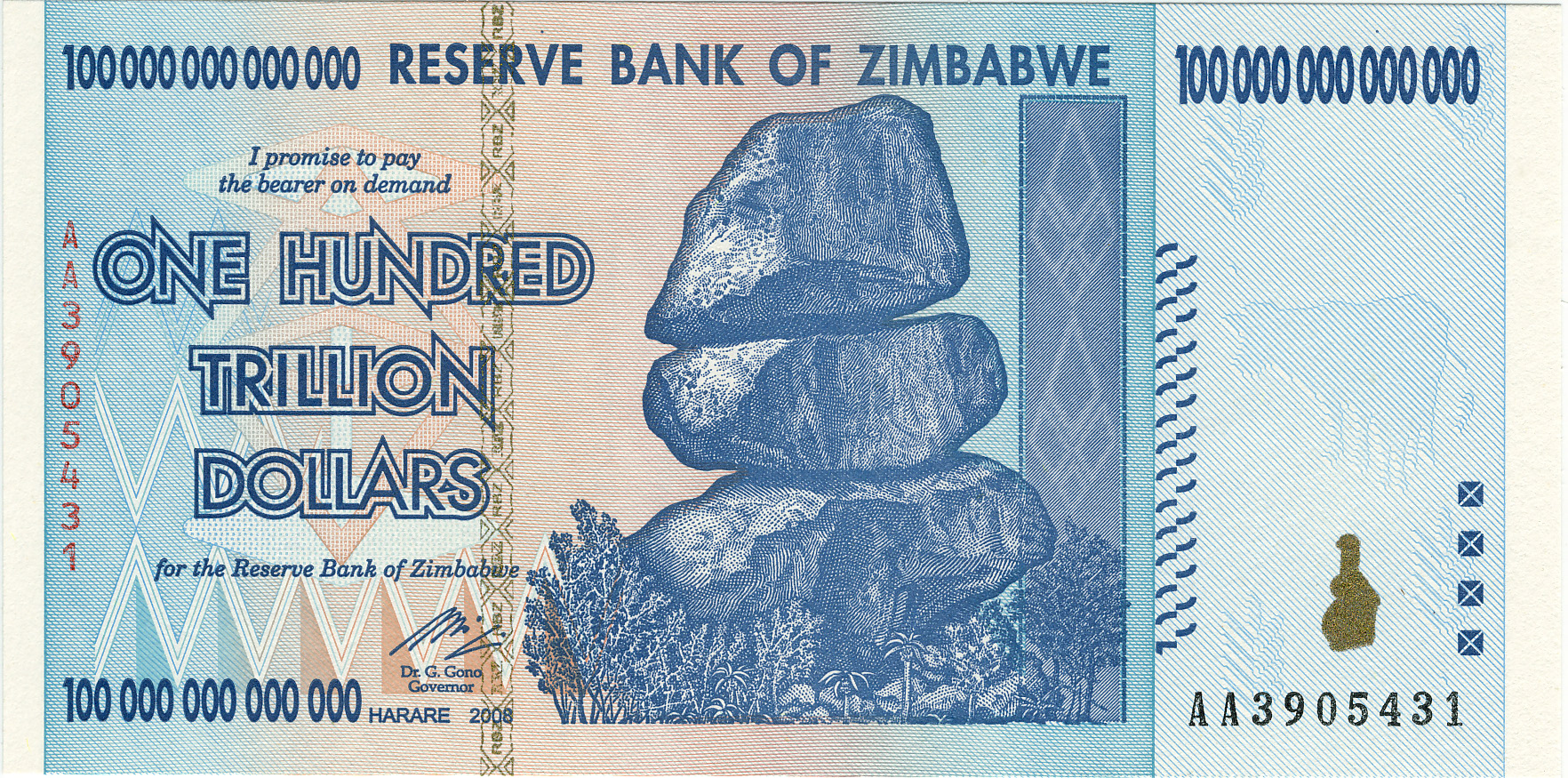

Just print up one of these and we can pay off the debt and have a lot saved up for future Social Security and Medicare bills.

Hey, Alan, inflation is slow motion default with every extra uptick in the CPI. What every happened to the Alan Greenspan who followed Ayn Rand?

12 posted on

08/08/2011 8:30:21 AM PDT by

KarlInOhio

(The Repubs and Dems are arguing whether to pour 9 or 10 buckets of gasoline on a burning house.)

To: Tulsa Ramjet

Ticker Guy has a great way to describe this sort of remark: technically correct, but factually lying. Nuff said.

13 posted on

08/08/2011 8:31:00 AM PDT by

sayuncledave

(A cruce salus)

To: Tulsa Ramjet

Well, technically he IS correct. We could simply print $14 Trillion and pay off the debt. Of course what he failed to mention is that inflation would be running in the triple digits and a loaf of bread would cost $500 dollars.

15 posted on

08/08/2011 8:32:13 AM PDT by

apillar

To: Tulsa Ramjet

When the war broke out on July 31, 1914, the Reichsbank (German Central Bank) suspended redeemability of its notes in gold. After that there was no legal limit as to how many notes it could print. The government did not want to upset people with heavy taxes. Instead it borrowed huge amounts of money which were to be paid by the enemy after Germany had won the war, Much of the borrowing was discounted and monetized by the Reichsbank, this amounted to issuing straight printing press money.

Perhaps the most well known example of hyperinflation occurred in Germany from 1922-1923 where the average price for all goods and services increased 20 Billion times. Prices doubled every 28 hours for 20 months! Some Germans were seen carrying cash in wheelbarrows to buy a loaf of bread.

18 posted on

08/08/2011 8:37:37 AM PDT by

Tulsa Ramjet

("If not now, when?" "Because it's judgment that defeats us.")

To: Tulsa Ramjet

Inflation? What inflation?

Using Greenspan's reasoning, the Fed should just print up $300 Trillion and distribute it to the people and make us all wealthy. We can all be millionaire's!!!

Every man a king,

Every man a king,

For you can be a millionaire.

If there's something belonging to others,

There's enough for all people to share.

When it's sunny June and December too,

Or in the winter time or spring.

There'll be peace without end,

Ev'ry neighbor a friend,

And ev'ry man a king.

What a sell out putz. Just remember that he was the genius who held interest rates too high for too long back in 2000 and delivered us the "Bush recession," which actually began under Clinton.

19 posted on

08/08/2011 8:38:00 AM PDT by

Sudetenland

(There can be no freedom without God--What man gives, man can take away.)

To: Tulsa Ramjet

Seriously? He said this?

Tell me this is from the Onion. Somebody. Please.

20 posted on

08/08/2011 8:39:35 AM PDT by

Mrs. Don-o

(Dry understatements free of charge, one per customer until supplies are exhausted.)

To: Tulsa Ramjet

I think Andrea Mitchell got to him

21 posted on

08/08/2011 8:42:14 AM PDT by

hecht

(TAKE BACK OUR NATION AND OUR NATIONAL ANTHEM)

To: Tulsa Ramjet

Greenspan is technically correct, but he should be smarter than this and explain what is going on. When Moody's downgrades as US state or a Eurozone member, they are looking a default risk because these sovereigns can not print money. Moody's knows this... As such, Moody's did not downgrade the US short term debt, only long-term. This indicates to me that Moody's downgraded the debt not based on default, but technical value on the bonds. In other words if the Federal Reserve keeps printing money to monetize the deficit, then value of the bonds decline. The longer the term of the bond, the more inflation devalues the bond. Moody's rating is a function of inflation and devaluation of the bond.

I am sure Greenspan knows this, he is just playing lapdog to the elitist that think they know better than all us commoners.

24 posted on

08/08/2011 8:58:50 AM PDT by

11th Commandment

(http://www.thirty-thousand.org/)

To: Tulsa Ramjet

The only question I have is, how will mortgage debt be handled. When you can easily satisfy the conditions of the loan, what happens to the mortgage holder?

26 posted on

08/08/2011 9:02:00 AM PDT by

runninglips

(Republicans = 99 lb weaklings of politics.)

To: Tulsa Ramjet

What´s the House say about this loon?

28 posted on

08/08/2011 9:08:58 AM PDT by

onedoug

To: Tulsa Ramjet

The United States can pay any debt it has because we can always print money to do that.If that is true, why don't we just print $15 trillion and be done with it? Anyone? Anyone? Bueller?

Navigation: use the links below to view more comments.

first 1-20, 21-32 next last

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson