Skip to comments.

45% don't owe U.S. income tax. These households will pay NO Federal Income Tax in 2010.

CNN Money ^

| 04/17/2011

| Jeanne Sahadi

Posted on 04/17/2011 6:08:36 PM PDT by SeekAndFind

The fastest way to make the tax-averse incensed is to tell them that nearly half of U.S. households end up owing no federal income tax when all is said and done.

But like most statistics, it is often misunderstood -- and, in the case of those trying to stir political outrage, misrepresented.

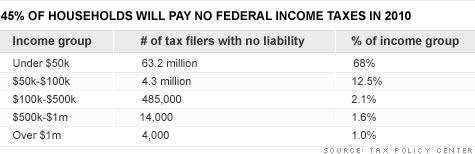

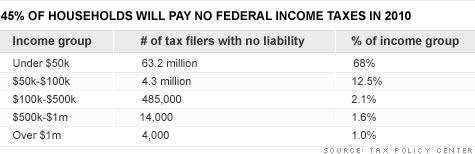

For tax year 2010, roughly 45% of households, or about 69 million, will end up owing nothing in federal income tax, according to estimates by the nonpartisan Tax Policy Center. Some in that group will even end up getting paid money from the federal government.

That does not mean such households end up paying no taxes whatsoever. For instance, those in the group still pay other taxes such as state and local income taxes, as well as property and sales taxes.

And the group doesn't necessarily get off scot-free when it comes to payroll taxes -- which support Social Security and Medicare.

More than two-thirds -- or 49 million of the 69 million households -- pay payroll tax. Of those, 34 million end up paying more in payroll taxes than they get back on their federal return. The other 15 million pay payroll tax but they get enough refundable credits to offset what they paid.

Contrary to what many assume, membership in the group isn't restricted to the poor.

It's true that the vast majority of the 69 million households make less than $50,000 -- with very heavy representation among households making less than $30,000.

But nearly 5 million households in the group make somewhere between $50,000 and more than $1 million.

Very high-income households can fall into the non-payer group if they get their income from tax-exempt bonds or overseas sources for which they get foreign tax credits, according to Roberton Williams,

(Excerpt) Read more at money.cnn.com ...

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: incometax

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-67 next last

To: AdmSmith; AnonymousConservative; Berosus; bigheadfred; ColdOne; Convert from ECUSA; Delacon; ...

Thanks SeekAndFind.

It's true that the vast majority of the 69 million households make less than $50,000 -- with very heavy representation among households making less than $30,000. But nearly 5 million households in the group make somewhere between $50,000 and more than $1 million.

So, IOW, flattening the income tax and dumping most deductions/loopholes, and setting the value of a personal exemption to, say, $30,000, would be (in the parlance of the Demwits) revenue-neutral.

21

posted on

04/17/2011 7:15:14 PM PDT

by

SunkenCiv

(Thanks Cincinna for this link -- http://www.friendsofitamar.org)

To: SeekAndFind

I have seen and heard these arguments before. They’re ludicrous.

Saying, “Hey — the 47% non-taxpaying statistic is both mean-spirited and misleading. Those people pay sales tax.”

But we were talking about income tax.

Their argument is a bit like saying, “Most people don’t buy newspapers any more; but they do use toilet paper.”

22

posted on

04/17/2011 7:17:00 PM PDT

by

Migraine

(Diversity is great... ...until it happens to YOU.)

To: muawiyah

You don't want to be limited to VA and SS disability payments.You don't want to be blind either, but I bet you forgot that one. This morning you see. This evening you don't. Nobody trains you for that

I wasn't begrudging anybody their disability checks. Why would you think that? I made a simple statement that I pay federal income tax on my S.S. checks, no more, no less.

I don't want to be blind either but I forgot that one? I don't even know what that means - Of course I don't want to be blind.

You sure got a lot out of my reply that I didn't put in.

To: SeekAndFind

Wanna fix the deficit with taxes?

Make EVERYONE pay some income tax.

We should have a basement level of income tax if we have an income tax at all. 5% so they can do their patriotic duty.

Even better, a "sales tax" AND no income tax.

Everyone must pay if anyone does.

Otherwise we will eventually have chaos and war.

24

posted on

04/17/2011 7:26:34 PM PDT

by

Mariner

(USS Tarawa, VQ3, USS Benjamin Stoddert, NAVCAMS WestPac, 7th Fleet, Navcommsta Puget Sound)

To: SeekAndFind

That number would be reduced considerably by passing the Fair Tax Act(HR25/S13). The Fair Tax will replace all federal income taxes with a national sales tax and abolish the IRS!

To: The Magical Mischief Tour

Ditto, my tax liability covers all the illegal aliens’ needs in my town.

26

posted on

04/17/2011 7:33:40 PM PDT

by

MissMack99

(Obama is the 12th Imam)

To: rlmorel

I agree. Federal income taxes are the largest source of income for the federal government. Payroll taxes were setup to fund specific programs in which taxes have some relationship to benefits. The situation is far worse than the statistic about 45% pay no federal income taxes. At least half of this group pays negative income taxes (refundable tax credits). The IRS has become a major welfare agency. Even worse, fraud is rampant in refundable tax credits especially among illegal aliens.

Republicans should call for an elimination of refunable tax credits. Every able individual with at least a small level of income should pay federal income taxes.

To: Minn

“In reality, payroll taxes are exactly the same thing as income taxes; money taken from the the individual that disappears into a black hole, never to be seen again.”

I disagree. As of last year, both SS and Medicare outlays exceed the amount of payroll taxes paid in. Yes, IN THE PAST payroll taxes were diverted to pay for other things and a meaningless paper “credit” placed in the SS “lock-box” to tell everyone that Uncle Sam owed the Trust Fund money. But now that is no longer true. Every penny of payroll taxes goes to its dedicated purpose: to pay for Medicare or SS.

Thus, anyone paying EXCLUSIVELY payroll taxes and no income taxes is, for the most part (ignoring the trivial amounts of federal taxes collected through excise taxes on cigarettes, liquor etc.) making NO contribution to the costs of national defense, the criminal justice system or other legitimate government activities. Consequently, everyone else is paying more than their “fair share” for these activities.

Claiming that payroll taxes just get mingled with income taxes in one big pot I believe obscures this important point.

28

posted on

04/17/2011 7:35:15 PM PDT

by

DrC

To: SeekAndFind

Contrary to what many assume, membership in the group isn't restricted to the poor.

It's true that the vast majority of the 69 million households make less than $50,000 -- with very heavy representation among households making less than $30,000.

Oh, I see. Because it's not 100.0%, we should just ignore the fact that 63,200,000 lower-income filers either pay no income tax or get free money from the government. Typical CNN, never missing a chance to spew the Hard Left's talking points.

To: Defend Liberty

RE: abolish the IRS!

MUSIC TO MY EARS!

Unfortunately, too many people still consider them absolutely essential for our government to work.

To: SeekAndFind

Modify the AMT so that everyone has to pay at least the minimum tax rate.

To: SeekAndFind

I wonder how many of these “households” are dependents filing their own taxes on little part-time jobs they hold while students.

32

posted on

04/17/2011 7:41:29 PM PDT

by

The_Reader_David

(And when they behead your own people in the wars which are to come, then you will know. . .)

To: Mariner; SeekAndFind

We should pass a law that everyone that gets to vote must pay a minimum amount of tax.

When our country was first created, only land owners had the right to vote - they all had a stake in the game. We now allow almost anyone to vote - they don’t even need to know how to read or write. What do we expect???

To: visually_augmented

I fully agree with you, with one formulaic adjustment:

They must have a (to be determined) number of years on record in which they paid taxes.

Obviously, there are many retired seniors/veterans, etc. who are so strapped they no longer pay taxes, but have contributed above and beyond the call in their primes.

They've certainly earned the right to cast a ballot.

34

posted on

04/17/2011 7:57:52 PM PDT

by

daler

To: familyop

Change the tax tables and create a minimum income tax rate. Or better yet, overhaul the entire tax code and replace it.

The reality is that the payroll tax is really an income tax.

Once you exclude more than 50% from paying income tax and use the EITC to subsidize some, the majority will have no problem in increasing the taxes on the "wealthy" and voting for more benefits for themselves. It is called redistribution of wealth or as Obama and his Marxist friends like to say, social justice.

35

posted on

04/17/2011 8:03:51 PM PDT

by

kabar

To: businessprofessor

Federal income taxes are the largest source of income for the federal government.

36

posted on

04/17/2011 8:11:18 PM PDT

by

kabar

To: DrC

The SS Trust Fund contains about $2.2 trillion in non-market, interest bearing T-bills. So although SS is running in the red now and will go permanently in the red in 2016, trillions of SS dollars have already been spent on “other things.”

37

posted on

04/17/2011 8:16:04 PM PDT

by

kabar

To: Minn

In reality, payroll taxes are exactly the same thing as income taxes; money taken from the the individual that disappears into a black hole, never to be seen again.

Yep, they're the same thing - just taken via different taxes.

38

posted on

04/17/2011 8:20:01 PM PDT

by

andyk

(Wealth != Income)

Comment #39 Removed by Moderator

To: Mariner

Or at the very least you should not be able to get back more than you paid in. 0=0

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-67 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson